Forex Managed Accounts Explained: The Ultimate Guide for Hands-Off Investing

Forex managed accounts let you invest in the $7.5 trillion daily Forex market without needing to trade yourself. Here's how it works: you retain ownership of your funds, while a professional trader executes trades under a Limited Power of Attorney (LPOA). This setup ensures transparency and control - you can monitor trades in real-time and revoke access anytime.

Key Points:

- What It Is: A professional trader manages your account, but you maintain control of your funds.

- Why Consider It: Avoid emotional trading decisions, benefit from professional strategies, and diversify your portfolio.

- Costs: Expect performance fees (20%-30%) and management fees (0.5%-2% annually).

- Risks: Market volatility, leverage, and potential fraud are key concerns - always verify a manager's credentials.

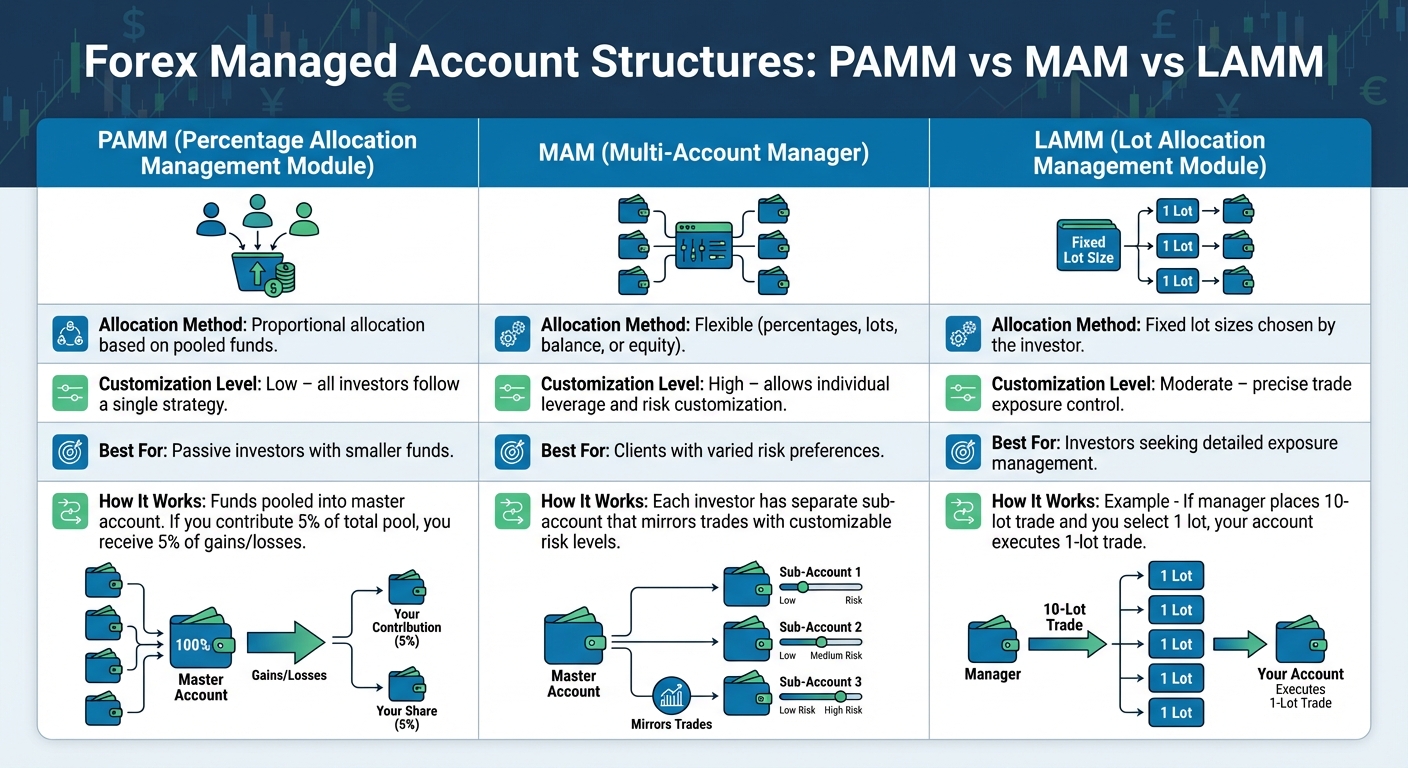

- Account Types: PAMM (pooled funds), MAM (customized risk), and LAMM (fixed lot sizes) offer different levels of flexibility.

