Trade copiers are tools that replicate trades across accounts, saving time and ensuring consistent strategies. For TradingView users, these tools automate trade execution seamlessly across multiple platforms. Here’s a quick summary of the six best options:

- Copygram: Advanced webhook integration, multi-platform support, and AI trade validation. Starts at $12.50/month (annual plan).

- Duplikium: Cloud-based with ultra-low latency (1–3 ms). Free basic plan or $4/month per seat for full features.

- Traders Connect: Cloud-based with equity protection and analytics. Starts at $10/account.

- Social Trader Tools: Focused on MT4/MT5 accounts with robust features. Starts at $20/month.

- FX Blue Labs Trade Copier: Simple MT4/MT5 trade replication with institutional-grade reliability.

- Heron Copier: Advanced features, including sub-10 ms execution and unlimited accounts. Free version available; full plan at $19/month.

Quick Comparison

| Trade Copier | Key Features | Starting Price | Platforms Supported |

|---|---|---|---|

| Copygram | Webhook automation, AI validation | $12.50/month | TradingView, MT4/MT5, Oanda |

| Duplikium | Cloud-based, 1–3 ms latency | Free/$4/month | MT4/MT5, cTrader, DXtrade |

| Traders Connect | Equity protection, analytics | $10/account | MT4/MT5, DXtrade, TradeLocker |

| Social Trader Tools | Multi-account MT4/MT5 focus | $20/month | MT4/MT5 |

| FX Blue Labs | Simple MT4/MT5 replication | Free | MT4/MT5 |

| Heron Copier | Sub-10 ms execution, advanced tools | Free/$19/month | MT4/MT5, cTrader, DXtrade |

Choose based on your needs: beginners may prefer Traders Connect, while advanced traders managing multiple accounts might find Heron Copier or Copygram more suitable.

