When managing multiple NinjaTrader 8 accounts, automated trade copiers are indispensable for minimizing errors, delays, and price slippage. Two popular options – Replikanto and Apex Trade Copier – offer distinct solutions depending on your trading needs. Here’s a quick breakdown:

- Replikanto: Best for advanced setups, including multi-machine copying, ATM strategy replication, and features like Stealth Mode and Follower Guard. Ideal for professional traders managing complex strategies or multiple VPS setups. Priced at $250.

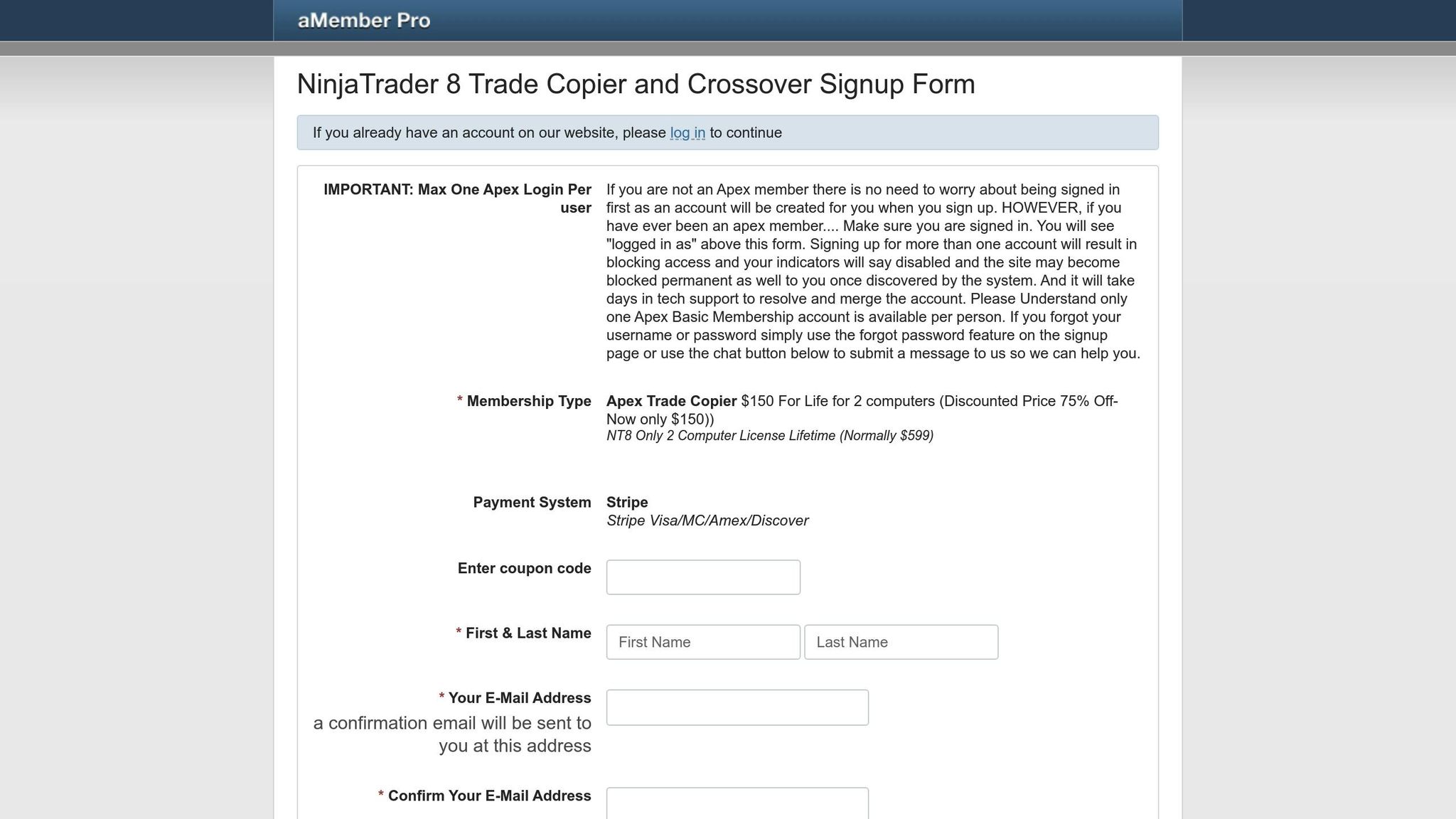

- Apex Trade Copier: Focuses on simplicity and speed, perfect for single-machine setups. It’s easy to use and supports basic ATM replication and contract ratio management. A great choice for retail traders. Priced at $150.

