Trade copying in NinjaTrader 8 automates the process of mirroring trades from a master account to one or more follower accounts, making it ideal for traders managing multiple accounts. Here’s what you need to know:

- What It Does: Replicates trades, including positions, stop-losses, and profit targets, across linked accounts using NinjaTrader-compatible add-ons.

- Why It’s Useful: Eliminates manual effort, reduces errors, and ensures consistent execution for prop traders and multi-account managers.

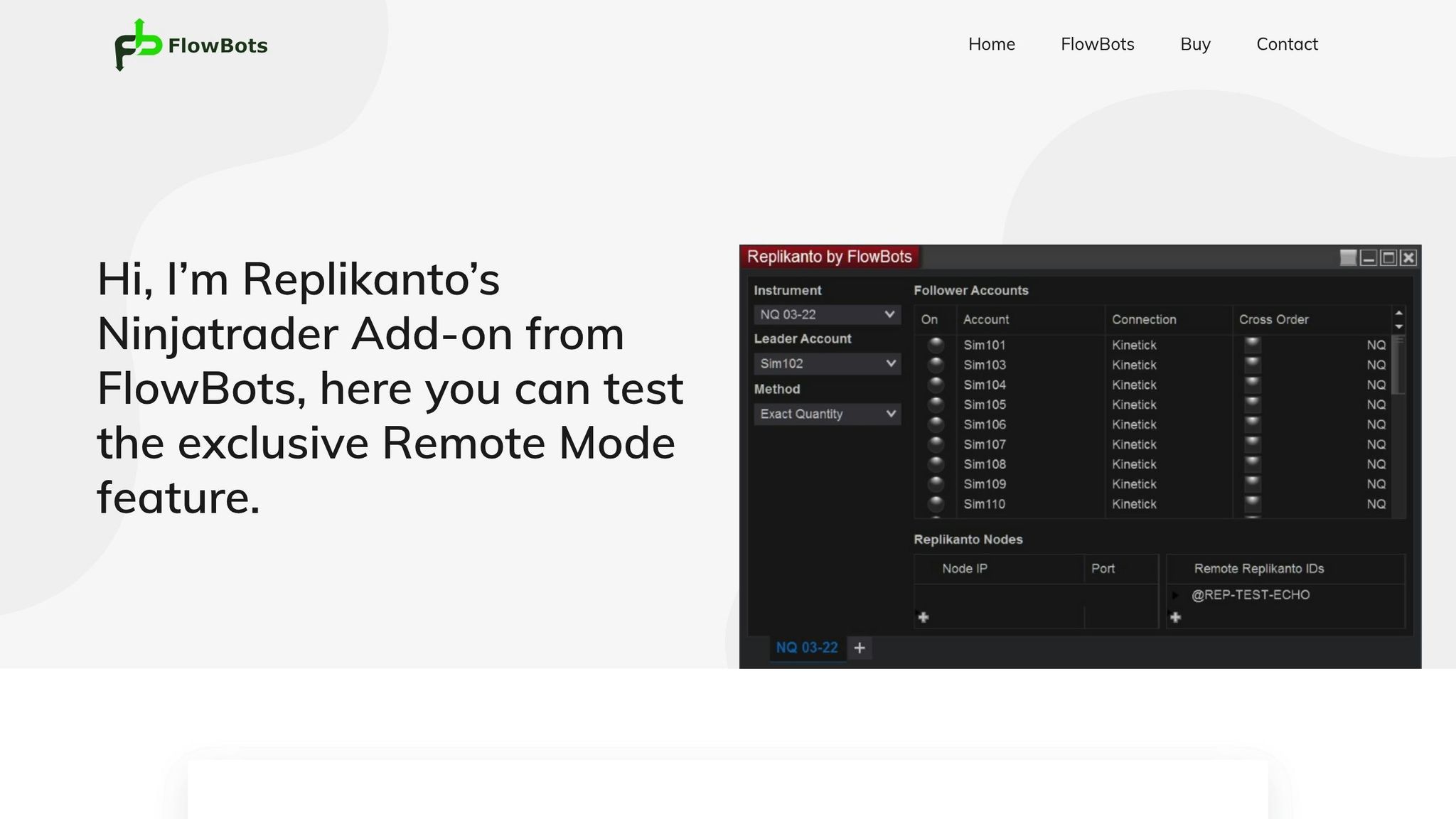

- Key Tools: Popular trade copier add-ons include CrossTrade TradeCopier, Duplicate Account Actions, Simple Trade Copier, and Replikanto.

