Top Hedge Fund Administration Services & Solutions Explained

Hedge fund administration services help fund managers handle critical tasks like accounting, investor reporting, and compliance, allowing them to focus on generating returns. Providers use advanced tools for accuracy and efficiency, catering to funds of all sizes with scalable solutions. Here's a quick overview of five key players:

- Decile Partners: Offers tailored services with strengths in accounting, investor reporting, and compliance support. Known for precise NAV calculations and technology integrations.

- Aduro: Combines technology with compliance expertise, featuring its proprietary platform, FundPanel, for efficient fund operations and reporting.

- SS&C: A large-scale provider offering a broad range of services, including fund accounting, investor reporting, and compliance, with strong technology integrations.

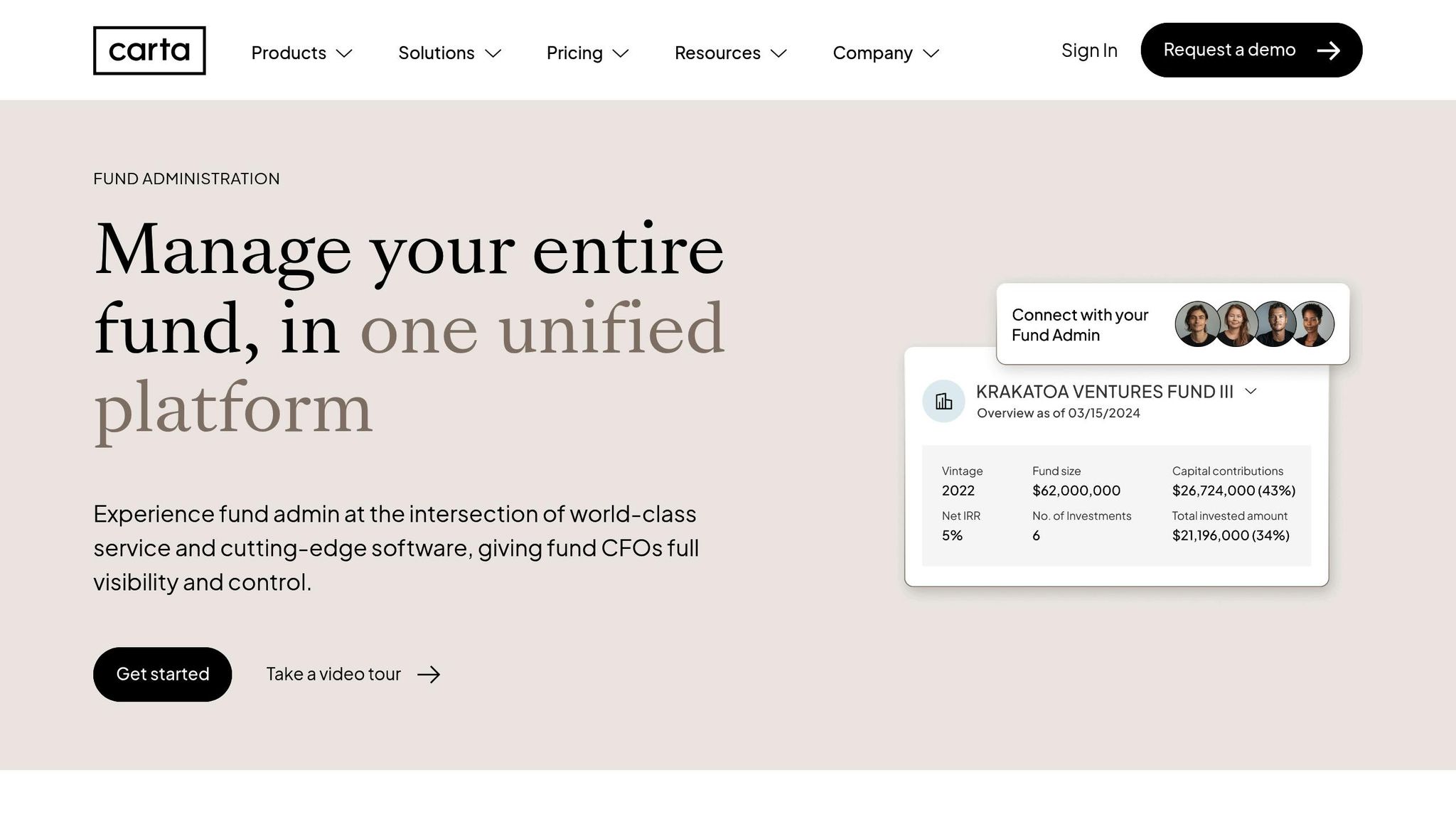

- Carta: Focuses on simplifying fund management and investor relations through its unified platform and secure data-sharing tools.

