A descending triangle is a well-known bearish chart pattern that signals potential downward price movement. It forms when a series of lower highs converge toward a flat support level, indicating growing selling pressure and weakening buyer demand. Traders use this pattern to identify entry points, set stop-loss levels, and estimate profit targets. Key takeaways:

- Structure: Defined by a horizontal support line and a descending resistance line.

- Breakout Confirmation: Typically occurs below the support level with increased trading volume.

- Timeframes: Appears across all timeframes, with longer patterns generally being more reliable.

- Success Rate: Around 54% of these patterns result in bearish breakouts.

To trade descending triangles effectively, wait for a confirmed breakout, use proper risk management, and monitor volume changes. Tools like QuantVPS can help traders analyze patterns in real-time and execute trades efficiently.

How Descending Triangles Are Structured

Main Components of Descending Triangles

A descending triangle takes shape when two trendlines converge, creating its characteristic structure. The lower boundary is a horizontal support line, formed by connecting at least two reaction lows that occur around the same price level. This line indicates a demand zone where buyers step in to prevent further price drops. On the other side, the upper boundary is a descending resistance line, created by linking at least two progressively lower reaction highs. This shows growing selling pressure.

As the two trendlines move closer, they form an apex, signaling a phase of consolidation. The Corporate Finance Institute describes descending triangles as having "flat bottoms, falling tops". This setup reflects the ongoing battle between buyers trying to hold a particular price level and sellers gradually driving prices downward. The more frequently the price touches these trendlines, the more reliable the pattern becomes.

For the pattern to be valid, the reaction highs that form the descending resistance line must consistently decrease. If a recent high matches or exceeds the previous one, the pattern is no longer valid. Typically, as the triangle develops, trading volume decreases, and prices tighten toward the apex. A breakout below the support line, confirmed by a noticeable increase in volume, signals the pattern’s completion. This setup often leads to price movements that can unfold over various timeframes, as explained below.

How These Patterns Form and Typical Timeframes

Descending triangles often emerge during a downtrend or a consolidation phase. For the pattern to be considered valid, there need to be at least two touches on both the horizontal support line and the descending resistance line. Price movement within these boundaries reflects dwindling buyer interest and growing seller dominance.

These patterns can last anywhere from a few weeks to several months, with most spanning one to three months. Descending triangles appear across all timeframes, from 15-minute charts favored by day traders to daily or weekly charts used by swing traders. Generally, longer-term patterns carry more weight and are seen as more reliable.

Data suggests that 54% of descending triangles lead to bearish breakouts. The most effective breakouts tend to occur around the two-thirds mark of the pattern’s development.

What Descending Triangles Tell You About Price Movement

Bearish Continuation Patterns

Descending triangles often suggest that a downtrend is likely to persist after a period of consolidation. This pattern highlights a growing imbalance between sellers and buyers, where sellers become increasingly assertive while buyers hold their ground at a key support level. Over time, this tug-of-war creates a negative outlook as selling pressure intensifies against a defense that gradually weakens.

The repeated formation of lower highs underscores the diminishing strength of buyers, as their attempts to rally fall short time and again. This inability to gain traction emphasizes the growing dominance of sellers. When the price finally breaks below the horizontal support level, it signals that sellers have successfully breached the last barrier of buyer resistance. That said, there are instances where this pattern can flip its script and indicate a potential reversal.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

When Descending Triangles Reverse to Bullish

While descending triangles are primarily associated with bearish continuation, there are scenarios where they hint at a bullish reversal. This is more likely when the pattern emerges at the end of a prolonged downtrend, supported by a strong base. In such cases, buyers may eventually gather enough momentum to break through the descending resistance line, leading to a bullish breakout. This upward move redefines the descending triangle, shifting it from a continuation pattern to a reversal signal. For traders, it’s crucial to wait for clear confirmation of this breakout before making any moves.

