Looking to trade futures without risking your own capital? My Funded Futures (MFFU) offers traders access to funded accounts up to $600,000 with a simple one-step evaluation process. Pass the challenge, and you can keep 100% of your first $10,000 in profits, then 90% of anything beyond that. MFFU also fosters a supportive community where traders can connect, share strategies, and help each other succeed.

Quick Facts:

- MFFU Offers Four Different Account Types:

- Core

- Scale: $50,000, $100,000, $150,000

- Pro: $50,000, $100,000, $150,000

- Eval to Live: $50,000

- Monthly Fees: Starting at $77 for Core accounts, up to $477 for Pro accounts.

- Discounts: MFFU regularly offers discounts and promotional codes for new and existing traders.

- Profit Withdrawals: Starter accounts can withdraw profits every 5 days; Expert accounts every two weeks.

- Risk Management: No daily loss limits; only End-of-Day (EOD) trailing drawdown rules apply.

Note: Discounts are updated frequently and can be applied to evaluations or resets.

Why Traders Choose MFFU:

- Simple Evaluation: Single-phase challenge with no time limit; traders can pass in as little as two days by meeting the 50% consistency rule.

- Flexible Accounts: Options for monthly fees or one-time payments, with account sizes from $50K to $150K.

- High Profit Sharing: Keep 100% of the first $10,000 in profits, then 90% thereafter, offering one of the most generous payout policies among prop firms.

- Value-Packed Account Options: Range of account types to suit different trading styles and goals, including scaling plans for position sizing.

- Tools: Compatible with TradingView, NinjaTrader, and Tradovate.

With a 4.6/5 Trustpilot rating from over 5,020 reviews, MFFU is a popular choice for futures traders seeking funding and flexibility.

