In the high-speed world of futures trading, speed, reliability, and security are critical. Every millisecond counts.

A Virtual Private Server (VPS) can significantly improve trading performance by reducing latency, ensuring uninterrupted uptime, and providing robust hardware for running trading platforms and algorithms. This guide reviews 20 Trading VPS providers, highlighting their latency, hardware, pricing, and compatibility with popular trading platforms like NinjaTrader, TradeStation, and MetaTrader.

Key Takeaways:

- Low Latency: Providers like QuantVPS offer sub-millisecond latency to exchanges like CME, ideal for high-frequency trading.

- Hardware Performance: Advanced setups with AMD Ryzen or AMD Epyc processors, DDR5 memory, and NVMe storage ensure fast, reliable performance.

- Reliability: Uptime guarantees range from 99.9% to 100%, with providers like QuantVPS excelling in continuous operation.

- Pricing: Options range from budget-friendly ($7.95/month with Cloudzy) to premium solutions ($150+/month with BeeksFX or institutional-grade services).

- Platform Compatibility: Most providers support popular trading platforms, but some, like QuantVPS, excel in offering pre-configured setups and expert support.

Quick Comparison

| Provider | Latency (CME) | Datacenter Location | Supported Markets | Hardware | Uptime Guarantee | Starting Price | Platform Support |

|---|---|---|---|---|---|---|---|

| QuantVPS | 0.52 ms | Chicago or New York | Futures (CME) | Ryzen 9, DDR5, NVMe | 100% | $59.99/month | NinjaTrader, TradeStation |

| Kamatera | 5-20 ms | Chicago | Not specialized | Intel Xeon, DDR4 | 99.95% | $130/month | NinjaTrader, MultiCharts |

| Vultr | 10 ms | Chicago | Not specialized | Intel, NVMe | 99.99% | $25/month | NinjaTrader, Quantower |

| BeeksFX | 0.8 ms | Chicago | Futures (CME) | Bare-metal servers | 99.9% | $150/month | NinjaTrader, MetaTrader |

| Cloudzy | 2-4 ms | Chicago | Not specialized | Shared CPUs, DDR4 | 99% | $7.95/month | MetaTrader, NinjaTrader |

| AWS | 5-10 ms | us-central | Not specialized | Customizable | 99.99% | ~$126/month | NinjaTrader, MetaTrader |

QuantVPS stands out with its sub-millisecond latency, cutting-edge hardware, and 24/7 expert support, making it ideal for both professional and retail traders. For budget-conscious users, Cloudzy and InterServer offer affordable options but may lack the speed and reliability needed for high-frequency trading. Choose based on your trading strategy, platform needs, and budget.

The Best VPS For Trading & Why You Should Use One!

1. QuantVPS

QuantVPS stands out as a VPS provider tailored specifically for futures trading. Founded by Ethan Brooks, the company focuses on delivering the ultra-low latency and high performance that professional and algorithmic traders demand. Its primary emphasis is on serving major exchanges, particularly the Chicago Mercantile Exchange (CME). QuantVPS is a trading-focused VPS provider tailored for futures and forex traders who require top-tier performance. It prioritizes ultra-low latency for zero slippage.

Latency to Exchanges

QuantVPS is designed to deliver sub-millisecond latency to CME, with speeds as fast as 0.52ms. This is made possible by its strategically located data centers right next to the CME in Chicago. For traders dealing in CME futures contracts, this lightning-fast connectivity can mean better order execution and reduced slippage during volatile markets. By situating its infrastructure within the same financial hub as CME Group’s servers, QuantVPS ensures traders experience the fastest possible connection to critical futures markets.

Hardware Performance

The hardware powering QuantVPS is built for trading. Servers are equipped with AMD Ryzen 9 7950X and EPYC processors, which operate at clock speeds of up to 5.4GHz. These processors are paired with DDR5 memory and RAID-10 NVMe storage. This setup ensures high computational power and exceptional I/O performance, which are essential for running complex trading algorithms and backtesting strategies. With a focus on single-thread performance, QuantVPS optimizes real-time responsiveness for trading platforms and processes tick data quickly. The DDR5 memory further enhances speed, making it ideal for tasks like multi-timeframe charting and intricate algorithmic calculations.

Uptime and Reliability

QuantVPS guarantees 100% uptime, ensuring uninterrupted trading operations. This reliability is supported by robust infrastructure and redundant systems in its Chicago data centers. For traders relying on automated strategies, continuous uptime is critical to processing market data and executing trades without delays. QuantVPS also prioritizes security, offering enterprise-grade protections such as DDoS defense, network segmentation, and regular audits to safeguard sensitive trading data.

Pricing and Value

Plans with QuantVPS start at $59.99 per month, with options that cater to a variety of trading needs. Whether you’re running a few charts or managing a full-scale professional operation, there’s a plan to suit your requirements. For those opting for annual billing, there are discounts across all tiers, making it a cost-effective choice for long-term users.

Platform Compatibility

QuantVPS supports popular trading platforms, including NinjaTrader, TradeStation, Quantower, Rithmic, and CQG. This broad compatibility ensures traders can seamlessly integrate their preferred tools and strategies. The service also provides 24/7 access to trading experts who specialize in these platforms, assisting with setup, optimization, and troubleshooting. Additionally, QuantVPS offers onboarding support, helping users with platform installation and configuration so they can transition smoothly from their previous setups. This focus on trading-specific needs ensures that QuantVPS is well-equipped to handle the unique challenges faced by algorithmic and high-frequency traders.

2. Kamatera

Kamatera is a cloud VPS provider offering flexible and scalable solutions, particularly suited for traders. With data centers located in financial hubs like Chicago and New York, Kamatera provides customizable server configurations and on-demand resource scaling tailored to the needs of futures trading.

Latency to Exchanges

Kamatera delivers impressive latency performance. From its Chicago data center, traders can expect 2–5ms latency to CME Group matching engines, while the New York servers achieve 2–3ms latency to NYSE, NASDAQ, and Interactive Brokers infrastructure. This low latency makes Kamatera a strong option for equities and options trading. Let’s dive into the hardware that supports these speeds.

Hardware Performance

Kamatera relies on Intel Xeon Platinum processors paired with DDR4 memory to power its servers. These enterprise-grade CPUs typically run at base frequencies of 2.5–3.7GHz, with additional boost capabilities for higher performance. While this setup ensures stable performance for most trading applications, traders with highly specific single-threaded performance needs may want to assess their requirements carefully.

Uptime and Reliability

Kamatera promises 99.95% uptime, backed by redundant power, networking, and storage systems across its global data centers. This translates to roughly 4.38 hours of potential downtime annually. For algorithmic traders or those managing positions during overnight sessions, this level of uptime reliability is a critical factor.

Pricing and Value

Kamatera’s pricing structure is highly customizable, allowing traders to tailor their resource allocations. A typical trading configuration with 8 vCPUs and 32GB DDR4 RAM costs between $130 and $160 per month. Their hourly billing model adds flexibility, potentially reducing costs to about $80–$100 monthly for part-time usage. They also offer a 30-day free trial, giving traders an opportunity to test performance before committing.

Platform Compatibility

Kamatera supports Windows Server environments compatible with popular trading platforms like NinjaTrader, TradeStation, MultiCharts, and MetaTrader 4/5. However, as a general-purpose cloud provider, Kamatera does not offer pre-configured trading platform setups or futures-specific optimizations. Traders are responsible for installing their platforms, optimizing Windows, and handling ongoing maintenance. Kamatera’s support is limited to server provisioning and basic Windows administration, without specialized troubleshooting for trading platforms.

3. Vultr

Vultr offers a cloud computing platform designed for fast and reliable VPS hosting. For traders who need low-latency execution, Vultr’s US-based data centers provide a solid foundation.