- VPS Benefits: Using a low-latency VPS (like QuantVPS) ensures fast, reliable trade copying with minimal delays, crucial for volatile markets.

- Setup Needs: Requires NinjaTrader 8.0.27.1 or higher, Windows 10+, live data feeds, and proper configuration of master and follower accounts.

Quick Setup Steps:

- Install NinjaTrader 8 and a trade copier add-on.

- Connect master and follower accounts with live data feeds.

- Use a VPS with 4+ CPU cores, 8GB RAM, and NVMe SSD for uninterrupted performance.

- Test your setup in simulation mode before live trading.

Trade copying simplifies multi-account management, especially for prop trading. Pairing reliable copier tools with a robust VPS ensures smooth, accurate execution.

Prerequisites and Setup Requirements

Technical Requirements

To set up trade copying in NinjaTrader, you’ll need a few key components in place. First, make sure you have the NinjaTrader Desktop Platform version 8.0.27.1 or higher installed. If you’re using NinjaTrader 8.1 or later, you’ll also need to enable the Multi-provider feature to support multiple account connections.

Your computer must run Windows 10 or newer, as NinjaTrader 8 and its trade copying add-ons are not compatible with other operating systems. This applies to the trade copier software as well.

Next, install a trade copier add-on. Popular choices include Duplicate Account Actions, Simple Trade Copier, and Replikanto. Both your master and follower accounts must have live data feeds for the copying process to work seamlessly. Supported broker connections include Rithmic, Tradovate, CQG, TradingView, and various prop firms or simulation platforms.

Additionally, ensure that automated trading is activated in NinjaTrader. You can do this by navigating to Tools → Options → Strategies and selecting the "Allow Automated Trading" option. Without this setting, the trade copier won’t be able to execute orders on follower accounts. Once your platform and trade copier are set up, the next step is to secure a reliable VPS environment.

VPS Hosting Requirements

Using your home computer for trade copying can lead to interruptions caused by internet outages, power failures, or system crashes – potentially disrupting the copying process at critical moments. A professional VPS eliminates these risks while providing the ultra-low latency needed for precise order execution. For instance, QuantVPS offers latency as low as 0-1ms and guarantees 100% uptime, ensuring seamless synchronization between your master and follower accounts, even during volatile market periods.

To run trade copying software effectively, your VPS should meet certain minimum specifications: 4+ CPU cores, 8GB RAM, and NVMe SSD storage. For smaller setups involving 1-2 charts, the VPS Lite plan at $59.99/month (or $41.99 annually) is a good fit. For more complex setups with multiple accounts, consider higher-tier options like the VPS Pro plan at $99.99/month, which includes 6 CPU cores, 16GB RAM, and support for up to 2 monitors.

The VPS’s geographic location is also critical. Select a data center near your broker’s servers – for example, Chicago for CME futures or New York for most U.S. equity brokers. This proximity helps reduce network delays, minimizing any discrepancies in order execution between master and follower accounts. Once your VPS is ready, double-check that your trade copying setup complies with your prop firm’s rules.

Funded Account Compliance Rules

For traders managing multiple accounts, following fund compliance rules is just as important as the technical setup. Funded and evaluation accounts often come with strict trade copying policies, which vary between firms and sometimes even between account types, such as challenge accounts versus funded accounts.

Most prop firms permit trade copying between accounts you personally own, but they typically forbid copying trades between accounts owned by different users. This means you can copy trades from your evaluation account to your funded account, but you cannot share trades with other traders or copy trades from someone else’s account.