Funded Account Types and Profit Structure

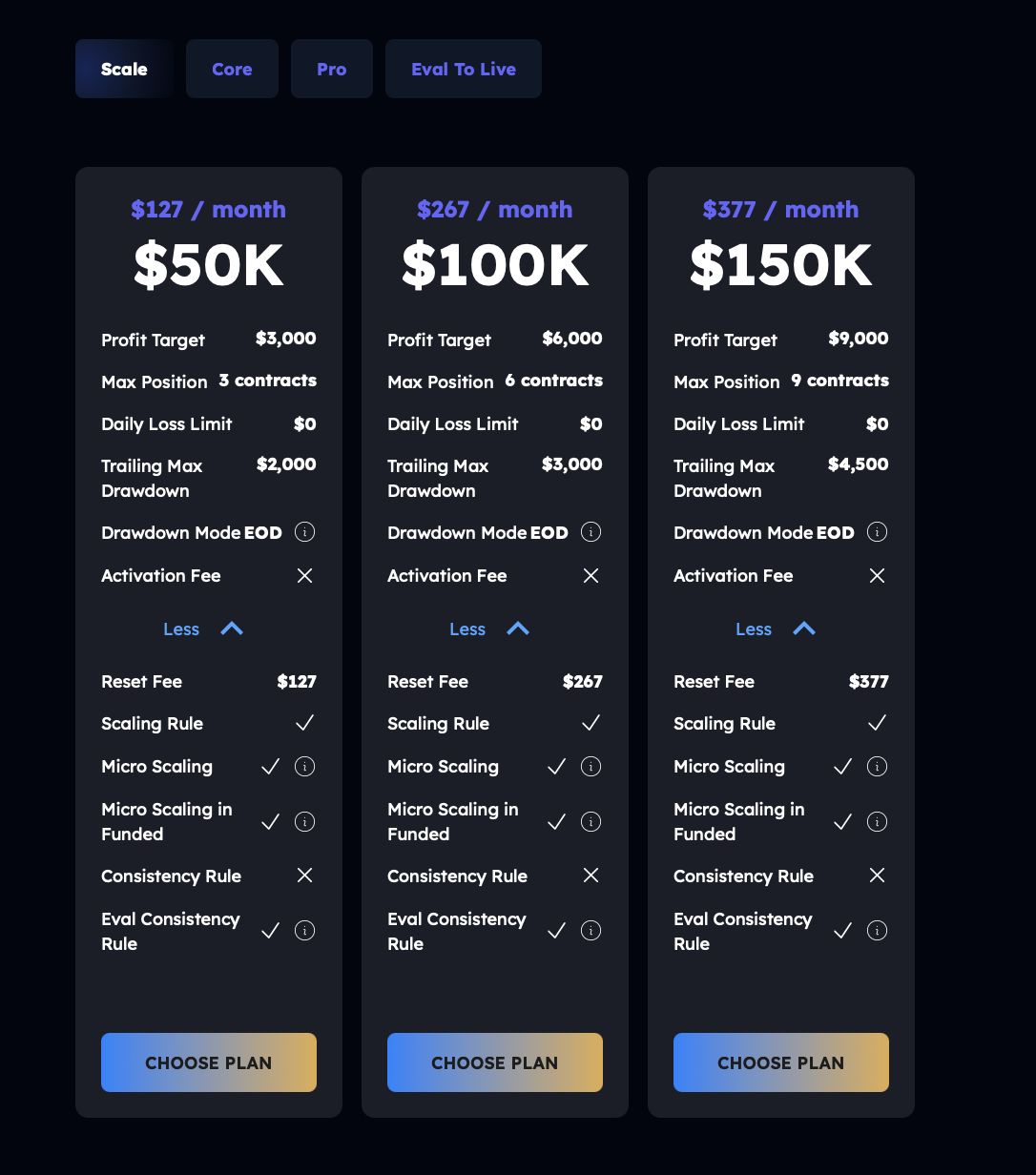

Scale Accounts

- Monthly Pricing

- $50K: $127/month

- $100K: $267/month

- $150K: $377/month

- Profit Targets

- $3,000 (50K) • $6,000 (100K) • $9,000 (150K)

- Drawdown & Daily Limits

- Daily loss limit: $0

- Trailing Max Drawdown (EOD): $2,000 • $3,000 • $4,500

- Other Features

- Activation fee: None

- Reset fee = monthly price ($127 / $267 / $377)

- Scaling rule: ✓ (allows position size scaling as profits grow)

