TradeDevil Indicators are tools designed for traders using platforms like NinjaTrader 8, Quantower, and Sierra Chart. They combine technical analysis with institutional trading concepts to help identify trading opportunities. Key features include tools for order flow analysis, market sentiment tracking, and strategy testing. Popular indicators, such as the Bar Replay Indicator and Devil’s Edge Indicator, focus on refining trading strategies and spotting patterns like Break of Structure (BOS) and Change of Character (ChoCh).

Key Insights:

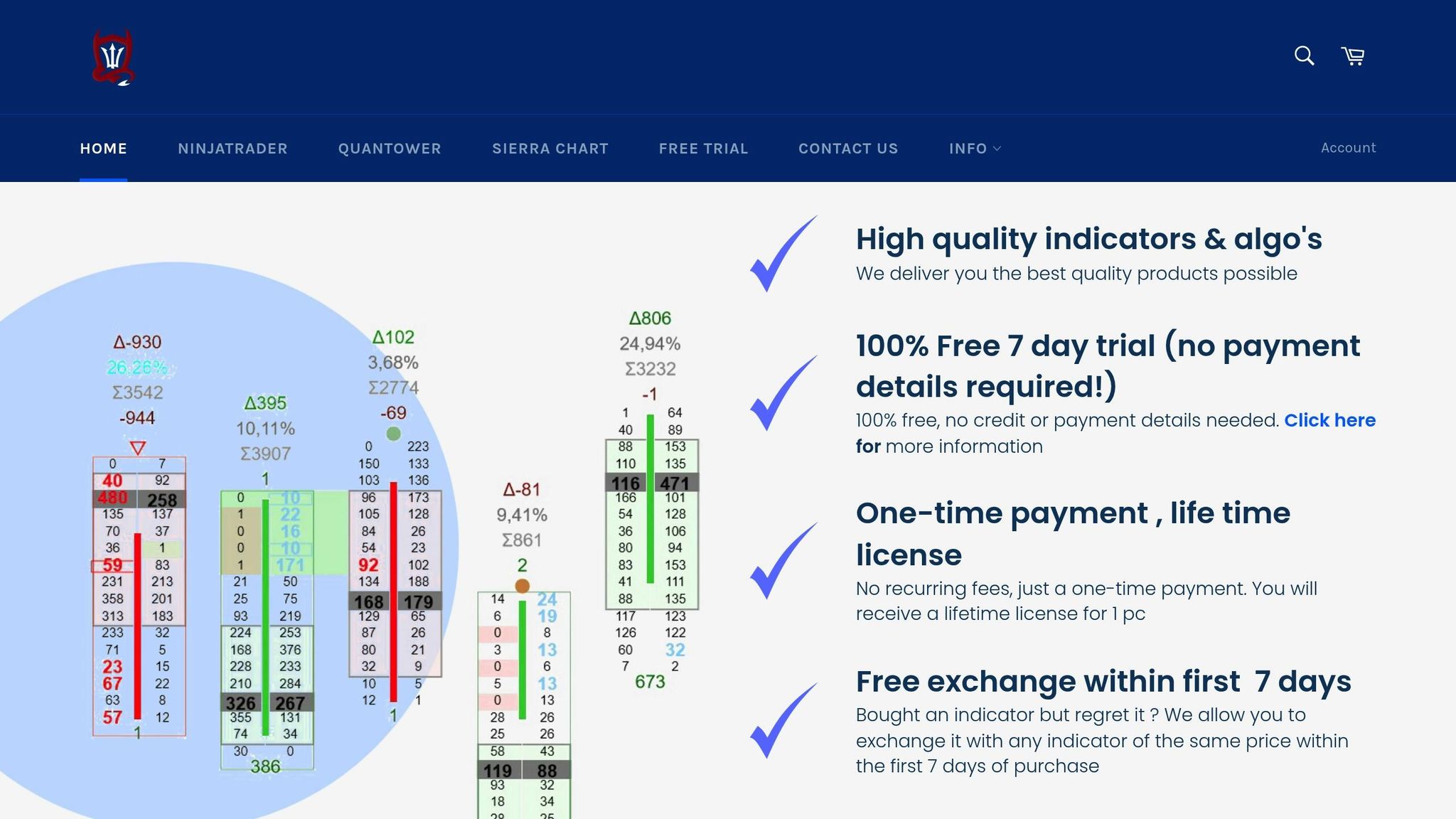

- Trial Option: 7-day free trial without requiring payment details.

