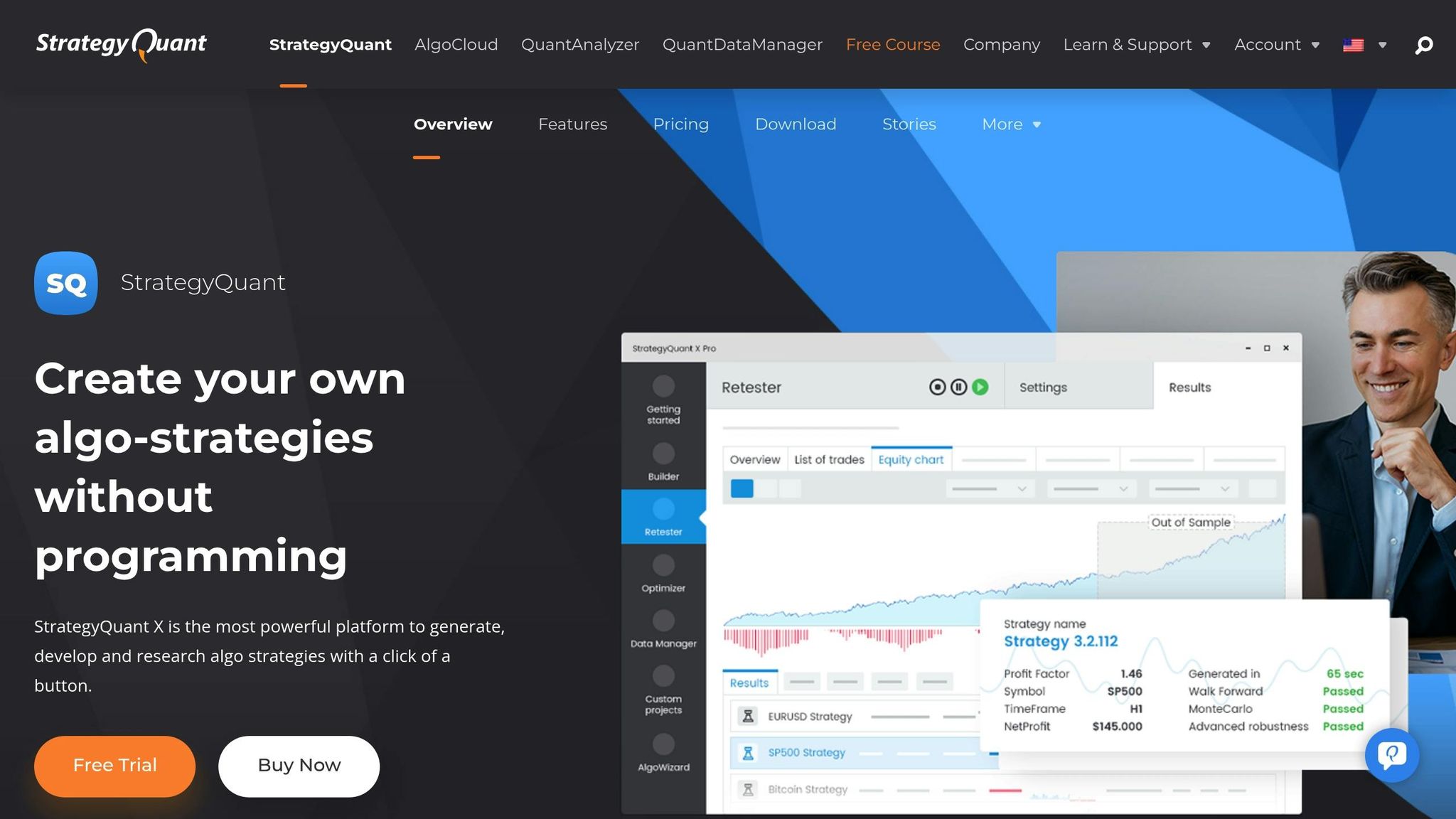

StrategyQuant X is a no-code platform for building, testing, and optimizing trading strategies. It uses AI and machine learning to create thousands of strategies based on user-defined preferences and market conditions. The platform is compatible with MetaTrader 4/5, NinjaTrader, and other trading systems, making it easy to deploy strategies without coding. Key features include:

- No-code strategy builder: Define trading logic with dropdown menus, eliminating the need for programming skills.

