Managing multiple trading accounts can boost profits and spread risk, but it’s challenging without the right tools. Automation is the key to simplifying this process, reducing errors, and saving time. Here’s what you need to know:

- Why trade multiple accounts? It allows you to scale strategies, segment risk, and maximize payouts across accounts.

- Challenges: Manual management leads to mistakes, missed trades, and compliance headaches.

- Solutions: Use platforms like NinjaTrader, Quantower, or TradingView for account management and trade copiers like Affordable Indicators or Duplikium for syncing trades.

- VPS for reliability: A VPS ensures 24/7 connectivity, low latency, and protection from outages.

Quick Tip: Combine a reliable VPS with trade copiers to efficiently manage multiple accounts, stay compliant, and execute trades seamlessly.

Read on for detailed tools, setup steps, and tips to optimize your multi-account trading strategy.

How I Use a Trade Copier to Trade Multiple Prop Accounts [Full Tutorial]

Problems with Managing Multiple Accounts Manually

Managing multiple trading accounts manually isn’t just tedious – it opens the door to costly mistakes and delays. Even seasoned traders can find themselves grappling with input errors, missed opportunities, and the overwhelming complexity of juggling multiple accounts.

Trade Execution Problems

When orders are entered one by one, mistakes are bound to happen. It’s easy to input the wrong quantity, select the wrong order type, or face slippage as markets move quickly. These errors can lead to trades being executed at prices you didn’t intend, which can significantly affect your profitability.

Compliance Requirements

Keeping up with compliance rules adds another layer of difficulty. Each proprietary trading firm often has its own set of guidelines – think position size limits, drawdown restrictions, or specific trading hours. Monitoring and adhering to these rules across multiple accounts simultaneously can feel like a full-time job in itself.

Time and Complexity Issues

Manually managing several accounts eats up valuable time and increases the chance of oversight. It’s not just about placing trades; it’s about tracking performance, staying compliant, and analyzing the market – all while trying to avoid errors. Instead of focusing on strategy or market trends, you end up buried in administrative tasks.

Using tools like portfolio management software or apps can help simplify this process by consolidating data and streamlining order execution. Automation tools, as we’ll explore next, provide a way to tackle these challenges head-on and regain control.

Best Platforms for Multi-Account Trading

Having a dependable trading platform is a must when managing multiple accounts. While plenty of platforms claim to handle this, only a handful deliver smooth execution across different brokers. Let’s dive into three platforms that stand out for simplifying multi-account management.

NinjaTrader

If you’re into futures trading, NinjaTrader is a solid choice. Its strong framework is ideal for both personal accounts and prop firm evaluations. One of its standout features is the "Multi-provider" function, available on NinjaTrader Desktop. This lets you link multiple evaluation services, like those offered through Tradovate, by setting up separate connections for each account. You simply assign a unique name and enter specific login details for each account. On top of that, NinjaTrader supports automated trading on major exchanges and works seamlessly with trade copiers for master-follower setups. Next up, let’s look at Quantower for its API flexibility.

Quantower

Quantower brings serious flexibility to multi-asset trading. Its robust API integrations connect with a wide range of brokers, including major forex brokers and stock trading giants like Interactive Brokers and TD Ameritrade. This makes it a great choice for traders juggling diverse strategies or managing master/follower setups. Whether you’re trading forex, stocks, or other assets, Quantower’s API functionality keeps things running smoothly.

TradingView

For traders who prefer a browser-based platform, TradingView is a top contender. Its web-based design means you can access it instantly – no downloads or installations required. TradingView also offers seamless integrations with a growing list of brokers, covering everything from traditional stock brokers to forex platforms and even crypto exchanges. This makes it easy to execute trades efficiently, whether you’re working with personal accounts or evaluation accounts.

Managing multiple accounts demands more than just a good platform – it requires a reliable setup. Running several instances and staying connected to various brokers at once often goes beyond what a standard home internet connection can handle. These platforms provide the infrastructure needed to make multi-account trading as efficient as possible.

Top Trade Copier Software for Account Syncing

Once you’ve chosen your trading platform, the next step is selecting a trade copier to synchronize your master and follower accounts. These tools ensure that every trade executed on your main account is mirrored accurately across all connected accounts.

