Market microstructure trading focuses on understanding the mechanics behind how trades are executed, how prices are determined, and how market participants interact. It’s essential for traders aiming to optimize their strategies, reduce costs, and improve outcomes. Key concepts include:

- Order Types: Market, limit, and stop orders influence liquidity and execution costs.

- Bid-Ask Spread: The difference between the highest bid and lowest ask impacts trading costs.

- Liquidity: Determines how easily assets can be traded without affecting prices.

- Market Participants: Retail traders, institutional investors, and market makers shape market behavior.

- Price Formation: Prices are driven by supply, demand, and order flow in electronic markets.

- Order Flow Analysis: Tracks buyer and seller activity to predict short-term price movements.

For advanced strategies like high-frequency or algorithmic trading, low-latency infrastructure is critical. Tools like QuantVPS offer tailored solutions to meet the speed and reliability demands of modern trading systems.

Core Elements of Market Microstructure

Order Types and How They Affect Trading

The type of order you choose can significantly shape how the market reacts to your trade. For instance, market orders are designed for immediate execution at the best available price, but they consume liquidity. If you’re trading a large volume, your order might "walk the book", meaning it will execute at progressively worse prices as it fills. This not only increases your trading costs but can also push the market price against you.

Limit orders, on the other hand, allow you to set a specific price – say, buying at $50.00 or lower or selling at $50.00 or higher. Unlike market orders, these rest in the order book and provide liquidity to the market. However, most limit orders are canceled before they ever get filled.

Then there are stop orders, which act as a safety net. Once the market hits your designated stop price, the order converts into a market order. This can sometimes cause rapid price movements, especially when a cluster of stop orders triggers around critical price levels. For highly liquid stocks, these orders usually execute smoothly, but for illiquid stocks, they may fill at multiple price points.

The interaction of these order types plays a direct role in shaping the bid-ask dynamics, which we’ll explore next.

Understanding the Bid-Ask Spread

The bid-ask spread is the difference between the highest price buyers are willing to pay (the bid) and the lowest price sellers are willing to accept (the ask). This spread directly impacts your trading costs – when you buy, you pay the higher ask price, and when you sell, you receive the lower bid price. Hans R. Stoll captures the essence of this concept:

The field of market microstructure studies the cost of trading securities and the impact of trading costs on the short-run behavior of securities prices. Costs are reflected in the bid-ask spread (and related measures) and in commissions.

The field of market microstructure studies the cost of trading securities and the impact of trading costs on the short-run behavior of securities prices. Costs are reflected in the bid-ask spread (and related measures) and in commissions.

A wider spread means higher costs for traders and reflects various market inefficiencies. These include order processing expenses, inventory risks taken on by liquidity providers, and the costs associated with asymmetric information. Research by Glosten and Milgrom also highlights how trading by informed participants can lead to a positive bid-ask spread, even when market makers are indifferent to risk.

How Liquidity Shapes Market Behavior

Liquidity is a cornerstone of how markets function. It measures how quickly and easily you can trade a financial asset without significantly affecting its price. In liquid markets, you can execute large trades with minimal price disruption. In contrast, illiquid markets often experience higher volatility, with a noticeable gap between quoted prices and actual execution prices.

Market makers play a vital role in maintaining liquidity by consistently posting bids and offers. Exchanges also encourage liquidity through measures like market maker mandates and commission rebates. The National Bureau of Economic Research emphasizes the importance of liquidity in market microstructure:

[Market microstructure research] is devoted to theoretical, empirical, and experimental research on the economics of securities markets, including the role of information in the price discovery process, the definition, measurement, control, and determinants of liquidity and transactions costs, and their implications for the efficiency, welfare, and regulation of alternative trading mechanisms and market structures.

[Market microstructure research] is devoted to theoretical, empirical, and experimental research on the economics of securities markets, including the role of information in the price discovery process, the definition, measurement, control, and determinants of liquidity and transactions costs, and their implications for the efficiency, welfare, and regulation of alternative trading mechanisms and market structures.

Market Participants and Their Roles

The market is made up of various participants, each with distinct roles. Retail traders typically place smaller orders and often use market orders to ensure immediate execution, acting as liquidity takers. On the other hand, institutional investors – like pension funds, hedge funds, or mutual funds – trade in much larger volumes. They must carefully manage their trades to avoid walking the book and driving prices against themselves.