The Descending Triangle Chart Pattern (How to Trade This KEY Price Pattern)

How to Trade Descending Triangle Patterns

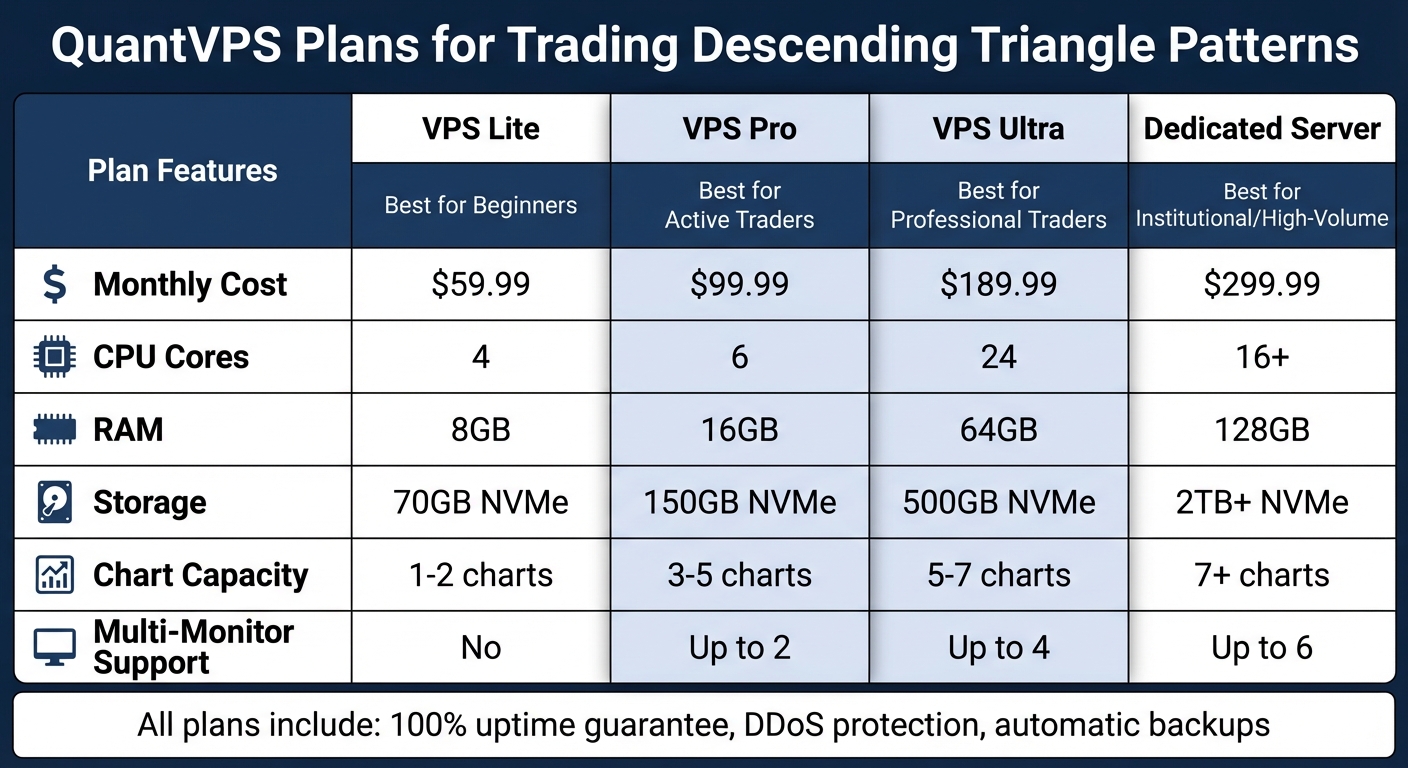

QuantVPS Trading Plans Comparison Chart

QuantVPS Trading Plans Comparison Chart

Spotting Patterns with QuantVPS

To identify descending triangle patterns, you need to keep a close eye on the charts and act quickly when breakouts occur. QuantVPS provides a high-performance environment that allows traders to perform real-time analysis seamlessly. When drawing this pattern, you’ll want to connect at least two progressively lower swing highs to form the descending resistance line and two similar swing lows to establish the horizontal support line. The pattern becomes more reliable when there are multiple touches on both lines. Historically, when identified correctly with volume confirmation, this pattern shows a success rate of around 75–80%.

During the consolidation phase, volume typically decreases. However, a breakout is often confirmed by a 2–3× increase in volume. Pinpointing this breakout is key to setting effective entry points and managing risks.