Latency to Exchanges

With servers based in New York, Vultr delivers latency of just 2–3 milliseconds to major exchanges like NYSE, NASDAQ, and IBKR. For CME Group, latency is around 10 milliseconds, which is crucial for traders relying on ultra-fast execution.

Hardware Performance

Vultr’s VPS infrastructure is built on Intel processors running at 4.0GHz and uses NVMe storage for speedy data access. This hardware setup ensures dependable performance for various trading applications.

Uptime and Reliability

With an uptime of 99.99%, Vultr minimizes downtime, ensuring uninterrupted trading operations. This reliability is particularly beneficial for automated strategies that require constant market access.

Pricing and Platform Compatibility

Vultr’s VPS hosting starts at around $25 per month, offering an economical solution for traders. It supports Windows Server environments, making it compatible with popular trading platforms like NinjaTrader and Quantower. The platform also allows for flexible scaling, so traders can adjust resources based on their specific needs.

Optimizing for Trading Performance

To get the most out of Vultr, choose server locations close to your target exchanges, allocate adequate resources, and implement strong security measures. These features make Vultr a compelling choice as we move on to the next provider.

4. OVHcloud

OVHcloud provides secure and dependable cloud hosting services. While it’s not specifically tailored for ultra-low latency futures trading, its enterprise-level features offer a reliable option for traders seeking a solid hosting platform. Below is a closer look at its performance and features.

Latency to Exchanges

When it comes to latency, OVHcloud delivers speeds in the range of 4–6 milliseconds to major U.S. futures exchanges, including CME Group. However, its U.S. data centers are located outside key financial hubs like Chicago and New York, which could be a drawback for high-frequency trading that demands ultra-low latency.

Hardware Performance

OVHcloud relies on AMD EPYC and Intel Xeon processors, offering dependable computing power. This setup is generally well-suited for traders running complex algorithms or strategies requiring solid single-thread performance. While the hardware is reliable, it might not stand out as the top choice for those with extremely demanding performance needs.

Uptime and Reliability

The platform promises a 99.9% uptime, meeting standard enterprise expectations. However, this translates to about 8.76 hours of downtime annually, which could disrupt trading during critical market movements. For traders operating automated systems around the clock, even minimal downtime can result in missed opportunities during periods of high volatility.

Pricing and Value

OVHcloud’s pricing starts at around $35 per month, reflecting its enterprise-level infrastructure and strong security measures. While this is competitive for the features offered, traders aiming for real-time futures trading performance may need to invest additional effort in manual optimization to achieve the desired results.

Platform Compatibility

OVHcloud supports widely-used trading platforms such as NinjaTrader and TradeStation, ensuring compatibility with popular software. However, setting up the environment requires some technical configuration, including installing trading software, optimizing Windows settings, and fine-tuning network parameters to minimize latency. The platform also includes advanced DDoS protection to safeguard trading data.

5. InterServer

InterServer stands out as a budget-friendly option for Windows VPS hosting, offering plans that start at just $10 per month. While it lacks the ultra-low latency and high-performance optimizations of pricier alternatives, it’s a practical choice for traders on tighter budgets or those experimenting with basic strategies.

Latency to Exchanges

With a latency of about 5 milliseconds to New York exchanges and slightly higher to Chicago’s CME Group facilities, InterServer’s servers are not situated near major exchange data centers, such as the Equinix facilities in Aurora or Chicago. This explains the higher latency figures. While this level of performance is sufficient for swing or position trading – where split-second execution isn’t critical – it may fall short for high-frequency trading, where every millisecond counts.

Hardware Performance

InterServer relies on Xeon processors running at 3.2GHz, paired with DDR4 memory and standard SSD storage. While Xeon processors are known for their reliability, the 3.2GHz clock speed may struggle with the demands of real-time futures trading. For trading platforms that depend on single-threaded performance – like those requiring fast chart rendering, order processing, or complex algorithm execution – this setup might introduce delays, especially when running multiple indicators or strategies simultaneously. While adequate for general trading needs, the hardware may not meet the demands of high-frequency or resource-intensive applications.

Uptime and Reliability

InterServer offers a 99.9% uptime guarantee, which equates to around 43 minutes of potential downtime per month (or roughly 8.7 hours annually). While this uptime level is standard for web hosting, even brief outages can disrupt algorithmic trading systems that need to operate continuously, particularly during volatile market periods or overnight trading sessions.

Pricing and Value

The base Windows VPS plan includes 2–4GB of RAM, 30–50GB SSD storage, and shared CPU resources – all for $10 per month. However, traders requiring more robust setups, such as 8GB of RAM and dedicated CPU cores for handling multiple charts and indicators, may find themselves spending $40–50 per month. At these higher resource levels, the cost advantage diminishes compared to other providers offering more advanced features.

Platform Compatibility

InterServer supports standard Windows VPS configurations, making it compatible with popular trading platforms like NinjaTrader, TradeStation, Quantower, and MetaTrader. However, users are responsible for managing their own configurations, including software installation and network optimizations. This self-service approach works well for experienced traders but could pose challenges for those needing more advanced setups. As a result, InterServer is better suited for basic trading strategies or swing traders, while more complex or resource-intensive trading environments might require a specialized VPS provider.

Note: While InterServer is an affordable option for entry-level and swing trading, traders seeking ultra-low latency and advanced hardware optimizations should explore alternatives like QuantVPS. QuantVPS offers sub-millisecond latency, cutting-edge 5.4GHz Ryzen processors with DDR5 memory, and dedicated support tailored for advanced futures trading.

