Managing multiple prop trading accounts can be challenging due to varying rules, platforms, and technical requirements. Here’s how to simplify the process:

- Why Traders Use Multiple Accounts: Diversify risk (34.3%) and access higher capital (33.8%).

- Main Challenges: Manual errors, information overload, emotional stress, and rising tool costs.

- Solution: Centralized account management using NinjaTrader, Replikanto for trade copying, and QuantVPS for stable infrastructure.

Key Tools:

- NinjaTrader: Centralizes accounts, offers advanced trading features, and supports multi-provider setups.

- Replikanto: Automates trade copying with flexible methods like ratio and exact quantity.

- QuantVPS: Ensures low-latency, reliable performance for smooth trading operations.

Steps to Get Started:

- Set up NinjaTrader with Multi-Provider mode for managing multiple accounts.

- Use Replikanto to copy trades across accounts.

- Host your setup on QuantVPS for stability and speed.

By combining these tools, you can manage accounts efficiently, reduce errors, and maintain consistent performance across platforms.

How I Manage MULTIPLE PROP FIRM ACCOUNTS w/Trade Copier

Using NinjaTrader for Centralized Trading

NinjaTrader stands out for its ability to centralize account management, offering powerful charting tools, advanced order flow features, and low-latency performance. It integrates seamlessly with Rithmic and Tradovate through its Multi-Provider mode, making it an excellent choice for traders managing multiple accounts. The platform also prioritizes real-time market data from the first active connection that provides the needed data type, a setting you can adjust under Tools > Options > Market Data.

Setting Up Multi-Provider Mode in NinjaTrader

To enable Multi-Provider mode, navigate to Control Center > Tools > Settings, activate the feature, and restart the platform. After restarting, head to Control Center > Connections > Configure to set up your connections.

For Tradovate-based evaluation accounts, log in using the username and password from your NinjaTrader Account Dashboard on the initial splash screen. If you’re using Multi-Provider mode, make sure to log in with your NinjaTrader credentials first, then configure the Tradovate connection. This setup simplifies the process of managing multiple prop firm accounts efficiently.

Adding Multiple Prop Firm Accounts

The steps to add accounts depend on the technology your prop firms use. For Rithmic accounts, an Evaluation License Key is required. You can check your Rithmic entitlement by going to Control Center > Help > About. Tradovate accounts, on the other hand, do not need a separate license key and allow multiple simultaneous connections. Before adding accounts, confirm that your prop firms permit concurrent connections to the NinjaTrader Desktop Platform to prevent any connectivity issues.

Once your accounts are set up, it’s important to understand the platform’s connection limits to ensure smooth operation.

Working with Connection Limits

NinjaTrader has specific connection limits that traders need to be aware of. While the platform supports multiple Tradovate connections simultaneously, only one Rithmic connection can be active at a time. This limitation exists because all Rithmic-based prop firms use the same broker technology adapter. As NinjaTrader Customer Service explains:

"All Rithmic based prop firms use the same broker technology adapter, which is represented by the Connection type known as ‘Rithmic for NinjaTrader Brokerage‘. Each adapter is only allowed to make one connection at a time."

If you need to use multiple Rithmic-based accounts simultaneously, you’ll have to install separate instances of NinjaTrader on different computers or virtual machines, each with its own license key. For traders juggling mixed account types, switching between Rithmic connections manually – by disconnecting from one and connecting to another – can be more practical than maintaining separate platforms.

In February 2024, a user successfully employed Apex Copy Trader to mirror trades across multiple prop firms, including TopStep, MFF, and Take Profit Trader, by enabling the Multi-Provider setting for Tradovate. To ensure seamless trading, always verify that your accounts meet the technical connectivity requirements before starting.