How to copy trades from TradingView to multiple trading …

1. Copygram

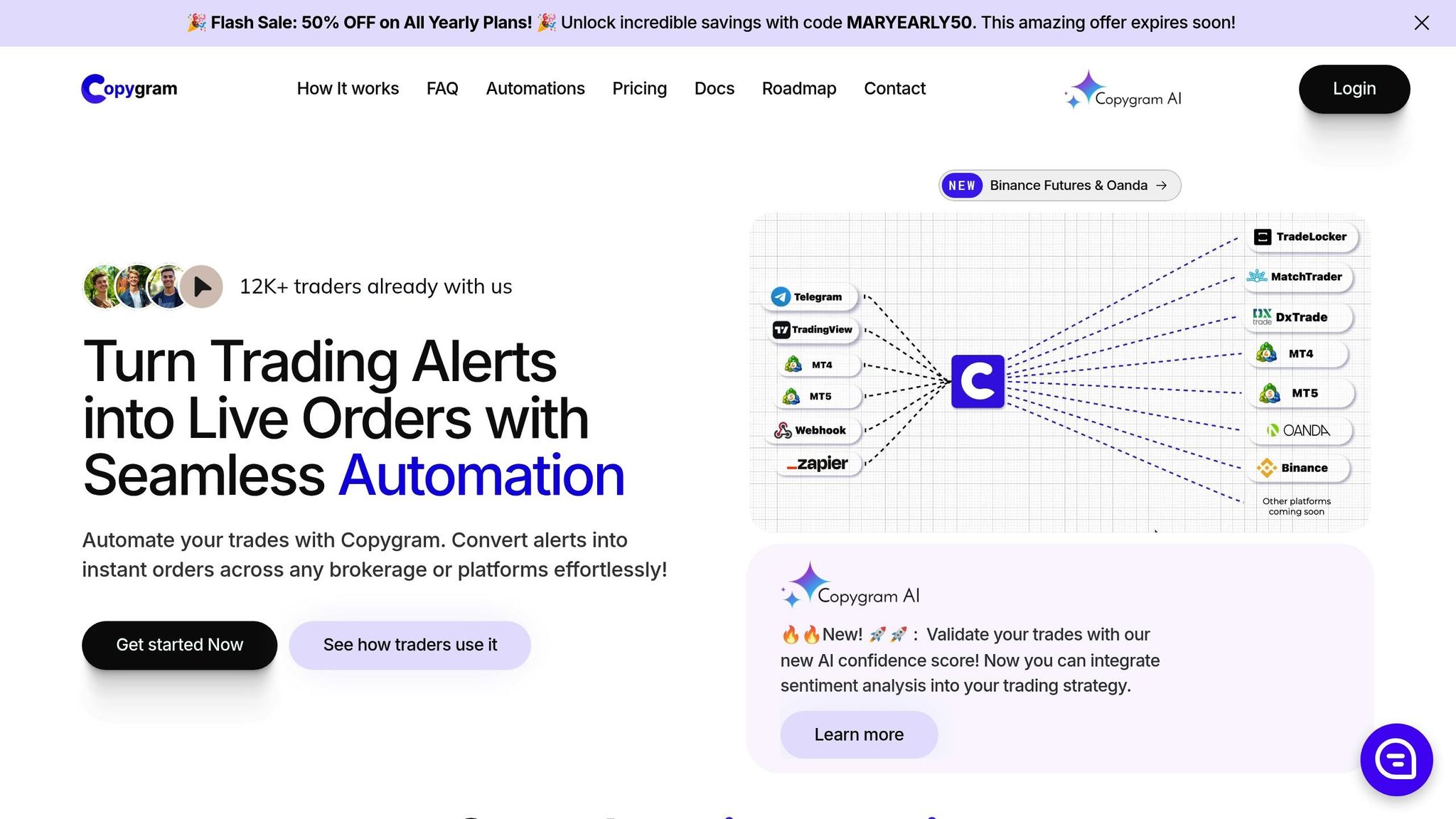

Copygram connects seamlessly with TradingView using advanced webhook functionality, automating trading alerts across platforms like MetaTrader, DxTrade, Binance Futures, and Oanda.

Key Features

- Tools for managing money and risk

- Identifies prefixes and suffixes for recipient accounts

- Accurate symbol matching across platforms

- Multi-take profit management

- Customizable order management system

These features ensure smooth and efficient trade execution.

Platform Integration

Copygram uses a dedicated webhook URL for direct, automated trade execution from TradingView. Supported actions include:

- Opening new positions

- Adjusting existing trades

- Closing active positions

Instant Notifications

Stay updated with real-time trade alerts sent via email or Telegram, making it easier to track multiple accounts.

Pricing Overview

| Plan | Monthly Price | Annual Price* | Accounts |

|---|---|---|---|

| Basic | $25 | $12.50/mo | 2 accounts (1 sender, 1 receiver) |

| Pro | $40 | $20/mo | 2 accounts + AI Trade Validation |

| Premium | $82 | $41/mo | 5 accounts (1 sender, 4 receivers) |

*Annual prices include a 50% discount with code MARYEARLY50 [1].

What Professionals Say

Benjamin Charles, a Prop Firm Trader, says: "Everything is copied to all accounts as soon as it’s triggered on TradingView. I can send pending orders and close orders directly from TradingView, which is fantastic." [1]

Platform Compatibility

Copygram integrates with a variety of platforms:

- Senders: TradingView, MT4, MT5, Telegram

- Receivers: DxTrade, TradeLocker, MatchTrader, MT4, MT5, Oanda, Binance Futures

The platform relies on official APIs for most integrations. For MetaTrader, a specialized Expert Advisor (EA) ensures secure connections, though using a VPS is recommended for the best performance.

With over 12,000 active users [1], Copygram has become a trusted tool for automating TradingView strategies across multiple platforms and accounts.

2. Duplikium

Duplikium connects TradingView with multiple platforms, ensuring trades are mirrored in just 1–3 milliseconds, reducing slippage. Here’s a breakdown of its standout features, platform compatibility, and support options.

Key Features

Duplikium offers several tools designed to streamline trading:

- Cloud-based hosting removes the need for dedicated servers

- Trades are synced in real time across brokers and markets

- Customizable risk settings for transaction sizing

- Compatible with platforms like MT4, MT5, cTrader, and DXtrade

Platform Support

The platform supports a variety of trading tools, including:

- TradingView

- MetaTrader 4 and 5

- cTrader

- DXtrade

- FXCM

- LMax

- Tradovate

- NinjaTrader

Pricing Structure

| Plan Type | Features | Cost |

|---|---|---|

| Free | 1 main + 1 copy account (limited) | $0 |

| Paid | Unlimited accounts, full features | $4/month per seat |

| Add-ons | Extended functionality | Variable |

Customer Support

Duplikium provides multiple support channels, including live chat, email, video tutorials, a knowledge base, and social media.

User Experience

Traders often highlight Duplikium’s dependability and speed. As Bruno shared:

"Trade-copier.com is one of the best trade copier in the market with low latency."

In March 2025, Xey Lee noted that Duplikium successfully addressed integration issues between MT5 and DXtrade, further proving its reliability. The platform enjoys a solid reputation, with a 4.5/5 rating from 68 user reviews [2].

Performance Metrics

- Operates continuously via cloud hosting

- No restrictions on account connections

- Real-time syncing across supported platforms

3. Traders Connect

Traders Connect provides a cloud-based trade copier tailored for TradingView users. With its cloud setup, there’s no need for downloads or extra software, making it quick and easy to get started.