Market makers are key players in providing liquidity. They continuously quote bid and ask prices, earning profits from the spread while managing inventory risks. As Hans R. Stoll explains:

An investor who wishes to trade immediately – a demander of immediacy – does so by placing a market order to trade at the best available price – the bid price if selling or the ask price if buying. Bid and ask prices are established by suppliers of immediacy. Depending on the market design, suppliers of immediacy may be professional dealers that quote bid and ask prices or investors that place limit orders, or some combination.

An investor who wishes to trade immediately – a demander of immediacy – does so by placing a market order to trade at the best available price – the bid price if selling or the ask price if buying. Bid and ask prices are established by suppliers of immediacy. Depending on the market design, suppliers of immediacy may be professional dealers that quote bid and ask prices or investors that place limit orders, or some combination.

The actions of these participants directly influence order flow, liquidity, and pricing, creating a dynamic interplay that defines market behavior.

Technical Analysis Series – Market Microstructure (UPDATED)

How Prices Form and Order Flow Works

After understanding order types and liquidity, it’s crucial to dive into how prices form and how order flow operates – two key elements for effective trading.

Price Determination in Electronic Markets

In electronic markets, prices are shaped by the constant push and pull of supply and demand. As detailed in, this interaction is the sole driver of price movements. The process plays out in the order book, where market makers post limit orders to establish a framework of supply (asks) and demand (bids). When market takers place market orders that interact with these limit orders, they consume liquidity, causing prices to shift.

The mid-price, calculated as the average of the highest bid and lowest ask, serves as a general indicator of the market price. However, the actual price you pay depends on whether you’re buying (at the ask price) or selling (at the bid price). Liquidity in the order book significantly affects price stability. Thin liquidity means even small orders can cause sharp price swings, while deep liquidity helps absorb larger orders with minimal impact.

Market makers play a pivotal role by constantly adjusting their quotes to manage inventory risk and earn profits from the bid-ask spread. This ongoing adjustment fuels the price discovery process, where the market collectively determines an asset’s value through the interaction of order flow, information, and available liquidity. This dynamic process lays the groundwork for understanding order flow, a critical tool for refining trading strategies.

Reading Order Flow for Trading Decisions

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Building on the price discovery process, analyzing order flow provides a real-time view of buyer and seller activity. By tracking the volume and types of orders being placed and executed, traders can gauge market sentiment and predict short-term price movements. For example, when market buy orders outnumber sell orders, prices often rise, and when sell orders dominate, prices tend to fall.

Several tools are essential for interpreting order flow, including the order book (also known as Depth of Market) and footprint charts. The order book shows all pending limit orders at various price levels, highlighting clusters that may act as support or resistance zones. Footprint charts, on the other hand, display executed order volumes at each price point within a candlestick, typically with sell orders on the left and buy orders on the right.

Wikipedia summarizes this concept well:

Order flow analysis allows traders to see what type of orders are being placed at a certain time in the market, e.g., the amount of Buy and Sell orders at a given price point. Traders can use Order Flow analysis to see the subsequent impact on the price of the market by these orders and therefore make predictions on the future price and direction of the market.

Order flow analysis allows traders to see what type of orders are being placed at a certain time in the market, e.g., the amount of Buy and Sell orders at a given price point. Traders can use Order Flow analysis to see the subsequent impact on the price of the market by these orders and therefore make predictions on the future price and direction of the market.

Trading Strategies Based on Market Microstructure

Market microstructure provides the foundation for two practical trading strategies: high-frequency trading (HFT) and order book-based algorithmic trading.

High-Frequency Trading (HFT) Approaches

High-frequency trading leverages market microstructure by executing trades at ultra-low latencies. These trades often last mere seconds, aiming to secure small but consistent profits across thousands of transactions daily.

Market Making

Market making is a central HFT strategy where traders continuously post bid and ask prices, profiting from the spread while managing inventory risks. As Olivier Guéant explains:

Market makers provide liquidity to other market participants: they propose prices at which they stand ready to buy and sell a wide variety of assets. They face a complex optimization problem with both static and dynamic components. They need indeed to propose bid and offer/ask prices in an optimal way for making money out of the difference between these two prices (their bid-ask spread). Since they seldom buy and sell simultaneously, and therefore hold long and/or short inventories, they also need to mitigate the risk associated with price changes, and subsequently skew their quotes dynamically.

Market makers provide liquidity to other market participants: they propose prices at which they stand ready to buy and sell a wide variety of assets. They face a complex optimization problem with both static and dynamic components. They need indeed to propose bid and offer/ask prices in an optimal way for making money out of the difference between these two prices (their bid-ask spread). Since they seldom buy and sell simultaneously, and therefore hold long and/or short inventories, they also need to mitigate the risk associated with price changes, and subsequently skew their quotes dynamically.