Quick Comparison

| Feature | Replikanto | Apex Trade Copier |

|---|---|---|

| Execution Speed | Slight delay in network setups | Faster for single-terminal setups |

| ATM Strategy Handling | Full replication of complex ATM templates | Basic ATM replication |

| Multi-Machine Support | Yes | No |

| Position Scaling | Advanced but uniform across accounts | Flexible for individual accounts |

| Error Recovery | Advanced monitoring (Follower Guard) | Basic error handling |

| Setup Complexity | More detailed configuration | Simple and quick setup |

| Pricing | $250 | $150 |

Key Takeaway: Replikanto is better for traders with complex, distributed setups, while Apex Trade Copier is ideal for simplicity and speed in single-machine environments. Test both tools in simulation mode to find the best fit for your trading style.

Best NinjaTrader VPS x Replikanto Trade Copier for Futures Prop Firms

How Trade Copiers Work: Basic Concepts

Trade copiers are tools designed to automatically replicate trades from a master account to one or more follower accounts. By eliminating the need for manual intervention, they help ensure consistent and error-free execution of trades.

Master and Follower Account Setup

The setup typically involves two main components: the master account and the follower account(s). The master account is where trading decisions are made and orders are executed. The trade copier system captures these trades and transmits them to the follower accounts. This transmission follows preset rules, ensuring that trades are mirrored accurately. The structure of this setup plays a key role in determining how quickly and precisely trades are replicated.

Speed and Execution Accuracy

One of the most critical features of a trade copier is its ability to minimize delays. A good trade copier ensures that the time between placing an order on the master account and executing it on the follower accounts is as short as possible. This speed is essential for maintaining the integrity of risk and reward across all accounts. Additionally, these systems are designed to manage order sizes and handle scenarios like incomplete fills, ensuring smooth and accurate replication of trades.

Position Sizing and Partial Fill Management

Trade copiers also excel in managing position sizes and handling partial fills. They often include ratio-based scaling options, which allow follower accounts to adjust the size of their trades in proportion to the master account. For instance, users can allocate a specific percentage of their account for trade replication. Some systems even come equipped with tools to address partial fills, ensuring that follower accounts maintain the correct proportional exposure, regardless of market conditions or execution limitations.

Replikanto vs Apex Trade Copier: Feature Overview

Both Replikanto and Apex Trade Copier are designed to replicate trades in NinjaTrader 8, but they cater to different trading styles and needs.

Replikanto Main Features

Replikanto focuses on offering advanced tools for replicating ATM strategies, including stop losses, take profits, and exit logic, all while maintaining the original strategy’s structure.

One standout feature is Stealth Mode, which hides trade copying activities – ideal for traders concerned about brokers detecting or flagging their accounts. Another key feature is Follower Guard, a risk management tool that keeps an eye on follower accounts. If unusual activity or discrepancies arise, it can automatically pause trade copying to prevent potential issues.

Replikanto also supports cross-machine and network copying, allowing master and follower accounts to operate on separate computers or VPS setups. This ensures a stable connection and smooth synchronization, regardless of the network environment.

On top of that, Replikanto provides advanced cross-order scaling with flexible position sizing options. This feature accommodates various contract types and account sizes, letting traders fine-tune how trades are replicated. Multiple copy modes further enhance its adaptability, enabling users to align replication with specific strategies or market conditions.

Apex Trade Copier Main Features

Apex Trade Copier, on the other hand, takes a more straightforward approach, focusing on simplicity and ease of use. It replicates trades within a single NinjaTrader instance, reducing the risk of connection problems and making the setup process quicker and more intuitive.

The copier supports basic ATM strategy replication, including stop loss, take profit, and exit logic. It also features a contract ratio management tool that adjusts trade sizes to match different account balances.

The streamlined setup process makes it easy to define leader and follower accounts and establish simple copying rules. This makes Apex Trade Copier particularly appealing to those using the Apex Trader Funding platform or traders who prefer a no-frills, user-friendly solution.

Head-to-Head Feature Comparison

Now that we’ve explored the core features of both tools, let’s see how they measure up in areas that matter most to NinjaTrader 8 users.

Speed and Execution Performance

When it comes to replicating trades, both tools handle the task with minimal delays. However, Replikanto tends to deliver smoother performance with less lag, particularly when managing multiple accounts. That said, it may experience slight delays in cross-machine setups due to network dependencies.

On the other hand, Apex Trade Copier shines in single-terminal setups. Since it operates entirely within the same NinjaTrader instance, it avoids the overhead of cross-network communication, making it faster for local copying.