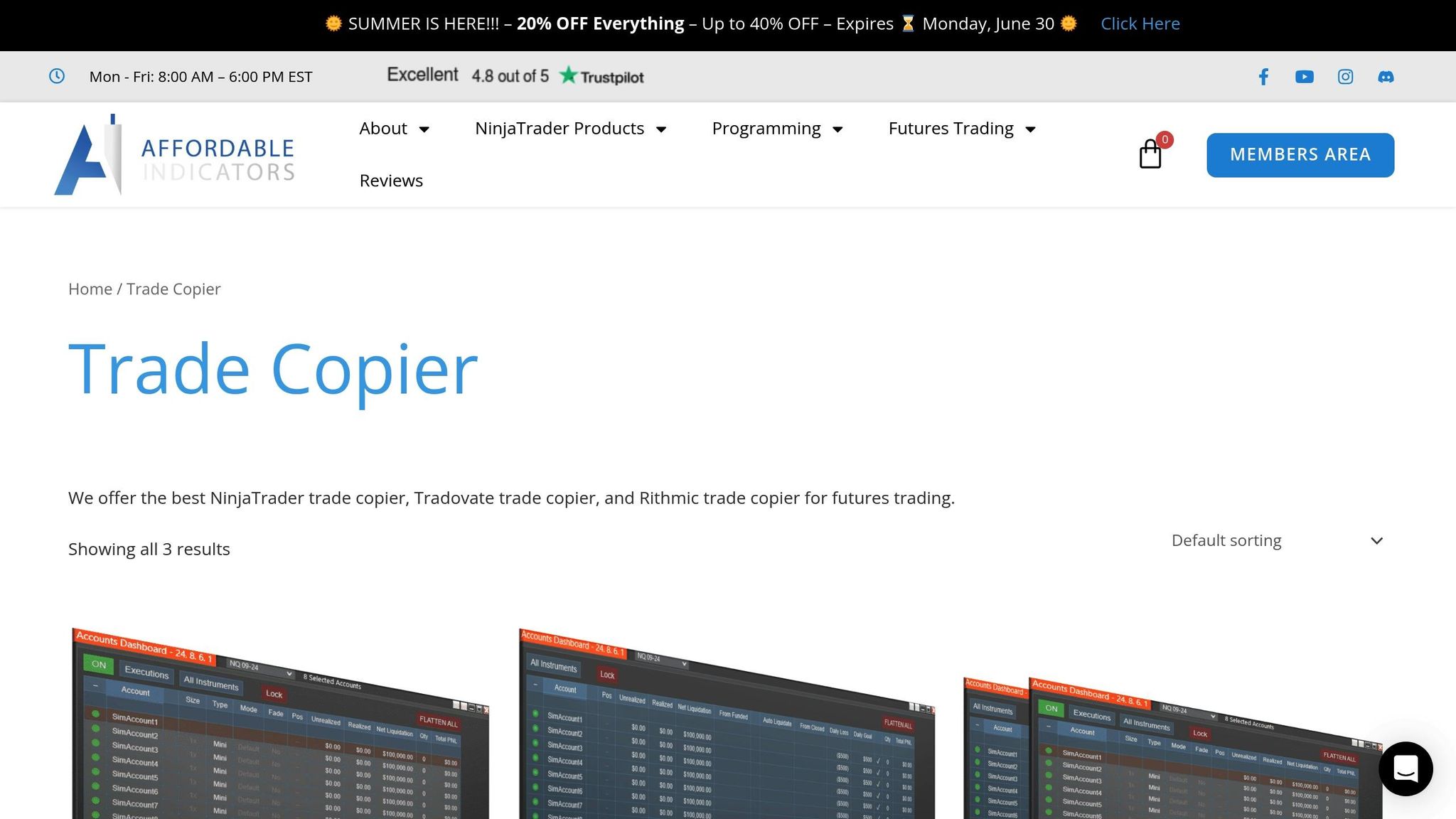

Affordable Indicators TradeCopier

Affordable Indicators TradeCopier is designed for real-time syncing between NinjaTrader instances, making it a go-to option for futures traders, especially those managing multiple proprietary firm accounts. One standout feature is its flexible position sizing, which automatically adjusts trades based on the equity of each account. This makes it particularly useful for traders juggling evaluation accounts alongside funded ones.

Duplikium

Duplikium offers a cloud-based solution that eliminates the need for local installations, making it incredibly user-friendly. With support for over 5,000 broker servers, it provides traders with a wide range of options.

Because of its cloud architecture, trade copying continues uninterrupted even if your computer goes offline. Duplikium is compatible with a variety of platforms, including MT4, MT5, cTrader, DXtrade, TradingView, FXCM, LMAX, Tradovate, and Fortex.