- Micro scaling: ✓

- Micro scaling in Funded: ✓

- Consistency rule: ✗

- Evaluation consistency rule: ✓

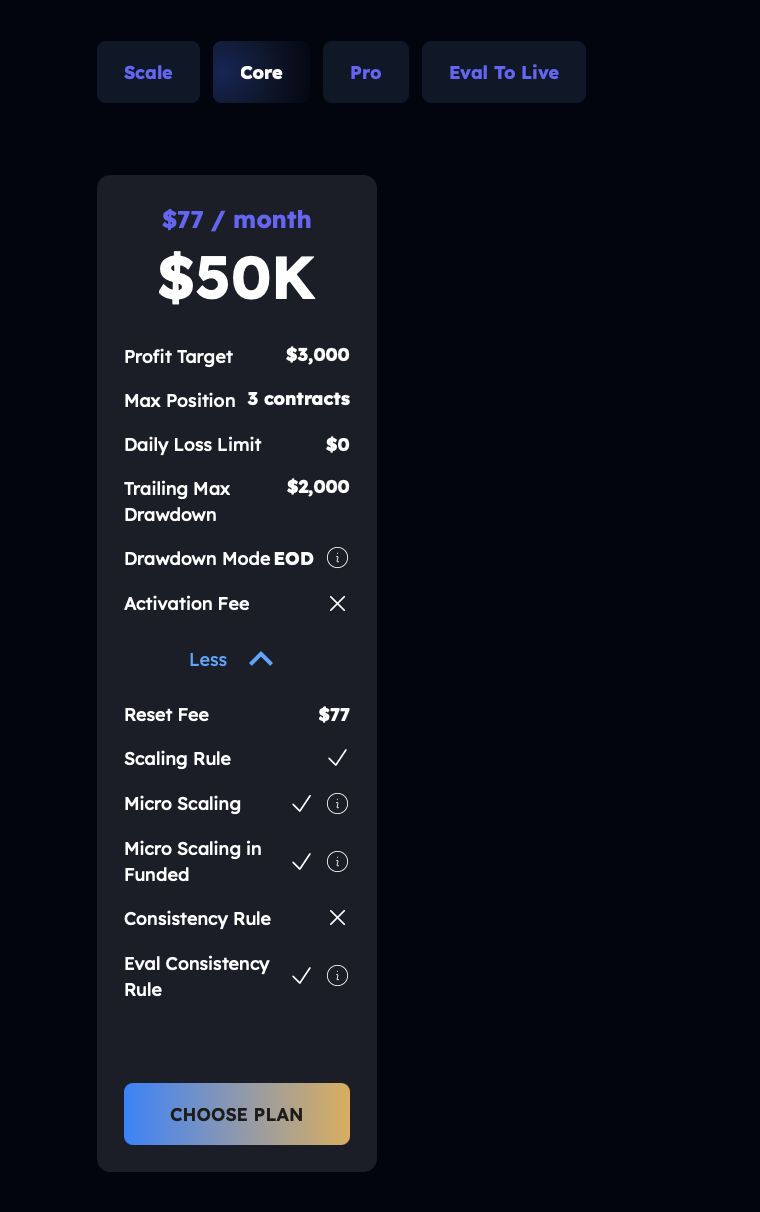

Core Accounts

- Monthly Pricing

- $50K: $77/month

- Profit Target

- $3,000

- Drawdown & Daily Limits

- Daily loss limit: $0

- Trailing Max Drawdown (EOD): $2,000

- Other Features

- Activation fee: None

- Reset fee: $77

- Scaling rule: ✓

- Micro scaling: ✓

- Micro scaling in Funded: ✓

