Want to trade crypto without risking your own money? Prop trading firms provide up to $300,000 in trading capital, letting you focus on strategies while keeping 70% to 95% of the profits. Here’s a quick overview of the top firms and what they offer:

- Crypto Fund Trader: Funding up to $300K, 80%-90% profit split, and multiple evaluation formats.

- FundedNext: Up to $200K funding, profit splits starting at 80% (scaling to 95%), and flexible challenge options.

- FTMO: $200K demo funding, potential scaling to $400K, with advanced tools and institutional opportunities.

- HyroTrader: Real exchange data, $400K funding, 70%-90% profit split, and instant payouts.

- PipFarm: $300K funding, up to 95% profit split, and a unique XP ranking system for consistent traders.

Quick Comparison

| Firm | Max Funding | Profit Split | Primary Platforms | Key Features |

|---|---|---|---|---|

| Crypto Fund Trader | $300,000 | Up to 90% | MT4, MT5, cTrader | Focuses on crypto trading |

| FundedNext | $200,000 | Up to 95% | MT4, MT5, cTrader | Standout challenge program |

| FTMO | $200,000 | 80%-90% | MT4, MT5, cTrader | Institutional-level scaling via Quantlane |

| HyroTrader | $400,000 | Up to 90% | ByBit, CLEO | Real exchange data and instant payouts |

| PipFarm | $300,000 | Up to 95% | cTrader | XP ranking system for scaling |

Prop trading firms make it easy to scale your trading, access advanced tools, and maximize your potential in the 24/7 crypto market. Ready to trade smarter? Let’s dive into the details.

Finding the RIGHT Crypto Prop Firm in 2025 ! (Avoid These Red Flags!)

1. Crypto Fund Trader

Crypto Fund Trader is a platform designed to evaluate and educate traders by testing their skills in a simulated environment before providing access to real trading capital [1]. So far, the company has distributed over $8.4 million in profits to traders who have successfully met its requirements [2]. Below is a summary of the platform’s evaluation parameters.

Traders can qualify for funding up to $300,000 in demo accounts. The profit-sharing model is straightforward: traders keep 80% of their earnings, while Crypto Fund Trader takes the remaining 20% [3]. For instant funding accounts, profits and account sizes increase by 10% every time traders hit a 10% profit milestone. This continues until traders reach a 90% profit share [2].

The platform offers two evaluation formats:

- One-phase evaluation: Requires a 10% profit target, with a 4% daily loss limit and a 6% trailing loss.

- Two-phase evaluation: Traders must achieve an 8% target in the first phase and a 5% target in the second phase. The daily loss limit is 5%, and the overall loss limit is 10% [1].

| Evaluation Type | Profit Target (Phase 1) | Profit Target (Phase 2) | Max Daily Loss | Max Loss | Min Trading Days |

|---|---|---|---|---|---|

| 2-Phase | 8% | 5% | 5% | 10% | 5 |

| 1-Phase | 10% | N/A | 4% | 6% Trailing Loss | 5 |

The evaluation fee depends on the account size and program type, starting at about $58 for a $5,000 account and going up to $1,250 for a $200,000 account [1]. All accounts come with leverage up to 1:100, providing traders with ample flexibility.

Access to the platform varies by location. U.S.-based traders are restricted to the Bybit demo environment, while international users can also access the CFT Platform (integrated with Binance) and MetaTrader 5 [1][6]. The daily loss calculation resets at 12:05 AM UTC, and traders must trade on at least five separate days during each evaluation phase [4].

To promote skill-based trading, the platform enforces strict rules. Strategies like reverse trading, gambling techniques, tick scalping, and arbitrage are strictly prohibited [5]. This ensures traders focus on sustainable and disciplined methods.

2. FundedNext Stellar Challenges

Launched in March 2022, FundedNext quickly became a leader in the prop trading space, distributing an impressive $51 million in virtual funds by January 2023 [7]. Through its Stellar program, the firm offers three distinct challenge structures, providing CFDs on nine cryptocurrency pairs [10].

Traders can access up to $300,000 in capital across funded accounts, with the potential to scale up to $4 million through the company’s growth program [9]. FundedNext also boasts a competitive profit-sharing model, starting at an 80% split for traders, with the possibility of increasing it to 95% through scaling opportunities [7]. These options cater to a variety of trading styles and risk preferences.