- Kranz: Specializes in personalized service for smaller funds, handling accounting, reporting, and compliance with a hands-on approach.

Each provider has unique strengths, making it essential to choose based on your fund’s priorities, whether it’s technology, compliance, or personalized service.

Fund Administration Explained | Key Functions, NAV, Reporting & Compliance | Module 7

1. Decile Partners

Decile Partners is a boutique firm dedicated to offering tailored services for emerging and mid-sized investment managers. Unlike firms that push standardized solutions, Decile Partners focuses on creating customized approaches that align with each client's unique operational needs. A standout feature of their offerings is their expertise in accounting services.

Fund Accounting

Decile Partners specializes in daily net asset value (NAV) calculations, maintaining precise records across a variety of hedge fund strategies. Their team is well-versed in handling complex financial instruments, including derivatives, private investments, and structured products. They rely on advanced accounting systems capable of managing multiple share classes and intricate fee structures.

Timeliness and accuracy are at the core of their operations. NAV calculations are typically delivered by 9:00 AM EST the following business day. For funds with more immediate needs, same-day NAV calculations are available for an additional fee. The firm also provides detailed transaction records, with monthly trial balances conveniently accessible through their client portal.

Investor Reporting

To support transparency and build investor trust, Decile Partners offers highly customized reporting solutions. They collaborate with fund managers to create monthly and quarterly statements tailored to each fund’s requirements. These reports often include performance attribution analysis, risk metrics, and detailed portfolio holdings.

Decile Partners has a strong focus on alternative investment reporting, particularly for funds with illiquid securities or complex trading strategies. Their reports break down valuation methodologies and provide clear insights into pricing sources for assets that are challenging to value.

Compliance Support

Decile Partners ensures smooth operations by reinforcing regulatory adherence. Their compliance team assists with monitoring and regulatory filings, staying up-to-date on SEC regulations that impact hedge funds. This includes tasks like Form ADV updates, Form PF filings, and annual compliance reviews. They also help fund managers develop compliance policies tailored to their specific business needs.

The firm offers proactive guidance for navigating regulatory thresholds and works closely with fund counsel and auditors to ensure seamless coordination during examinations or regulatory inquiries.

Technology Integrations

Decile Partners has invested in cutting-edge technology that integrates seamlessly with leading portfolio management and prime brokerage systems. Their client portal provides real-time access to accounting records, investor data, and reporting tools. Fund managers can download information in various formats and access historical data dating back to the fund’s inception.

For added convenience, Decile Partners offers API connectivity for automated data feeds and customized reporting. Their technology team collaborates with fund managers to establish secure data transmission protocols and can adapt to specific formatting needs for downstream systems.

2. Aduro

Aduro is a tech-focused administration provider that supports 650 firms managing over $131 billion in assets. Their approach blends cutting-edge technology with a personalized touch to deliver exceptional service.

Fund Accounting

Aduro specializes in handling the accounting needs of complex hedge fund structures. This includes tasks like calculating performance fees and managing waterfall distributions. They produce quarterly financial reports with precise partner allocations and coordinate year-end audits by working closely with external auditors and tax professionals. Their accounting process is seamlessly integrated with Aduro’s advanced technology, ensuring accuracy and efficiency.

Technology Integrations

At the heart of Aduro’s operations is their proprietary platform, FundPanel, which streamlines fund operations, investor relations, and portfolio monitoring. Impressively, it has already handled over 90,000 unique investor logins.

"Aduro uses best-in-class technology powered by the industry's top professionals to provide premier fund accounting services. We enable our clients to perform at their best."

– Aduro Advisors

"Aduro uses best-in-class technology powered by the industry's top professionals to provide premier fund accounting services. We enable our clients to perform at their best."

– Aduro Advisors

FundPanel offers a range of powerful tools, including an Investor Portal and Analytics features, giving fund managers real-time access to critical data. The platform integrates effortlessly with existing systems, allowing managers to maintain their preferred workflows while improving operational efficiency. Beyond these features, FundPanel also enhances investor reporting capabilities.