Keep in mind that the performance of both tools is influenced by your hardware and network setup. Upgrading to a high-speed Windows PC can help improve order entry speed. Additionally, using SuperDOM for order entry (instead of Chart Trader) can reduce graphical overhead and enhance execution speed.

| Performance Factor | Replikanto | Apex Trade Copier |

|---|---|---|

| Local Speed | Good, but network delays may occur in multi-PC setups | Excellent for same-terminal copying |

| Multi-Machine Performance | Optimized for network copying | Limited to single terminal |

| Resource Usage | Higher due to network capabilities | Lower for local operations |

ATM Strategy Handling

For traders who rely on ATM (Advanced Trade Management) strategies, precision is critical. Replikanto excels in this area by fully replicating the structure of ATM strategies. This includes stop losses, take profits, and exit logic, ensuring follower accounts align closely with the master account’s risk management and exit strategies.

Apex Trade Copier supports ATM strategy replication but takes a more simplified approach. While it handles basic templates well, it may not capture the full complexity of advanced ATM setups. For traders using intricate strategies with multiple profit targets or detailed exit conditions, Replikanto offers a more reliable solution.

Position Sizing and Contract Conversion

Position sizing is a key area where the two tools differ. Replikanto supports cross-account scaling and ratio trading but has a limitation: it applies a single scaling option across all follower accounts. This lack of per-account customization can be restrictive for some users.

Apex Trade Copier, on the other hand, includes a contract ratio management feature that allows trades to be scaled across accounts with varying sizes and balances. This added flexibility makes it more adaptable for traders managing accounts with different lot sizes.

"It has a contract ratio management feature allowing one to scale trades across varying account sizes." – Trading FX

| Sizing Feature | Replikanto | Apex Trade Copier |

|---|---|---|

| Cross-Account Scaling | Yes, but uniform across all followers | Yes, with individual account flexibility |

| Ratio Management | Limited to one selection for all accounts | Dedicated contract ratio management |

| Account Size Adaptation | Less granular control | Better scaling for varying account sizes |

Error Recovery and Account Sync

Both tools offer solutions for handling order failures and maintaining account synchronization, but their approaches differ. Replikanto’s Follower Guard feature actively monitors follower accounts for inconsistencies or unusual activity. If an issue is detected, it can automatically pause trade copying to prevent further problems.

Apex Trade Copier takes a more basic approach to error recovery. While this simplicity reduces potential points of failure, it lacks the advanced monitoring and safeguards provided by Replikanto. For traders managing larger portfolios or navigating volatile markets, Replikanto’s enhanced error handling provides an added layer of protection.

Setup Process and User Interface

Ease of setup and user experience are also important factors. Apex Trade Copier offers a straightforward, user-friendly interface. Most users can define leader and follower accounts and establish copying rules within minutes, making it an ideal choice for those seeking a quick and simple solution.

Replikanto, on the other hand, involves a more detailed setup process, especially for cross-machine or network copying. While features like Stealth Mode and Follower Guard add complexity, they also provide greater control and customization. This makes Replikanto better suited for experienced traders who require advanced functionality, while Apex Trade Copier is a better fit for beginners or those who prefer simplicity.

Which Tool Fits Your Trading Setup

Choosing the right trade copier depends heavily on your trading setup and goals. Each tool has its strengths, and understanding how they align with your needs is key to making the right choice.

Same Machine Multi-Account Trading

If you’re working on a single machine or using a VPS, Apex Trade Copier is a great option. It reduces network overhead, ensuring faster and more efficient trade copying. This makes it a solid choice for retail traders who are testing strategies across multiple account sizes.

On the other hand, if you’re dealing with complex ATM strategies or need advanced risk management, Replikanto might be worth considering. Its Follower Guard feature and full ATM replication capabilities can handle these advanced requirements, even if they demand more system resources.

Remote and Multi-Machine Trading

When it comes to multi-machine or remote setups, Replikanto stands out. It allows network copying to synchronize master and follower accounts across different systems, making it ideal for professional traders who prioritize system separation and redundancy.

In contrast, Apex Trade Copier is better suited for single-terminal environments. It doesn’t offer the same level of support for distributed configurations, which might be a limitation for traders requiring more complex setups.

Prop Trading vs Multi-Strategy Retail Trading

For proprietary traders managing multiple funded accounts, Replikanto provides a range of advanced features, including Stealth Mode and robust error handling. These tools are designed to maintain discretion and avoid costly mistakes, making it a strong choice for handling complex strategies and diverse portfolios.