- Core Features: Customizable tools for scalping, swing trading, and institutional trade tracking.

- User Feedback: Mixed reviews; praised for precision but some concerns about installation issues and community support.

- Performance: Tools like the Advanced Trade Panel received high ratings for improving risk management and entry precision.

Traders should evaluate their goals and readiness to learn these tools before committing to a lifetime license. For uninterrupted use, VPS hosting services like QuantVPS are recommended to ensure stable performance and low latency.

Order Flow Footprint AutoTrader. Backtest for Optimum Results. Find Your Combo. Rinse, Repeat, Learn

TradeDevil Indicators Overview

TradeDevil Indicators provides a comprehensive suite of trading tools tailored for NinjaTrader 8, Quantower, and Sierra Chart platforms. Designed with active traders in mind, the platform zeroes in on three critical aspects of trading: order flow analysis, market sentiment tracking, and strategy testing. This focus helps traders not only follow market movements but also understand the underlying reasons behind them.

What sets TradeDevil Indicators apart is its blend of traditional technical analysis with modern institutional trading techniques. The tools are built on the understanding that "smart money" – large institutional players – often drives major market moves. By offering insights into these activities, the suite empowers traders to make more informed decisions. Below, we’ll dive into the standout features that make these tools effective.

Main Features of TradeDevil Indicators

The platform excels in real-time data analysis, using algorithms to process live market data and transform it into clear, actionable visuals. This allows traders to make decisions quickly and confidently.

One of its strengths lies in its customizable tools, which can be adjusted to fit different trading styles and risk preferences. Whether you’re a scalper chasing short-term gains or a trader focused on long-term trends, the indicators adapt to your approach.

A standout feature is its institutional tracking capability, exemplified by the Big Trades Indicator. This tool pinpoints key chart areas where institutional players execute large trades. Users can define what qualifies as a "big trade" and set up alerts to stay informed when these conditions are met.

"Our Big Trades Indicator highlights key chart points where institutional trades occur."

The platform also offers footprint analysis, which provides a detailed view of order flow and market sentiment through visual representations of volume data. These tools make complex market data easier to interpret, giving traders a clearer picture of market dynamics.

Core Indicators in the Suite

The TradeDevil suite includes several specialized indicators designed to tackle specific trading challenges.

The Bar Replay Indicator is a manual backtesting tool that allows traders to review historical market data one bar at a time. It enables users to place virtual trades and receive immediate performance feedback.

"Introducing the ultimate manual backtesting tool for traders – an easy-to-use indicator that lets you skip through market data bar by bar and open virtual trades, giving you instant feedback on your trading performance."

The 2nd Entry Indicator focuses on identifying two-legged pullback patterns. These setups occur when prices retrace in two distinct moves before resuming their original trend, making it easier for traders to spot profitable opportunities.

For traders using Smart Money Concepts, the Devil’s Edge Indicator is a game-changer. Designed specifically for NinjaTrader 8, it supports multiple timeframes and provides real-time insights into Break of Structure (BOS) and Change of Character (ChoCh) patterns. It also identifies order blocks, supply and demand zones, volume profiles, and fair value gaps.

"The only smart money concepts indicator available for NinjaTrader 8. Supports multi-timeframes, draws BOS and ChoCh in real-time, order blocks, supply & demand zones, volume profiles, fair value gaps, and much more. If you are a smart money concept trader, then this indicator is definitely worth a look!"

In October 2024, TradeDevil Indicators enhanced its platform by resolving a compatibility issue that had affected the Big Trades Indicator’s functionality with Algo Studio Pro. This update improved the integration of strategy testing with automated trading systems, ensuring a smoother experience for users.

"With the Big Trades Indicator, you can unlock a whole new level of trading intelligence. No more guesswork or blind trades – you’ll have the data you need to make informed decisions and take advantage of market opportunities as they arise."

Detailed Analysis of Key TradeDevil Indicators

Bar Replay Indicator

The Bar Replay Indicator is a powerful tool that lets traders revisit historical market movements without any risk. By selecting a specific point on a chart, users can replay market actions at adjustable speeds, making it easier to analyze patterns and trends in detail. What sets this tool apart is its interactive annotation system, which allows traders to mark key levels and patterns directly on historical price data. This feature bridges the gap between theoretical learning and real-world application.

