Trade copiers are essential for traders managing multiple accounts, especially in fast-paced markets like futures and forex. These tools replicate trades from a master account to follower accounts in real-time, ensuring precision and speed. Modern trade copiers execute trades in under 100 milliseconds, making them indispensable for proprietary trading and high-frequency strategies. Reliable VPS hosting is critical to minimize latency and maintain uninterrupted performance. Below are the top trade copier tools for 2025:

- CrossTrade: Ideal for NinjaTrader users, with sub-100ms execution and advanced ATM synchronization.

- Replikanto: A budget-friendly option for NinjaTrader, offering reliable performance at ~200ms latency.

- Local Trade Copier (LTC): Best for MetaTrader users, with execution speeds under 150ms and robust cross-broker compatibility.

- Duplikium: A multi-platform solution supporting MetaTrader, NinjaTrader, and more, with 150–300ms latency.

- Forex Copier 3: Simple and effective for MetaTrader users, with features like proportional copying and a built-in trade journal.

Quick Comparison:

| Tool | Platforms Supported | Latency | Price Range | Best For |

|---|---|---|---|---|

| CrossTrade | NinjaTrader, Tradovate | <100ms | $89–$199/month | High-frequency futures trading |

| Replikanto | NinjaTrader 8 | ~200ms | $59–$129/month | Multi-account setups |

| Local Trade Copier | MetaTrader 4/5 | <150ms | $79–$149/month | Forex prop traders |

| Duplikium | Multi-platform | 150–300ms | $99–$249/month | Cross-platform trading |

| Forex Copier 3 | MetaTrader 4/5 | ~180ms | $69–$139/month | Signal providers and proportional copying |

For ultra-low latency and reliable performance, QuantVPS offers optimized hosting tailored for trade copiers. Choose VPS hosting for consistent execution, especially in volatile markets. Investing in the right tools and infrastructure ensures smoother operations and better trading outcomes.

How Trade Copiers Work

Master and Follower Account Setup

At the heart of any trade copying system is the master-follower relationship. As Expert Trading Programmers explains:

"Trade Copier software is an advanced tool that allows you to replicate trades from one trading account (the master account) to other connected accounts (follower accounts). It works seamlessly by identifying trades on the master account and instantaneously copying them to the follower accounts, ensuring synchronized trade duplication in real-time".

In this setup, the master account serves as the primary account where trading strategies are executed. The connected follower accounts then automatically replicate every action taken on the master account. The trade copier software works continuously, ensuring that all follower accounts mirror the master’s activity. This includes not only trade entries but also modifications, partial executions, and exits.

What makes this system versatile is its configurability. Traders can adjust parameters for each follower account, such as lot size ratios, equity allocation percentages, and risk management settings. This customization ensures that accounts of varying sizes can follow the same strategy while maintaining proportional risk and consistency. The result? A synchronized trading experience across all accounts, down to the finest detail.

Latency and Performance Impact

When it comes to trade replication, even the smallest delays can make a huge difference – especially in fast-paced markets like futures. For instance, the gap between a 50-millisecond execution and a 500-millisecond delay could mean the difference between a profit and a loss. Modern trade copiers aim to execute replicated trades in under 100 milliseconds, but achieving this relies heavily on the underlying infrastructure.

Here’s how the process works: the trade copier detects the master account’s trade, processes the order details, calculates position sizes, and transmits the orders to the brokers. Each of these steps introduces potential latency. To minimize delays, professional traders often use ultra-low latency hosting environments.

For example, QuantVPS servers are designed to reduce delays to sub-millisecond levels in futures trading and under 10 milliseconds for forex. By strategically placing servers near major exchange data centers, these hosting solutions ensure lightning-fast execution. Stability is just as critical – brief connection outages can lead to mismatched positions, which can be costly. Professional VPS hosting mitigates these risks with reliable connectivity, redundant networks, and around-the-clock monitoring.

Core Trade Copier Features

Advanced trade copiers come packed with features that enhance their functionality and reliability. Here are some of the key capabilities:

- Position Scaling: This feature adjusts trade sizes for follower accounts based on their equity or pre-set ratios. For example, if the master account trades one contract, a larger follower account might trade three contracts, while a smaller one could trade half a contract. This ensures proportional scaling across accounts.

