Polymarket Copy Trading Bot: How Traders Find Alpha by Mirroring Profitable Wallets

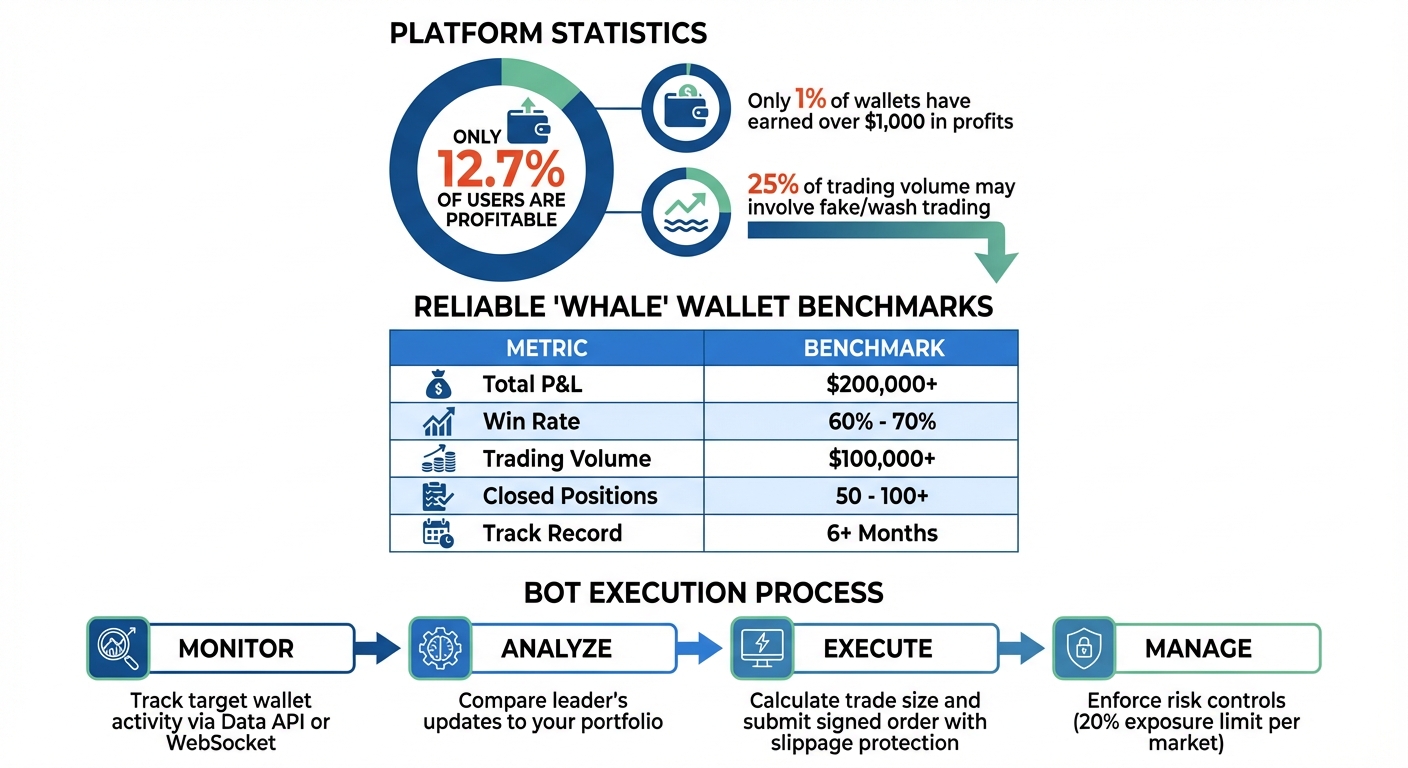

Polymarket's transparent blockchain allows traders to analyze wallet activity and replicate profitable strategies using automated bots. This approach leverages data on trades, profits, and market timing to follow top-performing wallets. However, only 12.7% of users are profitable, and risks like slippage, volatility, and copying underperforming wallets must be managed carefully. Here's what you need to know:

- Transparency: All trades on Polymarket are public, enabling analysis of wallet performance.

- Profitability Stats: Only 1% of wallets have earned over $1,000 in profits.

- Bot Features: Bots monitor wallet activity, replicate trades, and manage risks with safeguards like position limits and slippage controls.