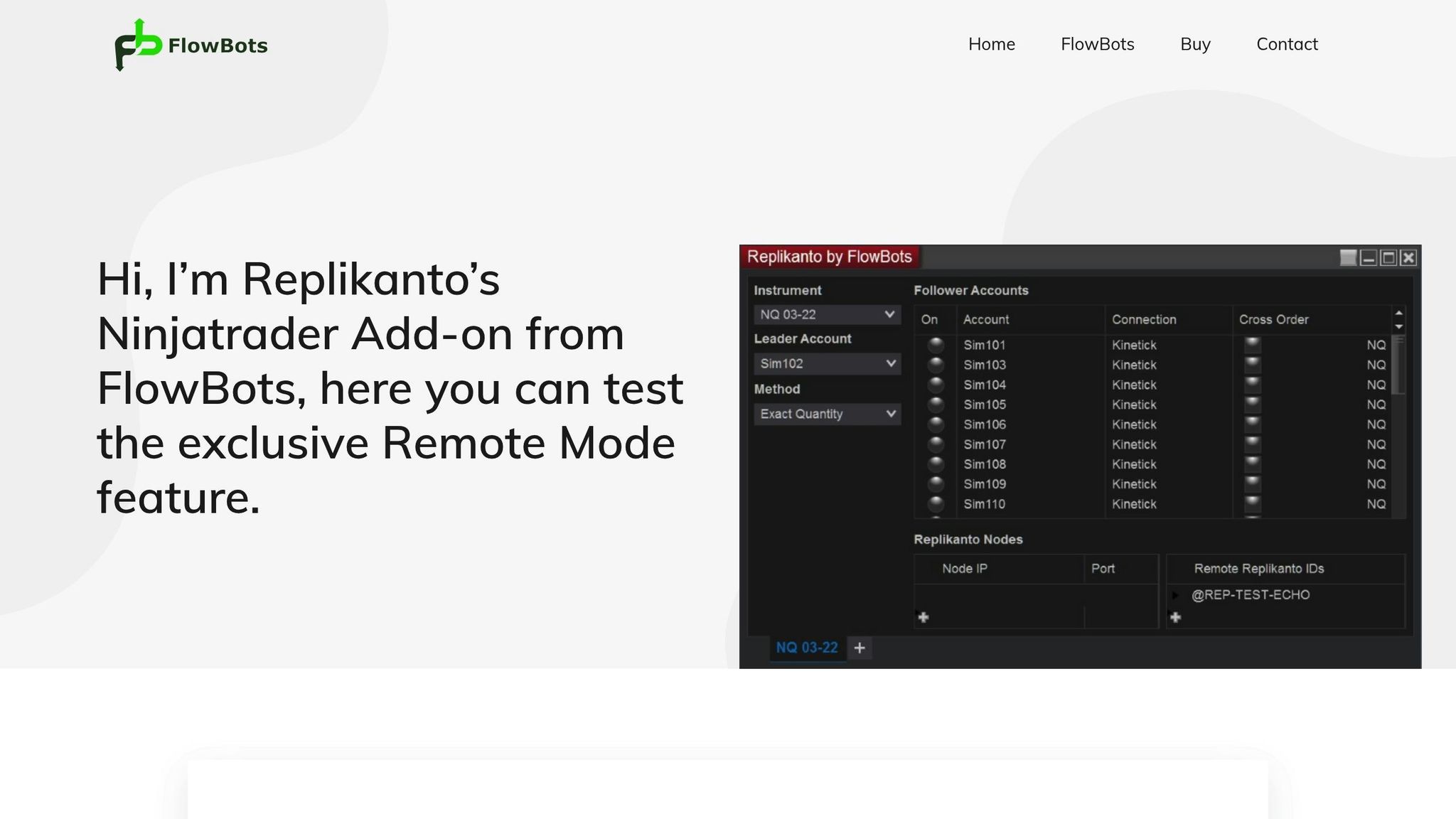

Copying Trades Across Accounts with Replikanto

Once NinjaTrader is set up for centralized account management, you can use Replikanto to streamline and automate trade copying across all your funded accounts.

How Trade Copiers Work

Replikanto works by replicating orders from a designated leader account to follower accounts. It uses advanced algorithms to ensure trades are copied instantly and accurately, eliminating delays and reducing the risk of manual errors.

There are two main approaches to trade copying: mirror trading, which fully automates the process, and copy trading, which allows for more manual control over individual trades. Replikanto functions as a mirror trading tool, offering complete automation once it’s properly set up.

Replikanto supports multiple copy methods, such as:

- Exact Quantity

- Pooled/Equal Quantity

- Ratio

- Pre Allocation

- Net Liquidation

- Available Money

- Percentage Change

These options allow you to adjust position sizes based on account equity or maintain consistent trade sizes across all accounts, giving you the flexibility to align with your trading strategy.