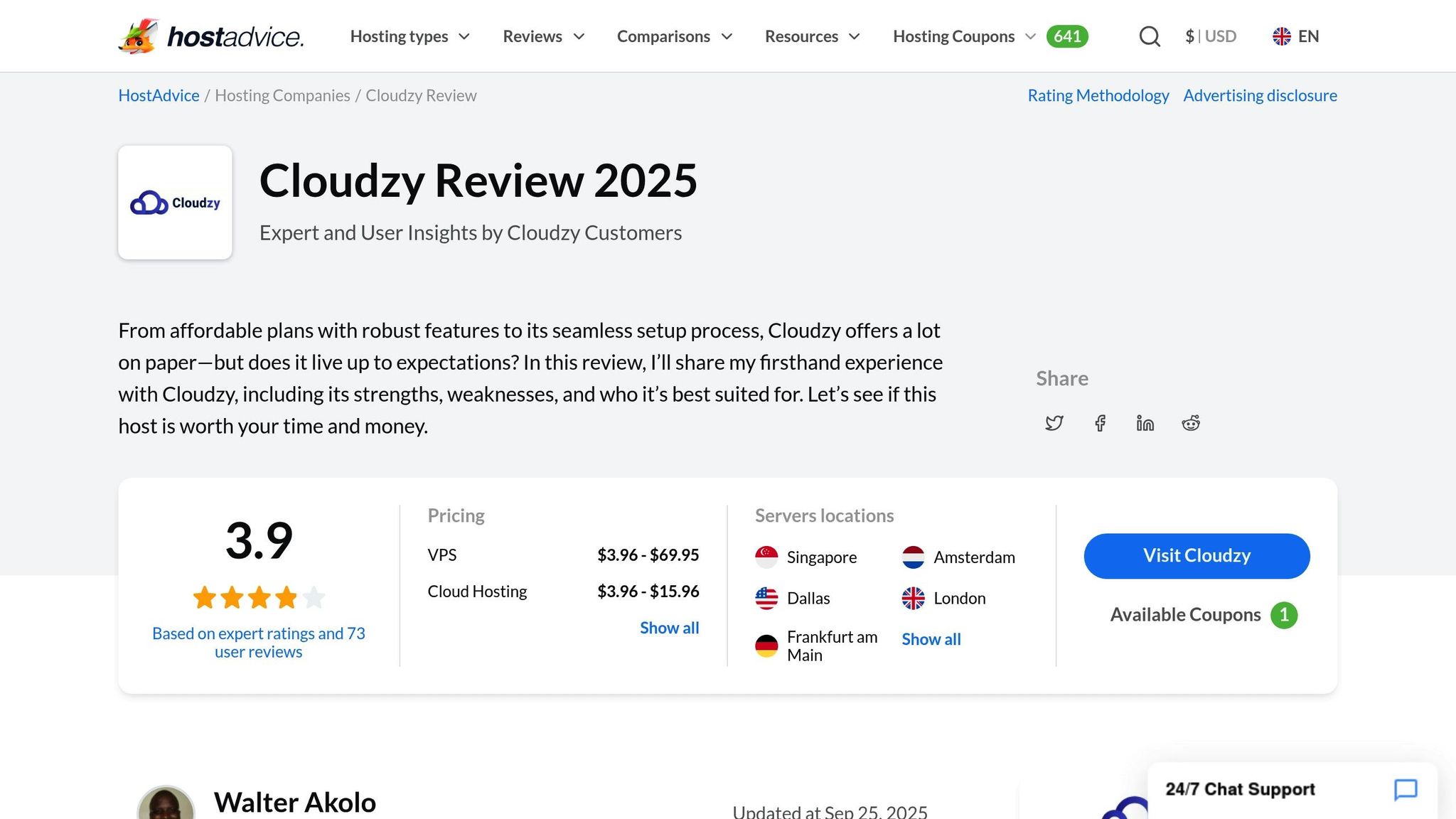

6. Cloudzy

Cloudzy stands out as a budget-friendly VPS provider tailored for retail traders and beginners. With plans starting at just $7.95 per month, it’s one of the most economical Windows-based VPS options for futures trading.

Latency to Exchanges

When it comes to latency, Cloudzy delivers 2–4 ms to CME in Chicago and approximately 3 ms to New York exchanges. These speeds are sufficient for day traders and swing traders, but they might not meet the demands of high-frequency trading strategies. For most retail trading setups, this performance is adequate.

Hardware Performance

Cloudzy’s VPS plans rely on shared Ryzen or Intel CPUs paired with DDR4 RAM. While this hardware is suitable for running a moderate number of charts or Expert Advisors (EAs), it may encounter limitations during peak usage or when handling resource-heavy tasks like backtesting large datasets or processing high-frequency tick data.

Uptime and Reliability

With an uptime of roughly 99%, Cloudzy allows for reliable trading most of the time. However, this translates to potential downtime of up to 7.2 hours per month, which could pose challenges during critical trading periods. While this level of availability works for many retail traders, it falls short of the uninterrupted connectivity required for 24/7 market monitoring.

Pricing and Value

At just $7.95 per month, Cloudzy provides an affordable entry point for traders looking to test automated strategies without a significant financial commitment. However, the lower price comes with compromises, such as shared hardware and fewer advanced optimizations, making it less ideal for traders with more demanding needs or those seeking higher performance.

Platform Compatibility

Cloudzy supports popular trading platforms like NinjaTrader, TradeStation, and MetaTrader. Its Windows-based VPS environment is well-suited for standard retail trading workflows, including automated strategies and charting tools. That said, professional traders requiring advanced optimizations or dedicated support may find it lacking.

Note: For traders prioritizing ultra-low latency and dedicated computing power, QuantVPS offers a high-performance alternative. With sub-1ms latency to CME, dedicated Ryzen 7950X/9950X processors running at 5.4 GHz with DDR5 memory, a 100% uptime SLA, and 24/7 expert support for platforms like NinjaTrader, TradeStation, Rithmic, and CQG, it’s designed to meet the needs of demanding trading environments.

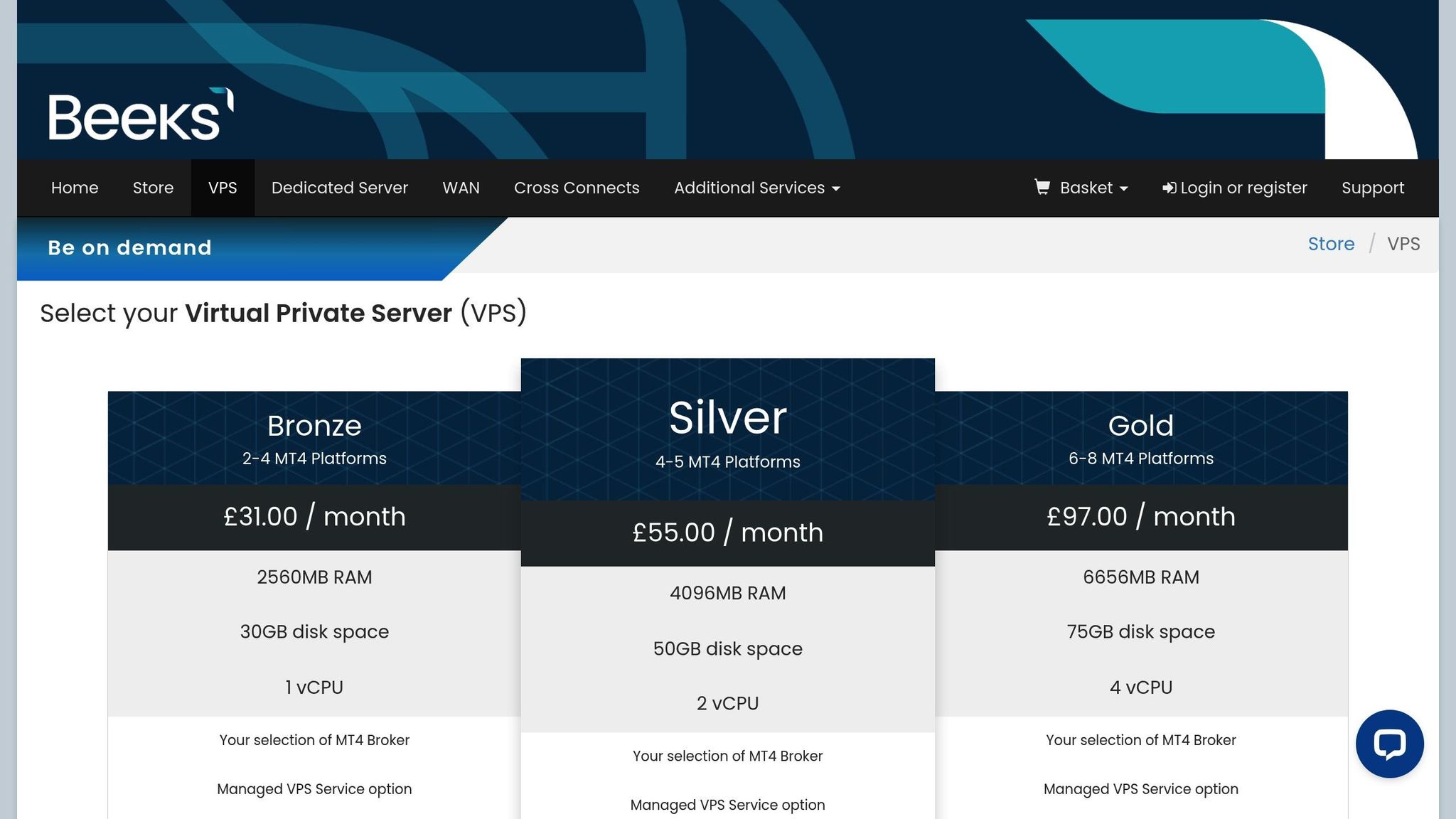

7. BeeksFX

BeeksFX provides a VPS hosting service tailored for hedge funds, proprietary trading firms, and regulated financial institutions. Their servers are hosted in Equinix CH1 Chicago, offering a top-tier infrastructure that emphasizes compliance, security, and ultra-low latency connections to key U.S. exchanges.