This hands-off approach is ideal for those seeking professional management but requires careful vetting of managers, understanding of fees, and awareness of risks. Make sure to verify performance records and regulatory compliance before committing funds.

What is a Managed Forex Account?

How Forex Managed Accounts Work

PAMM vs MAM vs LAMM Forex Account Structures Comparison

PAMM vs MAM vs LAMM Forex Account Structures Comparison

Once you’ve completed the broker registration and necessary paperwork, your managed account operates using a master/sub-account structure. Here’s how it works: the money manager executes trades through a master account, and those trades are automatically mirrored in your individual, segregated sub-account. Importantly, your funds remain solely in your name, and the manager does not have direct access to your capital, ensuring security and transparency.

Account Structures: PAMM, MAM, and LAMM

Understanding the different account structures helps clarify how trades are allocated in managed accounts. These structures - PAMM, MAM, and LAMM - offer varying degrees of customization and control, depending on your investment needs:

- PAMM (Percentage Allocation Management Module): This model pools funds from multiple investors into one master account. When the manager executes a trade, the profits or losses are distributed proportionally, based on each investor's contribution. For example, if you contribute 5% of the total pool, you receive 5% of the gains or losses.

- MAM (Multi-Account Manager): With MAM accounts, each investor has a separate sub-account that mirrors trades from the master account. This structure offers flexibility, allowing managers to adjust leverage and risk levels for individual accounts. Trades can be allocated in various ways - by percentage, lot size, balance, or equity - making it ideal for clients with different risk profiles.

- LAMM (Lot Allocation Management Module): In this setup, trades are distributed based on fixed lot sizes rather than percentages. You decide the number of lots to replicate for each trade. For instance, if the manager places a 10-lot trade and you select 1 lot, your account executes a 1-lot trade. This model provides precise control over your exposure, making it a preferred choice for investors with larger accounts.

| Account Type | Allocation Method | Customization Level | Best For |

|---|---|---|---|

| PAMM | Proportional allocation based on pooled funds | Low – all investors follow a single strategy | Passive investors with smaller funds |

| MAM | Flexible (percentages, lots, balance, or equity) | High – allows individual leverage and risk customization | Clients with varied risk preferences |

| LAMM | Fixed lot sizes chosen by the investor | Moderate – precise trade exposure control | Investors seeking detailed exposure management |

The Role of Limited Power of Attorney (LPOA)

The Limited Power of Attorney (LPOA) is the legal agreement that allows the manager to execute trades on your behalf while ensuring your funds remain secure. Under this arrangement, the manager is authorized to place buy and sell orders but cannot withdraw, transfer, or deposit funds. You maintain full control and oversight of your account through platforms like MetaTrader 4 (MT4), where you can track trades in real-time and review past performance.

Next, we’ll take a closer look at the costs and fees associated with these managed accounts.

Costs and Fees Associated with Forex Managed Accounts

Understanding the fee structure of forex managed accounts is essential, as these fees directly impact your net returns. Unlike self-directed trading, where you primarily deal with spreads and commissions, managed accounts come with additional charges to compensate the professional manager for their expertise and time.

Performance-Based Fees and Management Fees

Forex managed accounts typically involve two main types of fees: performance fees and management fees.

- Performance fees: These usually range between 20% and 30% of any profits generated, though some providers may charge as much as 50% for standard accounts. These fees are designed to motivate managers to consistently deliver profits.