Setting Up Replikanto for Multi-Account Trading

To get started, ensure your system meets the requirements: Windows 10 or newer, NinjaTrader version 8.0.27.1 or higher, and Multi-Provider mode enabled. After purchasing Replikanto, open the add-on in NinjaTrader and assign one account as the leader to mirror trades to follower accounts.

Replikanto is compatible with Tradovate accounts and supports trade copying through the web, mobile apps, or TradingView. It also integrates with OCO exit orders. Choose a copy method that aligns with your account sizes and risk tolerance. For example, the Ratio method is ideal for accounts with varying equity levels, while Exact Quantity ensures identical trade sizes across accounts with similar funding.

You can even copy trades between Replikanto instances running on separate computers, whether over a local network or the Internet.

Once Replikanto is configured, focus on maintaining system stability to ensure smooth and consistent replication of trades.

Maintaining Stable Operation

To ensure reliable performance, Replikanto comes with built-in features designed for stability. For example, Stealth Mode helps conceal its usage, while the Follower Guard feature automatically closes positions in follower accounts if any issues arise. Additionally, Replikanto supports cross-order trading between micro and mini contracts, such as ES ↔ MES and NQ ↔ MNQ, making it versatile for traders working with different contract sizes.

When selecting a mirror trading platform, consider the leader trader’s track record, performance metrics, and risk levels. It’s also essential to choose a platform with an intuitive interface, clear fee structures, and strong security measures.

Regularly monitor connection statuses and replication performance to ensure everything runs smoothly. Be mindful of the platform’s fee structure and evaluate how trade copying impacts your overall profitability across multiple accounts.