Another standout feature is the immediate feedback on virtual trades. This helps users pinpoint areas for improvement without putting real money on the line. As the TradingView Team puts it:

"Bar Replay isn’t just another tool; it’s your companion in the quest for trading excellence, turning theory into actionable insight."

This combination of hands-on practice and feedback makes the Bar Replay Indicator a vital resource for sharpening trading skills.

2nd Entry Indicator

The 2nd Entry Indicator is designed to help traders fine-tune their entry timing by identifying two-legged pullback patterns that confirm second entry setups. It comes with a customizable order panel, allowing users to preset essential trade parameters like stop-loss levels, breakeven points, targets, and trailing settings. This streamlines the trade management process, making it more efficient.

The indicator also provides visual and audio alerts when it detects second entry setups. Traders can customize various features, such as swing periods, visual settings like opacity, and the spacing between candle wicks and entry markers. For better chart clarity, there’s even an option to hide earlier markers.

However, traders should exercise caution with certain setups. Specifically, if an engulfing bar appears during either the first or second entry, it may signal stronger momentum that could invalidate the pullback pattern.

Devil’s Scalper Package

For those seeking a comprehensive scalping strategy, the Devil’s Scalper Package offers an all-in-one solution. This package integrates insights from multiple tools, making it ideal for high-frequency manual trading. Included are eight specialized indicators, pre-configured chart templates, workspace layouts, and detailed training videos.

The package has proven its effectiveness in real-world scenarios, successfully meeting profit targets during Leeloo 50K and 100K evaluations while keeping drawdowns within acceptable limits. Key tools in the package include the Multi-timeframe Support & Resistance Indicator, Daily Pivots Indicator, Initial Balance Indicator, and Market Internals Indicator.

Feedback from traders has been overwhelmingly positive, with users giving it a 5.0-star rating. Many have highlighted the value of the indicators and training materials in helping them achieve profit targets while managing risk effectively.

Priced at $1,145.00, the package reflects its value through its comprehensive offerings and proven success in evaluation settings.

Real Trader Feedback and Performance Data

Trading Community Feedback

Traders have shared their experiences with TradeDevil Indicators, highlighting improvements in speed, precision, and risk management. Among the tools offered, the Advanced Trade Panel has garnered significant praise, earning an impressive 4.8 out of 5-star rating from 11 customer reviews.

Christian Guzman praised the tool for its efficiency, saying:

"Amazing Indicator. With the click of a button, my order gets in rapidly. Another example of why TradeDevil’s Indicators are a must have."

Stephen Malan pointed out how the tool enhances precision and flexibility:

"Absolutely love this trade panel! Gives me way more precise entries and has a breakeven button that allows for whatever offset you want."

Other traders have noted its adaptability to various trading styles. Pradeep Kumar shared:

"Suits my breakout trading style easy to activate buy sell orders"

Adrian D. appreciated the integration with trend lines, stating:

"Exactly what needed I can use my trend lines to enter which is perfect!"

However, feedback hasn’t been universally positive. On Trustpilot, TradeDevil Indicators has an average rating of 3.3 stars based on a single review. In May 2025, one customer expressed frustration after spending nearly $7,000 on the tools, only to be banned from the community due to alleged ties to illegal software – claims they denied knowledge of or involvement with.

These diverse user experiences provide valuable insights into the tool’s performance and community reception.

Performance Results

Data from real-world use backs up the claims of improved trading outcomes. Ricky J. offered detailed feedback on the Advanced Trade Panel, noting:

"This tool outperforms NinjaTrader’s default chart trade panel. Now able to place orders in multiple clever ways and using them to trade off of drawings placed on the chart. Also, like how the trade panel provides a way to manage risk and position sizing. This tool is very useful."

Additionally, the Bar Replay Indicator has proven effective in refining traders’ entry and exit strategies by enabling them to review historical market movements and test their approaches. The Advanced Trade Panel further supports risk management by offering customizable settings that help traders protect their profits as trades progress. These tools collectively demonstrate their value in enhancing precision and managing risks, as reflected in both user feedback and performance data.

