Futures vs CFD Trading: Key Differences

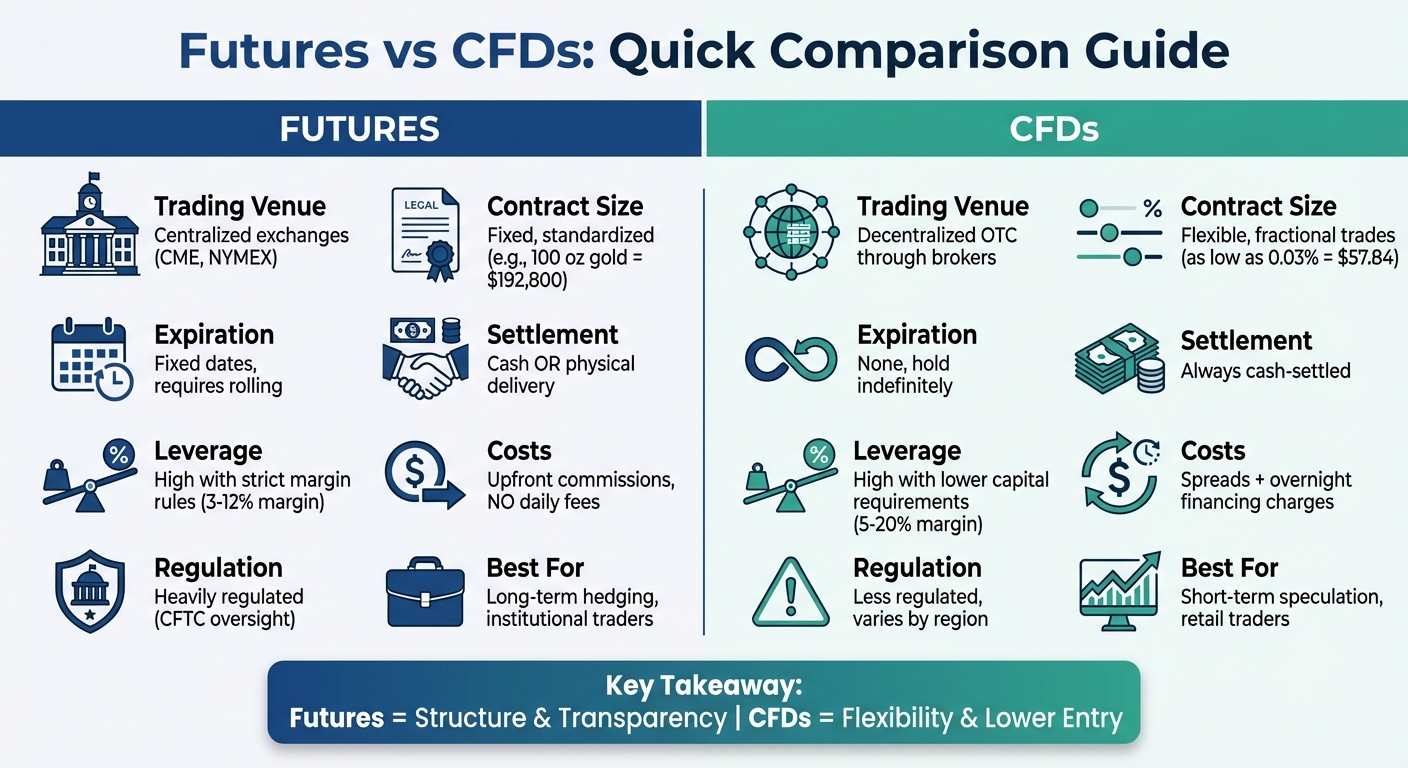

Futures and CFDs are two popular trading instruments that let you speculate on price movements without owning the underlying asset. Here’s a quick breakdown:

- Futures: Standardized contracts traded on regulated exchanges, ideal for long-term strategies and hedging. They have fixed expiration dates, transparent pricing, and no ongoing financing costs.

- CFDs: Flexible, broker-driven agreements with no expiration. They suit short-to-medium-term trading and smaller capital but incur daily financing fees for positions held overnight.

Quick Comparison:

| Feature | Futures | CFDs |

|---|---|---|

| Trading Venue | Centralized exchanges (e.g., CME) | Decentralized (OTC through brokers) |

| Contract Size | Fixed, standardized | Adjustable, fractional trades |

| Expiration | Fixed dates | None, but financing costs apply |

| Settlement | Cash or physical delivery | Always cash-settled |

| Leverage | High, with strict margin rules | High, with lower capital requirements |

| Costs | Upfront commissions, no daily fees | Spreads + overnight charges |

| Regulation | Heavily regulated | Less regulated, varies by region |

Futures offer structure and transparency, while CFDs provide flexibility and lower entry barriers. Choosing the right one depends on your trading goals, capital, and risk tolerance.