sbb-itb-7b80ef7

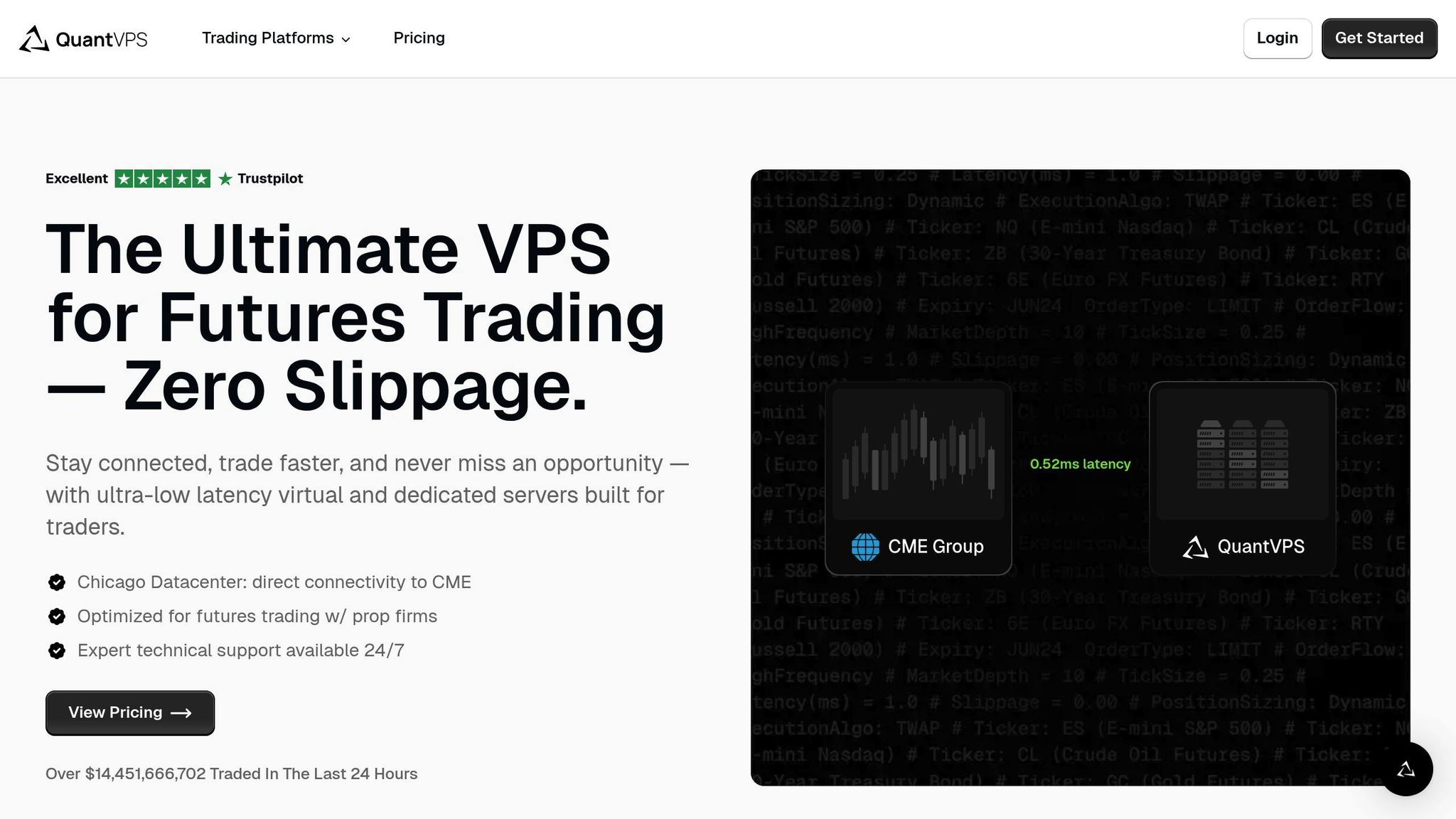

Using QuantVPS for Trading Infrastructure

Managing multiple prop firm accounts requires a trading setup that’s both reliable and efficient. QuantVPS provides the backbone for this, ensuring your NinjaTrader platform and Replikanto trade copier function seamlessly – even during volatile market swings.

Why QuantVPS Works for Prop Traders

QuantVPS stands out by offering ultra-low latency access to the Chicago Mercantile Exchange (CME). With servers based in Chicago and latency clocking in at under 0.52ms to CME Group’s matching engines, it ensures lightning-fast trade execution – essential when juggling multiple funded accounts.

Unlike home-based trading setups that are vulnerable to power outages, internet issues, or hardware failures, QuantVPS guarantees 24/7 uptime. It uses enterprise-grade infrastructure, complete with automatic backups and system monitoring, to keep your operations running without interruptions.

The platform also provides dedicated resources specifically tuned for trading tools like NinjaTrader. With secure, encrypted access available from any device, you can monitor your accounts from anywhere – whether you’re at home, in the office, or on the move. This reliability aligns perfectly with the centralized management and trade-copying strategies discussed earlier.

Choosing the Right QuantVPS Plan

To maximize performance, it’s important to pick the QuantVPS plan that aligns with your trading needs. Here’s a breakdown of the available plans:

| Plan | Price | Best For | CPU Cores | RAM | Storage | Monitor Support |

|---|---|---|---|---|---|---|

| VPS Lite | $59/month | 1-2 prop accounts | 4x cores | 8GB | 70GB NVMe | Single monitor |

| VPS Pro | $99/month | 3-5 prop accounts | 6x cores | 16GB | 150GB NVMe | Up to 2 monitors |

| VPS Ultra | $199/month | 5-7 prop accounts | 24x cores | 64GB | 500GB NVMe | Up to 4 monitors |

| Dedicated Server | $299/month | 7+ prop accounts | 16x+ cores | 128GB | 2TB+ NVMe | Up to 6 monitors |

For traders handling 3–5 accounts, the VPS Pro plan strikes the right balance. Its 16GB of RAM handles NinjaTrader’s multiple charts and Replikanto trade copier with ease. If you’re managing more than five accounts or running complex algorithms, the VPS Ultra plan offers the extra processing power and storage you’ll need.

To simplify the decision-making process, QuantVPS provides a configurator tool that matches your specific trading requirements with the most suitable plan.

Installing NinjaTrader on QuantVPS

Once you’ve chosen QuantVPS as your trading foundation, setting up NinjaTrader becomes a straightforward process. In just 15–20 minutes, you can have everything ready to support your centralized trading and trade-copying system.

Start by signing up at QuantVPS.com and selecting the plan that best fits your needs. When your VPS is ready, access it using Remote Desktop Protocol (RDP) with the credentials provided in your welcome email. The Windows Server 2022 environment is pre-configured for trading applications, saving you time.

Download and run the NinjaTrader installer. Thanks to QuantVPS’s high-speed NVMe storage, the installation process is quick, and the platform launches rapidly. Once installed, set up your data feed connections and add your prop firm accounts using your multi-provider configurations.