Scalping

Scalping is another HFT method, designed to exploit the bid-ask spread. QuantInsti describes it as:

Scalping: The trading wherein the trader ‘scalps’ a small profit from each trade by exploiting the bid-ask spread by darting in and out of a stock or other asset class multiple times a day to reap a small profit on each trade to add up to the big dough at the end of the day.

Scalping: The trading wherein the trader ‘scalps’ a small profit from each trade by exploiting the bid-ask spread by darting in and out of a stock or other asset class multiple times a day to reap a small profit on each trade to add up to the big dough at the end of the day.

In HFT, speed is everything. Algorithms analyze order book data to detect short-term price movements, supply-demand imbalances, and arbitrage opportunities – often executing trades in milliseconds.

However, as Traders.MBA notes:

High-frequency trading (HFT) can increase market volatility and transaction costs, while also improving market liquidity. However, it can also lead to market manipulation, price distortions, and concerns about fairness in trading.

High-frequency trading (HFT) can increase market volatility and transaction costs, while also improving market liquidity. However, it can also lead to market manipulation, price distortions, and concerns about fairness in trading.

Traders must also stay updated on regulatory changes, such as rules on order cancellations and measures designed to curb manipulative practices.

These HFT strategies provide the groundwork for algorithmic methods that delve deeper into order book data.

Algorithmic Trading Using Order Book Data

Algorithmic trading relies on order book data to identify opportunities, optimize execution, and manage risk. A key step is defining order book features that offer predictive insights. One example is "book skew", which measures the imbalance between resting bid and ask depth at the top of the order book.

An example from Interactive Brokers Campus highlights a rule-based liquidity-taking strategy using E-mini S&P 500 futures. In this strategy, book skew – calculated as the log difference between bid and ask depth – triggered trades when skew exceeded a set buy threshold or dropped below a sell threshold. The system limited positions to a maximum of 10 contracts and factored in real-time profit and loss calculations, including commissions. It utilized Databento‘s mbp-1 schema for top-of-book data.

Key steps for implementing such strategies include:

- Defining precise trading rules based on order book features.

- Starting with small order sizes to minimize market impact.

- Accounting for commissions and setting strict risk controls.

In live trading, it’s essential to consider execution delays and combine rule-based signals with robust risk management systems. Enhancements like machine learning models and advanced inventory management can further refine these strategies. Additionally, using limit orders strategically can help reduce slippage and manage execution costs, especially in markets with wider bid-ask spreads. Monitoring liquidity is equally important, particularly when handling larger positions.

