If you’re a trader deciding between Tradezella and TraderSync in 2025, here’s the key takeaway: Tradezella focuses on structured journaling and trader education, while TraderSync emphasizes data-driven insights and AI-powered analytics. Both platforms cater to professional and semi-professional traders but differ in their approach and pricing.

Key Highlights:

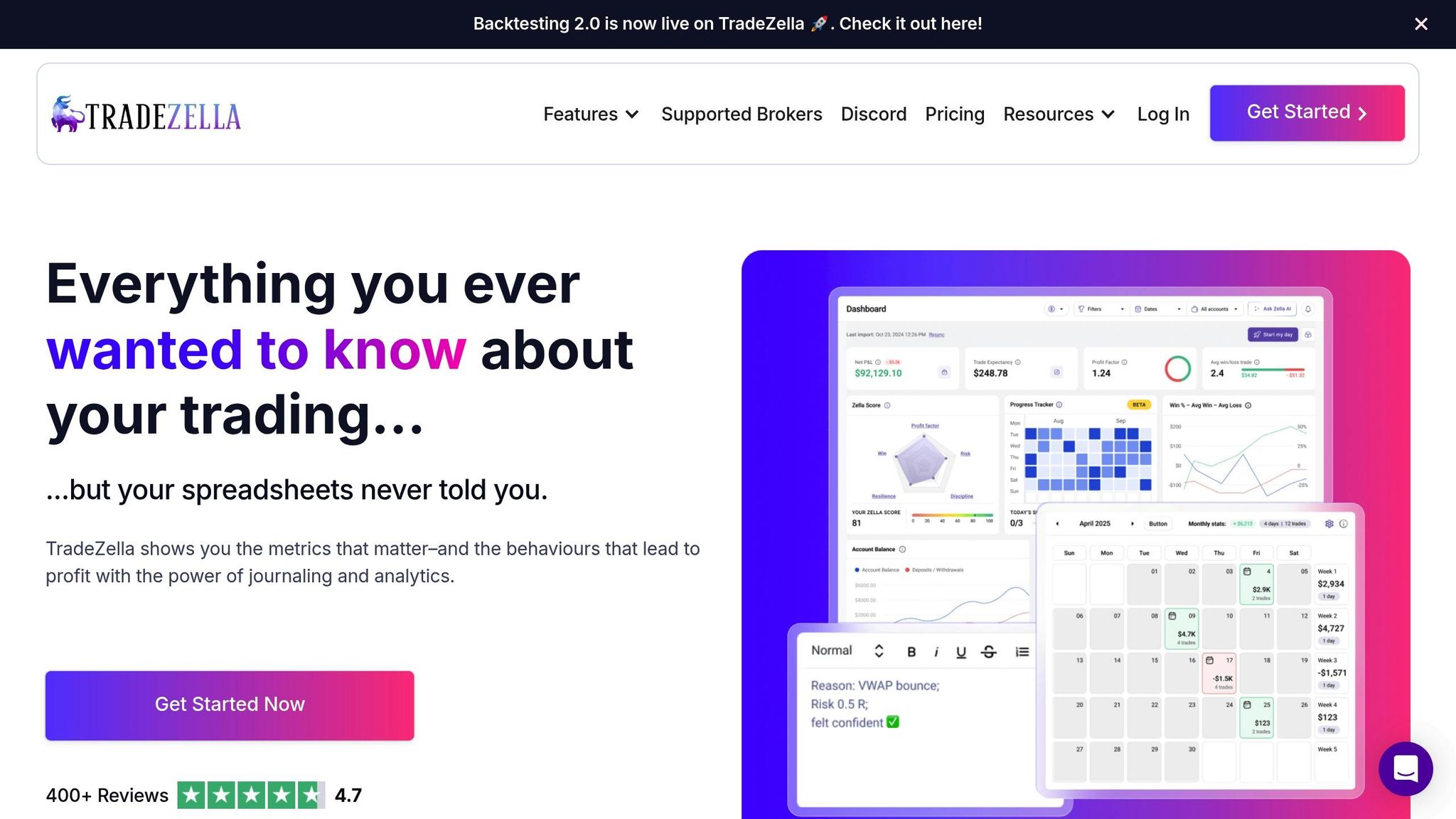

- Tradezella: Prioritizes trader psychology, education (Zella University), and user-friendly tools. Offers detailed performance tracking and seconds-level backtesting.