Challenge Structure Options

FundedNext’s Stellar program includes three evaluation pathways designed to match different trading strategies and risk tolerances:

- Stellar 2-Step Challenge: This pathway requires traders to hit an 8% profit target in the first phase and a 5% target in the second. It enforces a 5% daily loss limit and a 10% overall loss cap, with a minimum of five trading days.

- Stellar 1-Step Challenge: A quicker option, this challenge involves a single 10% profit target. It comes with a 3% daily loss limit, a 6% overall loss cap, and requires only two trading days.

- Stellar Lite Challenge: Designed for a balanced approach, this challenge sets an 8% profit target in phase one and a 4% target in phase two. It includes a 4% daily loss limit, an 8% overall loss cap, and a minimum of five trading days.

Here’s a quick comparison of the challenge requirements:

| Challenge Type | Profit Target (Phase 1) | Profit Target (Phase 2) | Maximum Daily Loss | Maximum Overall Loss | Minimum Trading Days |

|---|---|---|---|---|---|

| Stellar 2-Step | 8% | 5% | 5% | 10% | 5 |

| Stellar 1-Step | 10% | N/A | 3% | 6% | 2 |

| Stellar Lite | 8% | 4% | 4% | 8% | 5 |

Pricing and Platform Access

The cost of joining a challenge depends on the type and size of the account. For example, a $5,000 Stellar Lite account starts at $32, while a $200,000 Stellar 1-Step account costs $1,099 [8]. Traders can access the markets using cTrader, MetaTrader 4, or MetaTrader 5, though crypto trading is available only on weekdays [10]. FundedNext supports a broad range of tradable assets, including forex, indices, oil/energies, cryptocurrencies, and metals.

The platform has earned strong trader confidence, reflected in its 4.5-star Trustpilot rating from over 18,000 reviews, and boasts an average payout time of under 24 hours [11]. Additionally, both Stellar and Stellar Lite accounts allow news trading, though some restrictions apply during high-impact events [9].

3. FTMO Quantlane Program

Since its founding in 2015, FTMO has become a significant name in the prop trading world. With over 240,000 FTMO accounts created and a TrustScore of 4.8 on Trustpilot, it has built a strong reputation[12][13]. The FTMO Quantlane Program serves as a bridge for traders, transitioning them from demo account success to managing real capital.

FTMO provides traders with the chance to manage demo accounts funded with up to $200,000 in simulated capital, offering up to 90% of the profits made on these accounts[12]. However, the real prize is advancing through their system to join Quantlane – a proprietary trading firm under the FTMO Group since 2014[14]. This progression helps traders move from simulated accounts to managing actual funds.

The Path to Real Capital Trading

The journey begins with the FTMO Challenge, where traders must meet specific trading objectives while adhering to strict risk management rules[12]. Success in each phase paves the way for higher capital allocations and better profit-sharing. Traders can eventually access up to $400,000 in capital, with scaling opportunities reaching $2 million[13].

Top-performing traders can advance to the Premium Program, which has two tiers: Prime and Supreme. Supreme status represents the pinnacle of the program, offering a professional trading career with a fixed salary[12][14].

- Prime Status Requirements: Traders must maintain an active FTMO account, avoid failed accounts in the past four months, and demonstrate consistent profitability by earning four rewards, each with at least 4% profitability[14].

- Supreme Status Requirements: Traders need an active $400,000 demo FTMO account (either a single account or two merged $200,000 accounts) and must operate under Prime Status for three months. During this time, they must secure at least three rewards with 4% profitability[14].

Trading Platforms and Technology

Once traders reach the Quantlane level, they gain access to advanced platforms and institutional-grade support. FTMO supports popular platforms like MetaTrader 4, MetaTrader 5, cTrader, and DXTrade[13][15]. Quantlane traders benefit from customized, professional-grade trading tools[14].

Additional perks for Quantlane traders include a fixed salary, performance and mindset coaching, institutional trading conditions, and a competitive bonus structure[12][14]. Unlike FTMO-funded accounts, which are demo accounts with virtual profits (but real payouts), Quantlane traders manage actual capital and generate real profits[13].