Some firms impose timing restrictions to prevent identical trades across multiple funded accounts. For example, you might need to wait at least 30 minutes before placing the same trade in another account to avoid triggering their monitoring systems. Additionally, some firms may restrict the use of commercially available automated trading algorithms or Expert Advisors altogether.

Challenge accounts tend to have fewer restrictions compared to funded accounts. Many firms that don’t allow trade copying for funded accounts still permit it during the evaluation phase. However, you’ll need to stay within capital allocation limits and clearly define which account will act as your master.

Before committing to any trade copying solution, it’s crucial to reach out to your prop firm directly and confirm their policies. Rules can change frequently, and what one firm permits, another may prohibit. Always request written confirmation of their guidelines.

Be especially careful with cloud-based copy trading services, as some firms explicitly ban these while allowing VPS-based solutions. This distinction often stems from concerns about data security and the firm’s ability to monitor your trading activity for compliance purposes.

How to Set Up Trade Copying in NinjaTrader

Install and Activate the Copier Add-On

To get started, close NinjaTrader and reopen it. Then, head to Tools → Import → NinjaScript Add-On. Locate the .zip file you downloaded and open it.

You might see a warning about using third-party add-ons – read it carefully and click OK to continue. Once the import is complete, you’ll see a confirmation message: "NinjaTrader successfully imported all scripts contained in the NinjaScript Archive File."

Next, restart NinjaTrader to activate the add-on. If the copier is a licensed product, activate it by navigating to Tools → Vendor Licensing.

Once the add-on is ready, you can move on to setting up your accounts.

Set Up Master and Follower Accounts

Before proceeding, make sure all your trading accounts are visible in the Control Center.

Open the trade copier interface and hit Add Copier to establish a new copying relationship. Start by selecting your master account – the account where your trades originate. This could be your primary funded account or an evaluation account. Then, add one or more follower accounts. These accounts will replicate the trades made in the master account. Most trade copiers allow multiple follower accounts to be linked to a single master, which is ideal for managing multiple prop firm accounts at the same time.

Some advanced tools, like CrossTrade, even offer multi-directional copying. This means any account can follow or be followed by another, which can be especially handy for traders handling complex strategies or accounts with varying risk levels.

Configure Copy Settings

Your copy settings determine how trades are mirrored between accounts and ensure the setup aligns with your risk management approach.

Start by selecting a copy mode:

- Executions Mode: This option copies filled orders from the master account and sends market orders to the followers. It prioritizes speed but may result in slight price differences due to market fluctuations.

- Orders Mode: This mode replicates every limit order, stop, bracket setup, and any changes or cancellations in real time, ensuring precise synchronization.

Next, adjust position sizing to align with your risk preferences. For example, you might set follower accounts to trade at 0.5× the size of the master account or cap the number of contracts.

If your copier supports it, configure ATM strategies by assigning customized templates to each follower account. This lets you fine-tune stop-loss and profit target settings. You can also filter instruments to control which trades are copied – for instance, copying only specific futures contracts. Symbol replacement is another option, useful when the master and follower accounts trade different contract sizes.

For more advanced strategies, enable trade inversion. This feature allows certain follower accounts to trade in the opposite direction of the master, which can be useful for hedging.

Once your settings are in place, test the configuration to ensure everything works as intended.

Test and Monitor Trade Execution

Run a test using simulation accounts. Place a small trade in the master account and monitor how it’s executed across all follower accounts. Check the Orders and Executions tabs in NinjaTrader to confirm trades are being copied accurately and on time.

Keep an eye on the Accounts Dashboard to ensure synchronization. Look out for any issues, such as rejected orders, open positions that aren’t managed, or missed limit, take-profit, or stop-loss orders.

"No trade copier is flawless. The diverse configurations of NinjaTrader with other third-party indicators, including many possibilities of entry and exit methods, make it very difficult to handle every situation perfectly. Computer hardware, data feed connections, and Internet issues are also contributors to trade copier issues."