- ATM (Automated Trade Management) Synchronization: Beyond simply copying entry orders, trade copiers replicate stop losses, profit targets, and trailing stops across all accounts. This keeps the entire trading strategy intact, not just the initial trade.

- Risk Management Filters: These filters help enforce rules like maximum daily loss limits, contract caps per trade, and equity-based position sizing. This ensures that risk is managed consistently across all accounts.

As Topstep highlights:

"A trade copier is a tool that lets you place a trade in one account and automatically copy that order into your other accounts". However, they also stress the importance of incorporating risk management into the plan, as profits – and losses – are multiplied across accounts.

Another standout feature is partial fill handling, which ensures that when an order is only partially executed, follower accounts maintain proportional position sizes. This keeps the replication process accurate and aligned with the master account’s activity.

The Best Trade Copiers of 2025. CTrader, DXTrade, Metatrader

Best Trade Copiers for NinjaTrader (Futures)

NinjaTrader is a go-to platform for futures traders juggling multiple accounts. Its solid architecture makes it a top choice for high-frequency strategies, where every millisecond matters – especially when managing prop firm challenges or multiple accounts. Below, we’ll dive into some of the best trade copiers tailored for NinjaTrader and explore how low-latency VPS hosting can take their performance to the next level.

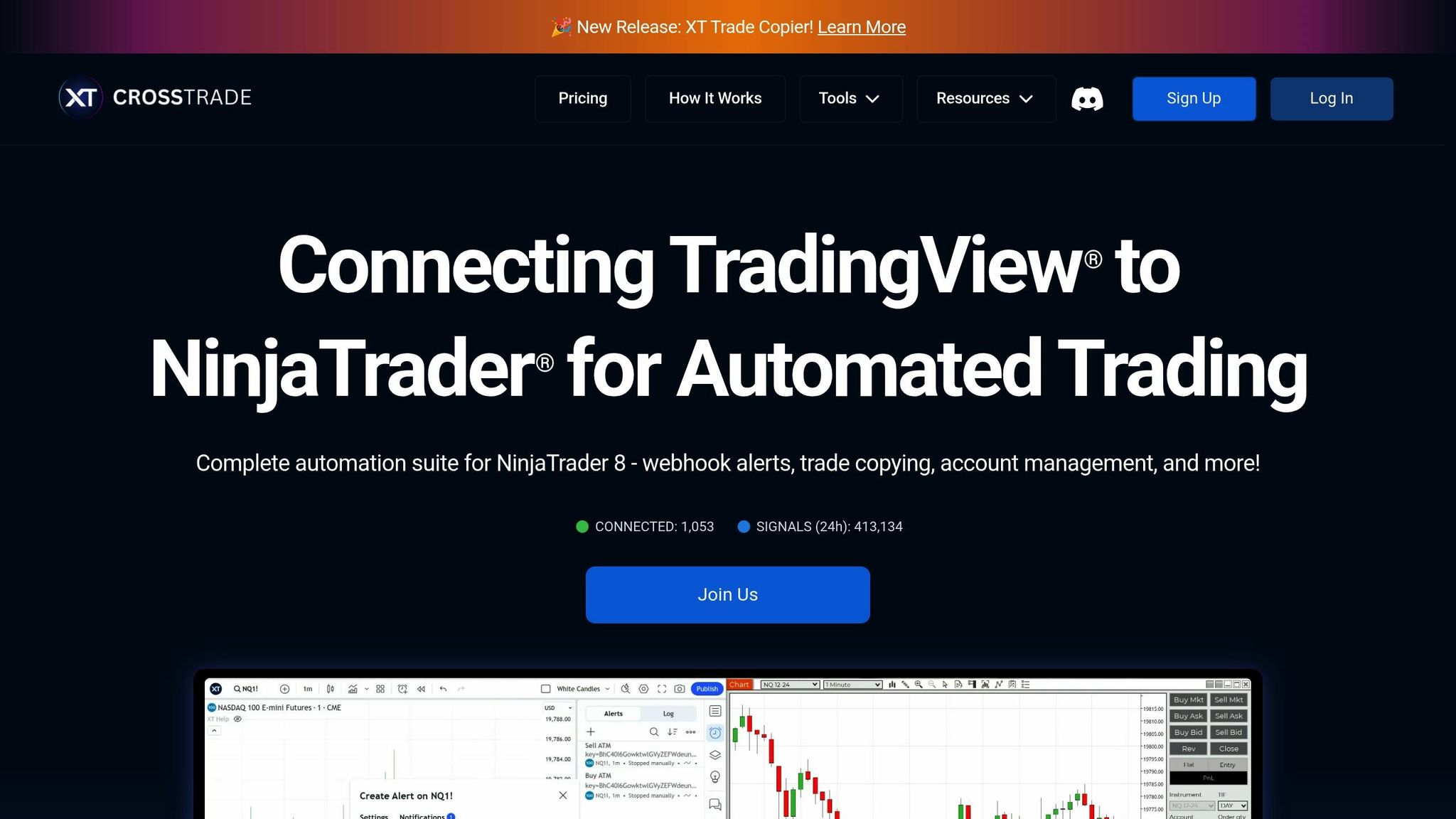

CrossTrade Trade Copier

CrossTrade is a standout choice for NinjaTrader 8 users who need top-tier performance. It offers lightning-fast replication speeds of under 100 milliseconds, making it perfect for scalping and day trading.

One of its key advantages is its ability to synchronize complete ATM (Advanced Trade Management) strategies. This includes stop losses, profit targets, and trailing stops, ensuring all follower accounts stay aligned with the leader strategy.

Another impressive feature is its stealth copy mode, which staggers order execution to minimize market impact while maintaining synchronization. On the risk management side, CrossTrade offers tools like position scaling based on account equity, daily loss limits, and trade-specific contract caps. These features ensure trades are adjusted proportionally to account sizes, keeping risk in check.