Latency to Exchanges

From its Equinix CH1 location, BeeksFX delivers 0.8ms latency to CME and ensures 1–2 milliseconds connectivity to CME, NYSE, and NASDAQ exchanges. This strategic setup in premium data centers ensures dependable performance, even during regional network disruptions, thanks to geographic redundancy.

Hardware Performance

BeeksFX operates on bare-metal servers, bypassing virtualization to provide consistent processing power. Their standard configurations include 4 dedicated CPU cores, 8GB RAM, and NVMe storage, making them well-suited for demanding algorithmic trading strategies. The infrastructure is built for reliability, using server-grade components that support continuous, 24/7 operations.

Uptime and Reliability

BeeksFX guarantees 99.9% uptime, equating to less than 8.76 hours of downtime annually. With robust DDoS protection, redundant power systems, network connections, and cooling systems, they ensure uninterrupted service and secure trading environments.

Pricing and Value

The pricing for BeeksFX’s institutional-grade VPS starts at approximately $150 per month for a Chicago-based setup with 4 dedicated cores and 8GB RAM. This pricing model is designed for high-volume trading operations, reflecting the service’s focus on institutional clients.

Platform Compatibility

BeeksFX supports widely-used trading platforms like NinjaTrader and MetaTrader. Their Windows-based environments allow for seamless operation of multiple platforms simultaneously. Additionally, they offer business-hours support to assist with compliance, audit trails, and other technical needs critical to regulated trading environments.

While BeeksFX is a powerful option for institutional clients, retail traders may find its offerings more than they need. For those seeking a balance of ultra-low latency, cutting-edge hardware, and 24/7 expert support, QuantVPS is an excellent alternative. It delivers ultra-low latency (0–1 ms) and robust reliability, making it a strong choice for both retail and professional futures traders.

8. AWS

Amazon Web Services (AWS) is a powerful cloud computing platform widely used by institutions to build algorithmic and high-frequency trading systems. While AWS offers unmatched scalability and a global presence, retail traders might find the setup and optimization process more complex compared to platforms tailored specifically for trading needs.

Latency to Exchanges

AWS provides connections to major exchanges with latencies typically ranging from 1–3ms in the US East (N. Virginia) region. However, accessing the CME Group from the AWS US Midwest (Ohio) region usually results in higher latencies, around 5–10ms – a noticeable difference compared to dedicated trading setups.

Latency performance depends heavily on the AWS region and instance type selected. Features like enhanced networking and dedicated tenancy can boost performance, but AWS’s default configurations are generally better suited for tasks like strategy development, backtesting, and data analysis rather than ultra-low latency live trading. This variability in latency highlights the importance of carefully evaluating both hardware and regional configurations.

Hardware Performance

AWS offers a wide range of hardware options, from basic virtual CPUs to high-performance instances with dedicated cores, NVMe SSDs, and ample memory. Below are some popular configurations for futures trading:

| Instance Type | vCPU | RAM | Monthly Cost (Windows Instance) | Typical Use |

|---|---|---|---|---|

| t3.medium | 2 | 4GB | ~$40 | Basic trading and swing trades |

| c7g.xlarge | 4 | 16GB | ~$126 | Algorithmic trading and backtesting |

| m6i.2xlarge | 8 | 32GB | ~$350 | High-frequency, institutional trading |

This level of customization allows traders to adjust resources according to their specific trading needs, whether they’re running simple strategies or handling more demanding workloads.

Uptime and Reliability

AWS is known for its reliability, offering a 99.99% uptime SLA for most EC2 services across its regions. The platform includes features like failover redundancy, robust security measures (firewalls and DDoS protection), and automated scaling with disaster recovery capabilities. These attributes make AWS a dependable choice for mission-critical trading operations.

Pricing and Value

AWS employs a flexible pricing model, charging on a pay-as-you-go basis. Traders can also choose reserved or spot instances to manage costs. For example, a c7g.xlarge Windows instance costs approximately $0.176 per hour, translating to about $126 per month for continuous operation. However, additional costs for storage, bandwidth, and support services can significantly impact the total expense of maintaining a high-performance trading setup.

Platform Compatibility

AWS supports a variety of operating systems, including Windows, Linux, and custom OS images. It integrates seamlessly with major trading platforms like NinjaTrader, MetaTrader, TradeStation, and Quantower. Its global infrastructure enables traders to deploy servers close to major exchanges, though achieving optimal performance requires careful regional selection and precise configuration.

Note: While AWS offers scalability and global reach, traders focused on ultra-low latency may prefer solutions like QuantVPS, which boasts sub-1ms CME connectivity, advanced Ryzen processors with DDR5 memory, and dedicated support for futures trading setups.

9. DigitalOcean

DigitalOcean offers a budget-friendly VPS option for traders, though its general-purpose infrastructure may not meet the demands of ultra-low latency trading.

Latency to Exchanges

DigitalOcean’s data centers are not strategically positioned near major financial hubs, leading to latency of around 10ms for CME and 2–3ms for NYSE/NASDAQ exchanges. This level of latency introduces delays that can hinder high-frequency trading strategies. As a result, DigitalOcean is better suited for swing trading, where millisecond-level execution isn’t as critical.

Hardware Performance

The VPS plans from DigitalOcean feature modern Intel CPUs (up to 4.0GHz) and NVMe SSD storage, which work well for general computing tasks. Most plans include DDR4 memory and shared CPU resources, but these aren’t optimized for trading-specific needs. For demanding algorithmic strategies, the shared resources and lack of specialized configurations – like high-frequency CPUs or dedicated memory channels – may lead to inconsistent performance.

On the plus side, DigitalOcean allows resource scaling, so you can adjust CPU, RAM, and storage to fit your requirements. However, compared to providers focused on trading, the hardware lacks the fine-tuned performance features necessary for high-frequency environments.

Uptime and Reliability

DigitalOcean boasts a 99.99% uptime SLA, which translates to roughly 52 minutes of downtime per year. This reliability is supported by standard cloud infrastructure features such as redundant power, network connections, and DDoS protection. However, these are general-purpose systems and lack the specialized redundancies that trading-focused platforms often provide.

Pricing and Value

One of DigitalOcean’s standout features is its affordability, with pricing starting at just $4 per month for basic droplets. This entry-level plan includes 1 vCPU, 1GB of RAM, and 25GB of SSD storage. For traders needing more resources, higher-tier plans remain competitively priced compared to trading-centric VPS providers.

The pricing model is straightforward and transparent, eliminating the worry of hidden fees or complex billing structures. This makes it appealing for traders who value predictable costs.

Platform Compatibility

DigitalOcean supports both Windows and Linux environments, enabling traders to run popular platforms like NinjaTrader, TradeStation, Quantower, and MetaTrader. With full root access, users have complete control over setup and optimization, though they must handle these tasks independently, as the platform doesn’t offer trading-specific support.

While DigitalOcean works well for backtesting, strategy development, and swing trading, it falls short for high-frequency or scalping strategies that demand ultra-low latency. Its general-purpose infrastructure and higher latency make it less suitable for time-sensitive trading activities.

10. Cloudways

Cloudways is a managed hosting platform that allows users to deploy VPS instances using top-tier cloud providers like AWS, Google Cloud, DigitalOcean, Vultr, and Linode. While it offers flexibility and scalability, its infrastructure is designed for general hosting needs rather than the ultra-low latency required for futures trading.