- Execution Speed: Hosting bots on a VPS for Polymarket ensures low-latency trading, crucial for fast-moving markets.

- Risk Management: Diversify across multiple wallets, set exposure limits, and monitor leader performance regularly.

Polymarket copy trading can be effective when paired with disciplined risk controls, fast infrastructure, and data-driven strategies.

Polymarket Copy Trading Statistics and Profitable Wallet Benchmarks

Polymarket Copy Trading Statistics and Profitable Wallet Benchmarks

Why Polymarket's Public Blockchain Data Creates Trading Opportunities

How Blockchain Transparency Enables Data-Driven Trading

Polymarket, built on the Polygon blockchain, makes every trade completely public. Unlike centralized platforms where trading data is often hidden, this level of transparency offers an unchangeable record of performance. By examining any wallet address, you can see its historical gains, losses, and the specific markets it has traded in.

Polymarket provides developers with access to its Data and Gamma APIs, which allow them to retrieve this information without needing API keys or authentication. These tools make it easy to analyze critical trading data, such as order book depth, user activity, and market specifics, without any restrictions.

This openness also highlights consensus signals. For instance, when several high-performing wallets take the same position at the same time, it can serve as a real-time indicator of market trends, backed by actual trading activity.

Armed with verified data, the challenge then becomes identifying wallets that consistently outperform the market.

How to Identify Profitable Wallets to Copy

This transparent data equips traders with the ability to filter and analyze wallets for consistent profitability. Start by assessing key performance metrics like historical profit and loss (P&L), win rate, trading volume, and the number of closed positions. For example, a wallet earning $10,000 from a single trade is less reliable than one that achieves the same profit spread across 100+ trades.

Focus on wallets with at least 50 closed positions to rule out luck. A win rate above 55% typically reflects skill, while rates exceeding 90% might indicate unusual patterns. Trading volume is another crucial factor - wallets with over $100,000 in volume show serious engagement rather than casual activity.

Different market niches require tailored evaluation. Polymarket's leaderboard API can help segment traders based on their specialties. Take Erasmus, for example - a trader who earned over $1.3 million by focusing on political markets and polling analysis. However, excelling in one category doesn’t guarantee success in others.

Look for wallets with a track record of at least six months and consistent monthly gains. Pay attention to position sizing as well - disciplined traders typically maintain steady bet sizes relative to their bankroll. On the other hand, erratic bets can signal excessive risk-taking. Be cautious of red flags like profits concentrated in just one market, high trading volumes paired with minimal P&L (a possible sign of wash trading), or trades executed suspiciously close to major news events.

| Metric | Reliable "Whale" Benchmark |

|---|---|

| Total P&L | $200,000+ |

| Win Rate | 60% - 70% |

| Trading Volume | $100,000+ |

| Closed Positions | 50 - 100+ |

| Track Record | 6+ Months |

How to Build a Polymarket Copy Trading Bot

Basic Copy Trading Bot Functionality

A Polymarket copy trading bot is made up of five key components:

- Data Collector: Tracks activity in target wallets using WebSocket streams or REST API polling.

- Strategy Engine: Evaluates signals and decides which trades to replicate.

- Order Manager: Signs and submits orders to Polymarket's Central Limit Order Book (CLOB).

- Risk Manager: Implements safeguards like position limits and slippage protection.

- Logger: Keeps a record of all actions for debugging and performance analysis.

The bot operates by scanning leader wallets every few seconds (or instantly through WebSocket) to identify new trades or increased positions. When a change is detected, it compares the leader's portfolio allocation to your current holdings. If the leader enters a new market or increases their exposure, the bot calculates your trade size using one of two methods:

- Proportional Sizing: Copies a percentage of the leader's position (e.g., 10%).

- Fixed Amount Sizing: Bets a predetermined dollar amount, such as $25, regardless of the leader's position size.

For placing trades, bots typically use market orders with "Fill-or-Kill" (FOK) instructions. This ensures the order is either executed immediately in full or canceled outright, avoiding partial fills in volatile markets. Below is an outline of how these components work together during execution.

Bot Execution Logic Step-by-Step

The bot's execution process follows these four steps:

-

Monitor: Keep track of target wallet activity using Polymarket's Data API (via the

/activityendpoint) or WebSocket channels to spot new trades. - Analyze: Compare the updates from the leader's wallet to your existing portfolio to identify necessary adjustments.