Next, install the Replikanto trade copier. Follow the same installation steps as with NinjaTrader, then configure your account connections, establish risk parameters, and designate a leader account for trade copying. Before trading live, perform a thorough test to ensure Replikanto transmits orders correctly across all accounts. In March 2025, a QuantVPS user demonstrated how buy orders from NinjaTrader were instantly replicated to multiple prop accounts.

Best Practices for Multi-Account Management

Using NinjaTrader alongside QuantVPS for centralized trading can streamline your operations, but following a few key practices is crucial to keep things running smoothly. Managing multiple prop firm accounts demands a disciplined approach to safeguard your funds, maintain steady performance, and avoid unnecessary disruptions.

Securing Your Accounts

Protecting your accounts should always be a top priority. Regularly check your account access logs and audit activity for any signs of unauthorized or unusual access. This kind of proactive monitoring helps you catch potential security issues early before they become major problems. These precautions work hand-in-hand with your centralized trading platform and automated trade copying setup, adding an extra layer of protection.

Regular System Maintenance

Keeping your systems in top shape is essential to avoid downtime or interruptions in trading. Plan maintenance during off-hours and make sure to update your systems regularly to ensure everything runs smoothly. Use system tools to monitor performance daily, keeping an eye on important metrics and overall stability. Reboot your QuantVPS periodically to clear out temporary files, and run speed tests several times a day to confirm latency remains under 1 millisecond. Incorporating these steps into your NinjaTrader and QuantVPS routine helps maintain consistent and reliable performance.

| System Check | Target Metric | Monitoring Frequency |

|---|---|---|

| Latency to CME | < 1 millisecond | Real-time |

| System Uptime | 99.99% | Daily |

| Trade Execution Accuracy | 99.9% match rate | Per trade |

Conclusion: Complete Multi-Account Management Setup

Managing multiple trading accounts doesn’t have to be complicated – using the right tools can make all the difference. NinjaTrader serves as your central hub, offering advanced charting features, algorithmic trading capabilities, and unified data feeds to streamline your trading process. Combine this with Replikanto, which mirrors trades from your primary account to all funded accounts, ensuring consistent and precise execution every time. Together, they create a seamless trading and copying system built on a strong, reliable foundation.

To keep your trading environment stable, QuantVPS provides ultra-low latency connections and guarantees 100% uptime, even during periods of market volatility. This ensures that your platform remains steady and responsive, no matter the market conditions.

Getting started is straightforward. Head to QuantVPS.com, choose a plan that matches your trading needs, and set up your Virtual Private Server (VPS) using Remote Desktop Protocol (RDP). Once that’s done, install NinjaTrader and Replikanto on your VPS, connect your accounts, configure your risk settings, and run a thorough test to ensure everything is functioning smoothly before going live.

FAQs

How does NinjaTrader’s Multi-Provider mode simplify managing multiple prop firm accounts?

NinjaTrader’s Multi-Provider mode simplifies managing multiple prop firm accounts by bringing them together on one centralized platform. This means no more jumping between different interfaces, saving you both time and effort.

With this functionality, you can easily connect accounts from funding providers like Rithmic and Tradovate. This setup streamlines trade execution and account management, letting you concentrate on refining your trading strategies instead of dealing with logistical hurdles.

What makes Replikanto an effective tool for copying trades across multiple accounts?

Replikanto is a trade copier designed to replicate trades across multiple accounts with precision and ease. It provides various copy methods, such as Exact Quantity, Equal Quantity, Ratio, and Percentage Change, so you can tailor trade distribution to suit your preferences. These options give you full control over how trades are mirrored across accounts.

The platform also includes features like Market Only and Follower Guard to enhance reliability during trade execution. These tools help minimize synchronization errors, ensuring smooth performance. Replikanto is an excellent choice for managing multiple funded accounts with efficiency and peace of mind.

What makes QuantVPS a dependable choice for managing multiple trading accounts?

QuantVPS has earned the trust of traders thanks to its outstanding reliability and performance. Boasting an impressive 99.9999% uptime, it ensures your trading operations stay seamless and uninterrupted. Its ultra-low latency servers are fine-tuned for lightning-fast execution – essential for handling trades across multiple accounts with precision.

With a secure infrastructure and around-the-clock monitoring, QuantVPS keeps your trades and strategies running smoothly, even during periods of intense market activity. Whether you’re managing manual trades or relying on automated systems, this platform is built to support your needs.