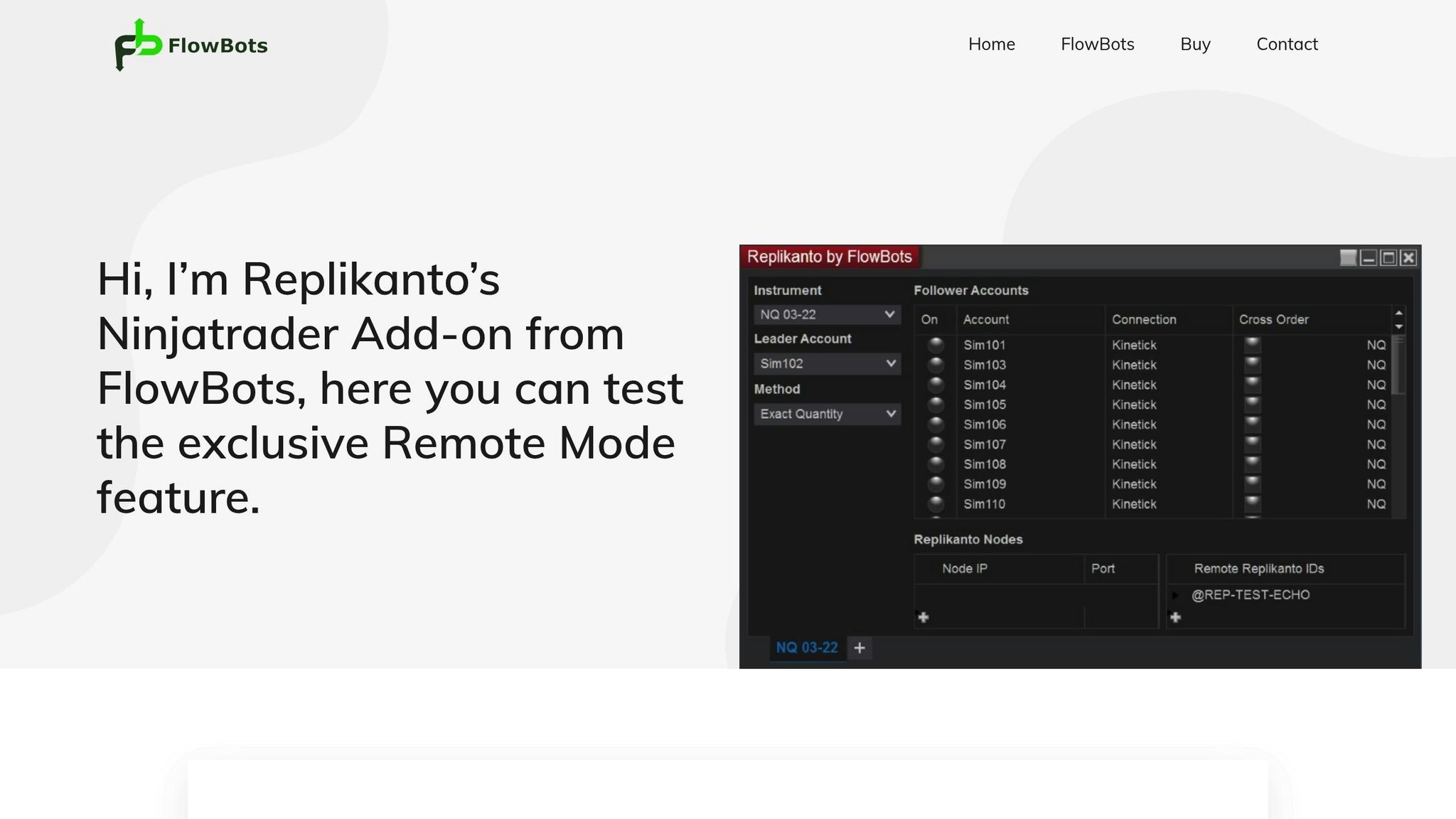

Replikanto and Affordable Indicators

Replikanto strikes a balance between performance and cost. Designed specifically for NinjaTrader 8, it delivers reliable trade copying with execution speeds around 200 milliseconds. While not as fast as CrossTrade, this latency is often sufficient for swing traders or those using position-based strategies.

The software handles a variety of order types and prioritizes stability. Its user-friendly setup makes it a great choice for traders who value reliability over advanced features.

Affordable Indicators’ Duplicate Account Actions is a budget-friendly option that doesn’t skimp on the basics. It offers dependable ATM synchronization and simple position scaling, with execution speeds around 250 milliseconds. This makes it most suitable for traders using longer timeframes or those experimenting with multi-account setups. However, it lacks advanced features like stealth copying and detailed risk management tools, making it less ideal for high-frequency or precision trading.

VPS Hosting for NinjaTrader

To get the most out of these trade copiers, reliable VPS hosting is essential. A robust VPS ensures these tools run smoothly, minimizing latency and avoiding disruptions. For NinjaTrader, QuantVPS Chicago is a top choice, offering optimized performance specifically for high-frequency trade copying.

QuantVPS Chicago provides ultra-low latency, with Pro plans supporting 3–5 NinjaTrader instances and Ultra plans designed for even larger setups. With redundant networks and a finely tuned Windows Server 2022 environment, it ensures uninterrupted performance – critical for avoiding position mismatches or risk rule violations during market hours.