- TraderSync: Excels in AI-driven analytics (Cypher assistant), extensive broker integration, and precise market replay (250ms tick data on Elite plan).

Pricing Overview:

- Tradezella: Starts at $24/month (annual billing). Premium plan at $33/month includes full feature access.

- TraderSync: Starts at $19.46/month (annual billing). Elite plan at $39.97/month offers advanced AI tools and ultra-precise replay.

Quick Comparison:

| Feature | Tradezella | TraderSync |

|---|---|---|

| Focus | Education, psychology, journaling | AI insights, analytics, automation |

| Broker Support | Major U.S. & global platforms | 700+ brokers |

| Backtesting | Seconds-level, 10 years data | 250ms tick, Level II data |

| AI Features | None | Cypher assistant |

| Pricing (Annual) | $24–$33/month | $19.46–$39.97/month |

| Free Trial | None | 7 days (no credit card) |

Choose Tradezella if you value simplicity, education, and structured journaling. Opt for TraderSync if you need advanced analytics, AI tools, and broader broker connectivity.

TradeZella vs TraderSync – Best Trading Journal in 2025!

Feature Comparison

Both platforms handle trade logging, analytics, and strategy testing, but each takes a distinct approach. Understanding these differences can help you decide which one aligns better with your trading style and technical needs.

Trade Logging and Automation

Broker Integration and Connectivity

Tradezella connects with major U.S. brokers like Interactive Brokers, TD Ameritrade, Charles Schwab, Robinhood, Tradovate, TradeStation, and TopstepX. It also supports international platforms such as MetaTrader 4 and 5, TradingView, cTrader, DXtrade, TradeLocker, and cryptocurrency exchanges like Binance, Bybit, and KuCoin. For unsupported brokers, you can upload trades via CSV files.

TraderSync, on the other hand, emphasizes broad compatibility with numerous brokers and offers strong automation features, though it doesn’t provide a detailed list of supported platforms.

Asset Class Support

Tradezella supports a wide variety of asset classes, including stocks, options, futures, forex, and cryptocurrencies. While TraderSync’s extensive broker integration implies broad asset class support, specific details aren’t clearly outlined.

Data Entry Methods

Both platforms offer multiple ways to log trades: manual input, CSV uploads, and automated API integration. Tradezella’s automation enriches sessions with price data, execution points, charts, and key metrics. Meanwhile, TraderSync focuses on seamless data import and processing, making it ideal for traders managing high volumes of trades.

Performance Analytics

After logging trades, the platforms diverge in how they analyze performance.

Analytics Approach and Depth

Tradezella’s Reports 2.0 provides interactive charts that make it easy to uncover key metrics.

"TradeZella, in contrast, focuses on clarity and usability. Reports are visual, interactive, and easy to filter. You can instantly see things like your most profitable setups, biggest mistakes, win rate by tag, and performance by trade duration or session. Everything is designed to help you find insights faster without needing to build custom spreadsheets or dig through dozens of filters."

– TradeZella Team

TraderSync uses its AI-powered analytics engine, Cypher, to deliver deeper insights. For instance, Cypher might analyze a "Gap and Go" strategy and suggest that focusing on trades with an R-Multiple of 2 or higher could boost profits from $560 to $1,250, with a 60% win rate and a 7% average return. It also highlights patterns like $12,340 in losses from trades that didn’t follow the trading plan or tendencies to hold trades longer than planned.

Customization and Reporting

Both platforms offer customizable dashboards. Tradezella boasts over 50 specialized reports, while TraderSync provides more than 20 widgets with advanced filters.