Futures vs CFDs Trading Comparison Chart

Futures vs CFDs Trading Comparison Chart

CFDs vs Futures: What Are the Differences And Which is Best? ✅

What Are Futures Contracts?

A futures contract is essentially a legal agreement between two parties to buy or sell a specific asset at a predetermined price on a future date. What makes it unique is that neither party needs to own the asset at the time of the agreement.

One standout feature of futures contracts is their strict standardization. Every detail - like the size of the contract or delivery terms - is predefined. Take crude oil futures, for example: one contract usually represents 1,000 barrels. Similarly, an E-mini S&P 500 futures contract adjusts by $50 for every one-point movement in the index. This level of standardization ensures that trading is transparent and consistent for everyone involved.

Futures contracts are traded exclusively on regulated exchanges like the CME Group or NYMEX. These exchanges provide structured trading environments with set hours, unified pricing, and oversight from agencies like the Commodity Futures Trading Commission (CFTC). To further reduce risk, a clearinghouse - often part of the exchange - guarantees that contracts will be honored, minimizing the chance of default by either party.

Each futures contract has a fixed expiration date. Most traders choose to close their positions before this date to realize profits rather than taking physical delivery of the asset. For example, index futures typically expire on the third Friday of each month. When contracts are settled, it can happen in one of two ways: through the physical delivery of the asset or via cash payment.

Futures contracts are used for both hedging and speculation. Businesses often use them to manage risk - like airlines locking in fuel prices to avoid market volatility. Speculators, on the other hand, aim to profit from price changes. For instance, if wheat prices rise from $7.50 to $8.00 per bushel, a trader holding a single contract (representing 5,000 bushels) could see a $2,500 profit.

Up next, we’ll dive into CFDs, which offer a different way to trade on price movements.

What Are CFDs?

A Contract for Difference (CFD) allows you to trade on the price movement of an asset without actually owning it. As Dukascopy Bank SA explains:

Without actually owning the asset itself, trading a Contract for Difference (CFD) is effectively placing a bet on whether its price will rise or fall.

Without actually owning the asset itself, trading a Contract for Difference (CFD) is effectively placing a bet on whether its price will rise or fall.

Here’s how it works: You and your broker agree to exchange the difference between an asset’s price when you open the position and its price when you close it. If you think the price will go up, you take a long position. If you expect it to drop, you go short. Your profit or loss is calculated by multiplying the price difference by your position size.

For example, in a 2025 gold CFD trade, a trader opened a long position at $2,700 per ounce using a 1:50 leverage ratio. With just $5,400 as an initial margin, they controlled 100 ounces of gold worth $270,000. When the price rose to $2,750, they earned $5,000 - a 92.6% return on their margin.

CFDs differ from standardized futures in several ways. They don’t have an expiration date, so you can hold positions indefinitely (though holding costs may apply). Additionally, CFDs allow smaller trades. For instance, while a standard gold futures contract represents 100 ounces (about $192,800), gold CFDs let you trade as little as 0.03% of a contract, equating to roughly $57.84 in exposure.

CFDs are traded over-the-counter (OTC) directly with your broker, offering flexibility and access to a wide range of markets. All trades are cash-settled, so there’s no physical delivery of the asset. As IG points out:

When you trade CFDs, you would always settle a position in cash. You wouldn't ever take ownership of the underlying asset.

When you trade CFDs, you would always settle a position in cash. You wouldn't ever take ownership of the underlying asset.

CFDs are particularly attractive to traders with limited capital or short-term strategies. However, it’s important to note that while leverage can amplify profits, it also increases potential losses. Up next, we’ll explore the structural differences between CFDs and futures.

Key Structural Differences: Futures vs CFDs

Futures contracts come with strict standardization in terms of size, delivery, and settlement. For instance, a standard gold futures contract on CME Group always equals 100 troy ounces and follows specific expiration dates. CFDs, on the other hand, are far more flexible. They let you adjust your trade size, even allowing fractional trades of what would be a standard contract.

Where these instruments are traded also sets them apart. Futures are traded on regulated exchanges like CME Group or NYMEX, where pricing is centralized - everyone sees the same numbers. CFDs operate in a decentralized over-the-counter (OTC) market through brokers, meaning prices can differ depending on the provider. This makes futures trading a go-to option for those seeking price transparency and structured risk management.