- Management fees: These are charged annually, regardless of performance, and generally range from 0.5% to 2% of assets under management (AUM). For example, if your account holds $100,000, a 2% management fee would cost $2,000 per year.

In addition to these, broker-level costs include:

- Spreads and commissions: Commissions are approximately $7 per $100,000 traded on RAW pricing accounts.

- Overnight rollover fees: Charged for positions held past 5:00 PM ET.

- Currency conversion charges: Typically around 0.5% for converting profits in non-base currencies.

These fees are an important consideration when comparing providers, and they often include safeguards like the high-water mark.

Understanding the High-Water Mark Concept

The high-water mark (HWM) is a key protection for investors, ensuring that performance fees are only charged on new profits. Here’s how it works:

If your account starts at $10,000 and earns $1,000, a 50% performance fee reduces the balance to $10,500. This $10,500 becomes the new high-water mark. Now, if the account drops to $10,400 due to losses, the manager cannot charge any performance fees until the account recovers and surpasses the previous high of $10,500.

This mechanism ensures that managers must recover losses and generate additional profits before earning more incentive fees. Always confirm that your managed account agreement includes a high-water mark clause to avoid paying fees for recovering lost capital.

| Fee Type | Typical Range | Frequency | What It Covers |

|---|---|---|---|

| Performance Fee | 20%–30% (up to 50%) | Monthly/Quarterly | Incentive for generating profits |

| Management Fee | 0.5%–2% | Annual (charged monthly) | Operational and administrative costs |

| Broker Commission | $7 per $100,000 | Per trade | Trade execution |

| Currency Conversion | ~0.5% | Per transaction | Converting non-base currency profits |

Risks and Limitations of Forex Managed Accounts

Forex managed accounts might seem like an attractive, hands-off way to invest in the foreign exchange market, but they come with their own set of risks. From market volatility to fraud, these accounts are far from risk-free. Understanding these challenges is crucial before committing your money.

Market Volatility and Leverage Risks

The forex market is known for its sharp price movements, especially during major economic announcements or geopolitical events. Combine this with leverage, and things can escalate quickly. Leverage allows traders to control large positions with relatively small amounts of capital. For instance, a standard forex lot equals 100,000 units of currency, but with leverage, you might only need $1,000 to trade it. In the U.S., leverage is capped at 50:1 for major currency pairs and 20:1 for others. While this might sound like an opportunity, it also means that a mere 2% unfavorable price change can wipe out your entire deposit.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

"The forex market can be especially unforgiving in that the underlying volatility can literally wipe out an overleveraged trading account." – Forex Training Group

"The forex market can be especially unforgiving in that the underlying volatility can literally wipe out an overleveraged trading account." – Forex Training Group

Statistics paint a sobering picture: about 66% of retail forex traders lose money each quarter. Even with professional management, losses can exceed your initial investment. Using more conservative leverage ratios, such as 10:1 or 30:1, can reduce risk, but no amount of caution can eliminate it entirely.

Fraud and Unregulated Providers

Fraud is a persistent issue in the forex world, especially with offshore platforms that operate outside regulatory oversight. Some scammers manipulate trade data, falsify performance records, or even steal investor funds outright. Be wary of platforms that:

- Only accept cryptocurrency payments

- Promise guaranteed returns or "foolproof" strategies

- Impose withdrawal restrictions disguised as additional "tax" or "commission" fees

"Registration alone won't protect you from fraud, but most fraud is conducted by unregistered people and platforms." – Commodity Futures Trading Commission (CFTC)

"Registration alone won't protect you from fraud, but most fraud is conducted by unregistered people and platforms." – Commodity Futures Trading Commission (CFTC)

To minimize these risks, confirm that both your broker and account manager are registered with reputable regulatory bodies like the CFTC or NFA in the U.S., the FCA in the UK, or ASIC in Australia. Use tools like the National Futures Association’s BASIC database to check for any disciplinary actions against them. Additionally, ensure your account operates under a Limited Power of Attorney (LPOA), which grants the manager trading authority but prevents them from withdrawing funds.