- AI-driven automation: Automatically generate and test strategies using genetic programming and machine learning.

- Advanced backtesting tools: Includes Monte Carlo simulations, walk-forward optimization, and real tick data testing for accuracy.

- Platform integration: Export strategies as code for MetaTrader, TradeStation, and more.

- Performance metrics: Evaluate strategies using net profit, drawdown, Sharpe ratio, win rate, and profit factor.

Backtesting results show the platform’s ability to create strategies that perform across different markets, including forex and stocks. Pairing StrategyQuant X with a high-performance VPS, like QuantVPS, ensures low latency and reliable execution for live trading.

If you want to create trading strategies without coding and validate them with precision, StrategyQuant X is a strong choice.

StrategyQuant review and results 2023

StrategyQuant X Core Features

StrategyQuant X stands out with three key features: a no-code strategy builder, AI-driven automation, and advanced backtesting tools. These elements work together to create a platform where traders can design and validate trading strategies without needing to write a single line of code.

Building Strategies Without Coding

The platform’s AlgoWizard makes it easy to define strategy logic through simple dropdown menus. Traders can select indicators like RSI, ADX, or moving averages, specify order types, and apply trade filters – all without programming knowledge.

"StrategyQuant X lets you build and test trading systems without writing code"

Robert from the Netherlands shared his thoughts on this approach, saying:

"The software and your plan for its development is brilliant, thorough and unmatched in the industry at this price point"

For more experienced users, customizable templates provide flexibility while still maintaining the no-code workflow. A great example of this in action is the RSI2 + SMA Filter for Index Trades, featured on StatOasis Blog. This strategy, which follows a mean reversion approach, was successfully tested on the S&P 500 and other large-cap indexes.

The platform’s no-code tools are just the beginning, as its AI capabilities take strategy development to the next level.

AI and Machine Learning Tools

With the help of genetic programming and machine learning, StrategyQuant X can generate and evaluate thousands of strategy combinations. This process is powered by a highly efficient backtesting engine that can analyze numerous strategies per hour, saving traders significant time compared to manual development.

"Most traders waste time trying to code strategies from scratch. StrategyQuant X lets you skip the tech and focus on what really matters – finding real edges"

- Ali Casey, Trading Educator

The platform also supports multi-market and multi-timeframe strategies, enabling users to analyze multiple charts across different symbols or timeframes at once. Additionally, it incorporates fuzzy logic, which allows traders to set percentage thresholds for validating signals.

Once strategies are generated, they undergo rigorous testing to confirm their effectiveness.

Backtesting and Performance Testing

StrategyQuant X integrates a variety of validation techniques to ensure strategies are truly viable. These include overfitting tests, Monte Carlo simulations, walk-forward analysis, parameter permutations, and optimization profile analysis.

The backtesting engine uses real tick data for precision, delivering results that closely mimic live trading conditions. Advanced filters automatically remove underperforming strategies, streamlining the process.

Weiheng Huang, a trader with limited MQL4 experience, highlighted the platform’s value:

"Its numerous robustness tests and efficient backtesting engine are well worth the investment. As someone with scarce MQL4 knowledge, I have coded countless strategies using EA Wizard"

Once a strategy passes all validation tests, StrategyQuant X can export it as full source code for platforms like MetaTrader 4/5, TradeStation, MultiCharts, and JForex. This means traders can deploy their strategies on demo or live accounts without needing further programming. The platform also supports customizable workflows, automating the entire development process with chained builds, retests, and optimizations.