Key Features

Traders Connect uses proprietary technology to deliver:

- Compatibility with platforms like MT4, MT5, cTrader, DXTrade, MatchTrader, and TradeLocker

- Cloud-based trade execution with speeds as fast as 20–30ms [3]

- Tools for portfolio analysis and dedicated trading environments

- Equity protection features to safeguard investments

These tools are designed to ensure reliable and efficient performance.

Performance Overview

The platform is built for reliable trade execution and continuous monitoring across accounts.

| Metric | Performance |

|---|---|

| Average Execution Speed | Under 40ms |

| Platform Uptime | 24/7 |

| User Rating | 4.9/5 (248 reviews) [4] |

| Cross-Platform Support | 6+ platforms |

Pricing Details

Traders Connect offers plans tailored for TradingView users, blending affordability with advanced features:

| Plan | Monthly Cost | Annual Cost | Features |

|---|---|---|---|

| Premium | $10/account | $100/account | Portfolio analytics, equity protection, priority support |

| Premium Plus | $15/account | $150/account | Advanced analytics, HFT support, premium notifications, priority support |

What Users Are Saying

The platform’s ease of use and performance have received glowing feedback. Daniel, a verified user, shared:

"I’ve had this product for less than a day and it’s hands down the best trade copier I’ve ever seen – and I’ve used several in the past. Completely intuitive, excellent mapping feature for dealing with the same asset represented by different symbols in master/slave, lightning fast and more things that would make this review far too long. Being cloud based it’s completely faff-free. If you are looking for a trade copier, look no further." [4]

Technical Reliability

An in-house team ensures consistent performance with regular updates, keeping the platform dependable across all supported systems.

Future Integrations

Traders Connect is planning to expand its platform support in upcoming updates, reinforcing its commitment to supporting a variety of trading needs.

sbb-itb-7b80ef7

4. Social Trader Tools

Social Trader Tools allows MT4 and MT5 users to replicate trades from TradingView. It focuses on quick execution and effective account management, making it a solid choice among trade copiers.

Key Features

| Feature | Details |

|---|---|

| Execution Speed | Average replication speed of 50ms [6] |

| Account Support | Unlimited MT4/MT5 accounts |

| Hosting | Operates 24/7 on a cloud-based system |

| Broker Compatibility | Works with any MT4/MT5 broker |

| Monitoring Tools | Includes equity alerts and trade automation |

Performance and Reliability

The platform simplifies trade management with features like equity alerts, automatic position closures at predefined thresholds, and performance-based copier disabling. It’s worth noting that pending TradingView orders are only copied after they are executed [5].

Pricing Structure

Social Trader Tools provides tiered subscription plans based on the number of accounts you manage:

| Plan | Monthly Cost | Account Limit |

|---|---|---|

| Standard | $20 | 2 accounts |

| Plus | $60 | 5 accounts |

| Pro | $120 | 10 accounts |

| Premium | $220 | 20 accounts |

For larger-scale operations, rolling plans are also available:

- Rolling 40: $400/month (40 accounts)

- Rolling 60: $600/month (60 accounts)

- Rolling 80: $800/month (80 accounts)

- Rolling 100: $1,000/month (100 accounts) [8]

User Experience

Social Trader Tools has a Trustpilot score of 2.9/5 based on 42 reviews [7]. The platform claims to offer "the fastest copier in the market with an average replication speed of 50ms." Users generally like its user-friendly interface and efficient account management features. However, some have mentioned occasional reliability issues with trade copying [7].

Technical Considerations

No software installation is required, but traders should keep an eye on their positions, as occasional copy errors have been reported [7].

5. FX Blue Labs Trade Copier

FX Blue Labs Trade Copier is a tool widely used by traders to replicate trades across multiple MetaTrader accounts efficiently.

Key Features

| Feature | Details |

|---|---|

| Execution Speed | Fast trade replication, dependent on broker performance |

| Platform Support | Works with MT4/MT5 instances on the same computer |

| Parallel Processing | Handles multiple signal copying through a worker EA (MT4) |

| Usage Scope | Suitable for both personal and institutional trading needs |

These features ensure dependable and quick trade replication.

Performance and Reliability

The copier performs efficiently, with execution often described as "almost instant, limited only by your broker’s speed" [10][12]. This speed is essential for maintaining consistency across accounts. The latest updates have further improved copying speed, making it a reliable choice for time-sensitive trading tasks [9][11].

Technical Implementation

FX Blue Labs provides two main solutions:

- Personal Trade Copier: Copies trades between MT4/MT5 accounts on the same computer.

- Trade Mirror: Allows trade copying between accounts on different computers.

For MT4 users, the system supports simultaneous signal copying through an optional worker EA [9][11].

Professional Applications

FX Blue Labs is trusted by institutional brokers for critical operations such as risk management and liquidity handling [9][11]. Its capabilities make it a dependable option for managing complex trading activities.