For those new to the process, FTMO also offers a free trial, allowing traders to practice and familiarize themselves with the challenge environment before committing to the evaluation phase[13].

sbb-itb-7b80ef7

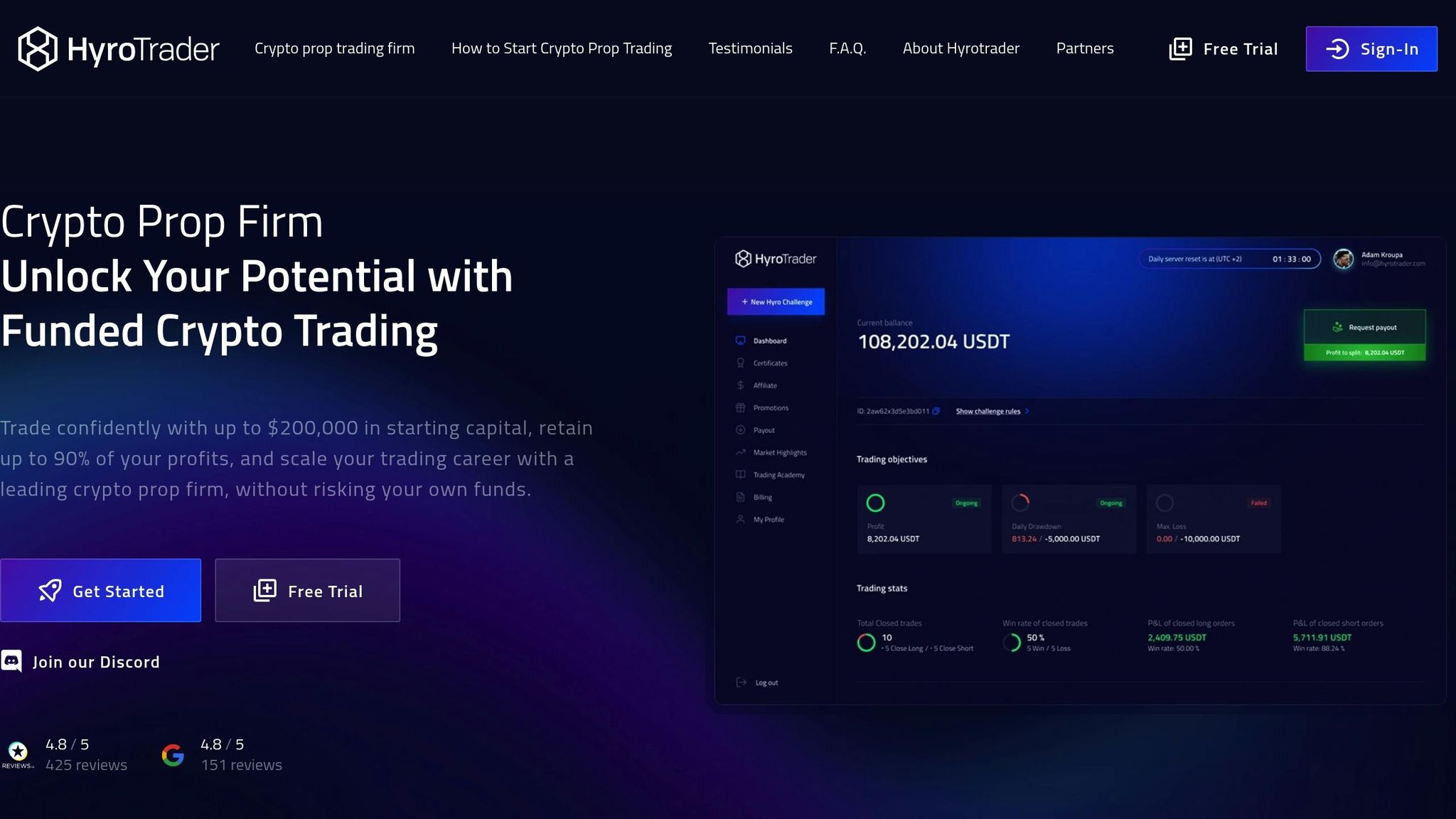

4. HyroTrader Institutional Tiers

Launched in 2023, HyroTrader has carved out a distinct space in the crypto prop trading world by offering direct exchange connectivity through ByBit and CLEO. Unlike many prop firms that rely on simulated setups, HyroTrader provides traders with access to real exchange data and liquidity. The firm’s institutional framework includes scalable funding opportunities, allowing traders to grow their accounts up to $1,000,000 – up to ten times their starting balance [16]. This setup creates a challenging yet rewarding environment for traders.