Another key difference lies in expiration dates. Futures come with fixed expiration dates, requiring traders to close, roll over, or settle their positions by that deadline. CFDs, however, have no set expiration and allow positions to remain open indefinitely - though overnight financing charges usually apply.

Settlement methods also vary. CFDs always settle in cash, based on the difference between the opening and closing prices. Futures, however, can settle in two ways: cash (commonly used for financial futures like stock indices) or physical delivery of the underlying asset. The latter can add logistical challenges if you're not prepared to handle the actual commodity.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Comparison Table: Structural Differences

| Feature | Futures | CFDs |

|---|---|---|

| Contract Standardization | Fixed sizes and specifications | Flexible, customizable trade sizes |

| Trading Venue | Centralized exchanges (e.g., CME Group, NYMEX) | Decentralized, OTC through brokers |

| Regulation | Heavily regulated by bodies like the CFTC | Varies by region; less standardized |

| Expiration Dates | Fixed dates requiring active management | No expiration; can hold positions indefinitely |

| Settlement Method | Cash or physical delivery | Always cash-settled |

| Price Transparency | High, due to centralized exchange pricing | Lower; prices vary between brokers |

These structural distinctions also influence trading costs, which we’ll dive into next.

Trading Costs and Fees: Futures vs CFDs

Understanding trading costs is crucial when deciding between futures and CFDs. With exchange-traded futures, costs are straightforward. You pay upfront commissions and meet clear margin requirements, so you know exactly what you're spending before opening a position. Now, let's dive into how CFD costs differ.

CFDs operate under a distinct cost structure. For example, when trading indices or commodities with no commission, the spread becomes your primary expense. On the other hand, stock CFDs often come with an additional commission that aligns with the rates of the underlying market.

One major difference lies in the cost of holding positions overnight. Cash CFDs incur daily financing charges to account for leverage. At FOREX.com, these charges are calculated as the relevant base rate plus 2.5% for long positions (or minus 2.5% for shorts), divided by 365 days. For instance, a £22,020 position at a SONIA rate of 0.25% would cost approximately £1.65 per day. Futures, however, embed these financing costs directly into the contract price, making them potentially more appealing for longer-term positions.

Futures CFDs also handle costs differently. While their spreads are typically wider than those of cash CFDs, they don't charge separate overnight fees since financing costs are built into the spread. Rolling a futures CFD into the next contract usually costs half the spread, offering an alternative structure for traders.

Comparison Table: Trading Costs

| Cost Component | Exchange-Traded Futures | Cash CFDs | Futures CFDs |

|---|---|---|---|

| Commissions | Yes (upfront per contract) | Yes (typically on stock CFDs only) | Generally included in the spread |

| Spreads | Not a direct cost (exchange-driven) | Yes (primary cost for indices/commodities) | Yes (wider than cash CFDs) |

| Overnight Financing | No (factored into contract price) | Yes (daily charges on held positions) | No (built into the wider spread) |

| Exchange Fees | Yes (charged by the trading venue) | No | No |

| Margin Requirements | Yes (upfront capital deposit) | Yes (deposit to open/maintain positions) | Yes (deposit to open/maintain positions) |

| Rolling Costs | May apply at expiration | N/A (no expiration) | Half the spread to roll contracts |

Leverage, Margin, and Capital Requirements

Though both CFDs and futures rely on leverage to amplify market exposure, their margin structures differ in ways that directly influence the upfront capital needed to trade and the risks involved. These differences are crucial for understanding how much capital you’ll need to get started and how these instruments align with your trading goals.

CFDs generally require less initial capital, making them a popular choice for retail traders. Margin requirements for CFDs vary by market - typically around 5% for most forex pairs and major indices, but they can climb to 20% for certain commodities. For example, purchasing 5 Wall Street CFDs at $34,000 each creates a total position size of $170,000. With a 5% margin requirement, you’d need $8,500 to open this position.

Futures, on the other hand, demand higher margin deposits due to their standardized contract sizes. Take a wheat futures contract as an example: it covers 5,000 bushels at $7.50 per bushel, resulting in a total contract value of $37,500. To trade this contract, you might need an initial margin of around $3,000. Margin requirements for futures typically range from 3% to 12% of the contract’s notional value, which can be a hurdle for smaller retail traders. However, micro futures contracts have introduced more flexibility, with margins as low as $50 per contract.