Trade Replay and Strategy Backtesting

The platforms also differ in how they simulate market behavior and test strategies.

Data Granularity and Simulation Quality

Tradezella delivers tick-by-tick data with second-level replays and up to 10 years of historical data. It has processed over 100,000 backtest sessions and supports market, limit, and stop orders with automatic position sizing based on your risk parameters.

TraderSync offers market replay with 250ms ticks and includes Level II data for U.S. stocks, options, and futures, along with Time & Sales data. It’s known for its speed, loading market data in under a second.

Strategy Development Tools

Tradezella integrates backtesting with its journaling system, offering multi-timeframe analysis, a "Go-To" function to revisit key moments, and economic calendar integration. It also includes a Mentor Mode for collaborative reviews.

"After extensively testing TradeZella’s backtesting feature, we think it’s one of the best tools for manual strategy testing."

– Learnforexwithdapo

TraderSync adds features like Playlists for focused chart practice and custom screeners to target specific market conditions, making backtesting more intuitive.

Performance Analysis Integration

Tradezella treats backtesting results as live trades, offering detailed analytics such as profit/loss, win rate, drawdown, and equity curve visualization. TraderSync’s AI coach, Cypher, provides "What-If" scenarios and detailed strategy reports, helping traders refine their strategies by identifying areas for improvement.

| Feature | Tradezella | TraderSync |

|---|---|---|

| Data Granularity | Tick-by-tick, seconds timeframe | 250ms ticks, Level II data |

| Historical Data | Up to 10 years | Real historical data |

| Order Types | Market, limit, stop orders with auto-sizing | Realistic simulation |

| AI Integration | Data-driven insights with smart tips | Cypher AI coach with interactive queries |

| Unique Features | Mentor Mode, drag & adjust SL/TP | Level II backtesting, fastest simulator |

Tradezella stands out for its user-friendly interface, integrated analytics, and journaling features. Meanwhile, TraderSync caters to traders seeking advanced AI-driven insights and detailed market data. These unique strengths make each platform appealing to different types of traders, depending on their priorities and trading infrastructure.

Pricing and Plans

Tradezella and TraderSync cater to different types of traders with their unique pricing structures. Knowing these options can help you decide which platform aligns best with your trading style and goals.

Tradezella Pricing

Tradezella offers a two-tier pricing model with discounts for annual subscriptions. The Basic Plan is priced at $29 per month or $24 per month when billed annually (totaling $288 per year). The Premium Plan costs $49 per month or $33 per month annually (totaling $399 per year).

The Basic Plan includes features like one trading account, 1GB of storage, three playbook creations, unlimited trade imports, and analytics. The Premium Plan expands on this with unlimited accounts, 5GB of storage, unlimited playbooks and mentor invites, seconds-level data for backtesting, multi-pair trading (up to 5), multi-chart functionality (up to 8), and advanced tools like the Go-to function and economic calendar integration.

Both plans provide full access to Tradezella’s core features, including journaling tools, over 50 specialized reports, trade replay capabilities, backtesting, and Zella University for educational resources. This comprehensive approach ensures all users can access essential tools regardless of their chosen tier.

TraderSync Pricing

TraderSync employs a three-tier pricing system, offering more granular options with discounts of 35% to 50% for annual plans.

- Pro Plan: Costs $29.95 per month or $19.46 per month annually (billed at $233.52 per year). It includes one account, five strategy creations, basic market replay with 1-minute tick precision, and five daily messages with the Cypher AI assistant.

- Premium Plan: Priced at $49.95 per month or $29.97 per month annually (billed at $359.64 per year). It offers unlimited accounts (up to 20), unlimited strategy creations, 1-second tick precision for market replay, 15 daily Cypher messages, sector reports, and advanced analytics.

- Elite Plan: Costs $79.95 per month or $39.97 per month annually (billed at $479.64 per year). Subscribers get unlimited accounts (up to 50), ultra-precise 250ms tick precision for market replay, 60 daily Cypher messages, support for all asset classes (including options), automatic AI insights after logging 100+ trades, and advanced trading plan tools.