Investor Reporting

Through FundPanel, Aduro delivers high-quality, institutional-grade reports. One standout feature is their Performance Benchmark Report, which provides detailed insights into capital activity, realized and unrealized gains and losses, LP composition, and rankings of top-performing funds. These reports allow hedge fund managers to measure their performance against industry benchmarks, offering valuable insights for making informed strategic decisions.

Compliance Support

Aduro also provides comprehensive compliance support, helping clients navigate complex tax requirements and stay updated on changes in tax legislation and foreign reporting rules. This service is especially critical for hedge funds with international exposure or multi-jurisdictional structures. Their compliance team keeps a close eye on regulatory developments, ensuring that fund managers remain aligned with evolving requirements. Aduro’s recognition as one of Inc. Magazine’s 5000 fastest-growing private companies for the fourth time underscores their ability to scale compliance support while maintaining high-quality standards.

3. SS&C

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

SS&C Technologies offers hedge fund administration solutions that combine technology and expertise to streamline operations and meet regulatory standards.

Fund Accounting

SS&C provides fund accounting services designed to accommodate various fund structures, such as multi-class and master-feeder setups. Their platform handles daily net asset value (NAV) calculations, general ledger upkeep, expense allocation, and detailed profit and loss (P&L) reporting. Tasks like processing corporate actions and managing currency conversions are automated, ensuring accuracy and efficiency. These accounting services are backed by advanced technology for seamless operation.

Technology Integrations

SS&C's technology suite brings together portfolio management, accounting, and reporting functions into a unified system. By connecting to a wide network of custodians and data providers, their platform enables real-time data feeds with automated reconciliation. Their order management and trade processing tools handle transactions from initial order to settlement, while portfolio management features support performance analysis and risk assessment.

Investor Reporting

SS&C's reporting tools allow fund managers to create tailored investor reports. These include performance summaries, tax documents, and other essential materials, all customizable to meet specific investor preferences. Secure online portals provide access to key documents like capital call notices and distribution statements, complete with detailed audit trails for transparency.

Compliance Support

SS&C's compliance solutions address regulatory demands across various jurisdictions. The platform automates the monitoring of investment restrictions, liquidity rules, and other compliance metrics while simplifying regulatory filings. Detailed audit trails ensure adherence to stringent regulatory standards, giving fund managers confidence in their compliance efforts.

4. Carta

Carta delivers hedge fund administration with a tech-driven approach, focusing on simplifying operations and boosting transparency. Their platform integrates fund management, investor relations, and administrative tasks into one cohesive system.

Technology Integrations

Carta's platform uses APIs to connect portfolio management, fund administration, and LP communications. This eliminates the hassle of juggling multiple disconnected systems and significantly cuts down on manual data entry.

A standout example of this integration is their connection with Ramp. With this setup, expenses move seamlessly from card swipes directly to the general ledger, making expense tracking almost effortless.

With its unified system, Carta doesn’t stop at streamlining operations - it also enhances how fund managers handle investor communications.

Investor Reporting

Carta's investor reporting revolves around a centralized Investor Relations hub, which simplifies stakeholder communication. From this hub, fund managers can view investor details, track ownership percentages, respond to inquiries, manage cap table access, and send updates - all in one place.

The platform also offers detailed control over information access, letting fund managers decide who sees what. These permissions can be adjusted in bulk for convenience or tailored for individual investors to meet specific needs.

For handling sensitive documents, Carta includes a virtual data room. This feature allows secure sharing of financial, legal, and due diligence materials, with advanced permission settings and options to set expiration dates. This ensures that confidential information is accessible only to authorized parties.

5. Kranz

Kranz Consulting specializes in hedge fund administration for alternative investment vehicles, earning the 2024 US Emerging Manager Award for "Best Administrator – Venture". Let’s take a closer look at their standout services in fund accounting and investor reporting.

Fund Accounting

Kranz’s fund accounting services focus on maintaining precise financial records while adhering to industry standards. Their team handles the heavy lifting, producing detailed financial reports like balance sheets, income statements, cash flow analyses, and performance metrics. They also tackle daily accounting tasks, such as:

- Investment valuation analysis

- Managing accounts payable invoices

- Handling 1099 filings

- Processing payroll

- Preparing annual budgets and conducting budget-to-actual reviews

Their expertise doesn’t stop there. Kranz also assists with tax forms, coordinates audits, and works alongside external advisors to ensure compliance.

Joelle Fox from Tech Square Ventures shared her experience with Kranz:

"I have been thoroughly impressed with the accounting and CFO advisory services provided by Kranz specialists. Their expertise has been a valuable supplement to our organization, confirming our valuation conclusions and providing in-depth research and advice on technical audit issues".