Here’s how Cloudways performs in areas critical to futures trading:

Latency to Exchanges

The latency you’ll experience with Cloudways depends on the cloud provider and data center you choose. For CME Group exchanges, typical latency ranges from 2–10 ms. If you opt for New York-based data centers (commonly used for NYSE/NASDAQ connections), latency is generally around 3–5 ms. However, Cloudways cannot achieve the sub-1 ms latency essential for high-frequency trading.

Hardware Performance

Cloudways’ hardware capabilities vary based on the provider. DigitalOcean and Vultr, for instance, often feature Intel CPUs with speeds up to 4.0 GHz and NVMe SSD storage. The platform stands out for its one-click deployment and easy scaling options, letting you adjust CPU, RAM, and storage as your trading needs grow. However, the hardware isn’t specifically optimized for the ultra-low latency and precision that futures trading demands.

Uptime and Reliability

Cloudways advertises a 99.99% uptime for most plans. It bolsters reliability with features like automated server monitoring, managed firewalls, and regular backups. Additionally, its 24/7 support team handles server administration tasks. While these features ensure consistent performance, they might not meet the stringent uptime requirements traders rely on during critical market hours.

Pricing and Value

Cloudways adopts a layered pricing model that combines the cost of the cloud infrastructure with management fees. Pricing starts at approximately $14/month for entry-level setups and can reach $150/month for higher-performance configurations, depending on the provider and location. Hourly billing options are available, offering flexibility for traders who need to scale resources quickly during volatile market periods.

Platform Compatibility

Cloudways supports both Windows and Linux environments, making it compatible with popular trading platforms like NinjaTrader, TradeStation, MetaTrader, and Quantower. Its user-friendly dashboard and simplified setup process are ideal for traders who prefer not to manage technical details. However, since Cloudways focuses on general server management, you’ll need to handle the installation and configuration of your trading software yourself.

Why QuantVPS Is Better for Futures Trading

Unlike Cloudways’ general-purpose hosting, QuantVPS is designed specifically for futures trading. It offers sub-millisecond latency, high-performance Ryzen 7950X processors, and DDR5 memory to ensure optimal execution speeds. Additionally, QuantVPS provides dedicated support tailored to the unique needs of futures traders, ensuring minimal delays and maximum reliability for every trade.

11. Hostinger

Hostinger brings a cost-effective VPS hosting solution to the table for retail traders in the futures market. While it’s not tailored specifically for futures trading, its AMD EPYC processors and NVMe storage offer reliable performance for most automated trading strategies. This makes it an appealing option for those who don’t require ultra-low latency or premium hardware.

Its primary audience includes beginners and budget-conscious traders who need dependable hosting without the higher price tag associated with specialized trading-focused providers. Hostinger is better suited for retail trading rather than high-frequency or professional algorithmic execution.

Latency to Exchanges

Hostinger’s latency performance is in the 5–10 ms range for Chicago and 3–7 ms for New York. While this level of latency won’t meet the demands of professional traders focused on high-frequency strategies, it’s sufficient for retail traders running automated systems that don’t depend on split-second timing.

For connections to key New York-based exchanges like NYSE, NASDAQ, or brokers such as Interactive Brokers, this latency is workable for swing or position trading strategies. However, it clearly underscores Hostinger’s focus on affordability rather than ultra-low latency performance.

Hardware Performance

Hostinger’s VPS hosting relies on AMD EPYC processors paired with NVMe SSD storage, delivering solid multi-core performance for everyday trading needs. While the EPYC architecture handles multiple tasks well, it lacks the single-core speed that platforms like NinjaTrader or TradeStation often require for optimal performance.

The NVMe storage ensures quick data access, which is useful for tasks like loading charts or processing historical data. However, details on CPU clock speeds and DDR5 memory options are not provided, which could influence the overall execution quality for more demanding trading setups.

Uptime and Reliability

Reliability is a critical factor, and Hostinger delivers 99.9% uptime across its VPS plans. While this meets general hosting standards, it doesn’t match the 100% uptime serious futures traders often demand – especially for automated strategies that operate during overnight sessions or volatile market events.

The service includes continuous monitoring and automated backups to ensure continuity. However, its AI-driven support system, while helpful for basic technical issues, may fall short when dealing with platform-specific problems during active trading sessions.

Pricing and Value

Hostinger’s standout feature is its affordability. VPS plans start at around $10–20 per month, making it an accessible option for traders who are just starting out or running simple automated strategies.

This pricing works well for those using tools like MetaTrader for straightforward setups. However, for advanced futures trading, the lower costs might not outweigh the limitations in performance and features compared to providers optimized for trading.

Platform Compatibility

Hostinger supports both Windows and Linux, making it compatible with most major trading platforms. Its user-friendly control panel simplifies the setup process, which is a plus for traders who prefer to avoid complex configurations.

While it works well for retail forex and futures trading, Hostinger lacks pre-configured trading environments or specialized support for fine-tuning platform performance. These features can be critical for achieving better execution quality in more demanding trading scenarios.

| Feature | Hostinger | Specialized Trading VPS |

|---|---|---|

| Latency to CME | 5–10 ms | <1 ms |

| CPU | AMD EPYC | Ryzen 9 series |

| Memory | DDR4 | DDR5 |

| Uptime | 99.9% | 100% |

| Starting Price | ~$15/month | $20–40/month |

| Trading Support | General AI | 24/7 Expert |

Overall, Hostinger is a solid choice for traders exploring VPS hosting, especially those at the entry level. However, its limitations in latency, hardware, and support make it less suitable for advanced or high-frequency trading needs.

12. Contabo

Contabo is a standout option in the VPS hosting world, especially for traders seeking cost-effective solutions with substantial computational power. It caters to those managing resource-heavy tasks such as backtesting, strategy development, and running multiple trading platforms at once. With generous RAM and storage, Contabo appeals to traders who prioritize raw computing resources over ultra-low latency.

Latency to Exchanges

Contabo operates data centers in Germany, St. Louis, Seattle, and the New York Metro area. The latency to CME Group in Chicago typically falls between 15-30ms, while connections to New York exchanges average around 5-15ms, depending on routing.

This latency range isn’t ideal for high-frequency trading or scalping, where every microsecond counts. However, for swing traders and position traders holding contracts over days or weeks, these latency levels are more than adequate. Plus, the cost savings can be substantial for traders with less time-sensitive strategies.

Hardware Performance

Contabo’s VPS plans are powered by AMD EPYC processors, offering configurations like up to 12 Virtual Cores, 60GB RAM, and 1.6TB SSD storage for $28.99 per month.

For those on a tighter budget, the VPS M plan starts at just $6.99 per month, providing 6 Virtual Cores, 16GB RAM, and 400GB SSD storage. The mid-tier VPS L plan offers 10 Virtual Cores, 30GB RAM, and 800GB SSD for $14.99 per month. While these plans deliver impressive specs, it’s worth noting that the resources are shared, with base clock speeds ranging from 2.0–3.0GHz, which could impact performance during heavy usage.

For traders running multiple instances of platforms like NinjaTrader or TradeStation, or conducting extensive backtesting, Contabo’s high RAM allocations offer excellent value. The 60GB RAM configuration, in particular, is priced far below similar offerings from specialized trading VPS providers.

Uptime and Reliability

Contabo boasts an excellent 99.996% uptime, equating to about 21 minutes of downtime annually. However, this downtime could coincide with critical trading events like Federal Reserve announcements or major earnings releases.

One limitation is the lack of formal Service Level Agreements (SLAs) with downtime compensation on standard VPS plans. This positions Contabo as a budget-friendly option rather than a solution for traders requiring mission-critical reliability.