TraderSync also offers a 7-day free trial without requiring a credit card, allowing users to explore the platform risk-free before committing. This trial is especially useful for traders who want to evaluate its AI-driven features and functionality.

Which Platform Offers Better Value?

Deciding between these platforms depends on your trading experience and priorities.

For beginner traders, TraderSync’s Pro Plan at $19.46 per month annually is the cheapest entry point, though it has limitations such as one account and basic market replay precision. Tradezella’s Basic Plan at $24 per month annually costs slightly more but includes broader journaling tools and educational resources.

Active traders will find both platforms competitive in the mid-tier range. TraderSync’s Premium Plan at $29.97 per month annually is slightly cheaper than Tradezella’s Premium Plan at $33 per month annually. TraderSync stands out with AI-powered insights via the Cypher assistant, while Tradezella emphasizes a robust journaling and mentoring experience.

For professional traders and scalpers, Tradezella’s Premium Plan at $33 per month annually offers seconds-level backtesting data and complete access to all features. TraderSync’s Elite Plan at $39.97 per month annually adds ultra-precise 250ms tick data and advanced AI coaching, which can be invaluable for high-frequency trading strategies.

"TradeZella offers everything at every tier. Full access starts at $29/month, or $49/month if you choose a monthly subscription. There are no hidden tools and no upgrade traps." – TradeZella Team

TraderSync’s free trial makes it easier to test the platform before committing, while Tradezella’s all-inclusive features at both tiers ensure users won’t face unexpected limitations or forced upgrades.

| Plan Comparison | Tradezella Basic | Tradezella Premium | TraderSync Pro | TraderSync Premium | TraderSync Elite |

|---|---|---|---|---|---|

| Annual Price | $24/month | $33/month | $19.46/month | $29.97/month | $39.97/month |

| Monthly Price | $29/month | $49/month | $29.95/month | $49.95/month | $79.95/month |

| Free Trial | No | No | 7 days | 7 days | 7 days |

| Accounts | 1 | Unlimited | 1 | Up to 20 | Up to 50 |

| AI Assistant | No | No | 5 messages/day | 15 messages/day | 60 messages/day |

| Market Replay Precision | Minutes/Hours/Daily | Seconds/Minutes/Hours/Daily | 1-minute tick | 1-second tick | 250ms tick |

| Strategy Creations | 3 playbooks | Unlimited playbooks | 5 checkers | Unlimited checkers | Unlimited checkers |

Ultimately, the choice boils down to whether you value Tradezella’s straightforward, feature-packed approach or TraderSync’s tiered structure with advanced AI tools and precision market data at higher levels.

Pros and Cons

Both platforms bring unique strengths and challenges to the table, catering to different trading approaches and experience levels. Here’s a closer look at what each offers, based on their features and pricing.

Tradezella: Pros and Cons

What Tradezella Does Well

Tradezella stands out for its easy-to-navigate interface, earning a Trustpilot score of 4.4/5, with many users praising its simplicity and effectiveness. The platform’s Zella University is a valuable resource, helping traders track their performance while sharpening their trading skills.

"TradeZella strikes a great balance between powerful functionality and being intuitive to use." – Maverick Trading

Another highlight? Its pricing is straightforward. Both the Basic and Pro plans include all core features, with differences mainly in account limits and storage. Automated journaling is another plus, minimizing manual errors and providing detailed reports to help refine trading strategies.

Where Tradezella Falls Short

For beginners, the advanced features might feel overwhelming. Mobile access is also a sticking point, as some users report issues with the mobile-optimized web version. Additionally, while it supports CSV uploads for broker integrations, direct integrations are limited. Price-wise, its subscription costs may discourage newer traders who aren’t ready to invest in premium tools.

TraderSync: Pros and Cons

What TraderSync Does Well

TraderSync shines with its extensive broker support, accommodating 700 to 900 brokers, making it a versatile choice for traders working across various asset classes. Its AI-powered Cypher assistant provides personalized insights, feedback, and pattern recognition for traders who have logged 100+ trades. Plus, the platform offers a risk-free 7-day trial.