"I have been thoroughly impressed with the accounting and CFO advisory services provided by Kranz specialists. Their expertise has been a valuable supplement to our organization, confirming our valuation conclusions and providing in-depth research and advice on technical audit issues".

Investor Reporting

Kranz excels in delivering transparent and dependable investor reporting. They create detailed financial reports that provide valuable performance insights and streamline communication with investors. Services include:

- Capital call and distribution notices

- Tax reporting, such as Schedule K-1s

- Periodic investor updates

- Audited financial statements

Additionally, fund managers benefit from regular meetings with the CFO and team, offering real-time visibility into their financial operations.

Kranz’s commitment to long-term client relationships is a testament to their reliability. Zalia Aliriza from Blockchain Capital, a client since 2016, shared:

"Throughout this time, our dedicated team has adapted quickly to our ever-changing needs, continuing to provide timely and accurate access to data. Their willingness to go above and beyond, on a consistent basis, is an exceptional contribution to our business".

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"Throughout this time, our dedicated team has adapted quickly to our ever-changing needs, continuing to provide timely and accurate access to data. Their willingness to go above and beyond, on a consistent basis, is an exceptional contribution to our business".

Andre Charoo from Maple VC, who has partnered with Kranz for nearly seven years, also praised their support:

"As a solo-GP managing multiple institutional funds with over 100 LPs, I wouldn't be able to operate without them. Their full service support is invaluable - they truly act as core members of my team with a dedicated CFO, Sr Accountant and Accounting Manager that I can rely on at any time".

"As a solo-GP managing multiple institutional funds with over 100 LPs, I wouldn't be able to operate without them. Their full service support is invaluable - they truly act as core members of my team with a dedicated CFO, Sr Accountant and Accounting Manager that I can rely on at any time".

Strengths and Weaknesses

Hedge fund administration providers offer a range of services tailored to meet the operational and regulatory needs of fund managers. Here's a closer look at the strengths and limitations of some key providers, helping to illustrate how their approaches align with different fund requirements.

Decile Partners is known for its cutting-edge automation, which simplifies complex processes and enhances operational efficiency. This makes them a strong choice for funds prioritizing streamlined operations. However, their heavy focus on technology might not provide the personal touch that smaller funds often prefer.

Aduro specializes in regulatory compliance and risk management, making it a dependable option for funds navigating strict regulatory environments. Their deep knowledge of compliance frameworks offers reassurance to fund managers. On the flip side, their specialization might limit flexibility for funds with unique or less conventional operational needs.

SS&C leverages its extensive scale and global reach to deliver a broad range of solutions. Their vast resources and established presence make them particularly appealing to large institutional funds. That said, their size can sometimes result in slower service responsiveness and higher costs, which may not suit smaller funds.

Carta focuses on innovation in investor relations and reporting technology, catering to funds that value clear and modern communication with stakeholders. Their forward-thinking approach distinguishes them in a field often dominated by outdated systems. However, their relatively recent entry into the hedge fund market means they may lack the long-standing experience of more established providers.

Kranz emphasizes personalized service and building long-term client relationships. Their boutique style ensures tailored attention and flexibility to adapt to client needs. However, their smaller scale may limit their ability to handle very large funds or provide certain niche services.

| Provider | Fund Accounting | Investor Reporting | Compliance Support | Technology Integration |

|---|---|---|---|---|

| Decile Partners | Strong | Strong | Good | Excellent |

| Aduro | Good | Good | Excellent | Strong |

| SS&C | Excellent | Strong | Strong | Strong |

| Carta | Good | Excellent | Good | Excellent |

| Kranz | Strong | Excellent | Good | Good |

This table highlights that no single provider dominates every category. For instance, SS&C leads in fund accounting, while Carta and Kranz excel in investor reporting. Aduro is the top choice for compliance support, thanks to its regulatory expertise, and Decile Partners and Carta shine in technology integration with their modern platforms.

When choosing a provider, fund managers should focus on their top priorities. Those needing advanced technology might consider Decile Partners or Carta, while funds in highly regulated environments could benefit from Aduro's compliance expertise. Large institutional funds are well-suited to SS&C's comprehensive offerings, whereas smaller funds may prefer the personalized service of boutique firms like Kranz.