Assessment Process and Requirements

HyroTrader evaluates traders through a crypto challenge, available in both one-step and two-step formats. The focus is on profitability and risk management rather than past trading performance. To pass the challenge, traders must complete 10 Evaluation days and 5 Verification days while adhering to strict risk management rules. These include a 5% daily drawdown limit, a 10% total drawdown cap, and a stop-loss requirement that limits individual trade risk to 3%.

Challenge fees depend on the account size, ranging from $89 for a $5,000 account to $999 for a $200,000 account. As an added incentive, these fees are refunded after the first profit split [16][17][18]. This structured process aligns with the prop trading principle of reducing personal financial risk while maximizing growth potential.

"HyroTrader’s crypto trading challenge is an exam of your profitability and risk management, designed with experienced traders in mind."

- HyroTrader

Scaling and Profit Structure

HyroTrader’s scaling system evaluates trader performance every four months. If a trader achieves a 20% profit over this period, with at least two profitable months and two profit payouts, their account size can increase by 25%.

"Prove you can make 15% profit and stick to the rules, then we trust you enough that you could even lead a following."

- HyroTrader

Profit splits range from 70% to 90%, depending on performance and account size. Unlike other firms that impose delays, HyroTrader offers instant payouts, ensuring traders can access their earnings without waiting [16][17].

Trading Platforms and Technology

HyroTrader supports two main platforms designed specifically for crypto trading:

| Platform | Data Source | Key Features | Asset Coverage |

|---|---|---|---|

| ByBit | ByBit Exchange | Intuitive interface, advanced charting, fast execution | Major and altcoin futures |

| CLEO | Binance Data Feed | Advanced tools, backtesting, custom drawing features | All Binance Futures pairs |

Both platforms provide up to 1:100 leverage and real-time market data for precise execution. HyroTrader also plans to integrate OKX into its platform lineup soon, further expanding its offerings. With crypto markets running 24/7, there are no trading hour restrictions, allowing traders to seize opportunities at any time. For those using automated strategies, the platform supports algorithmic trading, giving institutional-level traders the flexibility to implement their systems [16][19].

"You are the owner of your challenge account."

- HyroTrader

Several traders, including Neelam Khan, Anita Kovalski, and Emir Hoxha, have achieved notable payouts ranging from $27,927 to $49,783. These results highlight HyroTrader’s dedication to rewarding successful traders with a fair share of profits [16].

5. PipFarm Mega Accounts

PipFarm stands out for its blend of straightforward evaluations and generous funding opportunities. Since its launch in June 2023, it has earned recognition for its clear and transparent trader evaluation process. Traders can access virtual capital ranging from $10,000 to $200,000, with the potential for maximum initial funding of $300,000 for those who qualify [20][22]. In 2024 alone, PipFarm paid out over $1,000,000 to its traders [22].

Evaluation Programs and Requirements

PipFarm offers both one-step and two-step evaluation programs, allowing traders to showcase their skills and gain access to virtual trading accounts with profit-sharing benefits [20][21]. The evaluation process is designed with clear rules and fixed loss limits, making it easier for traders to focus on their performance without being bogged down by overly complicated requirements [20][22].

Profit Sharing and Compensation Structure

Traders who succeed with PipFarm can earn up to 95% of their trading profits [22]. Additionally, the firm’s XP ranking system rewards consistent performance by offering better terms and increased funding opportunities over time [20].

Trading Platform and Technology

PipFarm exclusively uses the cTrader platform, which provides traders with advanced tools and features [20][22]. With variable leverage options up to 1:50 [22] and a built-in Kill Switch for added account protection during volatile market conditions, the platform ensures a secure and efficient trading experience.

Support and Scaling Opportunities

To support its global trader base, PipFarm offers 24/7 customer service and a help center with resources available in multiple languages [22]. The firm also provides various challenge formats, multiple payout methods, and payout protection to ensure reliable earnings [22]. Using big data analysis, PipFarm identifies trading patterns and insights, which it integrates into its proprietary trading strategies [21].