The Market Replay feature, available in the Elite plan, is another standout. It delivers precision up to 250ms ticks and includes Level II data, offering traders a detailed view of market conditions and decision-making.

Where TraderSync Falls Short

The tiered pricing can be steep, especially for those wanting advanced AI features. For instance, the Elite plan costs $79.95 per month (or $39.97 per month when billed annually), which might be too high for casual traders. Manual trade entry can also be slow for those handling high volumes of trades. Additionally, the platform lacks community features, which some users may miss for collaborative learning or mentorship. After the trial, there’s no free version available, which could be a drawback for budget-conscious traders.

Comparison Table

| Aspect | Tradezella | TraderSync |

|---|---|---|

| User Interface | Intuitive, beginner-friendly | Modern and well-designed |

| Pricing (Annual) | $24–$33/month | $19.46–$39.97/month |

| Free Trial | None | 7 days (no credit card needed) |

| Broker Support | Good range with CSV upload option | Extensive support for 700–900+ brokers |

| AI Features | None | Cypher assistant with tiered access |

| Mobile Access | Mobile-optimized web (with some issues) | Available via web, iOS, and Android apps |

| Educational Tools | Zella University | AI coaching (limited community support) |

| Customer Rating | 4.4/5 (Trustpilot) | 4.8/5 (TrustScore), 4.0/5 (StockBrokers.com) |

| Best For | Traders wanting straightforward tools | Data-focused traders seeking advanced AI |

Choosing between these platforms depends on what suits your trading style best. Tradezella offers a more straightforward, accessible experience, while TraderSync caters to those who value advanced AI tools and broader broker support.

Integration with Trading Infrastructure

VPS hosting plays a crucial role in boosting the performance of Tradezella and TraderSync by offering a stable, high-performance trading environment. The effectiveness of a trading journal hinges on receiving precise, real-time data from your trading platforms.

VPS Hosting for Better Operations

Running your primary trading platforms – like MetaTrader 4/5, NinjaTrader, or TradeStation – on a high-performance VPS ensures smooth data flow to your journaling platform. This reliable data transmission is the backbone for the detailed analytics and trade replays that Tradezella and TraderSync provide.

QuantVPS, for example, delivers ultra-low latency (<0.52ms to CME Group from Chicago) and 99.999% uptime. This level of reliability ensures your trading platforms stay operational, consistently feeding accurate data to your journaling tools.

"Your QuantVPS server runs 24/7 independently in our secure datacenter, keeping your futures platform and bots active even when your home computer is off." – QuantVPS

This infrastructure advantage becomes even more apparent when you consider that TraderSync supports over 700 brokers and trading platforms. Similarly, Tradezella benefits from seamless VPS connectivity with platforms like MetaTrader 4/5 and TradingView. These features make VPS hosting an indispensable tool for traders seeking reliability and precision.

Practical Tips for Integration

To get the most out of VPS hosting, consider these integration tips:

- Host your trading platforms on a nearby VPS: Choose a VPS located close to major exchanges, and set up automatic data syncing between the VPS and your trading journal. This reduces data gaps caused by local outages.

- Prioritize security: Use VPS features like DDoS protection, advanced firewalls, and secure access protocols to safeguard your trading operations.

- Ensure uninterrupted automated trading: VPS hosting eliminates common risks like power outages, unstable home Wi-Fi, and high latency from local ISPs. This ensures that Expert Advisors or trading bots operate continuously, recording every trade without interruption.

- Optimize VPS performance: Monitor your VPS regularly and keep it streamlined by limiting installed software. For optimal performance, aim for 4–8 GB of RAM and SSD storage.

The real advantage comes when your VPS-hosted trading setup delivers uninterrupted, clean data to your journal. This allows you to track trades, analyze performance, and fine-tune strategies from anywhere, ensuring the reliability that professional trading demands.