Pricing and Value

Contabo’s annual billing option provides additional savings:

| Plan | Monthly Cost | Annual Cost | Virtual Cores | RAM | Storage |

|---|---|---|---|---|---|

| VPS M | $6.99 | $69.90 | 6 | 16GB | 400GB SSD |

| VPS L | $14.99 | $149.90 | 10 | 30GB | 800GB SSD |

| VPS XL | $28.99 | $289.90 | 12 | 60GB | 1.6TB SSD |

This pricing structure makes Contabo an attractive choice for budget-conscious traders testing automated strategies or developers building custom trading tools.

Platform Compatibility

Contabo supports all major futures trading platforms, including NinjaTrader 8, TradeStation, MultiCharts, Sierra Chart, and Quantower. Windows Server can be added for $4.99 per month, bringing total costs for a Windows-based setup to between $12 and $35 per month, depending on the chosen plan.

That said, Contabo is a general-purpose hosting provider, meaning traders must handle platform installations, optimizations, and configurations themselves. This includes setting up Windows Server, installing trading software, configuring data feeds, and troubleshooting broker connections with providers like Rithmic, CQG, or Interactive Brokers.

Customer support is focused on general server administration rather than trading-specific needs, making Contabo a better fit for experienced traders comfortable managing their own servers. Its competitive pricing and resource-heavy plans are ideal for strategies that don’t demand ultra-low latency.

13. Ultahost

Ultahost is a VPS provider designed to deliver fast and optimized performance, particularly for MetaTrader platforms. It promotes itself as offering significantly faster speeds for MT4 and MT5 trading compared to standard VPS options, making it appealing for forex and multi-asset strategies. That said, when it comes to futures trading, Ultahost has both strengths and limitations. Let’s break down its performance across some critical trading metrics.

Latency to Exchanges

While Ultahost emphasizes low latency, it doesn’t provide specific metrics for connections to major futures exchanges like CME Group or NYSE. For traders relying on ultra-high-frequency strategies, the lack of precise latency data can make it harder to assess whether the service meets their needs for fast and accurate order execution.

Hardware Performance

Ultahost uses AMD EPYC processors and NVMe storage, which are known for their speed and efficiency. NVMe storage, in particular, helps with faster data access, making it useful for handling high-frequency tick data and backtesting. However, without detailed CPU specifications, it’s difficult to gauge the single-thread performance, which is often critical for certain trading applications.

Uptime and Reliability

Ultahost advertises a 99.9% uptime guarantee. While this meets general industry standards, some traders – especially those running automated futures strategies – may require even greater reliability during volatile market conditions. The lack of historical uptime data or third-party verification could be a drawback for those seeking documented evidence of consistent performance.

Pricing and Value

Pricing details for Ultahost are not readily available, which complicates the process of evaluating its value. For futures traders, who often require dedicated resources, robust backup solutions, or specialized customer support, this lack of transparency might pose a challenge in conducting a thorough cost–benefit analysis.

Platform Compatibility

Ultahost’s primary focus is on MetaTrader 4 and 5, but it doesn’t provide clear information about compatibility with futures-specific platforms like NinjaTrader, TradeStation, Quantower, or Sierra Chart. For traders who rely on these tools for advanced charting and order execution, this uncertainty could be a significant limitation.

Note on Futures Trading Performance

To sum up, while Ultahost offers certain advantages like NVMe storage and a focus on MetaTrader platforms, it may not be the best fit for professionals in futures trading. For traders seeking ultra-low latency and advanced hardware tailored to futures markets, QuantVPS stands out as a stronger alternative. QuantVPS provides sub-millisecond connectivity to major U.S. exchanges, a 100% uptime guarantee, and cutting-edge hardware featuring next-generation Ryzen processors and DDR5 memory. These features, combined with specialized trading support, make it a more reliable option for those focused on professional futures trading.

14. VPSForexTrader

VPSForexTrader is a VPS provider tailored for traders, offering robust hardware to support various trading applications across multiple platforms.

Latency to Exchanges

This service delivers sub-millisecond latency to major exchanges, with connectivity under 1 ms. Such speed is ideal for high-frequency trading strategies where every millisecond counts.

Hardware Performance

VPSForexTrader relies on AMD EPYC processors and ECC (Error-Correcting Code) RAM, ensuring data integrity and smooth performance. This setup allows traders to run multiple MetaTrader instances or perform complex backtesting routines without a hitch. The multi-core architecture is particularly useful for managing diverse trading strategies simultaneously, making it a reliable choice for active traders with varied portfolios.

Uptime and Reliability

With a 99.9% uptime guarantee, VPSForexTrader ensures your trading operations remain uninterrupted, minimizing the risk of downtime during critical market movements.

Pricing and Value

The service is priced at $215.92 annually (equivalent to $18 per month). While this places it in the mid-range, the annual billing model might feel restrictive for traders looking for more flexible, short-term payment options or those wanting to test the service before committing long-term.

Platform Compatibility

VPSForexTrader supports running multiple MetaTrader instances, making it a solid choice for traders juggling several strategies. However, it lacks pre-configured setups for other trading platforms, particularly those focused on futures trading. This means users may need to handle the installation and optimization of such platforms themselves. On the bright side, the service offers 24/7 expert support for technical assistance and configuration, which can help ease the process.

15. NYC Servers

NYC Servers focuses on delivering ultra-low latency VPS hosting tailored for New York-based traders. Built on Equinix data center infrastructure, it provides the speed and reliability needed for algorithmic and high-frequency trading strategies.

Latency to Exchanges

NYC Servers offers 1 millisecond latency to New York exchanges, thanks to its Equinix data center location. This near-instant connection is vital for traders operating in markets like the NYSE and NASDAQ, where even a millisecond can influence order execution. While futures traders may experience slightly higher latency when trading between New York and Chicago compared to Chicago-based setups, the 1ms performance in New York still delivers a competitive advantage for multi-asset strategies. This level of connectivity ensures the precision required for complex trading approaches.

Hardware Performance

To match its high-speed connectivity, NYC Servers uses custom hardware optimized for trading. Designed for high-frequency processing and equipped with fast storage, the system ensures quick data handling and access to market information – key features for running automated trading systems effectively.

Uptime and Reliability

NYC Servers promises a 100% uptime SLA for its trading VPS plans. With redundant network paths and failover systems in place, the service is built to maintain availability, even during periods of market volatility, minimizing disruptions when they matter most.

Pricing and Value

Plans start at $35 per month for 2GB RAM. While the pricing reflects the premium features of an Equinix location and ultra-low latency, the potential benefits – like better fill rates and reduced slippage – can make it a worthwhile investment for traders relying on precise order execution in New York markets.

Platform Compatibility

The service supports Windows-based environments compatible with popular trading platforms like NinjaTrader, TradeStation, Quantower, and MetaTrader. This makes it easy to set up and operate professional or retail trading applications. However, while the platform is scalable, its support is generally limited to infrastructure issues rather than specific trading platform troubleshooting.

NYC Servers is a strong choice for traders using automated bots or latency-sensitive strategies, offering a combination of fast connectivity, robust hardware, and dependable performance.

16. ScalaHosting

ScalaHosting is a managed VPS provider focused on offering secure, scalable, and user-friendly solutions. Its services cater to various applications, including popular trading platforms such as MetaTrader 4 and 5. However, it falls short when it comes to the ultra-low latency connectivity essential for high-frequency futures trading.

Latency to Exchanges

ScalaHosting does not prioritize ultra-low latency connections to major futures exchanges and does not provide latency benchmarks for these key trading locations. Without infrastructure designed for proximity to exchanges, traders may experience inconsistent performance, which can be a disadvantage for time-sensitive strategies.

Hardware Performance

ScalaHosting offers VPS solutions equipped with modern multi-core CPUs and SSD storage. However, it does not specify the use of high-frequency processors or DDR5 memory. While this setup is sufficient for general trading platform requirements, it may not meet the demands of advanced algorithmic trading, where ultra-fast order execution is critical.