For prop traders managing multiple funded accounts, investing in premium VPS hosting is a small expense compared to the potential profits. It provides the stability and speed needed to meet profit targets and maintain consistent performance.

Best Trade Copiers for MetaTrader (Forex/CFD)

MetaTrader 4 and 5 are the go-to platforms for forex trading, making fast and reliable trade copying across brokers and time zones essential. Let’s dive into some of the top trade copiers designed specifically for MetaTrader.

Local Trade Copier (LTC)

Local Trade Copier (LTC) stands out for its speed and dependability, often achieving copying speeds of less than 150 milliseconds. It offers two modes: copying trades within the same broker and replicating trades across different brokers. This flexibility is a big plus for traders managing multiple accounts.

LTC also includes powerful risk management tools, such as adjusting lot sizes based on account balance ratios, setting daily loss limits, and filtering trades by symbol or magic number. Setting it up is simple – just add the EA files to your MetaTrader experts folder and configure the master and follower accounts. Since LTC runs locally, it avoids the delays that can come with relying on remote servers.

Duplikium and Forex Copier 3

Duplikium is a cloud-based trade copier that supports MetaTrader, cTrader, NinjaTrader, and DXtrade. With execution speeds ranging from 150 to 300 milliseconds, it’s a solid choice for swing and position traders. It also features a user-friendly visual interface for managing trade rules.

