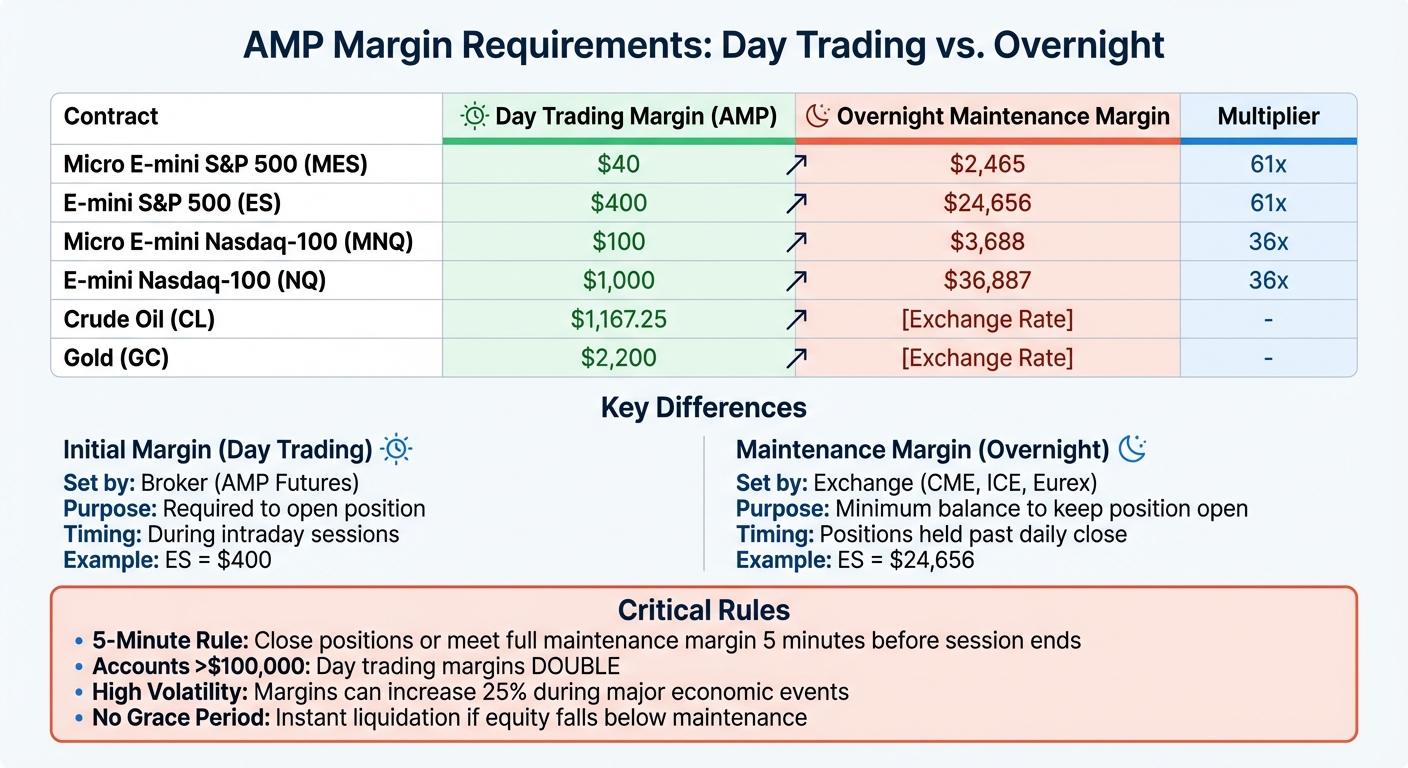

AMP Futures margin requirements are crucial for managing risk in futures trading. Here’s the key takeaway:

- Initial Margin: The upfront amount needed to open a position, set by AMP for day trading. For example, trading a Micro E-mini S&P 500 (MES) requires just $40 during the day.