Retail traders, especially those new to trade copying or managing fewer strategies, may find Apex Trade Copier more convenient. Its straightforward setup and effective contract ratio management make it a practical option for replicating trades across accounts of varying sizes.

In short, your choice depends on your trading volume and complexity. High-frequency traders or those managing a large number of accounts will likely benefit from Replikanto’s advanced monitoring and error recovery features. Meanwhile, traders with simpler setups might prefer the ease and efficiency of Apex Trade Copier. Matching the copier’s capabilities to your specific operational needs will ensure smoother and more effective trading.

VPS Hosting Requirements for Trade Copying

Even the smallest delays can impact trade replication, but a well-configured VPS can help you avoid these pitfalls.

A reliable hosting setup ensures quick and consistent execution. In volatile markets, even slight latency can disrupt replication, leading to missed updates or slippage. Unlike home internet connections, VPS solutions provide stable, low-latency networks, avoiding issues like account drift or misplaced stops.

Here’s how to configure your VPS for top-notch trade copying performance.

VPS Setup Best Practices for Trade Copiers

To get the most out of your trade copier, consider these VPS setup tips:

- Co-locate master and follower accounts on the same VPS. Running both accounts on a single, dedicated server drastically reduces network latency, allowing for near-instantaneous trade replication compared to setups spread across multiple locations.

- Select a VPS with sufficient resources. For multiple NinjaTrader instances, look for VPS plans with at least 8GB of RAM and 4 CPU cores as a starting point. If your trading strategy is resource-intensive, consider upgrading to higher specifications.

- Position your VPS near the target exchange. For example, if trading CME futures, using a VPS located close to the exchange can reduce latency significantly – an essential factor in fast-moving markets.

- Opt for ultra-low latency plans. Some VPS providers offer plans with 0–1ms connectivity and ample resources, such as 6 CPU cores and 16GB of RAM, for around $99.99/month. These setups can handle multiple NinjaTrader instances during volatile market conditions.

- Keep a close eye on VPS resource usage. Set up alerts to monitor CPU and memory usage, ensuring you can address potential bottlenecks before they affect performance.

- Automate daily backups of copier configurations. While many VPS providers include automated backups, manually exporting your copier settings adds an extra layer of protection for your customized configurations.

- Use CPU affinity settings to prioritize key processes. If your VPS supports CPU affinity, dedicate specific cores to your master NinjaTrader instance. This ensures signal generation remains a priority, especially during periods of high market activity.

Final Verdict and Comparison Table

Here’s a quick comparison of the key differences between Replikanto and Apex Trade Copier:

| Feature | Replikanto | Apex Trade Copier |

|---|---|---|

| Execution Speed | May introduce a slight delay in order submission, especially noticeable with high-frequency scalping or volatile markets | Faster local execution with minimal delay |

| ATM Strategy Handling | Fully replicates ATM templates, including detailed stop/target logic | Basic ATM copying with limited template options |

| Multi-Machine Support | Supports cross-network and remote copying | Limited to local machine copying |

| Position Scaling | Offers advanced ratio scaling and cross-contract conversion (e.g., mini to micro contracts) | Provides basic multiplier settings |

| Error Recovery | Can result in unmatched ATM orders if entry orders are rejected | Simplified error handling with fewer edge cases |

| Setup Complexity | Requires more complex configuration with extensive customization options | Easier and quicker to set up |

| Resource Usage | Consumes more memory and CPU resources | Lighter on system resources |

| Pricing | Higher cost with multiple licensing tiers | Lower cost with a more accessible price point |

This comparison highlights how each tool caters to different trading needs. If you’re focused on same-machine, multi-account setups, Apex Trade Copier is a strong choice. Its faster execution and simpler configuration make it ideal for traders prioritizing speed and ease of use.

On the other hand, Replikanto shines in remote or multi-machine setups. Its network copying capabilities are perfect for managing geographically distributed accounts or maintaining redundancy across hosting environments. This flexibility is unmatched for traders who need advanced account management options.

Your trading style also plays a big role in choosing the right tool. For high-frequency scalping, the speed of Apex Trade Copier is a game-changer. But if you’re managing accounts with different contract sizes or rely on detailed strategies like bracket orders, Replikanto’s advanced scaling and full ATM replication offer a significant advantage.

For retail traders juggling multiple strategies, Replikanto’s ability to replicate complete ATM templates ensures strategy consistency across accounts. However, if simplicity and speed are your top priorities, Apex Trade Copier delivers a streamlined experience with fewer potential hiccups.