Leverage amplifies both potential gains and losses, increasing the risk of margin calls. When your account balance falls below the required margin, positions may be automatically closed. Research shows that about 71% of retail client accounts lose money trading CFDs, highlighting the risks tied to high leverage. It’s critical to maintain adequate funds to meet margin requirements at all times.

Another distinction is the cost structure. CFDs often incur overnight financing charges for positions held beyond a day, while futures don’t have these ongoing charges since such costs are factored into the contract pricing. Understanding these capital requirements is essential for choosing the trading tool that best fits your strategy and risk tolerance.

Market Access and Availability

When it comes to market access, futures and CFDs operate in fundamentally different environments. Futures are traded on regulated exchanges like CME Group and NYMEX, which ensures standardized contracts and transparent pricing. On the other hand, CFDs are traded over-the-counter (OTC) through brokers, leading to decentralized pricing that can fluctuate between providers. These differences shape the trading experience, particularly in terms of hours, liquidity, and the range of markets available.

Futures trading adheres to exchange schedules. For example, CME operates from Sunday at 6:00 PM EST to Friday at 5:00 PM EST, with daily breaks. In contrast, CFDs generally offer 24/5 trading, running from Sunday at 5:00 PM EST to Friday at 5:00 PM EST. Unlike futures, CFDs don’t have fixed expiration dates, though traders should account for overnight financing fees.

Liquidity and execution quality also vary between these instruments. Futures for major assets like the S&P 500 E-mini or crude oil benefit from deep liquidity and transparent order books, which help minimize slippage. Meanwhile, CFD pricing depends on brokers, and execution quality can be less predictable, especially during volatile market conditions.

The range of markets available is another key difference. Futures grant access to major asset classes - commodities, indices, currencies, and interest rates - through regulated exchanges. CFDs, however, offer broader exposure, including individual stocks, ETFs, and an extensive selection of cryptocurrencies, often with flexible contract sizes. This flexibility appeals to retail traders, though U.S. retail traders face regulatory restrictions that limit access to CFDs.

Risks and Counterparty Exposure

When it comes to counterparty risk, futures and CFDs operate on entirely different foundations. Futures rely on a central clearinghouse that acts as a middleman between buyers and sellers. This setup ensures that every contract is backed by the clearinghouse, significantly reducing the risk of default. If one party fails to meet its obligations, the clearinghouse steps in to cover the shortfall, creating a secure trading environment.

CFDs, on the other hand, tell a different story. These are traded over-the-counter (OTC), meaning your broker serves as the direct counterparty for every trade. This arrangement ties your funds and potential profits to the financial stability of the broker. If the broker experiences financial trouble or goes bankrupt, recovering your money can become a difficult, if not impossible, task.

Regulation also sets these two instruments apart. Futures markets are heavily regulated by organizations like the Commodity Futures Trading Commission (CFTC) in the U.S., ensuring standardized contracts and transparent pricing through centralized exchanges. This centralized and regulated structure significantly reduces counterparty risk. In contrast, CFDs operate in a decentralized OTC market, often with less regulatory oversight. This lack of regulation means CFD traders are largely dependent on their broker's financial health, and the decentralized nature can lead to less price transparency and fewer protections.

Both futures and CFDs come with market risks such as volatility and leverage. However, the differences in counterparty exposure and regulatory safeguards make futures a more secure choice for traders focused on protecting their funds and ensuring transparency in market conditions. These distinctions are crucial when deciding between the two.

| Risk Factor | Futures | CFDs |

|---|---|---|

| Counterparty | Central clearinghouse guarantees contracts | Broker is the direct counterparty |

| Counterparty Risk | Very low due to clearinghouse backing | Higher risk, tied to broker's financial health |

| Regulation | Strict oversight (e.g., CFTC in the U.S.) | Less regulated; not permitted in the U.S. |

| Market Structure | Centralized, exchange-based | Decentralized, over-the-counter (OTC) |

| Investor Protection | Strong protections and transparency | Limited protections; potential broker conflicts |

Use Cases: Day Trading vs Long-Term Hedging

The choice between futures and CFDs depends heavily on your trading style. Each instrument offers distinct benefits, and knowing how they align with your strategy can make a significant difference in your results. Now that we've covered their structural and cost differences, let's dive into their practical applications for day trading and hedging.