How Easy is StrategyQuant X to Use

StrategyQuant X removes the usual technical hurdles that come with algorithmic strategy development. Its user-focused design perfectly complements the platform’s strong strategy generation and testing features.

Interface for New and Experienced Traders

The platform features a visual interface packed with modules, dropdowns, and drag-and-drop tools that make defining strategy logic straightforward. Instead of diving into complex coding, users can select indicators, set entry and exit conditions, and apply trade filters through simple menus.

For beginners, getting started is a breeze. All they need to do is pick a market and choose from prebuilt workflows or templates. The platform then automatically generates strategies – no technical setup or programming know-how required. Concepts like variables, loops, or syntax? Not necessary. All that’s needed are the trader’s preferences.

Experienced traders, on the other hand, get the best of both worlds: advanced customization without the need for coding. They can adjust parameters, combine multiple indicators, and build intricate rule sets using visual workflow tools. These tools clearly map out how each component connects, making it easy to understand how a strategy works at a glance – something that traditional code-based systems often fail to deliver.

And the ease doesn’t stop there. StrategyQuant X also integrates smoothly with popular trading platforms, ensuring a seamless user experience.

Works with MetaTrader and NinjaTrader

StrategyQuant X takes usability a step further by integrating seamlessly with major trading platforms like MetaTrader 4/5, NinjaTrader, TradeStation, MultiCharts, and JForex. Once a strategy is built and tested, the platform generates the necessary code – whether it’s MQL4 for MetaTrader 4, MQL5 for MetaTrader 5, or EasyLanguage for TradeStation and MultiCharts. The result? Fully functional expert advisors or trading systems that are ready to deploy immediately.

The platform’s backtesting engine is designed to closely align with the backtesting results of these trading platforms. This ensures that the strategies perform in live trading just as they did during development, bridging the gap that often exists between backtesting and real-world execution.

For MetaTrader users, this integration is a game-changer. It allows them to build and test strategies using visual tools rather than manually coding MQL scripts. NinjaTrader users also benefit from the same advanced strategy-building features while staying within their familiar environment.

Once exported, strategies operate independently, so there’s no need to maintain a constant connection to StrategyQuant X. This flexibility adds yet another layer of convenience for traders.

StrategyQuant X Backtesting Results

As mentioned earlier, thorough backtesting is essential for confirming the reliability of trading strategies. It’s the key to understanding how a strategy might perform in real-world conditions. StrategyQuant X offers a robust suite of backtesting tools to help traders assess their strategies with precision.

How Performance is Measured

StrategyQuant X evaluates strategies using several performance metrics that provide valuable insights:

- Net profit: This metric shows the total dollar gain or loss over the testing period, offering a clear view of absolute returns.

- Maximum drawdown: This measures the largest drop from a peak to a trough during the test period. For example, a 15% maximum drawdown means the strategy could face a 15% decline during challenging conditions. It’s a critical measure for understanding risk.

- Sharpe ratio: By comparing excess returns to volatility, the Sharpe ratio helps traders evaluate risk-adjusted performance. A value above 1.0 is considered solid, while anything over 2.0 is exceptional.

- Win rate: This indicates the percentage of trades that were profitable.

- Profit factor: A profit factor above 1.5 signals strong performance, as it means the strategy generates more profit than it loses.

- Average trade duration: This reveals how long positions typically remain open, helping traders gauge how capital is allocated over time.

- Recovery factor: Calculated as net profit divided by maximum drawdown, this metric shows how efficiently a strategy bounces back from losses.

These metrics collectively provide a comprehensive view of strategy performance, helping traders compare different approaches and understand potential risks and rewards.

Real Strategy Examples and Results

Using these metrics, StrategyQuant X demonstrates its capabilities across various markets with real-world examples. The platform’s genetic algorithm approach generates and tests numerous strategy variations using historical data, identifying the most promising candidates.