Conclusion

Key Takeaways

When comparing Tradezella and TraderSync, it’s clear they serve different trading needs, each offering distinct tools and features. Tradezella focuses on in-depth analysis and strategy refinement. Features like the Zella Score for performance tracking, a robust playbook for strategy organization, and comprehensive backtesting (included in all plans) make it a strong choice for traders aiming to improve systematically. Its detailed reporting breaks down performance by strategy, setup, mistakes, and timing, with interactive reports that allow users to analyze individual trades closely.

On the other hand, TraderSync emphasizes data logging and AI-powered insights. Its standout tools include the Cypher Assistant and Coach, with varying message limits depending on the plan (5 for Pro, 15 for Premium, and 60 for Elite). The platform also offers a market replay feature, providing precision from 1-minute ticks on the Pro plan to 250ms ticks on the Elite plan, making it a powerful option for traders who rely on precision and AI-driven feedback.

The platforms also differ in their educational resources. Tradezella’s Zella University focuses on using data to enhance trading performance while addressing mindset and process development. In contrast, TraderSync provides tutorials primarily aimed at helping users navigate its tools effectively.

Final Recommendation

Choose Tradezella if your priority is building and refining trading strategies while gaining deeper insights into your performance. With features like its playbook builder, detailed behavioral tracking, and comprehensive backtesting, Tradezella is particularly appealing to swing and position traders who value systematic, long-term growth. The Tradezella team sums it up well:

"If you’re serious about growth, tracking performance, refining strategy, understanding your behavior, and building accountability, TradeZella gives you everything you need in one place." – TradeZella Team

Alternatively, opt for TraderSync if you’re drawn to AI-driven insights and precise market replay. These tools are especially useful for active day traders and scalpers. TraderSync’s Pro plan, priced at $19.46 per month (annual billing), offers essential AI tools and 1-minute tick precision, making it a good starting point for beginners. However, those seeking more advanced tools for strategy development might lean toward Tradezella’s Basic plan.

Both platforms perform best when paired with reliable VPS hosting to ensure uninterrupted data flow, which is critical for optimal performance. Ultimately, your trading style – whether focused on strategic insights or AI-enhanced precision – should guide your decision.

FAQs

How do the educational resources of Tradezella and TraderSync compare?

Tradezella offers a variety of educational resources aimed at helping traders sharpen their skills. These include detailed manuals, step-by-step guides, webinars, training videos, and a comprehensive learning platform packed with trading strategies. It’s an ideal option for those who want to expand their knowledge and improve their trading techniques.

In contrast, TraderSync focuses on platform-specific tutorials, providing video guides that explain how to use its tools, such as trade management and portfolio tracking. While these tutorials are useful for navigating the platform, they don’t match the depth or breadth of Tradezella’s educational materials.

In summary, Tradezella excels with its extensive and structured learning resources, while TraderSync is more about offering practical guidance for its platform features.

How does TraderSync’s AI analytics improve trading decisions compared to Tradezella?

TraderSync’s AI, supported by tools like Cypher, functions as a personal trading coach. It identifies patterns, delivers detailed insights, and offers real-time feedback to help traders make better decisions. What sets it apart is its ability to dig deeper, analyzing the reasons behind trading behaviors and providing actionable suggestions for improvement.

On the other hand, Tradezella’s AI is effective at pinpointing risks and opportunities, offering clear and concise insights. However, TraderSync stands out with its advanced pattern recognition and strategic guidance, making it a more thorough tool for refining trading strategies in 2025.

Which platform is better for professional traders specializing in high-frequency trading?

For professional traders engaged in high-frequency trading, TradeZella is the go-to choice in 2025. It delivers advanced analytics, trade replay capabilities, and professional-grade tools crafted specifically for active traders handling fast-moving and complex portfolios. These tools cater to the precision and speed demands of high-frequency trading.

On the other hand, TraderSync offers powerful features like AI-driven insights and market replay. However, it leans more toward traders who prioritize in-depth performance tracking and pattern analysis, rather than the real-time analytics and lightning-fast execution critical for high-frequency trading strategies.