Forex Copier 3, on the other hand, focuses on simplicity. It offers an easy setup process and includes a built-in trade journal. Both tools support proportional trade copying, making them useful for traders looking to scale trades across accounts. To get the best performance from these tools, using low-latency VPS hosting is strongly recommended.

VPS Hosting for MetaTrader

After exploring trade copiers, it’s clear that having the right infrastructure is critical to making the most of these tools. Stable and uninterrupted connectivity is a must for MetaTrader, as relying on home systems can lead to outages and disruptions.

QuantVPS provides hosting solutions tailored specifically for MetaTrader users. Their servers feature dedicated resources, DDoS protection, and automatic backups to ensure smooth and secure operation.

For traders managing multiple funded accounts, QuantVPS Pro plans are particularly appealing. These plans support multiple MetaTrader instances running simultaneously. The servers operate on a Windows Server 2022 environment, pre-configured for trading with optimized system services and network settings designed to minimize latency.

Cloud-Based and Cross-Platform Trade Copiers

Cloud-based trade copiers make it possible to connect platforms like NinjaTrader, MetaTrader, and Tradovate, enabling smooth trading across multiple systems. Let’s dive into some of the key solutions that work across various trading platforms.

Duplikium and TradeSyncer

Duplikium offers a centralized cloud interface that links MetaTrader 4/5, cTrader, NinjaTrader, DXtrade, and TradingView. It supports execution speeds of 150–300 milliseconds, making it ideal for swing and position trading. One of its standout features is the ability to handle differences in contract sizes and margin requirements automatically. You can also set custom copying rules for each follower account, which is helpful for managing different risk levels and account sizes.

TradeSyncer focuses on bridging forex and futures platforms by converting forex lot sizes into equivalent futures contracts. It also adjusts for varying margin requirements and tick values. With execution speeds ranging from 200 to 400 milliseconds, it’s versatile enough for most trading strategies, though it may not be suitable for ultra-high-speed needs. The platform also includes built-in risk management tools to ensure smoother operations.

Cloud vs. VPS Hosting Comparison

When choosing between cloud-hosted and VPS-hosted trade copiers, it often boils down to convenience versus control.

Cloud-based solutions, such as Duplikium and TradeSyncer, are designed for ease of use. They handle the technical setup, offer automatic updates, and allow remote access. These features simplify integration across platforms, but the added routing through cloud servers can introduce an extra 50–200 milliseconds of latency. While this might not matter for many strategies, it could impact ultra-fast trading approaches.

On the other hand, VPS-hosted solutions provide more control over your trading environment. A service like QuantVPS is tailored for trading, offering ultra-low latency and a pre-configured Windows Server 2022 environment. This setup allows you to run multiple platforms, such as MetaTrader and NinjaTrader, on the same server. For traders who prioritize speed and security, QuantVPS delivers a dedicated environment that minimizes latency and keeps trading data secure.

For futures traders, where even small delays can significantly impact trades during volatile markets, the difference between 100ms and 300ms execution times can be critical. Forex traders, however, often have more leeway since the forex market is generally more forgiving of minor delays. If you’re using QuantVPS, following best practices for setup can help you achieve the best performance, ensuring your trade copier runs efficiently and securely.

Trade Copier Comparison Table

Comparison Criteria

When evaluating trade copier tools, it’s essential to consider platform compatibility, latency, ATM/strategy synchronization, and risk management features. These metrics are based on current market conditions and typical QuantVPS performance. The table below provides a side-by-side comparison of various tools, highlighting their strengths and ideal use cases.