In forex markets, strategies often focus on major currency pairs like EUR/USD and GBP/USD, which offer high liquidity and trading opportunities. For the stock market, strategies target liquid stocks with enough volatility to create profitable setups. To ensure realistic results, the backtesting engine factors in real-world spreads and commissions, eliminating overly optimistic projections based on theoretical data.

The platform also includes Monte Carlo analysis, which adds an extra layer of reliability. By running multiple simulations with randomized trade sequences, this feature identifies strategies that perform consistently across varying conditions, avoiding those that succeed only under specific historical scenarios.

Another standout feature is its ability to create multi-timeframe strategies. For instance, a strategy might use daily charts to determine overall trends while relying on hourly charts for trade execution. This multi-layered approach often results in strategies that are better equipped to handle shifting market dynamics.

Backtesting results also shed light on how strategies fare during different market phases – bull markets, bear markets, and sideways trends. StrategyQuant X helps traders pinpoint strategies that can maintain profitability across these varying conditions.

Beyond profits, the platform evaluates trade distribution patterns to ensure that success doesn’t hinge on just a few standout trades. Strategies with evenly distributed returns are more likely to succeed in live trading compared to those reliant on occasional large wins. This thorough validation process ensures that traders can approach live markets with greater confidence.

Running StrategyQuant X on High-Performance VPS

If you’re serious about algorithmic trading, transitioning from backtesting to live markets requires more than just a solid strategy – it demands a high-performance VPS. StrategyQuant X is excellent for creating and testing trading strategies, but live deployment introduces challenges that only robust infrastructure can handle. A reliable VPS ensures your strategies execute with minimal latency, making it a crucial piece of the puzzle.

Why Low Latency VPS Hosting Matters

In algorithmic trading, precision and speed are non-negotiable. Even the most advanced strategies built in StrategyQuant X can falter during live execution if technical limitations like delays or poor connectivity come into play.

"In the dynamic world of algorithmic trading, where precision, speed, and automation are paramount, StrategyQuant X emerges as a game-changer." – Road to Trader

Live trading presents unique challenges that backtesting can’t fully simulate, such as slippage, widened spreads, and network issues. As highlighted in StrategyQuant’s documentation:

"There are things like widened spreads, requotes, slippage, time delays, network disconnects, VPS failures and so on that affect real live trading." – StrategyQuant Documentation

This is where QuantVPS comes in. Designed specifically for trading, QuantVPS offers ultra-low latency connections (as fast as 0–1ms) to major financial hubs, along with a 100% uptime guarantee, DDoS protection, and automatic backups. These features help minimize the technical risks that can disrupt live trading.

Setting Up StrategyQuant X with QuantVPS

Getting StrategyQuant X running smoothly on QuantVPS requires a few key steps. First, install the software in a custom directory, like C:\StrategyQuant, to ensure full read-write access. This setup helps avoid potential permission issues.

Next, choose a QuantVPS plan that aligns with your trading needs. Here are some options:

- VPS Pro: Priced at $99.99/month (or $69.99/month with an annual plan), it comes with 6 cores, 16GB RAM, and 150GB NVMe storage.

- VPS Ultra: Offers 24 cores and 64GB RAM, ideal for traders running multiple strategies.

- VPS Pro+: Features optimized network routing for even lower latency, perfect for high-frequency trading.

After installation, StrategyQuant X’s Algo Cloud extension allows you to deploy strategies directly to live markets. This eliminates the need for a constantly running local PC, enabling true 24/7 trading.

For traders managing multiple strategies, QuantVPS’s higher-tier plans provide multi-monitor support. The VPS Ultra plan supports up to 4 monitors, while the Dedicated Server option accommodates up to 6. Combined with global access, this setup ensures you can monitor and control your trading environment anytime, anywhere.