Drawdowns and Performance Variability

Even the most experienced forex managers face performance variability. A drawdown - the drop from a portfolio’s peak value to its lowest point - is inevitable in trading. Past success doesn’t guarantee future results. Risk management tools like stop-loss orders and diversification across currency pairs can help, but they don’t eliminate the possibility of losses.

Between Q2 2021 and Q1 2022, only 33% of customers at registered OTC forex dealers in the U.S. reported profitability. To evaluate a manager’s performance, look at metrics like the Calmar Ratio, which compares potential returns to drawdown risks.

| Risk Factor | Impact | Mitigation |

|---|---|---|

| Market Volatility | Sudden, large losses during news events | Use stop-loss orders and diversify currency pairs |

| High Leverage | Losses can exceed your initial deposit | Stick to conservative leverage ratios (e.g., 10:1 or 30:1) |

| Manager Fraud | Misuse of funds or fake performance data | Verify regulatory registration and use LPOA agreements |

| Counterparty Risk | Broker insolvency or default | Choose regulated brokers with segregated accounts |

Forex managed accounts are not for everyone. Only invest money you can afford to lose entirely - never use funds earmarked for living expenses or retirement.

How to Choose a Reliable Forex Managed Account Provider

Selecting the right forex managed account provider can make the difference between consistent growth and substantial losses. To make an informed decision, focus on three key areas: verified performance, regulatory compliance, and transparent risk management. Let’s break down how to evaluate each aspect.

Verifying Performance and Track Record

A provider’s historical performance reveals how they’ve navigated real market conditions. But don't just take their word for it - always verify their claims using independent data sources. The Calmar Ratio is a key metric to assess. It compares the average annual compound return to the maximum drawdown over a three-year period. A higher Calmar Ratio suggests better risk-adjusted returns. For instance, a manager with 15% annual returns and a 10% maximum drawdown achieves a Calmar Ratio of 1.5, which is considered a solid benchmark.

"The higher the Calmar Ratio, the better the manager's risk-adjusted return has historically been." – Investopedia

"The higher the Calmar Ratio, the better the manager's risk-adjusted return has historically been." – Investopedia

When reviewing performance charts, look for a smooth equity line. Sharp dips or erratic patterns often signal high volatility and poor risk management. Be cautious of managers claiming returns above 30%, as these figures often indicate excessive leverage. Similarly, a near-perfect win rate (close to 100%) may point to risky strategies like "Martingale", which can lead to significant losses over time. Use platforms like MyFXBook.com to verify performance data. These tools provide tamper-proof, audited records to ensure transparency.

Regulatory Compliance and Transparency

Regulatory compliance is your safety net in the forex market. In the United States, you can verify a provider’s credentials through the National Futures Association's BASIC database. This resource shows licensing status and any disciplinary actions. Always verify the legal corporate name, as it may differ from what’s displayed on their website or app. Ensure both the broker and the account manager are licensed by reputable authorities, such as the CFTC/NFA in the USA, FCA in the UK, or ASIC in Australia.

Fee transparency is another critical factor. Reputable providers clearly outline their performance fees - commonly between 20% and 30% of profits, though some may charge up to 50%. They should also disclose any management fees. Be wary of vague or hidden charges, like unexpected "administrative" or "withdrawal" fees. A clear fee structure is a hallmark of a trustworthy provider.

Risk Management Protocols and Reporting

Effective risk management is what separates professional account managers from reckless traders. Look for providers who use stop-loss orders, carefully calculated position sizes, and conservative leverage ratios - typically between 10:1 and 30:1. They should also enforce predefined maximum drawdown limits to protect your capital during volatile market swings. Additionally, ensure the provider operates under a Limited Power of Attorney (LPOA). This allows them to trade on your account without granting them access to withdraw funds, ensuring you maintain full control over your money.