Ultimately, the decision comes down to your specific trading environment and what features align with your needs. Whether it’s the advanced capabilities of Replikanto or the speed and simplicity of Apex Trade Copier, both tools offer distinct benefits tailored to different scenarios.

Source: RAG Document

Conclusion and Next Steps

When it comes to trade copying solutions, Replikanto and Apex Trade Copier cater to distinct needs. Replikanto shines in multi-machine setups, offering advanced features like network copying and ATM strategy replication. Its $250 license is well-suited for professional traders managing distributed accounts across multiple VPS instances or different locations.

On the other hand, Apex Trade Copier is ideal for simpler, single-machine setups where ease of use and speed are priorities. Priced at $150 for a lifetime license that covers two computers, it delivers excellent value for retail traders or those managing multiple accounts on the same NinjaTrader instance. Its intuitive interface makes it accessible for traders of all technical skill levels, ensuring reliable local copying without the need for complex configuration.

Before committing to either tool, it’s highly recommended to test both in a simulation mode. This allows you to evaluate key performance metrics like replication speed, drift, and error recovery in a risk-free environment. Such testing will help you determine which tool aligns more closely with your specific trading setup.

No matter which tool you choose, the quality of your VPS hosting remains critical for consistent and accurate trade copying. Low-latency connectivity is essential for minimizing delays and ensuring precise trade replication. Placing both your leader and follower NinjaTrader instances on the same high-performance VPS can significantly improve execution speed by reducing network lag.

For optimal results, select a VPS provider that offers ultra-low latency connections, guaranteed uptime, and sufficient CPU and memory resources to handle multiple NinjaTrader instances. QuantVPS stands out with its 0-1ms latency, dedicated resources, and NVMe storage optimized for trading applications. Whether you’re leveraging Replikanto’s advanced features or Apex’s streamlined approach, a reliable VPS is a cornerstone for success.

Start by conducting controlled evaluations in a simulated environment, and once you’ve confirmed consistent performance, transition to live trading. Regularly monitor follower accounts for synchronization issues or ghost orders to ensure smooth operations as you scale your multi-account trading strategy. This methodical approach will help you optimize your trade copying system for long-term success.

FAQs

What should I consider when deciding between Replikanto and Apex Trade Copier for NinjaTrader?

When choosing between Replikanto and Apex Trade Copier for your NinjaTrader setup, it’s essential to weigh factors like latency, execution speed, and whether you need support for remote or network copying. Replikanto stands out with advanced features such as ATM strategy replication, cross-machine copying, and robust error-handling capabilities. These make it an excellent option for prop traders managing accounts spread across multiple locations. On the other hand, Apex Trade Copier offers a simpler setup, making it ideal for local, same-machine copying – a great choice for traders handling fewer accounts or working within a single-machine setup.

You’ll also want to think about elements like scalability, stability, resource consumption, and cost. Replikanto’s flexibility makes it a better fit for more complex, multi-account trading environments. Meanwhile, Apex’s straightforward nature is perfect for those who prioritize simplicity in a local copying solution. Ultimately, your choice should align with your trading style, account configuration, and technical requirements.

How do Replikanto and Apex Trade Copier compare in execution speed, and how can I optimize replication performance?

Both Replikanto and Apex Trade Copier are designed with speed in mind, ensuring quick execution to replicate trades accurately – even during unpredictable market swings. Replikanto stands out with its advanced capabilities like cross-network copying, while Apex Trade Copier prioritizes ease of use and focuses on local replication. That said, how well these tools perform often hinges on your specific setup and trading environment.

If you’re aiming to improve replication performance, hosting your accounts on a low-latency VPS can make a big difference. Placing the leader and follower accounts in the same location helps minimize delays. Beyond that, ensure your internet connection is stable, reduce unnecessary network traffic, and use top-notch hardware. These steps, paired with proper configuration, can significantly boost execution speed and cut down on slippage, making trade copying more precise and reliable.

Why should I use a VPS for trade copying, and how does it improve tools like Replikanto and Apex Trade Copier?

Using a VPS for trade copying can significantly improve the performance of tools like Replikanto and Apex Trade Copier. By hosting your VPS close to your broker’s servers, you can reduce latency, which means faster data transmission and less slippage. This ensures trades are executed more quickly and accurately – an essential factor when managing multiple accounts.

A VPS also offers a stable and dedicated environment, shielding your trading operations from interruptions caused by local network problems, power outages, or computer failures. This level of reliability keeps your trades running smoothly and ensures better synchronization across all accounts, making your trading process more efficient and stress-free.