6. Heron Copier

Heron Copier stands out for its compatibility with multiple platforms and advanced trade replication features. It allows efficient trade copying across platforms like cTrader, MetaTrader 4, MetaTrader 5, TradeLocker, MatchTrader, and DXtrade.

Core Features

| Feature | Details |

|---|---|

| Execution Speed | Uses TCP socket with polling times under 10ms |

| Platform Support | Compatible with 6 major platforms, including MT4/MT5 |

| Account Capacity | Supports unlimited master and slave accounts |

| Protection | Includes balance/equity monitoring and a killswitch |

| Trade Management | Features a real-time dashboard and email notifications |

Technical Setup

Heron Copier operates through a local installation using a cBot and EA on either a PC or VPS. Recent updates have significantly reduced polling times from 100 ms to under 10 ms, making it especially useful for high-frequency trading.

Advanced Trading Features

- Symbol Mapping: Adjust aliases for smooth cross-broker compatibility.

- Volume Management: Customize trade sizes for individual slave accounts.

- Risk Controls: Includes safety measures for proprietary trading accounts.

- Trade Direction: Offers full reverse trading functionality.

These capabilities have earned strong feedback from traders who value its flexibility and precision.

User Reviews

Users have praised Heron Copier for its performance, reflected in its 4.5/5 rating on Trustpilot[13].

Pricing Options

| Plan | Cost | Features |

|---|---|---|

| Free Version | $0 | Limited to two symbols |

| Monthly Plan | $19 | Unlocks all features |

| Annual Plan | $179 | Full functionality for a year |

Performance Tips

To achieve the best results, run Heron Copier on a VPS. It consistently delivers latency between 1–50 ms, making it suitable for both casual and high-frequency trading scenarios[14].

Compare Features and Performance

After evaluating six leading trade copiers for TradingView, here’s how they stack up in terms of features and performance for effective trade copying.

Core Features Breakdown

Each platform brings its own set of tools to manage risk, from adjusting lot sizes to automating stop-losses:

- Copygram: Offers automated trade replication with options for customizing position sizes and validating trades.

- Duplikium: Prioritizes exposure control with flexible risk percentage settings.

- Traders Connect: Supports smooth multi-account strategy execution while ensuring balance protection.

- Social Trader Tools: Includes multi-layered safety measures for trading activities.

- FX Blue Labs Trade Copier: Focuses on essential, no-frills features for basic trade copying.

- Heron Copier: Stands out with real-time trade execution and advanced risk management options.

Performance Insights

Execution speed is critical, especially in fast-moving markets. While all platforms are reliable, Heron Copier shines in high-volume scenarios with its quick execution. Traders Connect also impresses, offering a robust system for consistent trade replication across multiple accounts. These performance aspects become even more crucial when paired with a VPS, reducing latency significantly.

Boosting Execution with VPS

Using a VPS can dramatically improve performance by minimizing delays. Unlike local PC setups, a VPS ensures continuous platform access and faster execution during volatile market conditions, making it a key tool for traders.

Technical Integration

Integration options vary across platforms. Heron Copier stands out for its compatibility with major trading platforms, allowing for precise and seamless trade execution tailored to specific strategies.

Real-Time Monitoring Tools

Modern trade copiers now feature real-time tracking and detailed performance dashboards. These tools provide instant feedback, analytics, and custom reporting, helping traders adjust strategies in response to live market changes. Combined with the detailed reviews above, these features equip traders to make informed decisions in real time.

Which Trade Copier Should You Choose?

Picking the right trade copier depends on your level of experience, how often you trade, and your specific requirements. Here’s a simple guide to help you decide:

For Beginners and Non-Technical Traders

If you’re just starting out or prefer simplicity, Traders Connect is a great option. It’s a cloud-based platform, so there’s no need to download software or deal with complex setups. Plus, it offers affordable plans and an easy-to-use interface.

For Active Multi-Account Traders

If you manage multiple accounts, look for features that streamline your workflow, such as:

| Feature | Why It’s Important |

|---|---|

| Real-time Copying | Ensures trades are instantly mirrored across accounts |

| Exit Order Detection | Accurately handles Take Profit and Stop Loss orders |

| OCO Functionality | Efficiently manages related orders |

| Multiple Account Groups | Lets you run several trade copiers at once with ease |

For Advanced Traders

Experienced traders should prioritize platforms that offer:

- Verified connections with brokers

- Flexibility to trade various instruments

- Customizable risk management tools

- Strong security measures to protect your data

Technical Considerations

Before making a final choice, confirm that the trade copier meets these technical requirements:

- Platform Compatibility: Make sure it integrates smoothly with your broker.

- Order Management: Check that Take Profit and Stop Loss orders replicate correctly, including OCO settings.

- Risk Controls: Look for options to adjust position sizes and set exposure limits.