Uptime and Reliability

Although ScalaHosting promotes high availability, it does not disclose a specific uptime Service Level Agreement (SLA) tailored for trading applications. This lack of explicit guarantees means that even brief outages during crucial trading windows could result in missed opportunities or financial losses.

Pricing and Value

Managed VPS plans from ScalaHosting start at around $79 per month. While the pricing reflects its general-purpose offerings, these plans do not include the specialized low-latency connectivity or high-frequency hardware that professional futures traders often require.

Platform Compatibility

ScalaHosting supports widely used trading platforms like MetaTrader 4 and 5, with compatibility for both Windows and Linux. However, it does not offer pre-installed trading environments or specific optimizations for futures trading platforms such as NinjaTrader, TradeStation, or Quantower. This limits its appeal for traders seeking out-of-the-box solutions tailored to futures trading.

Why QuantVPS Stands Out

QuantVPS sets itself apart by addressing the critical needs of professional traders. With sub-millisecond latency achieved through strategically located data centers, high-performance Ryzen processors paired with DDR5 memory, and a 100% uptime guarantee, QuantVPS is designed to meet the demands of algorithmic and high-frequency futures trading.

17. AccuWeb Hosting

AccuWeb Hosting provides Windows-based VPS hosting with built-in firewall protection across 13 global locations. While the service is reliable and incorporates security-focused features, its infrastructure is more suited for general use rather than the demanding requirements of high-frequency futures trading.

Latency to Exchanges

With 13 global locations, AccuWeb Hosting offers decent coverage but does not prioritize ultra-low latency connections to major futures exchanges like CME or NYSE. For professional traders relying on high-frequency strategies, where latency under 1 millisecond is critical, this general-purpose setup could result in slower order execution and increased slippage during highly volatile market conditions.

Hardware Performance

AccuWeb Hosting’s VPS plans are built on Windows-based servers but lack details about high-performance hardware, such as AMD Ryzen or EPYC processors and DDR5 memory. These components are crucial for handling large volumes of tick data and executing complex algorithmic trades swiftly. While the hardware is adequate for basic trading tasks, it may fall short for traders running advanced algorithms or engaging in high-frequency trading.

Uptime and Reliability

The platform does not advertise a specific uptime guarantee or service-level agreement (SLA) tailored for trading. This absence of a dedicated uptime commitment poses a risk for automated trading systems that depend on uninterrupted connectivity. Even brief outages during critical trading sessions could lead to missed opportunities or losses.

Pricing and Value

AccuWeb Hosting’s Windows VPS plans start at around $30 per month. While this pricing is competitive for general hosting needs, it does not include the specialized features required for high-frequency futures trading. Traders seeking precision and speed may find this offering insufficient for their needs.

Platform Compatibility

The Windows environment supports trading platforms like NinjaTrader and TradeStation. However, AccuWeb Hosting does not include pre-installed trading software or offer platform-specific support. This means traders must handle software installations and optimizations on their own.

Why QuantVPS Stands Out

QuantVPS, on the other hand, is specifically designed to meet the needs of professional futures traders. It offers sub-millisecond latency to CME, state-of-the-art hardware, and a 100% uptime guarantee, ensuring the reliability and speed that high-frequency and algorithmic trading demand. Additionally, QuantVPS provides 24/7 expert support from professionals who understand the unique challenges of futures trading, making it a superior choice for traders who prioritize performance and precision.

18. NextPointHost

NextPointHost is a VPS provider geared toward traders, offering fixed-resource plans for straightforward hosting. With data centers located in New York, London, and Singapore, it caters to those who prefer predictable, no-frills solutions over the complexity of customizable cloud services. Here’s a closer look at what NextPointHost brings to the table.

Latency to Exchanges

Positioned near major financial hubs, NextPointHost provides reasonable connectivity to exchanges. While specific latency figures aren’t disclosed, its New York data center suggests a latency range of 2–5ms for NYSE brokers. This level of performance is sufficient for retail and swing trading strategies but falls short of the sub-1ms latency needed for high-frequency trading.

Hardware Performance

NextPointHost offers fixed hardware setups, typically including 3GB of RAM and 40GB of SSD storage in its standard plans. While the exact CPU specifications aren’t highlighted, these resources are adequate for basic trading and moderately complex algorithmic strategies. However, the fixed nature of the resources could limit traders running multiple or resource-intensive strategies.

Uptime and Reliability

The provider advertises an uptime of around 99.9%, though it doesn’t offer detailed guarantees. User reviews generally confirm this figure, which is suitable for most trading needs. However, for traders relying on 24/7 algorithmic strategies, the lack of a clear uptime guarantee might pose a risk during critical trading sessions.

Pricing and Value

Unlike cloud-based solutions with usage-based pricing, NextPointHost sticks to fixed monthly rates for its standard 3GB/40GB plan. This approach appeals to traders looking for predictable costs without the variability that comes with scalable options.

Platform Compatibility

NextPointHost supports popular trading platforms like MetaTrader 4/5, NinjaTrader, and TradeStation. Its Windows-based environment is compatible with most retail trading software. However, it doesn’t offer pre-installed configurations or specialized support for advanced platforms like Quantower or Rithmic, leaving traders to handle software installation themselves.

In summary, NextPointHost is a solid choice for traders who want a dependable, fixed-cost VPS solution in major financial hubs. That said, it’s not ideal for those requiring ultra-low latency or scalable hardware for high-frequency trading.

Note: For traders prioritizing top-tier performance, QuantVPS offers ultra-low latency (0–1ms), cutting-edge Ryzen CPUs with DDR5 memory, and expert 24/7 support, making it a superior alternative.

19. Forex Cheap VPS

Forex Cheap VPS offers an affordable hosting solution aimed at traders who value low costs over premium performance. Starting at just $5.99 per month, it provides a budget-friendly option, while Aurora-area hosting is priced at $39 monthly, catering to those willing to accept some performance compromises.

Latency to Exchanges

When it comes to connectivity, servers located near the CME Group in Aurora, Illinois, provide latency of 3–6 ms. While this is adequate for swing or position trading, it falls short for high-frequency trading due to shared infrastructure and potential peak-time congestion.

Hardware Performance

The standard plans include 2 shared CPU cores, 8GB of RAM, and SSD storage. However, because resources are shared, performance may vary, especially during periods of high trading activity or when running multiple platforms simultaneously.

Uptime and Reliability

Forex Cheap VPS does not publish a specific uptime guarantee. User feedback indicates occasional downtime during critical trading hours, which could pose challenges for those relying on automated trading systems.

Pricing and Value

With a price tag of $39 per month for Aurora-area hosting, this VPS is best suited for traders testing strategies, operating lightweight setups, or engaging in swing trading where moderate latency is acceptable.

Platform Compatibility

The service supports MetaTrader 4/5 and NinjaTrader within a Windows-based environment. However, it does not come with pre-installed configurations or specialized support, leaving users responsible for setup and optimization.

Note: For traders seeking professional-grade performance, QuantVPS offers features like sub-1ms CME latency, advanced Ryzen processors with DDR5 memory, and 24/7 expert support – ideal for futures trading at a higher level.

20. Exness

Exness offers a free VPS service to qualifying clients, providing a convenient way to run automated trading strategies without incurring additional hosting costs. This broker-integrated solution is tailored primarily for forex and algorithmic trading, though it may also support futures trading if the platform is compatible. Below, we’ll explore its pricing, compatibility, and performance attributes in more detail.

Pricing and Value

Exness provides its VPS service at no charge for clients who meet specific eligibility requirements, which are typically tied to maintaining a minimum account balance or reaching certain trading volume thresholds. However, this VPS is exclusively linked to Exness trading accounts and cannot be used independently or with other brokers or unsupported platforms. For traders already engaged with Exness, this can be a cost-effective choice, but it’s essential to verify the qualification criteria before relying on the service.