In October 2024, a trader from Las Colinas, Nicaragua, highlighted how Duplikium simplified the management of multiple accounts. They praised its excellent customer service, advanced features, competitive pricing, and easy setup.

Pricing starts at €4.00 per account per month when billed annually, with prepaid options as low as €0.20 per account per day. A limited free plan is also available.

Key features include:

- Multi-master/multi-slave copying: Replicate trades from several master accounts to follower accounts.

- Reverse trading: Ideal for hedging strategies.

- Multi-currency support: Automatically handles currency conversions.

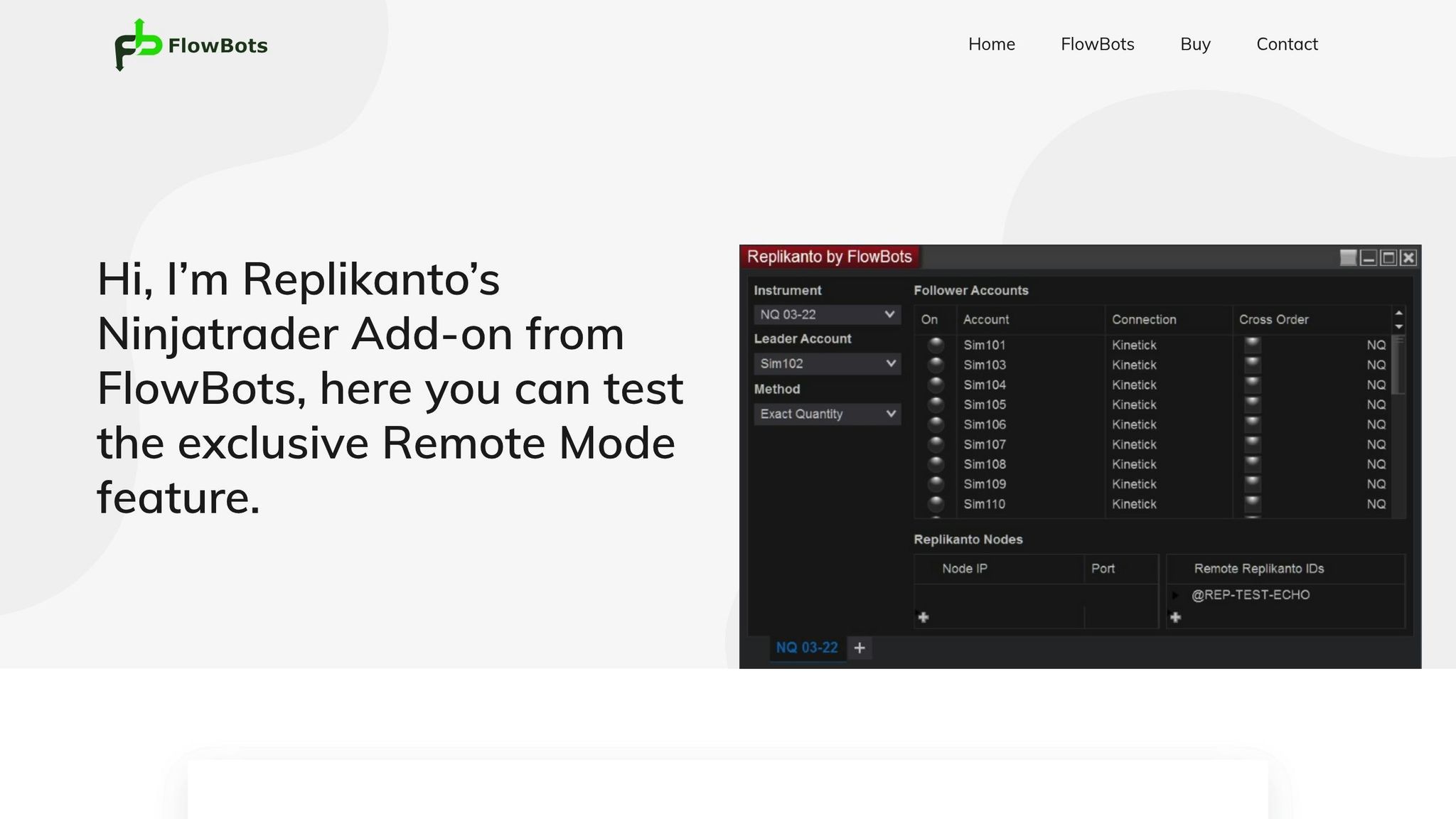

Replikanto

Replikanto is tailored for NinjaTrader 8 users, offering reliable copying between computers. With pricing options ranging from free to $299.00, it caters to a variety of trading needs.