| Tool | Supported Platforms | ATM/Strategy Sync | Position Scaling | Typical Latency | Monthly Price | Ideal Use Case | Best Hosting Environment |

|---|---|---|---|---|---|---|---|

| CrossTrade | NinjaTrader, Tradovate | ✅ Full Support | ✅ Advanced | <100ms | $89–$199 | Professional futures traders | QuantVPS Chicago / New York |

| Replikanto | NinjaTrader 8 | ✅ Complete | ✅ Standard | ~150ms | $59–$129 | Multi-account prop setups | QuantVPS Chicago |

| Local Trade Copier | MT4/MT5 | ✅ Expert Advisors | ✅ Flexible | <120ms | $79–$149 | Forex prop traders | QuantVPS London / New York |

| Duplikium | MT4/5, cTrader, NT, DXtrade | ✅ Multi-platform | ✅ Advanced | 150–300ms | $99–$249 | Cross-platform trading | Cloud or QuantVPS |

| Affordable Indicators | NinjaTrader 8 | ✅ Basic ATM | ❌ Limited | ~250ms | $39–$79 | Budget-conscious traders | QuantVPS Chicago |

| TradeSyncer | MT4/5, NinjaTrader | ✅ Bridge Mode | ✅ Advanced | 200–400ms | $129–$299 | Forex-to-futures copying | QuantVPS or Cloud |

| Forex Copier 3 | MT4/MT5 | ✅ Signal Copying | ✅ Visual Interface | ~180ms | $69–$139 | Signal providers | QuantVPS London |

For futures traders, achieving sub-100ms execution is crucial, while forex traders can typically work with latencies between 200–300ms. Scalpers, in particular, benefit significantly from lower delays. For CME routing, QuantVPS Chicago offers ultra-low latency, making it an ideal choice for professional futures trading.

Cross-platform tools like Duplikium provide flexibility by bridging different trading ecosystems. However, this convenience may come at the cost of additional routing delays, which could impact execution speed.

When budgeting, it’s important to account for both software and hosting costs. Premium options such as CrossTrade or Local Trade Copier often deliver better execution quality, which can justify their higher price tags compared to budget-friendly alternatives.

As discussed earlier, using a dedicated VPS is critical for consistent performance. QuantVPS servers are equipped with dedicated resources, reliable DDoS protection, and a 24/7 uptime guarantee. These features are essential for managing funded accounts or running multiple strategies effectively. The comparisons here highlight the importance of selecting the right hosting environment, which will be further explored in the upcoming section on setup best practices.

Trade Copier Setup Best Practices

Testing and Risk Management

Always test on demo accounts before going live. This step helps uncover potential issues like order synchronization delays, incorrect position sizing, or platform compatibility problems – things that might not be obvious from the documentation.

Ensure master and follower accounts use identical data feeds. Minor price differences during high volatility can lead to slippage, which can significantly impact performance.

Adjust position scaling ratios based on account size and risk tolerance. Many professional tools, such as CrossTrade and Local Trade Copier, include built-in scaling calculators to align position sizes with each account’s equity, making this process easier.

Set maximum drawdown limits to protect your capital. For example, halt trading if a follower account exceeds a daily loss threshold, often between 5% and 8%. This is especially important when managing multiple funded or proprietary trading accounts.

Review execution logs daily. Look for skipped orders, mismatched partial fills, or inconsistent stop-loss executions. These issues can signal synchronization problems that need immediate attention.

Once you’ve established solid testing and risk management practices, focus on optimizing your hardware and network setup for seamless execution.

Infrastructure Setup

Use a dedicated VPS to avoid latency and connectivity issues. Home internet connections often suffer from disconnects and bandwidth limitations, which can disrupt trade execution.

Consider QuantVPS for ultra-low latency (0–1ms) to major trading venues. For example, if you trade CME futures, QuantVPS offers Chicago-based servers with direct routing, which is ideal for scalping or managing time-sensitive trades during news events.

Select a VPS plan that matches your trading needs. For instance, running multiple NinjaTrader instances may require a configuration like 6 cores and 16GB of RAM. Upgrade as needed for setups that demand more resources.

Enable weekly automatic backups of copier settings and export configurations. This adds an extra layer of security and ensures you can quickly recover in case of a failure.

Set up regular ping checks and latency alerts. Address any routing issues promptly to maintain smooth trading operations.

Synchronize all trading platforms using NTP. This prevents timestamp mismatches that could disrupt trade execution.

Take advantage of QuantVPS’s 24/7 uptime. Continuous operation ensures you won’t miss trades during critical market sessions, keeping your strategy on track.

Conclusion: Choosing the Right Trade Copier for 2025

Top Picks for Futures and Forex

For NinjaTrader futures trading, CrossTrade Trade Copier stands out as the top choice. With lightning-fast latency under 100ms and robust ATM synchronization, it’s perfect for prop traders juggling multiple funded accounts. Features like stealth copying and advanced risk filters make it worth the higher price, especially when every millisecond counts during volatile market conditions.