– lawyse, Vendor, NinjaTrader Ecosystem Vendor – Affordable Indicators

If your copier includes an Auto-Sync feature, enable it to automatically align follower accounts with the master at regular intervals. Alternatively, use the manual "Sync Followers" button for immediate re-synchronization when needed.

Many copiers also offer toggle controls, allowing you to quickly enable or disable copying for specific accounts. This is particularly useful during major market events or when you want to trade certain accounts independently.

Finally, if you’re running NinjaTrader on a VPS (like QuantVPS), monitor your system’s CPU and memory usage. Aim to keep CPU usage below 70%, and consider restarting NinjaTrader periodically to maintain smooth performance. These steps help ensure your trade copier runs efficiently, even during volatile market conditions.

Replikanto Copy Trader Setup for Ninja Trader | Full Tutorial to Copy Trade Multiple Prop Accounts ✅

Best NinjaTrader Trade Copiers

When it comes to trade copying in NinjaTrader, Affordable Indicators’ Duplicate Account Actions stands out as the top choice. For professional traders, maintaining consistent performance across funded and evaluation accounts is essential, and this tool delivers by synchronizing all positions and orders seamlessly across multiple accounts. Here’s a quick feature breakdown:

| Tool | Key Feature | Best For |

|---|---|---|

| Affordable Indicators – Duplicate Account Actions | Synchronizes all positions and orders across accounts | Professional traders managing funded or evaluation accounts |

This solution is tailored for the unique needs of professional multi-account trading. It ensures that every trade executed in the master account is mirrored with precision in follower accounts, which is especially critical for managing funded or evaluation accounts. Pairing this reliable copier with low-latency VPS hosting can further enhance trade copying efficiency and performance.

VPS Hosting Setup for Trade Copying

Why Low Latency VPS Matters

When you’re managing trade copying across multiple NinjaTrader accounts, every millisecond counts. The time it takes for your trade copier to receive a signal from the master account and execute trades on follower accounts can directly impact performance. Even the smallest delay can lead to missed opportunities or inconsistent execution.

Using a home computer comes with risks – things like internet outages or power failures can disrupt your trading workflow. A low-latency VPS bypasses these problems by hosting your NinjaTrader instances in data centers equipped with direct fiber-optic connections to major exchanges. This setup can reduce network delays to as little as 0-1ms. Essentially, when your master account places a trade, follower accounts can mirror it almost instantly. This level of speed and reliability is critical for meeting the hardware demands of trade copying.

VPS Specifications for Trade Copying

Running multiple NinjaTrader instances for trade copying requires more robust hardware than managing a single account. Your VPS must handle the added workload of simultaneously running the trade copier add-on, multiple NinjaTrader setups, and live data feeds – without lag.

At a minimum, you’ll need a VPS with 4 CPU cores and 8GB of RAM. However, if you’re working with complex strategies or managing a higher number of accounts, you might require 6–8 CPU cores and 16–32GB of RAM. Fast NVMe SSD storage is essential for quick data access, and a stable 1Gbps internet connection with guaranteed uptime ensures that trade signals are delivered reliably, even during high-traffic trading sessions.

QuantVPS Features for NinjaTrader

QuantVPS offers a tailored VPS solution designed specifically for NinjaTrader users. With ultra-low latencies of 0-1ms to major exchanges, it ensures that your trade copier executes orders with the speed and precision required for seamless multi-account replication.

The service provides dedicated hardware, meaning your VPS resources are reserved entirely for your trading activities. This guarantees consistent performance, regardless of other server demands. Key benefits include ultra-low latency connections, exclusive hardware allocation for your trading, and a 100% uptime guarantee, ensuring your trades run smoothly even during high-pressure moments.

Troubleshooting and Best Practices

Common Problems and Solutions

Trade copying in NinjaTrader can sometimes disrupt workflows, especially when managing multiple accounts. Identifying common issues and applying targeted solutions is key to keeping your trading setup running smoothly.