- Maintenance Margin: The minimum balance required to keep a position open overnight, set by the exchange. For MES, this jumps to $2,465 if held overnight.

- Day Trading Margins: AMP offers lower intraday margins, such as $400 for E-mini S&P 500 (ES), but these increase significantly for overnight positions.

- Dynamic Adjustments: Margins can change during high volatility or economic events, with AMP enforcing stricter rules like the "5-minute rule" to ensure compliance.

Quick Comparison

| Feature | Initial Margin (Day Trading at AMP) | Maintenance Margin (Overnight) |

|---|---|---|

| Micro E-mini S&P 500 (MES) | $40 | $2,465 |

| E-mini S&P 500 (ES) | $400 | $24,656 |

| E-mini Nasdaq-100 (NQ) | $1,000 | $36,887 |

To avoid margin calls or forced liquidations, monitor your account balance, maintain a buffer, and close positions or meet maintenance requirements before the market closes.

AMP Futures Margin Requirements: Day Trading vs Overnight Comparison Chart

Initial Margin vs. Maintenance Margin: Key Differences

What Is Initial Margin?

Initial margin is the upfront deposit you need to provide to open a futures position. Think of it as a good faith payment that ensures you can meet your contract obligations. This margin is calculated as a percentage of the contract’s total notional value (the full cash equivalent of the underlying asset). Typically, it falls between 3% and 12% of the contract’s worth. For example, opening a $140,000 E-mini S&P 500 contract might require an initial margin of $5,500, which is 4% of the contract’s value.

At AMP Futures, the broker sets its own Day Trading Margin for intraday trades, which is much lower than the exchange’s requirements. For example, trading the E-mini S&P 500 (ES) during the day only requires $400, while the Micro E-mini S&P 500 (MES) requires just $40.

"In futures, you put down a good faith deposit called the initial margin requirement. It’s important to note that gains or losses on futures positions could exceed the initial margin requirement."

– Charles Schwab

This highlights how initial margin serves as the entry cost for a position, while maintenance margin ensures the account remains funded for ongoing trades.

What Is Maintenance Margin?

Maintenance margin is the minimum account balance you must have to keep a position open. Unlike the initial margin, this requirement is determined by the exchange, not the broker, and it applies to positions held beyond the daily trading session. If your account balance drops below this level, you’ll receive a margin call, requiring you to deposit additional funds to bring the account back to the initial margin level.

The difference between day trading and maintenance margins can be dramatic. For instance, while you only need $40 to day trade a Micro E-mini S&P 500 (MES), holding the same contract overnight requires a maintenance margin of $2,465. For the standard E-mini S&P 500 (ES) contract, the maintenance margin jumps to $24,656 – over 60 times the day trading margin.

Maintenance margins are usually set at 50% to 75% of the initial margin. Exchanges can also adjust these requirements without prior notice during periods of high market volatility or major economic events.

Comparison Table: Initial vs. Maintenance Margins

Here’s a quick breakdown of the main differences:

| Feature | Initial Margin (Day Trading at AMP) | Maintenance Margin |

|---|---|---|

| Purpose | Required to open a new position | Minimum balance required to keep a position open |

| Set By | Broker (AMP Futures) | Exchange (e.g., CME, ICE, Eurex) |

| Timing | Applies during intraday trading sessions | Applies to positions held past the daily close |

| ES Example | $400 | $24,656 |

| MES Example | $40 | $2,465 |

| Enforcement | Checked at order entry | Monitored continuously; triggers margin calls |

AMP Futures Margin Policies

Day Trading Margins at AMP

AMP Futures is a low intraday margin futures broker that offers reduced requirements compared to full exchange maintenance, giving intraday traders more room to maneuver their capital. These margins are applicable during active market hours but exclude the final 15 minutes of trading.