"A managed forex account protects you, as you would retain complete control of your funds in an FCA regulated brokerage. You are the only person that would have access to your funds and the only person who can withdraw those funds." – The Forex Fund Manager

"A managed forex account protects you, as you would retain complete control of your funds in an FCA regulated brokerage. You are the only person that would have access to your funds and the only person who can withdraw those funds." – The Forex Fund Manager

Transparency is key, so insist on real-time reporting through platforms like MT4 or MT5. These tools allow you to monitor live trades, open positions, and profit/loss statements 24/7. Before committing significant funds, start with a small investment to test their execution quality and reporting accuracy. If a manager hesitates to provide verified performance data or avoids answering your questions directly, it’s a clear sign to move on.

| What to Verify | How to Check | Red Flags |

|---|---|---|

| Performance History | Calmar Ratio, equity line stability, third-party verification via MyFXBook | Returns above 30%, 100% win rate, self-reported data only |

| Regulatory Status | NFA BASIC database, FCA/ASIC/CySEC registries | Unregistered providers, offshore-only operations, vague licensing |

| Risk Controls | LPOA agreement, stop-loss protocols, drawdown limits | No LPOA, requests for account passwords, unlimited leverage |

| Fee Transparency | High-Water Mark usage, clear performance/management fee disclosure | Hidden charges, withdrawal restrictions, unclear fee structures |

Legal Framework and Investor Protections

Once you're clear on operational structures and fees, the next priority is understanding the legal protections in place to safeguard your investment. In the United States, retail forex trading operates under the oversight of the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), as mandated by the Commodity Exchange Act. These regulations require entities managing your account to register as Commodity Trading Advisors (CTAs), while those managing pooled investment vehicles must register as Commodity Pool Operators (CPOs).

To ensure your funds remain secure, U.S. regulations mandate that your capital is held in segregated accounts with registered counterparties, such as Futures Commission Merchants (FCMs) or Retail Foreign Exchange Dealers (RFEDs). This prevents managers from directly accessing or misusing your funds.

"A person exercising trading authority over a customer's account may not receive or hold the customer's funds. Those funds must be held by the FCM or RFED counterparty." – National Futures Association

"A person exercising trading authority over a customer's account may not receive or hold the customer's funds. Those funds must be held by the FCM or RFED counterparty." – National Futures Association

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Strict leverage limits are also in place to protect retail investors from excessive risk. For major currency pairs, leverage is capped at 50:1 (requiring a 2% margin), while minor pairs are limited to 20:1 (5% margin). Additionally, registered dealers must maintain a minimum net capital of $20 million, with an extra 5% of liabilities for retail customer balances exceeding $10 million. If disputes arise, investors can seek resolution through the CFTC Reparations Program or the NFA arbitration process.

Account Ownership and Control

Regulatory safeguards are just one piece of the puzzle - maintaining control over your account is equally important. Your account remains in your name, and you retain the ability to revoke trading permissions at any time. Managers operate under a Limited Power of Attorney (LPOA), which allows them to execute trades on your behalf but prohibits any fund withdrawals or transfers.

"With a forex managed account your funds are held by you and only you... you are the only person that would have access to your funds and the only person who can withdraw those funds." – The Forex Fund Manager

"With a forex managed account your funds are held by you and only you... you are the only person that would have access to your funds and the only person who can withdraw those funds." – The Forex Fund Manager

You can monitor trading activity in real time through platforms like MT4 or your broker’s dashboard. Before granting an LPOA, confirm that your broker is licensed by top-tier regulators such as the FCA, ASIC, or NFA/CFTC. This ensures your funds remain properly segregated and protected.

Contractual Terms and Termination Clauses

Before signing any agreement, carefully review the contract’s fee structure, termination clauses, and risk management terms. Some providers may impose minimum investment periods before allowing penalty-free withdrawals, while others offer more flexible arrangements that let you stop trading or withdraw funds whenever you choose.