Orders Not Copying is one of the most frequent challenges. If trades aren’t duplicating as expected, first confirm that the trade copier is active and that both the master and follower accounts are showing as connected in the Control Center. If either account appears disconnected, try restarting the data feed connection. If the issue persists, contact your broker to address potential authentication problems.

Follower Order Rejections usually happen due to mismatched account permissions. For instance, if your master account operates in a live environment while follower accounts are set to simulation mode (or vice versa), orders may fail. Ensure all accounts are operating in the same environment and mode – live or simulation. Additionally, check that follower accounts have sufficient margin and access to the necessary instruments. Some brokers limit certain futures contracts or forex pairs based on account type.

High Latency and Delayed Orders can undermine the effectiveness of your trade copier. If follower accounts experience delayed executions, network latency is often the culprit. Running NinjaTrader on QuantVPS can reduce latency to as low as 0–1ms. As explained in the VPS Hosting Setup section, using QuantVPS can significantly minimize delays and improve trade copying accuracy.

ATM Strategy Synchronization Issues arise when a trade copier fails to replicate stop losses and profit targets alongside entry orders. Not all trade copiers support full ATM strategy replication. For example, CrossTrade and Affordable Indicators offer complete ATM synchronization, while Replikanto only handles basic entry and exit logic, leaving out ATM templates. If you rely heavily on ATM strategies, choose a copier that explicitly supports this feature.

System Overload with Multiple Accounts becomes a concern when managing numerous follower accounts. High data feed activity can slow down or even freeze NinjaTrader. Keep an eye on CPU usage – if it exceeds 70%, consider reducing the number of active follower accounts or upgrading your VPS to handle the load.

By addressing these common issues, you can maintain a more reliable trade copying setup. The best practices below further enhance performance.

Best Practices for Smooth Operation

Ensuring reliable trade copying requires ongoing monitoring and proactive management. Follow these practices to keep your system running efficiently.

Test in Simulation Mode First before enabling live copying. Use identical instrument mappings across all accounts and execute test trades from your master account. Verify that follower accounts replicate each order accurately. For example, ensure that an ES (E-mini S&P 500) contract on the master account maps correctly to ES on follower accounts, avoiding mismatches with similar contracts. This step helps identify configuration errors without risking real funds.

Monitor the Event Log for rejected orders and address issues promptly. The NinjaTrader Log provides error codes that can help you troubleshoot failed executions.

Optimize VPS Resources by keeping CPU usage below 70% during active trading sessions. Restart NinjaTrader weekly to clear memory leaks and refresh data connections. On QuantVPS, use the control panel to monitor performance and upgrade your plan if needed.

Avoid Using Multiple Copiers Simultaneously unless explicitly supported by your vendor. Running multiple copiers, such as CrossTrade and Replikanto, can create conflicting signals and duplicate trades. Stick to a single copier solution per NinjaTrader installation to avoid these complications.

Maintain Consistent Account Funding Ratios when using position scaling. For example, if your master account trades two contracts but a follower account only has the capital for one, adjust the copier’s scaling settings accordingly. Misaligned scaling settings can lead to margin calls or rejected orders on underfunded accounts.

Perform Regular System Maintenance during market downtime. Update your trade copier add-on to the latest version, as updates often include bug fixes and performance improvements. Clear temporary files and restart your VPS to ensure smooth operation.

Document Your Copier Settings for quick recovery in case of updates or migrations. Keep a record of parameters, account mappings, and scaling ratios in a simple text file. This documentation will save you time and effort if you need to rebuild your setup after software changes or VPS migrations.

Final Checklist and Conclusion

Setup Completion Checklist

Before you go live with your NinjaTrader trade copying setup, take a moment to double-check that everything is configured correctly. Start by ensuring that NinjaTrader 8 is updated to the latest stable version. Then, confirm that your trade copier add-on is installed and activated – whether you’re using CrossTrade for professional setups, Replikanto for simpler needs, or Affordable Indicators for budget-friendly options.

Next, verify that both your master and follower accounts are properly connected and active in NinjaTrader’s Control Center, with live data feeds from providers like Rithmic, Tradovate, or CQG. Make sure automated trading is enabled and functioning as expected.