Replikanto offers a balanced solution for NinjaTrader users. While its latency is slightly higher at around 200ms, it provides dependable order mapping and ATM synchronization at a more budget-friendly price, making it a great option for retail traders looking to grow their operations.

Local Trade Copier (LTC) remains the benchmark for MetaTrader users. Its proven reliability, execution speeds under 150ms, and cross-broker compatibility make it the preferred choice for forex and CFD traders managing multiple MT4/MT5 accounts.

Duplikium is a standout for multi-platform environments. If you’re working across NinjaTrader, MetaTrader, cTrader, and DXtrade accounts, its 150–300ms latency is manageable for most strategies, and its flexibility across platforms is a significant advantage.

Avoid cloud-only solutions like Traders Post for latency-sensitive strategies. With delays ranging from 1 to 5 seconds, these tools are unsuitable for scalping or news trading but may suffice for longer-term trades.

With these options in mind, your hosting setup becomes the next critical piece of the puzzle.

Final Recommendation: VPS Hosting

Reliable VPS hosting is just as important as the copier software itself. Even the best trade copier can falter on unstable home internet or low-quality hosting services.

QuantVPS delivers ultra-low latency for seamless trade execution, even during volatile market conditions. As highlighted in the VPS Hosting sections, a stable server environment is the backbone of any successful trade copier strategy. The VPS Pro plan ($99.99/month) offers an excellent setup with 6 cores and 16GB RAM, perfect for most multi-account configurations. For larger operations, the VPS Ultra plan ($189.99/month) supports up to 4 monitors and 24 cores, catering to more demanding setups.

A 100% uptime guarantee ensures trades aren’t missed during critical moments. This reliability is crucial when managing funded accounts or running time-sensitive strategies, as even a brief disconnect can lead to costly errors.

For latency-critical strategies, consider upgrading to the Performance Plans (+). The slight increase in cost can pay off significantly during high-volume trading periods.

The combination of professional-grade copier software and optimized VPS hosting lays the groundwork for scalable and efficient trading operations. Together, they provide the tools and infrastructure needed to succeed in the fast-paced world of futures and forex trading.

FAQs

How do trade copiers maintain synchronization across multiple accounts in fast-moving markets like futures and forex?

Trade copiers use low-latency technology to synchronize trades from a master account to follower accounts almost instantly. This allows all connected accounts to execute trades in near real-time, which is crucial in fast-paced markets like forex and futures.

To minimize delays, many trade copiers rely on dedicated VPS hosting located near major exchange servers, such as QuantVPS Chicago. This setup helps reduce latency and ensures stable, reliable performance. Additional features like order scaling, partial fill management, and risk filters add another layer of precision, even during volatile market conditions. With these tools, traders can seamlessly manage multiple accounts and avoid missing key market opportunities.

What should I look for in a trade copier tool for high-frequency trading strategies?

When choosing a trade copier for high-frequency trading (HFT), the main focus should be on achieving ultra-low latency execution. In fast-moving markets, even the smallest delays can mean missing out on critical price changes. To stay competitive, opt for a copier that supports direct API integrations and ensures rapid order replication across all accounts, minimizing any lag that could affect your profits.

The ideal copier must also handle high order flow efficiently, maintaining accuracy while reducing the risk of jitter. To further enhance reliability, consider hosting your system on a dedicated VPS with minimal latency. This setup helps ensure stable performance and uninterrupted uptime, particularly during intense market fluctuations.

Why is VPS hosting essential for trade copiers, and how does it improve latency and trading performance?

VPS hosting plays a key role in trade copiers by ensuring your trading systems run with minimal delay. Hosting them closer to exchange servers reduces execution lag, helping to avoid slippage and keeping order replication in sync between master and follower accounts.

Additionally, VPS hosting provides a stable, round-the-clock operational environment. This eliminates the risk of desynchronization caused by local hardware failures or internet disruptions. For high-frequency or multi-account trading setups, a low-latency VPS is crucial for maintaining accuracy and dependability, especially in fast-moving market conditions.