Its Follower Guard feature safeguards accounts by monitoring equity levels and halting trade copying if risk thresholds are exceeded. The ATM Copy function ensures automated trading strategies – including stop losses and profit targets – are replicated seamlessly across accounts. For added control, the Market Only feature allows users to filter trades based on specific market conditions. Additionally, Stealth Mode ensures trading activities remain discreet.

A real-time monitoring dashboard provides critical insights like execution times, slippage, and any copying errors. This is especially important for traders managing multiple funded accounts, where precision is key.

Whether you prefer cloud-based tools like Duplikium for uninterrupted uptime or NinjaTrader-focused options like Replikanto for tight integration, these trade copiers simplify the process of setting up and managing a master/follower account structure.

sbb-itb-7b80ef7

How to Set Up Master/Follower Trading

Creating a master/follower trading setup requires careful configuration to ensure smooth and synchronized execution across accounts.

Setting Up Master and Follower Accounts

Once your accounts are loaded into the platform’s control center, start by designating one as the master account. From there, use order routing commands to replicate trades across follower accounts. You can choose allocation methods – such as equal, proportional, or custom – to manage risk effectively.

Order routing plays a key role here. By using precise commands, you can control how trades flow from the master account to the followers. For instance, in CrossTrade, a command to execute a buy order for crude oil futures across three accounts might look like this:

account=sim101,sim102,sim103; instrument=CL 09-24; action=BUY; qty=1; order_type=MARKET; tif=DAY; flatten_first=true; This command ensures that all accounts execute the order simultaneously and in sync.

For added flexibility, advanced trade copier tools allow you to tweak trade sizes with multipliers or fixed quantities. You can also specify whether to copy mini or micro futures contracts. Some tools even offer a "fade" mode, which places opposite trades in follower accounts – useful for hedging strategies. These options provide a solid foundation for multi-account strategies, as explored in the next section.

Common Master/Follower Use Cases

Master/follower setups are popular among futures traders looking to scale their strategies across multiple proprietary (prop) firm accounts. For example, a trader might execute a strategy on a funded Topstep account (master) while copying the trades to Apex and Leeloo accounts (followers). This approach allows traders to maximize payouts across different accounts while maintaining a consistent strategy.

Another frequent scenario involves copying trades from funded prop accounts to personal accounts. By mirroring trades, traders can generate extra profits beyond the payout limits imposed by prop firms. However, it’s crucial to carefully manage position sizes, as personal accounts often have different capital levels compared to prop accounts. Strict adherence to compliance measures ensures that these strategies align with the rules of each firm.

How to Stay Compliant with Prop Firm Rules

Staying compliant with prop firm rules requires attention to detail, especially when it comes to trade timing and patterns. One way to avoid triggering risk management systems is to stagger trade executions. Instead of executing trades in all accounts simultaneously, introduce a delay of 1-3 seconds between trades. This small adjustment can help prevent compliance flags.

Keeping detailed records is another critical step. Document every trade, including execution times, order types, and any delays in copying trades. Regularly export and back up these logs to ensure you have a clear audit trail in case of compliance reviews.

Lastly, stay up to date with each prop firm’s policies on trade copying. While some firms explicitly allow automated trade replication, others may not. Regularly review the terms of service and, if needed, reach out to the firm directly to clarify their stance. Ensuring compliance not only protects your accounts but also helps you get the most out of your multi-account trading setup.

Why You Need a VPS for Multi-Account Trading

Relying on a home setup for multi-account trading can lead to missed opportunities or even compliance violations. A Virtual Private Server (VPS) provides the reliable infrastructure needed to handle the precision and uninterrupted execution that multi-account trading demands.

Benefits of Using a VPS for Trading

A VPS ensures uninterrupted connectivity, which is critical for successful multi-account trading. Unlike home internet connections, which can suffer from outages or slow speeds, a trading-optimized VPS operates 24/7. With features like redundant power supplies and multiple internet connections, it delivers a near-perfect uptime of 99.99%.

Ultra-low latency is another key advantage. While home internet connections may result in latency of over 100 milliseconds to exchange servers, a VPS located near major trading hubs can bring this down to just 1-5 milliseconds. This faster execution can make the difference between hitting your target price or missing out completely.