Ensure the LPOA limits the manager's authority strictly to trading, with no rights to withdraw or transfer funds. The contract should also specify how often performance reports will be provided and whether you’ll have access to real-time account monitoring. Be cautious of agreements that lack clarity or include vague liability terms. Even with registration, fraud remains a risk, as many scams are carried out by unregistered entities or individuals.

These legal and contractual measures are designed to strengthen your investment security, ensuring your rights and funds remain protected in the managed trading process.

Conclusion: Are Forex Managed Accounts Right for You?

Forex managed accounts provide a hands-off way to tap into the massive $7.5 trillion daily forex market. They're an appealing option for those who lack the time or expertise to actively trade. This approach is particularly suited for busy professionals, beginners in trading, or investors looking to diversify their portfolios with an asset class that often moves independently of traditional stocks and bonds.

However, it’s crucial to understand the risks. Leveraged currency trading demands a high tolerance for risk. Additionally, performance fees for forex managed accounts - typically ranging from 20% to 30% of profits - are much steeper than the fees associated with traditional portfolios, which usually fall between 0.50% and 5%. Before committing, take the time to vet the manager by reviewing their Calmar Ratio and at least three to five years of performance data through platforms like Myfxbook.

While professional management can help reduce emotional decision-making, it does come at a cost. You’ll pay higher fees, relinquish direct control over trades, and still be subject to market volatility and the manager’s strategies, which can affect your returns.

To mitigate risk, consider starting with a smaller investment to evaluate the manager’s communication and execution before committing more capital. Make sure your broker is licensed by reputable regulatory bodies like the FCA, ASIC, or NFA/CFTC. Also, confirm that the contract includes a high-water mark provision to ensure you don’t pay performance fees twice on the same gains.

If you're comfortable with delegating trading authority, can handle potential losses, and want professional management without the need to monitor the market daily, a forex managed account could be a good fit for your investment goals.

FAQs

How can I check if a forex account manager is trustworthy and qualified?

Before handing over your funds to a forex account manager, it’s essential to do some due diligence to ensure they’re reliable and qualified. Start by checking if they’re registered with a respected regulatory authority, such as the U.S. Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). You can find their registration number on the regulator’s official website for verification.

Ask for independently audited performance reports that provide detailed metrics like gross and net returns, maximum drawdown, and risk-adjusted figures such as the Sharpe ratio. Steer clear of managers who rely solely on self-reported data. Instead, look for third-party validation or access to live trade logs on platforms like MT4 or MT5 for added transparency.

It's also a good idea to review their professional background. Request proof of identity, relevant certifications (such as CFA or CFP), and references from previous clients or colleagues in the industry. Use resources like the NFA’s records to check for any complaints or disciplinary actions. A manager who is open, transparent, and has a proven track record is more likely to align with your financial goals and risk preferences.

What’s the difference between PAMM, MAM, and LAMM in Forex managed accounts?

Forex managed accounts offer three main account structures - PAMM, MAM, and LAMM - each designed to let professional managers trade on behalf of investors, but with different approaches to fund allocation and trade execution.

- PAMM (Percentage Allocation Management Module): In this setup, all investors’ funds are combined into a single account. The manager trades from this pooled account, and profits or losses are distributed proportionally based on each investor’s share of the total pool. This process is fully automated, so investors only see their net results without access to individual trade details.

- MAM (Multi-Account Manager): Unlike PAMM, MAM keeps each investor’s funds in separate sub-accounts. The manager can customize trade allocation using lot sizes, fixed amounts, or specific formulas, allowing for tailored strategies or risk levels per investor. Trades are executed simultaneously across all accounts, but with flexibility in how they’re distributed.

- LAMM (Lot Allocation Management Module): LAMM is similar to MAM but focuses exclusively on allocating trades by lot size. This structure gives the manager precise control over each investor’s trade exposure, making it particularly useful for strategies that rely on lot-based adjustments.

To sum up, PAMM simplifies allocation with a pooled approach, MAM offers flexibility with individual sub-accounts, and LAMM sharpens control by emphasizing lot-based trade management. The right choice depends on your investment priorities and risk preferences.