- Execute: Determine the trade size based on your chosen scaling strategy, then submit a signed order through the CLOB API. Slippage protection is applied to maintain execution quality.

- Manage: Enforce risk controls, such as limiting exposure to 20% per market. Exit positions when the leader reduces or closes their exposure.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

This structured approach ensures that your bot's trading aligns with Polymarket's transparent blockchain data and your predefined strategy.

To authenticate API requests, use HMAC-SHA256 signatures with your credentials. Be mindful of API rate limits; techniques like exponential backoff can help avoid being blocked.

Developers often rely on tools like the Python library py-clob-client or Polymarket's official TypeScript SDK for seamless interaction with the platform. Key environment variables you'll need to configure include:

-

Your target wallet address (

USER_ADDRESS) -

Your follower account (

PROXY_WALLET) - Your private key

- API endpoints for both the CLOB and RPC connections

Why Speed and Infrastructure Matter for Copy Trading

How Timing Affects Profitability

In the world of copy trading on Polymarket, timing is everything. The moment a profitable wallet enters a new position, every millisecond becomes crucial for securing favorable prices and reducing slippage. This is especially true during high-volatility events like election nights, CPI reports, or breaking sports updates, where prices can shift in the blink of an eye. Even a small delay can chip away at the leader's advantage. The challenge is even greater in illiquid markets, where the prices followers get may differ significantly from those of the leader.

"In fast-moving markets, milliseconds matter. Optimize your bot by hosting servers close to Polymarket infrastructure using WebSocket connections instead of polling." - PolyTrack

"In fast-moving markets, milliseconds matter. Optimize your bot by hosting servers close to Polymarket infrastructure using WebSocket connections instead of polling." - PolyTrack

Automated systems are often better equipped than manual trading to handle these rapid shifts, delivering faster execution and better profitability. Reducing latency isn’t just a technical improvement - it’s a necessity for staying competitive, making robust hosting solutions a key part of the equation.

Using QuantVPS for 24/7 Bot Performance

To keep up with the demands of high-speed trading and avoid the pitfalls of latency, a dedicated VPS (Virtual Private Server) is essential. Running a copy trading bot from a home computer introduces risks like downtime, inconsistent latency, and missed trades - especially during critical off-hours. Since Polymarket operates 24/7, market-moving events can happen at any moment, and being unprepared could mean lost opportunities.

QuantVPS provides a reliable solution with uninterrupted uptime, low-latency connections, and stable WebSocket streams that deliver real-time trade data without delay. Unlike API polling, which can be slower and prone to rate limits (60 orders per minute per key), persistent WebSocket connections allow your bot to react instantly when a leader wallet takes action. This speed and reliability are vital during periods of high trading volume, where every second counts.

QuantVPS offers plans tailored to different needs. The Pro plan ($99.99/month or $69.99/month annually) includes 6 cores, 16GB of RAM, and 1Gbps+ speeds - more than enough for monitoring wallets and executing trades quickly. For those managing heavier workloads or tracking multiple wallets simultaneously, the Ultra plan ($189.99/month or $132.99/month annually) delivers 24 cores, 64GB of RAM, and the same high-speed connectivity. Both plans come with Windows Server 2022, automatic backups, and DDoS protection, ensuring your bot operates smoothly even during volatile market conditions.

In copy trading, even slight differences in execution price can be the difference between profit and loss. A reliable VPS isn’t just a convenience - it’s the backbone of a strategy designed to capture alpha in a systematic and consistent way.

Risk Management for Copy Trading Bots

Common Risks in Copy Trading

Once you've built and launched a copy trading bot, the next critical step is understanding and managing the risks involved. Automated copy trading comes with its own set of challenges that can quickly deplete your capital if not properly addressed. For instance, leaders - traders whose strategies you follow - may lose their competitive edge as market dynamics evolve. Additionally, when too many traders replicate the same moves, any price advantage can quickly disappear. A striking example comes from Polymarket: nearly 25% of its trading volume may involve fake or wash trading, and only 12.7% of its users are actually profitable. These figures highlight the importance of having strong risk management measures in place.