- Consistency rule: ✗

- Evaluation consistency rule: ✓

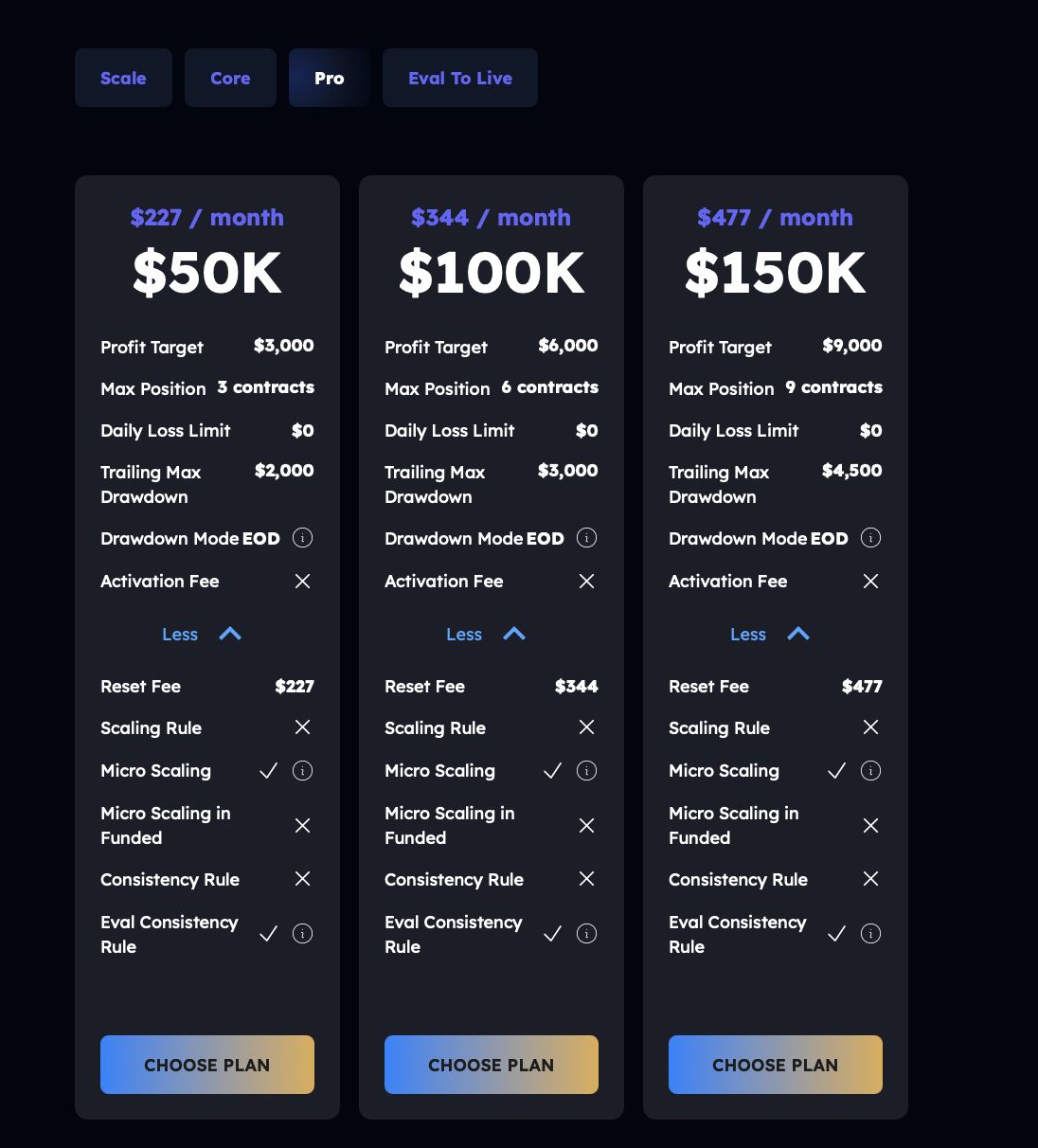

Pro Accounts

- Monthly Pricing

- $50K: $227/month

- $100K: $344/month

- $150K: $477/month

- Profit Targets

- $3,000 • $6,000 • $9,000

- Drawdown & Daily Limits

- Daily loss limit: $0

- Trailing Max Drawdown (EOD): $2,000 • $3,000 • $4,500

- Other Features

- Activation fee: None

- Reset fee = monthly price ($227 / $344 / $477)