QuantVPS Hosting for Better Indicator Performance

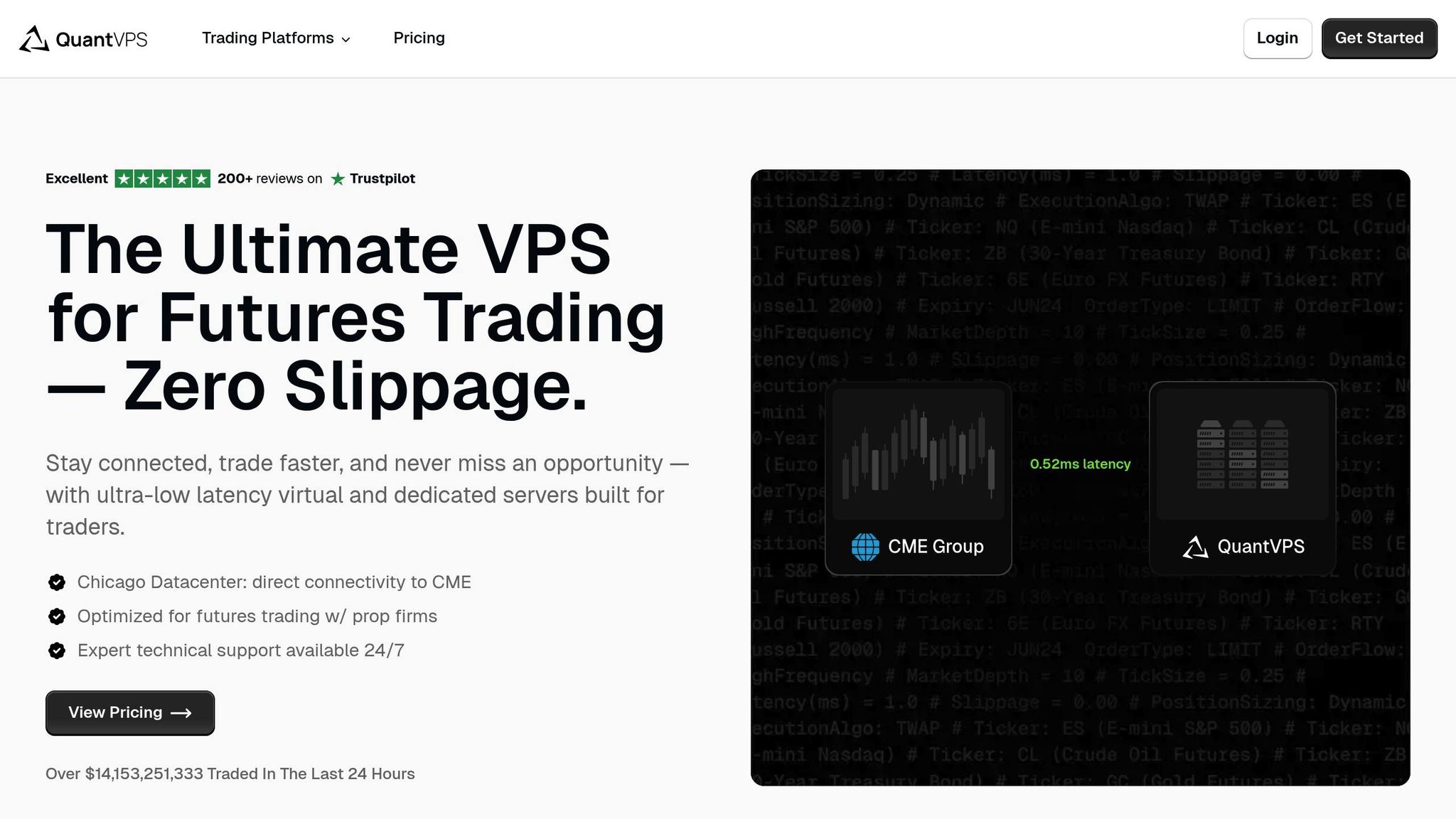

When using advanced trading indicators like TradeDevil, having a stable, high-speed environment isn’t just a luxury – it’s a necessity. Interruptions like computer crashes, internet issues, or power outages can disrupt your trades at the worst possible moments. This is where VPS hosting steps in. By providing a dedicated virtual environment that operates independently of your personal setup, VPS hosting ensures your TradeDevil Indicators stay up and running 24/7, even if your own device is offline. Plus, hosting your setup on servers located near major exchanges significantly reduces order execution time.