Infrastructure Requirements for Low-Latency Trading

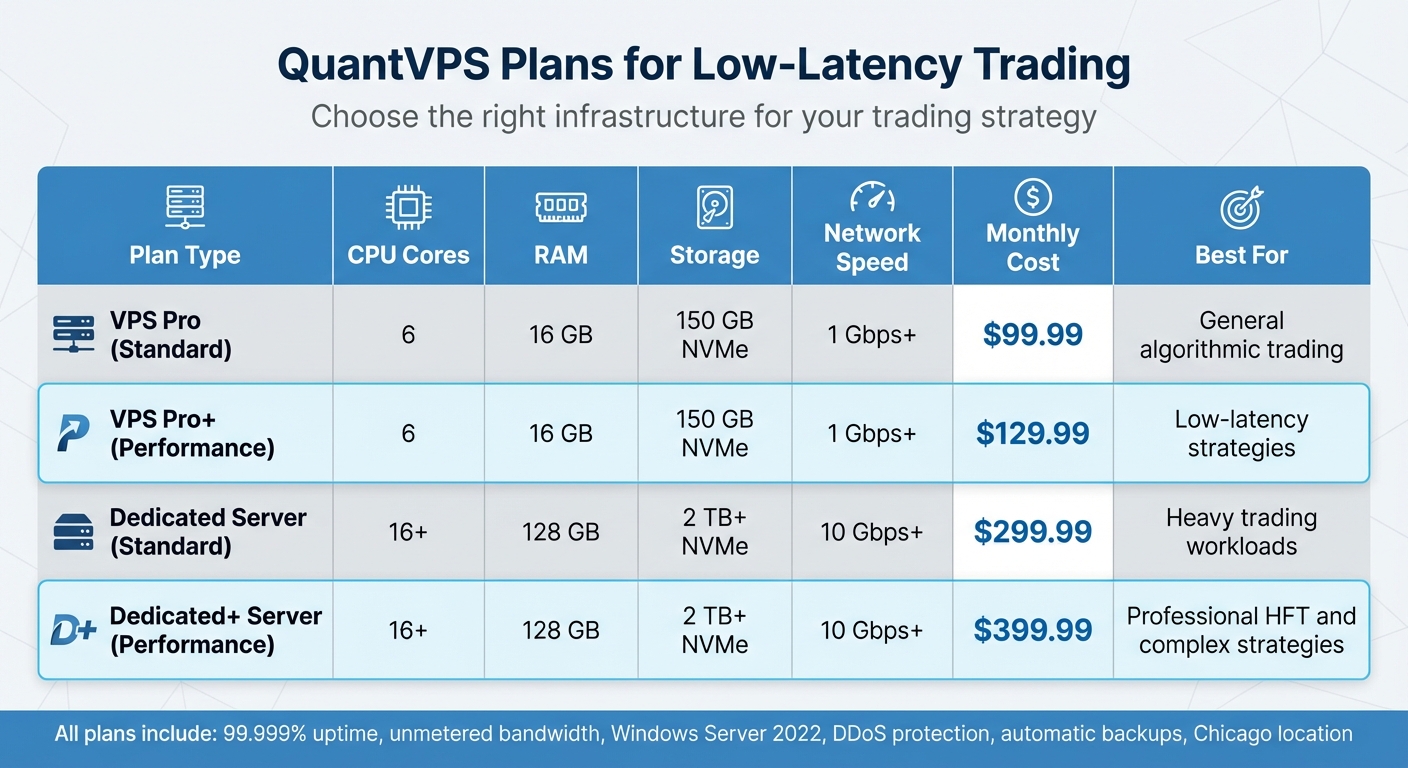

QuantVPS Trading Server Plans Comparison Chart

QuantVPS Trading Server Plans Comparison Chart

Why Low Latency Matters in Microstructure Trading

In the world of market microstructure trading, speed isn’t just an advantage – it’s a necessity. High-frequency trading systems can execute trades in as little as 10 milliseconds. This lightning-fast execution allows traders to seize fleeting price differences that often vanish in the blink of an eye.

As Investopedia explains:

Having the fastest execution speeds allows traders and financial institutions to capitalize on minimal price discrepancies for higher profitability.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Having the fastest execution speeds allows traders and financial institutions to capitalize on minimal price discrepancies for higher profitability.

The influence of latency on market behavior is substantial. For example, a study found that imposing taxes on high-frequency trading resulted in a 13% average increase in bid-ask spreads, underscoring the role these systems play in maintaining market liquidity. Even a delay of 40 milliseconds can mean the difference between successfully capturing or missing a lucrative arbitrage opportunity. In December 2025, HangukQuant emphasized that high-frequency trading models must operate with latency below 40 milliseconds to remain competitive in exploiting cross-exchange arbitrage opportunities. Firms such as Tower Research Capital and Virtu Financial rely on advanced algorithms to execute trades in fractions of a second, taking full advantage of rapid market shifts.

This relentless demand for speed drives the need for specialized infrastructure solutions, tailored to meet these exacting requirements.

QuantVPS Plans Compared for Trading Needs

QuantVPS provides infrastructure specifically designed for low-latency trading, with servers strategically located in Chicago to ensure 99.999% uptime. Their offerings include FPGA Accelerated Network Interface Cards for ultra-fast connectivity, robust DDoS protection, and automatic backups to safeguard data.

| Plan Type | CPU Cores | RAM | Storage | Network Speed | Monthly Cost | Best For |

|---|---|---|---|---|---|---|

| VPS Pro (Standard) | 6 | 16 GB | 150 GB NVMe | 1 Gbps+ | $99.99 | General algorithmic trading |

| VPS Pro+ (Performance) | 6 | 16 GB | 150 GB NVMe | 1 Gbps+ | $129.99 | Low-latency strategies |

| Dedicated Server (Standard) | 16+ | 128 GB | 2 TB+ NVMe | 10 Gbps+ | $299.99 | Heavy trading workloads |

| Dedicated+ Server (Performance) | 16+ | 128 GB | 2 TB+ NVMe | 10 Gbps+ | $399.99 | Professional HFT and complex strategies |

Performance plans stand out with enhanced routing and optimized network configurations, making them ideal for traders who need the absolute lowest latency. While standard plans are tailored for general algorithmic trading, performance plans cater specifically to high-frequency strategies where every millisecond matters. All plans come with unmetered bandwidth, Windows Server 2022, and full compatibility with popular trading platforms like NinjaTrader and MetaTrader.