Before diving into live trading, test your setup in simulation mode. Place small test trades from your master account and check that follower accounts mirror each trade precisely. Pay special attention to stop losses and profit targets, especially if you’re using ATM strategies. The Orders and Executions tabs should display identical fills across all linked accounts.

Finally, confirm that your VPS (Virtual Private Server) meets the recommended specifications – at least 4 vCPU cores, 8GB of RAM, and NVMe storage. For optimal performance, the VPS should be located close to your broker’s servers, such as in Chicago for CME futures, to minimize latency. During active trading sessions, keep CPU usage under 70% to avoid performance issues.

Once these steps are complete, you’re ready to enjoy the benefits of a streamlined trade copying setup.

Key Takeaways

After completing your setup, it’s worth noting the key benefits this system offers. Trade copying in NinjaTrader simplifies multi-account management, especially for traders handling multiple funded prop accounts. By combining advanced trade copier tools with low-latency VPS hosting, you create a reliable environment where trades execute seamlessly across accounts.

Modern tools like CrossTrade come with features like stealth mode, which makes copied trades appear as manual entries to brokers. This, along with options for flexible position sizing and advanced filtering, allows traders to customize their setups to match specific risk profiles and compliance needs.

Hosting your copier on a service like QuantVPS eliminates many of the latency problems associated with home-based setups. With ultra-low latency (0–1ms) to major exchange servers and a 100% uptime guarantee, you can achieve institutional-grade reliability. For example, the VPS Pro plan at $99.99/month offers 6 cores and 16GB of RAM – ideal for most multi-account setups. For larger operations, the VPS Ultra plan provides 24 cores and 64GB of RAM, ensuring smooth performance even under heavy loads.

NinjaTrader’s trade copying capabilities also go beyond the basics. Advanced copiers support multi-directional copying, enabling any account to follow another, which is especially useful for prop firms managing diverse strategies across multiple accounts.

FAQs

What are the benefits of using a VPS for trade copying in NinjaTrader, and how does it improve performance?

Using a VPS for trade copying in NinjaTrader can significantly improve your trading experience by ensuring quicker order execution and enhanced reliability. Hosting your trading setup near your broker’s servers minimizes latency, which means trades are mirrored almost instantly – even during those high-speed market movements.

Another key advantage is the stable, always-on environment a VPS provides. With consistent internet connectivity and optimized resources, you can avoid problems like missed orders or delays caused by hardware glitches or unreliable internet at home. This makes it a smart choice for anyone aiming for professional-level trade copying.

How can I ensure that using trade copying in NinjaTrader complies with prop firm rules?

If you’re planning to use trade copying in NinjaTrader while working with a prop firm, the first step is to check whether your firm permits trade copiers. Some firms have strict rules around this, especially when you’re managing several funded accounts. It’s a good idea to review their policies carefully or reach out to their support team for clarification.

Once you confirm it’s allowed, make sure all the accounts involved in trade copying are set up with the same settings. Consistency is key here. Also, steer clear of any trading behavior that might seem out of the ordinary. Prop firms often keep a close eye on trading patterns, and anything unusual could raise red flags. Staying transparent and sticking to their guidelines will help you avoid any potential issues with your accounts.

What should I consider when setting up and testing a trade copier in NinjaTrader to ensure smooth operation?

To keep everything running smoothly, make sure your trade copier is installed correctly, set up properly, and actively functioning. Double-check that both the master and follower accounts are connected, visible in NinjaTrader, and have the necessary permissions to trade. It’s a good idea to test your setup with small trades in simulation mode to ensure orders are being copied without any issues.

Keep an eye on instrument mappings, and verify that settings like tick size are consistent across all accounts. Regularly review the NinjaTrader logs to catch any skipped or rejected orders. If you’re using a VPS, aim to keep the CPU load below 70%, and restart NinjaTrader weekly to maintain peak performance. These steps can help avoid common problems like delayed or missed orders.