Speed is everything in trading. Even the smallest delay – a fraction of a second – can turn a winning trade into a losing one. With tools like TradeDevil’s Advanced Trade Panel and Devil’s Scalper Package, precision timing is critical. This is exactly why QuantVPS was designed, offering a robust infrastructure that prioritizes reliability and speed.

QuantVPS Key Features

QuantVPS provides an ultra-fast trading environment, specifically designed for futures and forex markets. Its Chicago datacenter is directly connected to the CME Group exchange via fiber-optic connections, delivering trade execution speeds with latency as low as 0.52ms.

"Our Chicago datacenter provides ultra-low latency (<0.52ms) directly to the CME exchange, enabling faster futures trade execution and significantly minimizing slippage." – QuantVPS

With a 99.999% uptime guarantee, QuantVPS ensures uninterrupted performance for your TradeDevil Indicators – an essential feature for automated trading strategies or managing multiple accounts. The platform supports all major trading software and offers remote access, so you can monitor and tweak your indicators from anywhere.

To keep your trading data safe, QuantVPS includes anti-DDoS protection and automated backups. It also supports multiple data feeds like Rithmic, CQG, dxFeed, TT, and IQFeed, allowing you to choose the most reliable feed for your trading needs. Now, let’s take a look at the pricing plans QuantVPS offers to accommodate different types of traders.

QuantVPS Pricing and Plans

QuantVPS provides four tailored plans to match various trading setups:

| Plan | Monthly Price | CPU Cores | RAM | Storage | Network | Multi-Monitor Support | Best For |

|---|---|---|---|---|---|---|---|

| VPS Lite | $59 | 4× cores | 8GB | 70GB NVMe | 1Gbps+ | No | 1–2 charts |

| VPS Pro | $99 | 6× cores | 16GB | 150GB NVMe | 1Gbps+ | Up to 2 monitors | 3–5 charts |

| VPS Ultra | $199 | 24× cores | 64GB | 500GB NVMe | 1Gbps+ | Up to 4 monitors | 5–7 charts |

| Dedicated Server | $299 | 16×+ cores | 128GB | 2TB+ NVMe | 10Gbps+ | Up to 6 monitors | 7+ charts |

Every plan includes Windows Server 2022, unmetered bandwidth, and full root access. Whether you’re running a simple TradeDevil setup with just a few charts or handling complex algorithmic strategies across multiple accounts, QuantVPS has a plan to match your requirements. With NVMe storage for faster data access and higher-tier plans offering the processing power needed for advanced indicators, QuantVPS ensures your trading environment is always up to the challenge.

TradeDevil Indicators Pros and Cons

TradeDevil Indicators present a mix of benefits and challenges, based on real trader feedback and performance data. By weighing their strengths and weaknesses, traders can decide if these tools align with their trading style and technical needs.

Feature and Usability Comparison

| Aspect | Strengths | Weaknesses |

|---|---|---|

| Ease of Use | 7-day free trial without requiring payment details; detailed video tutorials and documentation provided | Some users encounter installation issues due to virus scanners blocking zip files |

| Customization | Compatible with multiple platforms (NinjaTrader 8, Sierra Chart, Quantower); Algo Studio Pro allows no-code strategy creation | Certain indicators, like TDU Volume Profile, offer limited customization options (e.g., resolution adjustments) |

| Accuracy | Market Structure indicator provides real-time, multi-timeframe insights; Smart Money Concepts achieve up to 1:20 risk/reward ratios | Effectiveness relies heavily on proper configuration and understanding of the tools |

| Platform Compatibility | Works across popular trading platforms; frequent updates based on user feedback | NinjaTrader 8 machine ID changes can disrupt indicator functionality |

| Cost Structure | One-time lifetime license fee; free exchange available within the first 7 days | Restricted to a single PC, requiring extra licenses for multiple setups |

| Support | Free Discord community for quick responses and peer learning | Some users report inadequate support for technical problems |

These details highlight both the appealing features and the challenges traders may encounter when using TradeDevil Indicators.