Cost is another crucial factor. Larger firms like SS&C often come with higher price tags, while boutique providers may offer more competitive pricing. Managers should carefully balance these strengths, costs, and scalability to find the best fit for their specific operational needs.

Conclusion

Choosing the right hedge fund administration provider means finding one that aligns with your fund’s specific priorities and growth plans. No single provider is perfect across the board, so it’s crucial to focus on what matters most for your operations.

For funds that prioritize technology, Decile Partners and Carta offer cutting-edge tools to streamline operations. However, their tech-driven approach might not appeal to those who value a more personal, hands-on service.

When it comes to regulatory compliance, many fund managers place this at the top of their list, especially in highly regulated industries. Aduro excels in this area, offering deep expertise in compliance frameworks and risk management. That said, their focus on regulatory adherence might make them less flexible for funds with unique operational needs.

Cost, scalability, and growth potential also play a major role. Larger institutional funds often turn to SS&C for its extensive resources, even if it comes at a higher price point. On the other hand, smaller funds may find Kranz more appealing, thanks to its competitive pricing and tailored, personal service.

FAQs

How can I choose the right hedge fund administration provider for my fund's unique needs?

Choosing the right hedge fund administration provider begins with a clear understanding of your fund's unique needs and priorities. It's essential to find a provider with a proven history of managing funds that align with your strategy and complexity.

Take a close look at their technology infrastructure - their systems should be secure, adaptable, and work seamlessly with your current tools. Also, review the range of services they offer, such as fund accounting, investor reporting, and compliance assistance, to ensure they meet your operational objectives. Finally, consider their level of client support and their ability to grow alongside your fund's changing demands.

How do technology integrations from hedge fund administrators enhance fund operations?

Technology solutions offered by hedge fund administrators are key to making fund operations smoother and more efficient. Many of these tools include cloud-based platforms designed for tasks like data management, compliance, and reporting. These platforms give funds the ability to handle operations more securely while also boosting productivity.

Advanced systems, including those powered by AI, can take on complex processes like fund accounting, delivering faster and more precise results. With these technologies, fund managers can strengthen risk monitoring, streamline workflows, and access real-time data for better insights. Beyond simplifying intricate tasks, these tools also help funds adapt to changing regulations, keeping operations on track with fewer hurdles.

Why is compliance support essential for hedge funds, and how do fund administrators help manage regulatory requirements?

Compliance support is a cornerstone for hedge funds aiming to keep up with the shifting landscape of regulations while adhering to legal and industry standards. Fund administrators are instrumental in this process, offering critical services like regulatory reporting, compliance monitoring, and AML/KYC checks. These services not only help hedge funds steer clear of penalties but also reinforce trust among investors.

To make compliance more efficient, many providers now use advanced technology, introducing automated solutions for tasks like reporting and monitoring. By teaming up with a dependable fund administrator, hedge funds can dedicate their energy to core investment strategies without losing sight of regulatory obligations.

Choosing the right hedge fund administration provider begins with a clear understanding of your fund's unique needs and priorities. It's essential to find a provider with a proven history of managing funds that align with your strategy and complexity.

Take a close look at their technology infrastructure - their systems should be secure, adaptable, and work seamlessly with your current tools. Also, review the range of services they offer, such as fund accounting, investor reporting, and compliance assistance, to ensure they meet your operational objectives. Finally, consider their level of client support and their ability to grow alongside your fund's changing demands.

Technology solutions offered by hedge fund administrators are key to making fund operations smoother and more efficient. Many of these tools include cloud-based platforms designed for tasks like data management, compliance, and reporting. These platforms give funds the ability to handle operations more securely while also boosting productivity.

Advanced systems, including those powered by AI, can take on complex processes like fund accounting, delivering faster and more precise results. With these technologies, fund managers can strengthen risk monitoring, streamline workflows, and access real-time data for better insights. Beyond simplifying intricate tasks, these tools also help funds adapt to changing regulations, keeping operations on track with fewer hurdles.

Compliance support is a cornerstone for hedge funds aiming to keep up with the shifting landscape of regulations while adhering to legal and industry standards. Fund administrators are instrumental in this process, offering critical services like regulatory reporting, compliance monitoring, and AML/KYC checks. These services not only help hedge funds steer clear of penalties but also reinforce trust among investors.

To make compliance more efficient, many providers now use advanced technology, introducing automated solutions for tasks like reporting and monitoring. By teaming up with a dependable fund administrator, hedge funds can dedicate their energy to core investment strategies without losing sight of regulatory obligations.

"}}]}