Comparison Table

When choosing a prop firm, it’s important to weigh factors like maximum funding, profit splits, and supported platforms. Each firm has its own strengths, making it easier to find one that aligns with your trading style and goals.

Here’s a quick breakdown of the key offerings from the firms discussed earlier:

| Firm | Max Funding | Profit Split | Primary Platforms | Key Features |

|---|---|---|---|---|

| Crypto Fund Trader | $300,000 | Up to 90% | MT4, MT5, cTrader | Focuses on crypto trading |

| FundedNext | $200,000 | Up to 95% | MT4, MT5, cTrader | Offers a standout challenge program |

| FTMO | $200,000 | 80% to 90% | MT4, MT5, cTrader | Backed by Quantlane institutions |

| HyroTrader | $400,000 | Up to 90% | MT4, MT5, DXTrade | Provides institutional-level scaling |

| PipFarm | $300,000 | Up to 95% | cTrader only | Features a unique XP ranking system |

While this table highlights the essentials, your final decision should also take into account factors like your trading preferences, risk tolerance, and any applicable local regulations. Use this as a starting point to identify the firm that best matches your trading ambitions.

Conclusion

Prop trading in the crypto world opens the door to substantial funding with limited personal financial risk. Many firms offer funding as high as $300,000, coupled with profit-sharing structures that let traders keep an impressive 80% to 90% of their earnings [23]. This setup allows traders to tap into significant capital while retaining the bulk of their profits.

Beyond funding, these firms equip traders with cutting-edge platforms, advanced risk management tools, and educational resources – all essential for navigating the unpredictable nature of cryptocurrency markets. These resources not only enhance trading efficiency but also provide a solid foundation for success.

With the comparisons outlined earlier, the next step is finding a firm that aligns with your trading style and goals. Consider factors like available funding, profit splits, platform features, and the firm’s reputation. Choosing wisely ensures you’ll have the resources and support to maximize your trading potential in the ever-evolving crypto market.

FAQs

What are the main differences in evaluation processes offered by top crypto prop trading firms?

Top crypto prop trading firms generally provide two ways for traders to access funding: two-step evaluations and instant funding.

With the two-step evaluation, traders begin by proving their skills on a demo account. They need to hit specific profit targets while adhering to strict risk management rules. Once they meet these requirements, they gain access to a funded account.

Alternatively, some firms offer an instant funding option. This allows traders to bypass the evaluation process entirely by paying a fee for immediate access to trading capital. It’s a great choice for seasoned traders who are ready to start trading with firm-provided funds right away.

These options cater to different levels of experience and preferences, providing traders with the flexibility to choose the path that suits them best.

What are profit splits in prop trading firms, and what factors determine how much traders earn?

Profit splits in proprietary trading firms determine the percentage of profits a trader keeps from their successful trades. These splits typically fall within the range of 50% to 90%, depending on the firm’s policies and the trader’s individual performance.

Several factors can impact how much of the profit a trader gets to keep:

- Account type: Higher splits are sometimes offered for traders operating under specific account tiers.

- Experience level: Traders with a strong track record or extensive experience often qualify for more favorable profit-sharing arrangements.

- Performance benchmarks: Meeting or exceeding set performance goals consistently can result in better splits.

Many firms also require traders to meet certain criteria, such as passing evaluations or adhering to particular trading strategies, to unlock higher profit-sharing percentages. It’s essential to carefully review a firm’s terms to fully understand how their profit splits work and what steps are needed to maximize earnings.

What should traders consider when selecting a prop trading firm, and how do the tools provided impact their success?

When choosing a proprietary trading firm, it’s essential to weigh key factors like the firm’s reputation, the types of assets it supports, its profit-sharing structure, and any fees involved. Another important consideration is whether the firm provides access to educational resources or mentorship programs, which can be invaluable for honing trading skills and improving strategies over time.

Equally important are the tools and platforms the firm offers. A reliable trading platform with quick execution speeds, low latency, and an easy-to-navigate interface can greatly impact your trading results. Features like advanced analytics, customizable settings, and real-time data access allow traders to fine-tune their strategies with precision. Opting for a firm that invests in strong technology can play a crucial role in achieving consistent performance.