One of the standout features is the implementation of Smart Money Concepts. The TDU Market Structure/Smart Money indicator is recognized as the first for NinjaTrader 8 to display market structure across multiple timeframes in real-time. Additionally, Algo Studio Pro empowers traders without coding skills to design and test automated strategies.

Key Insights from User Experiences

The feature breakdown offers a foundation for understanding how traders experience these tools in real-world scenarios.

User feedback suggests that TradeDevil Indicators are most effective for traders willing to dedicate time to learning the concepts, rather than expecting an out-of-the-box solution. For example, the TDU Market Structure/Smart Money indicator has received 35 user reviews, reflecting active engagement, while newer tools like the Manual/Visual Strategy Backtester have garnered 3 reviews so far.

The free Discord community stands out as a valuable resource, providing quick answers and opportunities to learn from other traders. The 7-day free trial is another highlight, allowing users to explore the indicators thoroughly before making a financial commitment. Reports also show that Smart Money Concepts work well for both scalping and swing trading, offering attractive risk/reward ratios. However, success hinges on understanding institutional trading strategies and proper use of the tools.

While the lifetime license offers long-term value for dedicated traders, the single PC limitation may be a drawback for those who operate multiple setups and need additional licenses.

Conclusion

TradeDevil Indicators offer a robust set of tools aimed at improving both decision-making and efficiency for traders of all levels. These indicators stand out by identifying institutional trading patterns and providing real-time performance feedback, helping traders analyze market trends across different timeframes with precision.

"Learning technical analysis is a start, but having the knowledge and experience to create a strategy that works for you is what will bring success." – Sam Eells, TradeDevils

However, success doesn’t come overnight. These tools require a commitment to learning and understanding institutional trading concepts. Traders who dedicate time to mastering the platform and tailoring strategies to their needs are more likely to see meaningful results. The supportive Discord community is an added bonus, offering guidance and helping users navigate the learning curve.

For traders running these indicators continuously, having a reliable hosting setup is crucial. QuantVPS hosting is an excellent option, offering ultra-low latency connections and a 100% uptime guarantee. This makes it particularly valuable for automated strategies and real-time market analysis, where a stable connection is non-negotiable.

When deciding if TradeDevil Indicators are right for you, take stock of your trading objectives, your tolerance for risk, and your willingness to learn. Whether you’re into scalping or swing trading, the key lies in proper implementation. Take advantage of the free trial to ensure these tools align with your trading style before making a commitment.

FAQs

How can TradeDevil Indicators help identify institutional trading activity?

TradeDevil Indicators shed light on institutional trading by pinpointing critical zones where large orders are executed. They track the buying and selling behaviors of institutional investors and smart money, while also examining volume spikes in relation to price changes. This gives traders a clearer picture of where the major market players are operating and how their moves impact price trends.

What challenges might users encounter when setting up and using TradeDevil Indicators?

Challenges with Installing and Using TradeDevil Indicators

When it comes to setting up TradeDevil Indicators, users might encounter a few bumps along the way. A common issue is navigating the download and installation process, especially when ensuring the indicators are compatible with trading platforms like NinjaTrader or MetaTrader. Compatibility mismatches can lead to frustration if not addressed properly.

Another challenge some traders face is performance inconsistencies. Indicators may perform impressively with historical data but fail to deliver the same results in live trading. This can be due to overfitting, where the indicator is overly tailored to past data and struggles to adapt to real-time market conditions.

Lastly, connection or data feed issues during setup can create additional headaches. These problems might interfere with the proper functioning of the indicators, delaying your trading activities.

To avoid these pitfalls, make sure to follow the installation instructions carefully. Double-check that your trading platform is updated and correctly configured to work seamlessly with the indicators. A little extra attention upfront can save a lot of trouble later.

Why is VPS hosting the best option for running TradeDevil Indicators continuously?

VPS hosting is a smart choice for running TradeDevil Indicators because it guarantees round-the-clock operation, which is essential for maintaining steady trading performance. With a VPS, you can reduce latency, leading to quicker trade executions – something that can have a big impact on your trading results.

Another advantage is the remote access it provides. No matter where you are, you can easily monitor and manage your trading setup. Plus, a VPS adds an extra layer of security and dependability, shielding your system from issues like power outages, shaky internet connections, or hardware malfunctions. This way, your trading strategies stay on track without any hiccups.