For day trading, both futures and CFDs can work well, but each has its own set of trade-offs. CFDs are attractive due to their lower capital requirements and the ability to trade fractional positions, which eliminates the need to deal with standardized contract sizes. On the other hand, futures stand out for their narrow spreads and deep liquidity, especially with major contracts like the E-mini S&P 500. The introduction of micro futures, such as the Micro E-mini S&P 500 (MES) and Micro NASDAQ-100 (MNQ), has made futures more accessible for retail traders. These micro contracts retain the benefits of tight spreads and transparency that day traders prioritize, making them a competitive option.

When it comes to long-term hedging, the differences become even more apparent. Futures contracts are specifically designed for long-term strategies and excel in areas like commodities trading, where businesses often need to lock in prices far in advance. For instance, a wheat farmer can sell futures contracts to secure a price for the next harvest, effectively eliminating price uncertainty. CFDs, by contrast, are less suited for long-term hedging because of the ongoing financing fees they incur. These daily fees can significantly cut into profits, making CFDs impractical for positions held over extended periods. Futures, with their one-time upfront costs and no ongoing charges, offer a more predictable and cost-effective option for long-term positions.

For short to medium-term speculation, CFDs have a clear edge due to their flexibility and lower barriers to entry. They allow traders to hold positions for days or weeks without worrying about contract expiration dates. However, if your time horizon extends to months, the daily financing costs of CFDs start to erode returns. In such cases, futures become the more economical choice, thanks to their fixed costs and lack of ongoing fees.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Comparison Table: Use Cases

| Trading Style | Futures | CFDs |

|---|---|---|

| Day Trading | High liquidity, tight spreads, micro contracts (MES, MNQ) | Lower capital requirements, flexible position sizing, easier account access |

| Short-Term Speculation | Fixed expiry dates require rolling positions, higher capital needs | No expiry dates, flexible holding periods, lower initial capital |

| Long-Term Positions | No ongoing fees, predictable costs, ideal for extended holds | Overnight financing charges accumulate, significantly reducing profitability |

| Hedging Strategies | Built for hedging, standardized contracts, exchange-traded | Limited hedging use due to financing costs and OTC structure |

| Capital Efficiency | Higher upfront margin, standardized contract sizes | Lower margin requirements, fractional position sizing |

QuantVPS: High-Performance VPS for Futures Trading

In the fast-paced world of futures trading, execution speed can make all the difference. Prices in the futures market can shift in the blink of an eye, reacting to economic updates, global events, or sudden shifts in trader sentiment. Even a few milliseconds of delay can mean missing a key opportunity or entering a trade too late. That’s why having a high-performance VPS is crucial, especially for traders relying on algorithms or navigating highly volatile market hours.

To meet this need for speed and reliability, QuantVPS delivers top-tier performance tailored for futures trading. With lightning-fast 0-1ms latency and 100% uptime, it ensures your trading strategies - whether automated or manual - run without interruption. The platform is built with features like DDoS protection, automatic backups, and NVMe storage, so your trading operations stay smooth even during peak market activity.

QuantVPS supports popular trading platforms such as NinjaTrader, MetaTrader, and TradeStation. It offers full root access, dedicated resources, and system monitoring, making it easy to integrate and manage. For algorithmic traders, this means your Expert Advisors (EAs) and automated strategies can operate 24/7 without worrying about internet outages or unexpected computer shutdowns at home.

Here’s a breakdown of the available plans:

- Starter Plan: $59.99/month (or $41.99/month annually) includes 4 cores, 8GB RAM, and 70GB NVMe storage - perfect for running 1–2 charts.

- VPS Pro Plan: $99.99/month (or $69.99/month annually) upgrades to 6 cores and 16GB RAM, ideal for multi-monitor setups or heavier workloads.

- Dedicated Server Plan: $299.99/month (or $209.99/month annually) offers 16+ cores, 128GB RAM, and 2TB+ NVMe storage for traders managing intensive strategies.

For advanced trading, a dedicated VPS provides consistent, fast order execution, minimizing slippage and ensuring that trades are executed at the prices you expect. Whether you’re day trading E-mini S&P 500 futures or running overnight algorithms on crude oil contracts, having a server located close to exchange data centers gives you a significant edge. This level of performance supports the strategies and cost-saving measures discussed earlier, making it an essential tool for serious futures traders.

Choosing Between Futures and CFDs

Deciding between futures and CFDs depends on your trading objectives, available capital, and approach to risk. Futures offer stricter regulatory oversight, transparent pricing, and lower long-term holding costs due to their formal exchange trading. These features make them a solid choice for institutional traders or anyone who values standardized contracts with set expiration dates. However, futures typically demand a higher upfront investment. For instance, a standard gold futures contract represents 100 ounces of gold, which is worth about $192,800.