Final Verdict: Should You Use StrategyQuant X

StrategyQuant X brings automated trading within reach for traders, thanks to its user-friendly no-code setup, AI-driven tools, and rigorous backtesting features. By eliminating the need for programming, the platform clears traditional hurdles, while its AI tools and detailed backtesting lay the groundwork for creating trading strategies that can adapt to different market conditions.

The backtesting capabilities stand out, demonstrating the platform’s ability to generate strategies that balance risk and performance across various scenarios. Features like Monte Carlo analysis and walk-forward optimization ensure that strategies are not just tailored to past data but have the potential to perform in live markets.

What sets StrategyQuant X apart is its practical design. The drag-and-drop interface, advanced customization options, and smooth integration with platforms like MetaTrader and NinjaTrader make it a versatile tool for traders. The AI strategy generator is especially noteworthy, as it generates diverse trading approaches that human traders might overlook, opening up new possibilities for strategy development.

However, creating strategies is only part of the equation – executing them reliably is just as important. StrategyQuant X shines when paired with a dependable VPS hosting solution. Transitioning from backtesting to live trading requires not only solid strategies but also a robust infrastructure to ensure seamless execution. This is where a high-quality VPS becomes critical.

QuantVPS is an excellent match for deploying StrategyQuant X strategies in live markets. With ultra-low latency (0-1ms to major financial hubs), a 100% uptime guarantee, and plans starting at $59.99/month, it addresses the technical demands of live trading. The VPS Pro plan, priced at $99.99/month, offers a strong mix of performance and value, making it a solid choice for most algorithmic traders.

For traders serious about automated trading, StrategyQuant X delivers the tools and flexibility needed to thrive in today’s competitive environment. Whether you’re just starting with automated strategies or managing a portfolio of algorithms, the platform, combined with professional VPS hosting, provides an integrated solution for success.

StrategyQuant X is highly recommended for those who want to focus on strategy development without coding, traders looking to use AI for strategy diversification, and anyone ready to move from manual to automated trading with the right infrastructure in place.

FAQs

How does StrategyQuant X deliver accurate backtesting results?

StrategyQuant X excels in delivering accurate backtesting by leveraging advanced algorithms and tools that closely mimic real-world trading conditions. It allows traders to import custom indicators, fine-tune data settings, and choose the appropriate bar types to align seamlessly with their target trading platform.

The platform’s backtesting engine is designed to integrate smoothly with well-known trading platforms like TradeStation and MultiCharts, ensuring consistent and reliable performance analysis. On top of that, StrategyQuant X includes robustness tests that help traders assess how their strategies hold up under different market scenarios. This feature provides valuable insights into the stability and reliability of trading strategies.

What are the advantages of using a no-code platform like StrategyQuant X to create trading strategies?

Using a no-code platform like StrategyQuant X simplifies the process of creating trading strategies, making it accessible to traders regardless of their technical background. By removing the need for programming skills, it empowers both beginners and experienced traders to design and test strategies without getting bogged down in coding. This is particularly helpful for those who prefer to concentrate on crafting effective strategies rather than tackling technical hurdles.

What’s more, StrategyQuant X speeds up the entire development process. Instead of spending hours on manual work, traders can quickly test ideas, fine-tune strategies, and identify real market opportunities. By bypassing the complexities of coding, this platform becomes an invaluable resource for building reliable, data-driven trading strategies with greater efficiency and ease.

Why is a high-performance VPS essential for running strategies built with StrategyQuant X?

Using a high-performance VPS plays a key role in deploying strategies developed with StrategyQuant X. It ensures the speed, reliability, and uninterrupted operation needed for smooth execution. When it comes to algorithmic trading, low-latency connections are essential for executing trades quickly and precisely – something a dependable VPS is built to deliver.

Another major advantage of using a VPS is the ability to run your strategies around the clock without depending on your personal computer. This minimizes risks like power outages, hardware malfunctions, or internet interruptions. Such stability is critical for maintaining consistent performance and getting the most out of your trading strategies.