The margin requirements vary depending on the contract and market conditions. For instance:

- Micro E-mini S&P 500 (MES): $40 per contract

- E-mini S&P 500 (ES): $400 per contract

- Micro E-mini Nasdaq-100 (MNQ): $100 per contract

- E-mini Nasdaq-100 (NQ): $1,000 per contract

- Crude Oil (CL): $1,167.25 per contract

- Gold (GC): $2,200 per contract

"Day Trade Margin is solely the amount required to enter into a position per contract on an intraday day basis. It is NOT the risk liquidation trigger nor the maximum amount your account can lose." – AMP Futures

These margins are calculated on a per-contract basis, so if you plan to trade multiple contracts, you’ll need to multiply the margin by the number of contracts.

Let’s take a closer look at how margin requirements change when positions are held overnight or during periods of high volatility.

Overnight and High Volatility Adjustments

If you hold positions past the daily close, the margin requirements increase significantly. AMP enforces a "5-Minute Rule", meaning traders must either close their positions or ensure they have enough funds to meet the full exchange maintenance margin at least five minutes before the session ends. For example:

- E-mini S&P 500 (ES): Margin jumps from $400 to $24,656

- Micro E-mini S&P 500 (MES): Margin increases from $40 to $2,465

During the U.S. overnight session (starting at 5:00 PM CST) or around major economic events, AMP temporarily sets margins for U.S. Equity Indices at 25% of the full maintenance requirement.

In extreme market conditions, AMP may double the day trading margins or require 100% of the exchange maintenance margins for both day and overnight trading sessions. Additionally, AMP enforces Market Limit Halt triggers during volatility. For instance, if the ES price comes within 8 points of the CME Limit Halt Price, AMP requires your account to meet the maintenance margin or they may close your position.

"If the market gets close to the Daily CME Limit Halt Price, we will require your account balance to meet Exchange Maintenance Margins… or we will attempt to close your OPEN positions before the CME Market Limit Market Halt is Triggered." – AMP Futures

These policies demonstrate how AMP adjusts margins dynamically to address market risks. Now, let’s see how account size influences margin requirements.

Account Size and Margin Requirements

For accounts exceeding $100,000, AMP doubles the day trading margins. Here’s how the margins change:

- Micro E-mini S&P 500 (MES): From $40 to $80 per contract

- E-mini S&P 500 (ES): From $400 to $800 per contract

- E-mini Nasdaq-100 (NQ): From $1,000 to $2,000 per contract

Despite these increases, maintenance margins remain determined by the exchange.

This adjustment helps manage risk for larger accounts. For example, with a $100,000 balance, the standard $400 day trading margin for ES contracts might allow you to trade more contracts. But once your account surpasses $100,000 and the margin doubles to $800, your buying power for ES contracts is effectively reduced by half.

Additionally, retail traders face a 10% higher margin requirement. AMP also enforces strict position limits, regardless of account size – 1,000 contracts for M2K and 500 contracts for MES, MNQ, and MYM.

Margin Requirements in Practice: Examples

E-mini S&P 500 Margin Breakdown

To trade one E-mini S&P 500 (ES) contract, you’ll need $400.00 during active market hours (day trading margin) and $24,656.00 if you hold the position past the daily close (full exchange maintenance margin).

Let’s say you start with a $5,000 account at 9:30 AM EST and enter a long ES position. This transaction deducts $400 as the day trading margin. If you close the position before 4:55 PM, you avoid the overnight requirement of $24,656. However, if you hold the position overnight without sufficient funds, your broker will automatically liquidate it.

For traders with accounts exceeding $100,000, the day trading margin doubles to $800 per ES contract, though the maintenance margin remains $24,656. For smaller-scale trading, the Micro E-mini S&P 500 (MES) is an option, with margins set at one-tenth of the ES tick and point values. This means $40 for day trading and $2,465 for maintenance.

Nasdaq (NQ) Margin Example

The E-mini Nasdaq-100 (NQ) contract comes with a $1,000 day trading margin and a $36,887 maintenance margin. For instance, trading one NQ contract with a $10,000 account deducts $1,000, leaving $9,000 to cover potential losses during trading hours. If you hold the position overnight and your account equity falls below $36,887, AMP’s risk management system may liquidate the position.