Liquidity issues also pose a significant risk. If a leader opens a position in a liquid market, they might secure a good price. However, followers executing the same trade moments later could face worse prices due to slippage, especially during volatile market conditions. In less liquid or more niche markets, your bot might inadvertently act as exit liquidity for the leader, buying at inflated prices just as they sell off their position.

Another pitfall is copying underperforming wallets. For example, a wallet with a win rate below 40% could indicate a trader who had one lucky win but has since experienced consistent losses. Security risks add yet another layer of concern. In December 2025, malicious code was discovered in the "polymarket-copy-trading-bot" repository on GitHub, designed specifically to steal private keys. That same year, off-chain attacks accounted for 80.5% of all stolen funds in the DeFi space.

How to Implement Risk Controls

To navigate these risks effectively, disciplined risk management is non-negotiable. Below are strategies to help safeguard your bot's performance while minimizing exposure to potential losses.

Capital Exposure Limits:

- Set strict per-trade and daily loss limits to automatically halt trading if thresholds are breached.

- Limit exposure to any single market to a small percentage of your total portfolio, reducing the risk of over-concentration.

Execution Safeguards:

- Incorporate emergency kill switches to instantly stop all bot activity during periods of extreme volatility, API failures, or sudden changes in leader behavior.

- Disallow trades older than five minutes to avoid entering stale or outdated positions.

- Apply slippage limits (e.g., 1–2% maximum price deviation) and liquidity filters to prevent poor fills that deviate significantly from the leader's entry price.

- Use Fill-or-Kill (FOK) orders to ensure trades either execute at the desired price immediately or cancel altogether.

Leader Wallet Monitoring:

- Conduct weekly profit-and-loss (P&L) reviews and monthly optimizations to weed out underperforming wallets.

- Assess performance across at least 10–20 trades to account for natural variance.

- Check whether wallets have been active in the last 30 days and are maintaining positive P&L during that time.

- Remove leaders who stray from their original trading niche, as their strategies may no longer be effective.

"Trading bots can lose money rapidly, especially during volatile events. Never run a bot with money you can't afford to lose." - PolyTrack

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Trading bots can lose money rapidly, especially during volatile events. Never run a bot with money you can't afford to lose." - PolyTrack

Diversification Strategy:

- Follow 5–10 traders across different niches instead of relying on just one.

- Look for consensus signals where multiple top traders independently take the same position, reducing the risk of following an outlier.

- Separate your bot's "Risk Manager" from the "Strategy Engine" to ensure exposure controls and stop-loss mechanisms are checked before any trade reaches the execution phase.

The Ultimate Copy Trading Bot Speed Test on POLYMARKET

Conclusion

Polymarket copy trading presents a unique challenge in data science, leveraging the transparency of blockchain data to uncover valuable insights. The real advantage lies in systematically analyzing on-chain activity to pinpoint wallets with consistent success across various market conditions. In a space where most traders face losses, identifying genuine trading skill - true alpha - sets systematic traders apart.

Once this analytical edge is established, automation steps in to enhance execution. By removing emotions from the equation, bots can secure entry prices before markets fully adjust to new positions. However, automation alone doesn’t guarantee success - your infrastructure plays a critical role in capturing alpha instead of losing it to slippage. As Tattva Tarang from Coding Nexus explains:

"profit = edge - slippage - latency - fees"

"profit = edge - slippage - latency - fees"

Using a VPS like QuantVPS ensures uninterrupted operations, low-latency API access, and stable performance during periods of high market volatility when timing matters most.

When combined, data analysis, automation, and robust infrastructure create a three-pronged strategy for success. Traders who enforce strict risk management - through position limits, slippage controls, and signals from multiple high-performing wallets - can consistently profit from prediction markets.

Achieving success in Polymarket copy trading requires discipline and a quantitative mindset. The transparency of blockchain data opens the door, automation ensures precision, and reliable infrastructure like QuantVPS provides the stability needed to act when opportunities arise.

FAQs

How can I find the most profitable wallets to copy on Polymarket?

To find profitable wallets to copy on Polymarket, take advantage of the platform’s on-chain transparency. Start by diving into the trading history of wallets using Polymarket’s data tools. These tools let you pull details like orders, fills, and positions, giving you a clear view of each wallet’s activity. Pay close attention to performance metrics, including:

- Historical P&L by market type: Look at categories like sports, politics, or breaking news to identify wallets with expertise in specific areas.