Conclusion

Key Points About Market Microstructure

For anyone serious about trading, understanding market microstructure is not just a bonus – it’s a necessity. As Sachin Kotecha from Traders.MBA puts it:

The study of market microstructure is essential for investors, traders, and regulators as it helps them understand how financial markets operate, how trades are executed, and what factors can impact the efficiency and fairness of the market.

The study of market microstructure is essential for investors, traders, and regulators as it helps them understand how financial markets operate, how trades are executed, and what factors can impact the efficiency and fairness of the market.

Key concepts like order flow, liquidity, and price formation play a direct role in how trades are executed. Order flow shows who holds control at certain price levels, making it easier to identify precise entry and exit points. Liquidity affects transaction costs through the bid-ask spread – tight spreads indicate high liquidity, while wider spreads suggest higher implicit costs. Tools like order books and footprint charts help traders identify support, resistance levels, and optimal trading opportunities with greater accuracy.

QuantInsti highlights the importance of these concepts:

Market microstructure is essential in trading firms because it enhances order execution, cost efficiency, and strategy development.

Market microstructure is essential in trading firms because it enhances order execution, cost efficiency, and strategy development.

By understanding these dynamics, traders can reduce market impact and improve performance through better transaction cost analysis. Combining these insights with a strong trading infrastructure is critical for successfully executing microstructure-based strategies.

Using QuantVPS for Better Trading Performance

Mastering market microstructure also underscores the importance of a high-performance trading setup. QuantVPS ensures you have the speed and reliability needed to capitalize on fleeting market opportunities with sub-millisecond latency and a 100% uptime guarantee.

Whether you’re running high-frequency strategies on the Dedicated+ Server for $399.99/month or testing algorithms with the VPS Pro+ at $129.99/month, QuantVPS provides unmetered bandwidth, Windows Server 2022, and seamless compatibility with platforms like NinjaTrader and MetaTrader. Plus, features like DDoS protection and automatic backups give you peace of mind, allowing you to focus entirely on executing your trades.

FAQs

How do different order types impact trading costs and execution outcomes?

Order types are essential tools in trading, shaping both direct costs (like fees) and indirect costs (such as slippage). Let’s break it down:

Market orders are all about speed. They aim for immediate execution at the best price available. However, if your order size is large compared to the market’s depth, it can push prices against you, leading to higher costs.

Limit orders work differently. They allow you to set a specific price for buying or selling. This approach can help you avoid unfavorable price changes, potentially saving on costs. The trade-off? If the market doesn’t hit your target price, the order might not go through.

Then there are stop-loss and stop-limit orders, which add a layer of risk management. A stop-loss order turns into a market order once a trigger price is reached, guaranteeing execution but with the possibility of slippage. A stop-limit order, on the other hand, transforms into a limit order at the trigger price, giving you control over the price – but at the risk of the order not being filled if the market moves too quickly.

For those seeking more specialized options, fill-or-kill and iceberg orders offer additional control. Fill-or-kill ensures the entire order is executed immediately or not at all, while iceberg orders hide the full size of your trade, revealing only small portions at a time. These advanced strategies can help manage visibility and timing but might come with higher fees or incomplete execution.

Ultimately, traders choose their order types based on their priorities. If speed is the goal, market orders are the way to go. For strategies focused on price precision, limit and stop orders are more suitable. The key is understanding the trade-offs between execution speed, cost, and certainty to make informed decisions.

What do market makers do to ensure liquidity in trading?

Market makers play an essential role in keeping financial markets running smoothly. They consistently offer bid prices (what they’re willing to pay for an asset) and ask prices (what they’re willing to sell it for), ensuring that traders can always find someone to trade with. This setup allows transactions to happen quickly and with predictable costs, even when market activity is low.

By narrowing the bid-ask spread and balancing out excess supply or demand, market makers help minimize the price swings caused by large trades. This steady presence ensures there’s a constant flow of tradeable shares or contracts, supporting everything from high-frequency trading to everyday investment strategies. Their efforts make the trading environment more stable and dependable for everyone.

Why is low latency important in high-frequency trading?

In high-frequency trading, low latency is absolutely essential. It enables traders to execute, modify, or cancel orders in just microseconds – an edge that’s crucial for seizing fleeting price changes and staying ahead of competitors.

When the time it takes for data to travel and orders to process is minimized, traders gain a noticeable advantage in a market where even the tiniest fraction of a second can tip the scales. Faster execution means more chances to take advantage of price inefficiencies and sudden market shifts, making speed a game-changer in this fast-paced environment.