Entry Points, Stop-Loss Placement, and Risk Management

The ideal entry point comes after a confirmed breakout below the horizontal support line, accompanied by a significant spike in volume. A short position is typically entered just below the broken support line. Be cautious, though – low-volume breakouts can lead to false signals.

For stop-loss placement, position it just above the former support line, which now acts as resistance. This limits your losses in case the breakdown reverses. Effective risk management also requires understanding the broader market trend since descending triangles work best in established downtrends. To further confirm bearish momentum, look for technical indicators such as an RSI reading below 50 or a bearish MACD crossover. Typically, these patterns break down once 50–75% of their formation is complete.

Once your entry and risk parameters are set, ensure your trading setup can handle the demands of active monitoring and execution.

QuantVPS Plans for Different Trading Needs

To successfully monitor and trade descending triangle patterns, you need a reliable trading infrastructure. QuantVPS offers several plans tailored to meet the needs of different traders:

| Plan | Monthly Cost | Cores | RAM | Storage | Chart Capacity | Multi-Monitor |

|---|---|---|---|---|---|---|

| VPS Lite | $59.99 | 4 | 8GB | 70GB NVMe | 1–2 charts | No |

| VPS Pro | $99.99 | 6 | 16GB | 150GB NVMe | 3–5 charts | Up to 2 |

| VPS Ultra | $189.99 | 24 | 64GB | 500GB NVMe | 5–7 charts | Up to 4 |

| Dedicated Server | $299.99 | 16+ | 128GB | 2TB+ NVMe | 7+ charts | Up to 6 |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

If you’re analyzing multiple timeframes or using several technical indicators, consider the VPS Pro or Ultra plans. These options provide the processing power needed to track descending triangle patterns across various markets. All plans include essential features like a 100% uptime guarantee, DDoS protection, and automatic backups – ensuring you’re ready to act when breakouts occur.

Conclusion

Descending triangles are a classic chart pattern that signal a continuation of a downtrend. They’re defined by lower highs and a flat support level, which, when broken, confirms increasing selling pressure. Successfully trading this pattern involves waiting for a confirmed breakout below support and using strict stop-loss strategies to manage risk effectively. Precision in technical analysis becomes even more critical when paired with a reliable trading platform.

To take advantage of these bearish signals, traders need an environment that offers stability and low latency for uninterrupted market access. QuantVPS delivers exactly that, offering high-performance trading solutions with flexible plans tailored to your needs. With a 100% uptime guarantee and ultra-low latency, you’re equipped to act swiftly and capture key breakouts as they happen.

Whether you’re focused on a single market or monitoring multiple instruments across various timeframes, a dependable, low-latency platform ensures you can turn technical insights into actionable trades when bearish patterns like descending triangles emerge.

FAQs

How do I confirm a breakout in a descending triangle pattern?

To validate a breakout in a descending triangle, keep an eye on a distinct price movement paired with a significant rise in trading volume. For a bearish breakout, the price needs to drop convincingly below the support line. On the other hand, a bullish reversal requires the price to break strongly above the resistance line.

Monitoring these indicators can help you gauge whether the pattern is unfolding as anticipated, boosting your confidence in making trading decisions.

How can I effectively manage risk when trading descending triangle patterns?

When trading descending triangles, managing risk is crucial. Here are some strategies to help you stay on track:

- Use tight stop-loss orders: Place them just above the descending trendline or the most recent swing high to minimize potential losses.

- Wait for a confirmed breakout: Ensure there’s higher trading volume accompanying the breakout to reduce the chances of falling for false signals.

- Define clear profit targets: Base your targets on the height of the triangle pattern to secure your gains effectively.

Steer clear of entering trades too early, as acting before a breakout confirmation can lead to getting caught in a false move. Staying disciplined and sticking to your plan will allow you to approach these patterns with greater confidence.

Can a descending triangle ever signal a bullish trend reversal?

While descending triangles are generally associated with bearish trends, they can occasionally signal a bullish trend reversal. This happens when the price breaks upward through the descending trendline, suggesting a possible change in market sentiment. Though less frequent, these scenarios can present worthwhile trading opportunities if spotted accurately.