Additionally, during ES and MES overnight sessions, margin requirements can temporarily increase, reaching approximately $9,221.75. For traders with smaller accounts, the Micro E-mini Nasdaq-100 (MNQ) offers a more accessible option, with day trading and maintenance margins of $100 and $3,688, respectively.

High Volatility Scenario Example

AMP Futures emphasizes the rapid adjustments that can occur during periods of high market volatility. For instance, if the ES price nears the CME Limit Halt Price, your account must meet the full maintenance margin immediately. Otherwise, AMP will attempt to close your open positions before a trading halt is triggered.

"If the market gets close to the Daily CME Limit Halt Price, we will require your account balance to meet Exchange Maintenance Margins… or we will attempt to close your OPEN positions before the CME Market Limit Halt is Triggered." – AMP Futures

In such extreme market conditions, AMP may require you to post the full $24,656 maintenance margin or double the day trading margin to $800, depending on the situation. To avoid forced liquidations, it’s crucial to keep your account balance well above the minimum requirement to handle sudden shifts.

How to Manage Margins and Avoid Margin Calls

Monitoring Margin Levels Daily

AMP Futures keeps a close eye on your account equity in real time. If your equity falls below the maintenance requirement, the margin call system kicks in immediately – there’s no grace period. Positions may be liquidated right away to protect the system.

Stick to the 5-minute rule: close positions or ensure you meet the full maintenance margin at least five minutes before the market closes. Since futures accounts are marked-to-market daily – where gains are credited and losses debited on the spot – a loss that dips your balance below the maintenance level will trigger an instant margin call.

This constant monitoring lays the groundwork for smarter position sizing.

Managing Risk and Position Sizes

To stay on the safe side, maintain at least a 25% buffer above the minimum margin requirement. When sizing positions, calculate whether (Available Equity – Initial Margin) ÷ Dollar Value per Point can handle normal market fluctuations. It’s better to size your positions to endure typical market swings rather than maxing out your leverage.

"Day Trading Margin is solely the amount required to enter into a position per contract on an intraday day basis. It is NOT the risk liquidation trigger nor the maximum amount your account can lose." – AMP Futures

Being ready for sudden margin changes is another critical piece of the puzzle.

Preparing for Margin Adjustments

In addition to daily monitoring and managing risk, traders must be ready for sudden changes in margin requirements. For example, overnight margins for U.S. Equity Indices can increase by 25% during major economic events. Exchanges may also raise maintenance requirements without warning, especially during periods of extreme volatility.

To anticipate these shifts, regularly check economic calendars for upcoming news that could lead to temporary margin increases. Reducing your position sizes during volatile times can help keep your account within margin limits, even if requirements go up. Using stop-loss orders can further protect your equity, as rapid price movements can quickly exceed your initial margin deposit.

Before placing new trades in high-volatility markets, double-check your purchasing power using your broker’s margin calculator, as these values change daily. Keeping a cash buffer in your account can also absorb sudden price swings, lowering the risk of forced liquidations when margin requirements unexpectedly rise.

Using QuantVPS for AMP Trading Platforms

Why Low Latency Matters for Margin Management

When it comes to margin management, speed and reliability are everything. AMP’s risk team adjusts margins quickly during volatile market conditions, and even the tiniest delay can make a huge difference. A VPS based in Chicago, close to the CME Group‘s matching engines, cuts network latency to under 0.52 milliseconds. With direct fiber-optic cross-connects, order execution happens in less than 1 millisecond. This kind of speed is critical because AMP can liquidate positions immediately if your equity dips below maintenance levels – even by a single tick. Ultra-low latency gives you the chance to react, whether that means closing trades or adding funds, before incurring forced liquidation fees. Plus, real-time "Excess Margin" displays keep you informed about your account status at all times. These features highlight the advantages of low latency futures trading with a specialized VPS.