What safeguards are in place to protect investors from fraud in Forex managed accounts?

Forex managed accounts in the United States operate under strict oversight by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies ensure a strong layer of protection for investors. Only registered entities - like Futures Commission Merchants (FCMs) and Introducing Brokers (IBs) - are authorized to handle retail Forex transactions. These firms must adhere to key requirements, including keeping client funds segregated from company accounts, undergoing regular financial audits, and maintaining transparent performance records.

The CFTC also provides fraud advisories to help investors recognize potential scams. Common red flags include promises of guaranteed profits or high-pressure tactics urging quick decisions. To further protect themselves, investors are advised to verify a manager’s registration status using official databases before committing any funds. Many managed Forex accounts also use a Limited Power of Attorney (LPOA). This structure limits the manager’s authority to trading activities, while keeping control over withdrawals firmly in the hands of the investor. Together, these safeguards help protect your investments from fraudulent schemes.

Before handing over your funds to a forex account manager, it’s essential to do some due diligence to ensure they’re reliable and qualified. Start by checking if they’re registered with a respected regulatory authority, such as the U.S. Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). You can find their registration number on the regulator’s official website for verification.

Ask for independently audited performance reports that provide detailed metrics like gross and net returns, maximum drawdown, and risk-adjusted figures such as the Sharpe ratio. Steer clear of managers who rely solely on self-reported data. Instead, look for third-party validation or access to live trade logs on platforms like MT4 or MT5 for added transparency.

It's also a good idea to review their professional background. Request proof of identity, relevant certifications (such as CFA or CFP), and references from previous clients or colleagues in the industry. Use resources like the NFA’s records to check for any complaints or disciplinary actions. A manager who is open, transparent, and has a proven track record is more likely to align with your financial goals and risk preferences.

Forex managed accounts offer three main account structures - PAMM, MAM, and LAMM - each designed to let professional managers trade on behalf of investors, but with different approaches to fund allocation and trade execution.

- PAMM (Percentage Allocation Management Module): In this setup, all investors’ funds are combined into a single account. The manager trades from this pooled account, and profits or losses are distributed proportionally based on each investor’s share of the total pool. This process is fully automated, so investors only see their net results without access to individual trade details.

- MAM (Multi-Account Manager): Unlike PAMM, MAM keeps each investor’s funds in separate sub-accounts. The manager can customize trade allocation using lot sizes, fixed amounts, or specific formulas, allowing for tailored strategies or risk levels per investor. Trades are executed simultaneously across all accounts, but with flexibility in how they’re distributed.

- LAMM (Lot Allocation Management Module): LAMM is similar to MAM but focuses exclusively on allocating trades by lot size. This structure gives the manager precise control over each investor’s trade exposure, making it particularly useful for strategies that rely on lot-based adjustments.

To sum up, PAMM simplifies allocation with a pooled approach, MAM offers flexibility with individual sub-accounts, and LAMM sharpens control by emphasizing lot-based trade management. The right choice depends on your investment priorities and risk preferences.

Forex managed accounts in the United States operate under strict oversight by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies ensure a strong layer of protection for investors. Only registered entities - like Futures Commission Merchants (FCMs) and Introducing Brokers (IBs) - are authorized to handle retail Forex transactions. These firms must adhere to key requirements, including keeping client funds segregated from company accounts, undergoing regular financial audits, and maintaining transparent performance records.

The CFTC also provides fraud advisories to help investors recognize potential scams. Common red flags include promises of guaranteed profits or high-pressure tactics urging quick decisions. To further protect themselves, investors are advised to verify a manager’s registration status using official databases before committing any funds. Many managed Forex accounts also use a Limited Power of Attorney (LPOA). This structure limits the manager’s authority to trading activities, while keeping control over withdrawals firmly in the hands of the investor. Together, these safeguards help protect your investments from fraudulent schemes.

"}}]}