A VPS also protects your trading from local outages. Imagine a futures trader managing multiple funded accounts through a trade copier. If a local power outage occurs during a volatile market event, trades hosted on a VPS will continue to execute without interruption. This ensures compliance with strict prop firm rules and avoids costly missed trades.

Another critical benefit is enterprise-level security. Home setups are vulnerable to cyber threats like DDoS attacks and malware. VPS providers, on the other hand, offer robust defenses, including firewalls, intrusion detection systems, and regular updates to safeguard your trading operations.

These features make a VPS an essential tool for serious multi-account traders. Below, we’ll outline the ideal VPS specifications for different trading needs.

VPS Specs for Multi-Account Trading

The right VPS configuration depends on the complexity of your trading setup. For most traders, 2-4 virtual CPU cores are sufficient to manage multiple platforms and trade copiers simultaneously.

Memory requirements vary based on trading activity. A basic setup handling trades across 3-5 accounts typically needs 4-8 GB of RAM. However, if you’re running multiple trading platforms, intensive charting, or complex algorithms, you’ll need 8+ GB for smooth performance.

SSD storage is another must-have. With fast data access and quicker platform startups, a minimum of 50 GB of solid-state storage is recommended for storing charts, historical data, and executing trades in real time.

Low-latency network connections are more important than raw bandwidth. Choose a VPS provider offering latency under 5 milliseconds to major exchanges like the Chicago Mercantile Exchange (CME).

| Trading Setup | CPU Cores | RAM | Storage | Best For |

|---|---|---|---|---|

| Basic | 2-4 cores | 4-8 GB | 50+ GB SSD | 3-5 accounts, simple strategies |

| Advanced Trading | 4-6 cores | 8-16 GB | 100+ GB SSD | 5+ accounts, heavy charting |

| Algorithmic/HFT | 6+ cores | 16+ GB | 200+ GB SSD | Complex automation, multiple platforms |

QuantVPS exceeds these specs, offering a seamless experience for multi-account trading.

QuantVPS Features and Benefits

QuantVPS is designed with traders in mind, offering ultra-low latency (as low as 0-1 milliseconds), enterprise-grade DDoS protection, and compatibility with major trading platforms like NinjaTrader, MetaTrader, and TradeStation. This ensures your trade copier and automation tools run smoothly on an optimized Windows Server environment.

With a 100% uptime guarantee, your strategies remain active around the clock. Automatic backups safeguard your trading configurations and data, while 24/7 technical support ensures any issues are resolved quickly. This reliability is especially important for managing funded accounts with strict compliance guidelines.

QuantVPS also offers scalable resources to grow with your trading needs. Start with the VPS Lite plan at $59/month for basic setups, and upgrade to VPS Pro ($99/month) or VPS Ultra ($199/month) as you expand your accounts or increase automation. Each plan includes dedicated resources to maintain consistent performance.

Lastly, the global accessibility feature allows you to monitor and adjust your strategies from anywhere with an internet connection. This ensures you can manage positions and risks effectively, no matter where you are.

Extra Tips for Better Multi-Account Trading

Managing multiple trading accounts successfully requires a solid plan for handling unexpected failures and a well-tuned system to manage simultaneous positions efficiently.

Planning for Backups and Failures

To stay prepared for potential issues, schedule weekly exports of your platform settings and store these backups securely in cloud storage. Include essential files like NinjaTrader workspaces, TradingView layouts, and trade copier configurations. This ensures you can quickly restore your setup if needed.

Set up automated alerts to monitor critical performance metrics like CPU usage, memory levels, and network stability. Configure your VPS to send email or SMS notifications if these metrics exceed safe thresholds.

For added security, maintain a secondary VPS located in a different data center. This setup allows you to switch operations within minutes if your primary VPS experiences downtime.

Document your recovery procedures in detail. A step-by-step checklist should cover restoring platform settings, reconnecting accounts, and verifying trade copier functionality. Test these recovery steps during off-market hours at least once a month to ensure everything works smoothly.

As a final backup, have a manual trading protocol ready. Keep login credentials for all accounts easily accessible, and familiarize yourself with each platform’s manual order entry system in case automation fails completely.

When your backup protocols are solid, the next step is ensuring your VPS is operating at peak performance.

Getting the Most from Your VPS

A high-performing VPS is critical for uninterrupted trading. Continuously monitor your VPS resource usage, and consider upgrading if CPU or memory demand remains consistently high. For instance, running multiple NinjaTrader instances with heavy charting typically requires at least 8 CPU cores and 16GB of RAM.