On the other hand, CFDs come with no fixed expiration dates, allowing traders to hold positions indefinitely, though overnight financing charges will apply. Gold CFDs also represent 100 ounces per contract but can be traded in increments as small as 0.03% of a contract, giving exposure at approximately $57.84. This lower entry point and flexible position sizing make CFDs particularly appealing to retail traders focused on short-term profits. These differences highlight how each instrument aligns with specific trading strategies.

For day trading and short-term speculation, CFDs are often the go-to option because of their flexibility and ability to adapt quickly to market movements. On the flip side, longer-term strategies, hedging, or risk management may favor futures, thanks to their price stability and lack of daily financing charges. These factors play a key role in shaping your trading approach.

Both CFDs and futures offer high leverage, which can magnify both gains and losses. As mentioned earlier, managing risk effectively is critical when using leverage, regardless of the instrument you choose.

If you're just starting out, consider beginning with smaller positions to build experience. CFDs might be more accessible for new traders, while those with larger capital and a well-defined market perspective could benefit from the structure and transparency that futures provide.

FAQs

What are the key risks of trading CFDs compared to futures?

Trading CFDs (Contracts for Difference) presents its own set of challenges compared to futures. One of the main concerns is counterparty risk. Since CFDs are traded over-the-counter (OTC) rather than on regulated exchanges, there’s a greater chance that the broker could default, leaving traders exposed.

Another key factor is the use of higher leverage in CFD trading. While leverage can magnify potential profits, it also significantly increases the risk of losses. Coupled with wider spreads and less transparent pricing, this can lead to higher trading costs and unforeseen risks. Unlike futures, CFDs are not standardized, which makes them harder to predict and manage, especially for traders with long-term strategies.

Before diving into CFD trading, it’s crucial to evaluate these risks and have a strong risk management plan in place. Proper preparation can make all the difference in navigating this complex market.

How do CFD financing costs affect long-term trading strategies?

CFD financing costs, like overnight funding fees, can eat into your profits, especially if you're holding positions for an extended period. These fees are charged daily when positions are kept open overnight, and over time, they can add up significantly.

For long-term traders, this can be a drawback. Instruments like futures might be a better choice since they don’t come with these daily charges. When building your trading strategy, it’s crucial to account for these costs to make sure they align with your goals and risk appetite.

Why do traders often prefer futures over CFDs for hedging?

Futures contracts are a popular choice among traders for hedging, primarily because they are traded on regulated exchanges. This setup guarantees standardized terms and a higher level of transparency, which significantly reduces counterparty risk. As a result, futures provide a safer option for managing long-term risks.

The standardized structure of futures also simplifies pricing and tracking, giving traders clearer insights when crafting their hedging strategies. These qualities make futures especially attractive to those who place a strong emphasis on risk management and regulatory compliance in their trading activities.

Trading CFDs (Contracts for Difference) presents its own set of challenges compared to futures. One of the main concerns is counterparty risk. Since CFDs are traded over-the-counter (OTC) rather than on regulated exchanges, there’s a greater chance that the broker could default, leaving traders exposed.

Another key factor is the use of higher leverage in CFD trading. While leverage can magnify potential profits, it also significantly increases the risk of losses. Coupled with wider spreads and less transparent pricing, this can lead to higher trading costs and unforeseen risks. Unlike futures, CFDs are not standardized, which makes them harder to predict and manage, especially for traders with long-term strategies.

Before diving into CFD trading, it’s crucial to evaluate these risks and have a strong risk management plan in place. Proper preparation can make all the difference in navigating this complex market.

CFD financing costs, like overnight funding fees, can eat into your profits, especially if you're holding positions for an extended period. These fees are charged daily when positions are kept open overnight, and over time, they can add up significantly.

For long-term traders, this can be a drawback. Instruments like futures might be a better choice since they don’t come with these daily charges. When building your trading strategy, it’s crucial to account for these costs to make sure they align with your goals and risk appetite.

Futures contracts are a popular choice among traders for hedging, primarily because they are traded on regulated exchanges. This setup guarantees standardized terms and a higher level of transparency, which significantly reduces counterparty risk. As a result, futures provide a safer option for managing long-term risks.

The standardized structure of futures also simplifies pricing and tracking, giving traders clearer insights when crafting their hedging strategies. These qualities make futures especially attractive to those who place a strong emphasis on risk management and regulatory compliance in their trading activities.

"}}]}