QuantVPS Plans for AMP Traders

To meet the demands of low-latency trading, QuantVPS offers tailored plans that ensure top-tier performance.

- VPS Pro Plan: Includes 6 cores, 16GB RAM, and 150GB of NVMe storage. It’s priced at $99.99/month or $69.99/month if billed annually, and supports 3–5 charts on up to 2 monitors.

- VPS Ultra Plan: Provides up to 24 cores, 64GB RAM, and 500GB of NVMe storage. This plan costs $189.99/month or $132.99/month when billed annually, and supports 5–7 charts on 4 monitors.

Both plans feature a 1Gbps connection with a 10Gbps burst capability and come pre-configured with Windows Server 2022, making them ready for trading right out of the box. They’re compatible with major AMP data feeds like Rithmic, CQG, and TT, ensuring automated strategies and trade copiers run smoothly around the clock, independent of your home setup. To put it in perspective, over $100 billion was traded on QuantVPS servers in just one week in December 2025.

Maintaining Uptime During High Volatility

QuantVPS ensures 99.999% uptime through its enterprise-grade infrastructure, so you can monitor margins without interruptions, even during local outages. This reliability is especially important since AMP requires traders to meet maintenance margins or close positions within the last 5 to 15 minutes of a session. Automated bots handle closing orders to ensure compliance with these tight deadlines.

During high-volatility periods, such as news events that cause margin spikes, QuantVPS keeps your platform connected and executing trades at peak performance. With its Chicago-based datacenter, direct exchange connectivity, and 24/7 technical support, you’re equipped to navigate sudden changes in margin requirements.

Understanding Futures Margin

Conclusion

The distinction between initial and maintenance margins plays a crucial role in shaping your trading strategy. AMP Futures sets day trading margins at levels like $40.00 for MES or $400.00 for ES, offering flexibility to open positions during the trading day. However, it’s important to remember that positions must be closed – or the higher maintenance margin must be posted – before the market closes.

"Day Trading Margin is set by AMP Global. Day Trade Margin is solely the amount required to enter into a position per contract on an intraday day basis." – AMP Futures

Once you’re familiar with these margin requirements, risk management becomes your top priority. It’s wise to maintain a buffer above the minimum margin levels, calculate potential losses before entering trades, and keep an eye on your excess margin throughout the day. Be prepared for margin increases during periods of high volatility – like the 25% spike AMP imposes during overnight sessions tied to major U.S. Economic News Releases.

In such a dynamic environment, quick decision-making is essential. AMP’s risk team adjusts margin requirements in real time, and their low-latency infrastructure ensures you can act swiftly to avoid automated liquidations at unfavorable market prices, especially in the critical moments leading up to session close.

FAQs

What happens if my account falls below the maintenance margin overnight?

If your account balance falls below the maintenance margin set by the exchange overnight, your broker might issue a margin call. This requires you to either add more funds to your account or reduce your open positions to meet the margin requirements.

Failing to address the margin call quickly can result in your broker automatically liquidating some or all of your positions to restore compliance. To prevent this, keep a close eye on your account balance and manage your trades with care.

How does AMP Futures handle margin requirements during periods of high market volatility?

During periods of high market volatility, AMP Futures may temporarily raise day-trade margin requirements, sometimes doubling the standard levels. In some cases, traders may also need to meet the exchange-defined maintenance margin or scale back their positions if prices near CME’s limit-halt thresholds. These measures aim to protect against risk and maintain account stability in fast-moving market environments.

What’s the difference between day trading margins and overnight margins?

Day trading margins are set by brokers and involve lower requirements that apply when traders open positions within the same trading session. These margins are intended to give traders greater flexibility for short-term trading activities.

On the other hand, overnight margins, often referred to as maintenance margins, are determined by exchanges and come with higher requirements. This is because holding a position after the market closes carries more risk, and these margins ensure traders have enough in their accounts to handle potential price changes during non-trading hours.