- Win rate and average return per market: These numbers help you gauge consistency over time.

- Risk-adjusted returns and maximum drawdown: Use these to weed out wallets that rely on risky or lucky bets rather than skill.

Focus on wallets that show steady, reliable performance with minimal risk. Be wary of accounts with results driven by one-off successes - they might not be as reliable in the long run. Make it a habit to regularly review and update your choices to ensure you’re tracking wallets with a proven, ongoing edge. By systematically analyzing this data, you can confidently select top-performing wallets to mirror in your copy trading strategy.

What risks should I be aware of when using a Polymarket copy trading bot?

Polymarket copy trading carries its own set of risks that traders should be aware of. Market volatility in crypto prediction markets can cause sharp and unexpected losses, particularly during major events. On top of that, simply copying a leader’s trades without careful evaluation can backfire. If their strategy falters or there’s not enough liquidity to mirror their positions accurately, losses can pile up quickly.

To navigate these challenges, it’s crucial to manage your funds wisely. Avoid putting too much capital into any single trade, set clear risk limits (like defining the maximum amount you’re willing to lose), and keep a close eye on the performance of the leader wallets you’re following. Make sure their strategies are still effective over time. Most importantly, trade with caution and only use money you’re prepared to lose.

Why is fast and reliable infrastructure important for copy trading success?

Fast and reliable infrastructure plays a key role in copy trading. It ensures that your bot can swiftly detect and replicate trades from a leader wallet without delays. This is especially important in prediction markets, where prices can shift rapidly during high-volatility moments like elections or breaking news. The quicker your bot reacts, the better your chances of securing similar prices and positions, maintaining the leader’s advantage.

Low-latency systems are equally critical, as they help prevent missed opportunities or unfavorable trade executions caused by slower responses. Leveraging a VPS for continuous uptime and faster API access can make a big difference, enhancing your bot’s responsiveness and overall efficiency in time-sensitive trading environments.

To find profitable wallets to copy on Polymarket, take advantage of the platform’s on-chain transparency. Start by diving into the trading history of wallets using Polymarket’s data tools. These tools let you pull details like orders, fills, and positions, giving you a clear view of each wallet’s activity. Pay close attention to performance metrics, including:

- Historical P&L by market type: Look at categories like sports, politics, or breaking news to identify wallets with expertise in specific areas.

- Win rate and average return per market: These numbers help you gauge consistency over time.

- Risk-adjusted returns and maximum drawdown: Use these to weed out wallets that rely on risky or lucky bets rather than skill.

Focus on wallets that show steady, reliable performance with minimal risk. Be wary of accounts with results driven by one-off successes - they might not be as reliable in the long run. Make it a habit to regularly review and update your choices to ensure you’re tracking wallets with a proven, ongoing edge. By systematically analyzing this data, you can confidently select top-performing wallets to mirror in your copy trading strategy.

Polymarket copy trading carries its own set of risks that traders should be aware of. Market volatility in crypto prediction markets can cause sharp and unexpected losses, particularly during major events. On top of that, simply copying a leader’s trades without careful evaluation can backfire. If their strategy falters or there’s not enough liquidity to mirror their positions accurately, losses can pile up quickly.

To navigate these challenges, it’s crucial to manage your funds wisely. Avoid putting too much capital into any single trade, set clear risk limits (like defining the maximum amount you’re willing to lose), and keep a close eye on the performance of the leader wallets you’re following. Make sure their strategies are still effective over time. Most importantly, trade with caution and only use money you’re prepared to lose.

Fast and reliable infrastructure plays a key role in copy trading. It ensures that your bot can swiftly detect and replicate trades from a leader wallet without delays. This is especially important in prediction markets, where prices can shift rapidly during high-volatility moments like elections or breaking news. The quicker your bot reacts, the better your chances of securing similar prices and positions, maintaining the leader’s advantage.

Low-latency systems are equally critical, as they help prevent missed opportunities or unfavorable trade executions caused by slower responses. Leveraging a VPS for continuous uptime and faster API access can make a big difference, enhancing your bot’s responsiveness and overall efficiency in time-sensitive trading environments.

"}}]}