Choose a VPS data center that’s geographically close to your broker’s servers. Even small reductions in latency can make a noticeable difference in order execution, especially during volatile market conditions.

Streamline your VPS by disabling unnecessary background processes and services. Many Windows Server installations include programs that aren’t required for trading and can slow down performance.

Schedule regular maintenance during market closures. Tasks like updating software, rebooting, and clearing temporary files can prevent slowdowns and crashes during trading hours.

Organize your trading interfaces by creating separate desktops for platforms, monitoring tools, and backups. This setup makes it easier to manage multiple accounts and quickly identify potential issues.

If you’re running high-frequency strategies or handling a large number of accounts, consider upgrading to a higher-tier VPS plan. Extra processing power ensures consistent execution speeds during peak trading periods.

Work with your VPS provider to optimize routing to exchange servers and explore options that prioritize trading traffic during high-volume times.

Finally, log every change you make to your trading and VPS configurations. Keeping a detailed record helps you troubleshoot issues faster and revert any changes that cause problems.

Conclusion: Making Multi-Account Trading Work

Managing multiple trading accounts successfully requires a blend of the right tools, technology, and careful planning. Today’s traders lean on automation to handle operations with precision and efficiency. The foundation of effective multi-account trading lies in using specialized platforms and dependable trade copiers that seamlessly replicate trades across accounts.

But platforms and trade copiers are just part of the equation. A strong hosting solution is the backbone of any multi-account setup. At the heart of this is a dedicated VPS tailored for trading needs. QuantVPS delivers ultra-low latency, a 100% uptime guarantee, and the robust infrastructure required for strategies that demand flawless execution. With features like DDoS protection, automatic backups, and compatibility with major trading platforms, QuantVPS ensures your trade copiers operate smoothly and without interruptions, 24/7.

This approach offers more than just convenience – it enables advanced risk management and hedging strategies. Thanks to flat-rate pricing, professional-grade multi-account trading is now more accessible than ever.

Success in this space depends on preparation and redundancy. Regular backups, real-time monitoring, and clear recovery plans shield you from unexpected setbacks. When paired with a high-performance VPS offering dedicated resources and global reach, what once seemed like a daunting manual task becomes a streamlined, professional process.

The ability to tap into multiple prop firm accounts, spread risk across different strategies, and scale your trading operations is within your grasp. By investing in a reliable VPS like QuantVPS and pairing it with effective trade copier software, you can unlock the full potential of multi-account trading. The technology is ready – it’s time to make it work for you.

FAQs

What are the main advantages of using a VPS for managing multiple trading accounts, and how does it enhance trade execution?

Using a VPS for multi-account trading comes with several advantages. First, it reduces latency, which means trades are executed faster – a crucial factor for strategies that depend on precise timing. This can give you an edge in markets where every millisecond counts.

A VPS also ensures your trading tools and trade copiers stay active around the clock. With its stable, always-on environment, you don’t have to worry about interruptions, even if your local internet connection or computer encounters issues.

Another benefit is the reduced risk of execution errors. Unstable internet connections or hardware failures can disrupt trades, but a VPS creates a reliable setup, ensuring smoother operations and better consistency when managing multiple accounts at the same time.

How do trade copiers like Duplikium and Replikanto keep trades synchronized across multiple accounts?

Trade copiers such as Duplikium and Replikanto are designed to synchronize trades by instantly replicating orders from a master account to follower accounts in real time. They rely on sophisticated order routing and execution algorithms to reduce delays, minimize slippage, and limit errors, ensuring trades are carried out with precision.

In addition to executing trades, these tools continuously monitor account activity to spot and fix any inconsistencies, keeping everything in sync. This makes them a dependable choice for traders juggling multiple accounts or strategies at once.

What are the best practices for setting up a master/follower trading strategy while staying compliant with prop firm rules?

To ensure you stay within the rules when using a master/follower trading strategy with prop firms, start by carefully reviewing each firm’s specific guidelines. Pay close attention to areas like account linking restrictions, daily loss limits, trading volume caps, and position sizing rules. Setting up your master account to align with these limits is crucial to avoid accidental violations.

Keep a close eye on all linked accounts to confirm that trades are being copied correctly and remain within the firm’s allowed boundaries. It’s also a good idea to maintain detailed records of your trading activity. This can help you prove compliance if needed. By staying on top of these details, you can reduce the risk of account suspensions or disqualifications while making the most of your multi-account trading setup.