Platform Compatibility

The Exness VPS supports 24/7 automated trading strategies and Expert Advisors (EAs). However, it operates solely within the Exness ecosystem, meaning traders should confirm whether their preferred trading platforms are supported. For U.S. futures traders using platforms like NinjaTrader, TradeStation, or Quantower, compatibility may be limited, as Exness primarily focuses on forex and CFD trading rather than direct access to futures markets.

Uptime and Reliability

Hosted in secure, professional-grade data centers, the Exness VPS ensures consistent and uninterrupted access to trading platforms. This setup helps mitigate risks like power outages or internet disruptions that could interfere with automated trading strategies. While the service aims to maintain high uptime standards, Exness does not publicly share specific Service Level Agreement (SLA) details or guaranteed uptime percentages. Traders with critical performance needs, especially those seeking ultra-low latency, should weigh these factors carefully.

Latency to Exchanges

Exness does not provide detailed latency metrics for connections to major U.S. futures exchanges. This lack of transparency may make it less appealing for traders engaged in high-frequency futures trading, where latency is a crucial factor.

Advantages and Disadvantages

When it comes to futures trading, choosing the right VPS (Virtual Private Server) involves assessing key factors like performance, hardware, uptime, and support.

Performance and Hardware

For futures trading, proximity to exchanges is a game-changer. QuantVPS, located in Chicago, ensures ultra-low latency, allowing for faster order execution. This can reduce slippage by nearly one tick during volatile market conditions. But what powers this performance?

QuantVPS relies on AMD Ryzen 9 7950X/9950X processors combined with DDR5 memory. This high-performance setup is built to handle complex trading algorithms and enables traders to run multiple strategies simultaneously with impressive processing speeds.

Reliability and Support

Speed and power mean little without reliability. QuantVPS guarantees uninterrupted operation with a 100% uptime service level agreement, supported by robust infrastructure. On top of that, they provide 24/7 expert assistance tailored for futures trading. This specialized support helps traders fine-tune their setups and resolve problems quickly, ensuring smooth operations.

| Category | Advantages | Disadvantages |

|---|---|---|

| Premium Trading‑Focused | Ultra‑low latency, advanced hardware, 24/7 expert support, 100% uptime | Higher pricing designed for specialized trading needs |

| Budget Options | Affordable with basic functionality | Higher latency, shared resources, and limited support |

| Enterprise Solutions | Top-tier security, compliance, and scalability | Premium costs and potentially complex configurations |

| General Cloud Solutions | Flexible setups and global reach | Often lack optimizations for high-frequency trading |

Cost vs. Value

QuantVPS pricing starts at $59.99 per month, offering significant benefits in speed and reliability. While there are cheaper VPS options, they often come with trade-offs like reduced performance or limited support, which can negatively impact trading efficiency.

Platform Compatibility

QuantVPS is designed to integrate seamlessly with popular trading platforms like NinjaTrader, TradeStation, and Quantower. This compatibility minimizes setup time and ensures consistent performance, making it easier for traders to focus on their strategies rather than technical configurations.

Final Recommendations

After a detailed review of critical performance factors, QuantVPS emerges as a top-tier solution for futures trading. Its sub‑1ms latency to CME, AMD Ryzen 7950X/9950X processors with DDR5 memory, and a 100% uptime SLA provide a solid foundation for professional traders aiming to stay ahead.

For High‑Frequency and Algorithmic Traders

For traders relying on ultra‑low latency execution, QuantVPS is the go-to option. Its Chicago-based data center ensures a lightning-fast 0.52ms latency to major broker servers, while specialized futures trading plans start at just $59.99 per month. This performance advantage can make all the difference in fast-moving markets. Powered by Ryzen 9 processors clocked at 5.4GHz and DDR5 memory, the platform ensures automated strategies run seamlessly, even during high-volume trading periods. Many users have reported reduced slippage, faster order fills, and noticeable improvements in strategy execution.

For Budget‑Conscious Traders

Even for traders working within tighter budgets, QuantVPS offers a balance of cost and performance that’s hard to beat. The improved execution quality and minimized slippage more than justify the monthly subscription, making it a smart investment for those who want premium performance without overspending.

For Institutional and Enterprise Traders

For large-scale operations, QuantVPS provides the scalability and enterprise-level compliance needed to handle complex demands. With its robust infrastructure and dedicated support, it’s well-suited for institutional traders requiring customized configurations and high reliability.

Platform‑Specific Recommendations

If you’re using platforms like NinjaTrader or TradeStation, QuantVPS’s specialized support team is a standout feature. Their expertise ensures your configurations are optimized for peak performance, a crucial advantage during volatile trading periods. This level of support extends to all major trading platforms, so no matter your software preference, QuantVPS has you covered.

Geographic Considerations

For U.S.-based traders, selecting the Chicago or New York data centers is key to achieving the fastest possible exchange connectivity. The Chicago location, in particular, offers the shortest path to CME matching engines. Additionally, U.S. dollar pricing and support during American trading hours make the service even more convenient for domestic traders.

When it comes down to it, QuantVPS delivers the speed, reliability, and expertise that serious futures traders need to maintain a competitive edge. Its ultra‑low latency, advanced hardware, and focus on futures trading make it a powerful ally in today’s demanding markets.

FAQs

How does using a VPS enhance speed and reliability in futures trading?

A Virtual Private Server (VPS) can take your futures trading to the next level by offering faster and more reliable performance. With ultra-low latency connections and uninterrupted uptime, a VPS ensures your trades execute with precision. Hosting your trading platform on a VPS near major exchange servers – like CME in Chicago – means your orders reach the market faster, a crucial advantage in environments where milliseconds can make or break a trade.

Beyond speed, a VPS provides consistent connectivity, shielding you from issues like home internet outages or power failures. This reliability is invaluable, especially for automated trading strategies that run around the clock. Equipped with top-tier hardware, including advanced CPUs and DDR5 memory, a VPS can easily handle the intense demands of high-frequency trading and data-heavy backtesting, far outperforming the capabilities of a standard home setup.

What should I look for when selecting a VPS provider for trading futures?

When selecting a VPS provider for futures trading, it’s essential to prioritize low latency, reliable uptime, and proximity to major exchanges like CME in Chicago or NYSE/NASDAQ in New York. These elements play a crucial role in ensuring fast order execution and minimizing slippage. Look for providers offering high-performance hardware, such as modern CPUs like Ryzen or Xeon and DDR5 memory, along with strong security measures to safeguard your trading setup.

If you rely on automated or algorithmic strategies, choose a VPS that guarantees 24/7 uptime, stable connectivity, and compatibility with trading platforms like NinjaTrader, TradeStation, or Quantower. Having access to expert technical support is equally important to address any issues quickly, especially during peak trading hours.

What hardware configurations are ideal for high-frequency trading on a VPS?

For high-frequency trading (HFT), the performance of your hardware directly affects how fast you can execute trades – and, ultimately, your profitability. To stay competitive, the following configurations are ideal:

- High clock-speed CPUs: Processors like the AMD Ryzen 7950X or 9950X, with clock speeds of 5.4GHz or more, are perfect for managing the intense calculations HFT demands.

- Low-latency memory: Opt for DDR5 RAM, as it provides faster data access compared to DDR4, ensuring smooth operations even in volatile markets.

- NVMe storage: Ultra-fast read/write speeds are critical for processing tick data and running backtests efficiently, and NVMe drives deliver just that.

On top of hardware, the physical location of your VPS matters. Hosting it near exchange matching engines – like in Chicago for CME – can cut down latency significantly, giving you a noticeable edge in the fast-paced world of HFT.