- Scaling rule: ✗

- Micro scaling: ✓

- Micro scaling in Funded: ✗

- Consistency rule: ✗

- Evaluation consistency rule: ✓

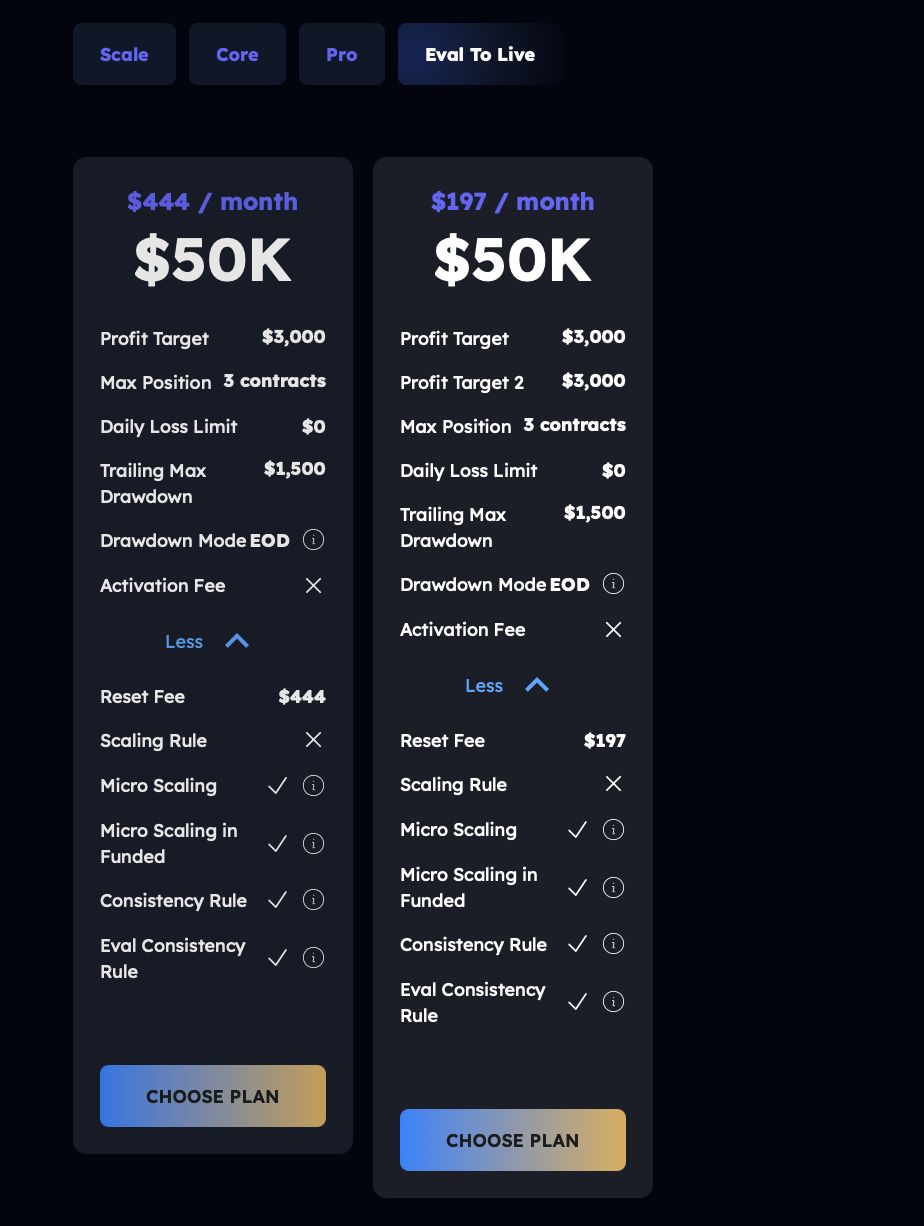

Eval To Live Accounts

- 1-Step ($50K) — $444/month

- Profit target: $3,000

- Daily loss limit: $0

- Trailing Max Drawdown (EOD): $1,500

- Activation fee: None

- Reset fee: $444

- Scaling rule: ✗

- Micro scaling: ✓

- Micro scaling in Funded: ✓

- Consistency rule: ✓

- Evaluation consistency rule: ✓

- 2-Step ($50K) — $197/month

- Profit target 1: $3,000 • Profit target 2: $3,000

- Daily loss limit: $0

- Trailing Max Drawdown (EOD): $1,500

- Activation fee: None

- Reset fee: $197

- Scaling rule: ✗

- Micro scaling: ✓

- Micro scaling in Funded: ✓

- Consistency rule: ✓

- Evaluation consistency rule: ✓

Contract Limits by Account Size

- $50K: up to 3 contracts

- $100K: up to 6 contracts

- $150K: up to 9 contracts

Notes & Key Differences

- Reset fees match the monthly price on Scale, Pro, and Eval-to-Live accounts; $77 on Core.

- Micro scaling in Funded is available on Scale, Core, and Eval-to-Live but not on Pro accounts.

- Consistency rule applies only on Eval-to-Live accounts for funded trading; all plans enforce it during evaluation.

Funding Amounts and Profit Sharing

My Funded Futures offers funding starting at $50,000, with popular account sizes at $50K, $100K, and $150K. Traders keep 100% of their first $10,000 in profits, then receive 90% of profits thereafter, making it one of the most trader-friendly payout policies.

Trading Rules and Flexibility

- No Daily Loss Limits: MFFU uses trailing EOD drawdown limits instead of daily loss limits, giving traders more flexibility intraday.

- Scaling Plans: Scale and Core accounts allow position size scaling as profits grow; Pro and Eval-to-Live accounts do not.

- Account Activity: Traders must place at least one trade per week to keep accounts active.

- Maximum Accounts: Traders can hold up to 10 total accounts, with a maximum of 5 funded accounts simultaneously for $50K accounts.

- Evaluation Accounts: Single-phase evaluation with no time limit; traders can pass by completing profit and drawdown objectives, following the 50% consistency rule.

Profit Withdrawals and Payout Policy

- Withdrawal Frequency: Starter accounts can request payouts every 5 winning days; Expert accounts every two weeks.

- Profit Sharing: 100% on the first $10,000 profit, then 90% thereafter.

- Minimum Withdrawal: $250 for Starter accounts and $1,000 for Expert accounts.

- Buffer Zone Policy: Applies to Expert accounts, allowing withdrawals up to 60% during the buffer phase, but resets the buffer upon withdrawal.

- Fast Payouts: MFFU is known for industry-leading fast payout processing times, facilitated by an automatic payout approval system.

Trading Setup and Tools

MFFU supports popular trading platforms including:

- TradingView: Features the Long/Short Position Tool for precise entries.

- Tradovate: Provides real-time market data; users must sign a market data agreement during first login.

- NinjaTrader: Trusted, user-friendly trading interface.

VPS Hosting

QuantVPS offers ultra-low latency, guaranteed uptime, dedicated resources, automatic backups, and multi-monitor support, ideal for traders needing consistent execution and real-time market data.

Trader Experiences and Support

Many traders praise MFFU’s support team for professionalism, quick responses, and effective issue resolution. Individual agents like Emmanuel and Ike receive frequent commendations. The platform’s transparency, speed, and community support contribute to its strong reputation.

Summary

My Funded Futures provides a flexible, trader-friendly funding program with competitive fees, generous profit splits, and a straightforward evaluation process. Its focus on trailing drawdown limits over daily loss limits offers traders more freedom, and its variety of account plans accommodates diverse trading styles and goals.

With a 4.6/5 Trustpilot rating and thousands of satisfied traders, MFFU stands out as a top choice for futures prop trading funding.